If you watched my recent talk on Citywire’s Fintech Forum, you’ll know I gave my two cents on what firms should be looking for in a technology provider – and why it matters.

If you missed it, or you’d like a recap, don’t fret. I’ve laid out all the info in this blog post, so you can refer back to it any time.

Firstly, a bit about us and what we do. In a nutshell, we’re a custodian and investment technology company. We provide firms of all sizes with affordable custody, trading and settlement services, feature-rich investment management technology, and a suite of paperless adviser and client portals.

Financial advisers and investment managers can combine these modules to operate their own platform – helping them to take control of their client relationships, improve their customer experience and own more of the value chain.

We’re already powering platforms for ambitious DFMs like IronBright and P1 Investment Management, whose P1 Platform was recently named a ‘Digital Process Champion’ by NextWealth, and voted number 1 for service by advisers twice in a row as part of the lang cat’s quarterly service ratings.

Elsewhere, technology-first businesses from all sectors can use Seccl’s publicly documented APIs to get plug-and-play access to the financial markets – helping them to launch new investment propositions more quickly and affordably than ever before. We currently work with a number of exciting fintechs you might have heard of – like Chip, Multiply and Penfold.

Doing your due diligence

Now that the introductions are out of the way, let’s get onto what you should be looking for in a technology provider. Here are some key things to consider, before I go into more detail below…

-

Financial strength and resilience

-

Organisational structure and governance

-

Regulatory status

-

Legal and compliance

-

Pricing

-

Customer service

-

Technology

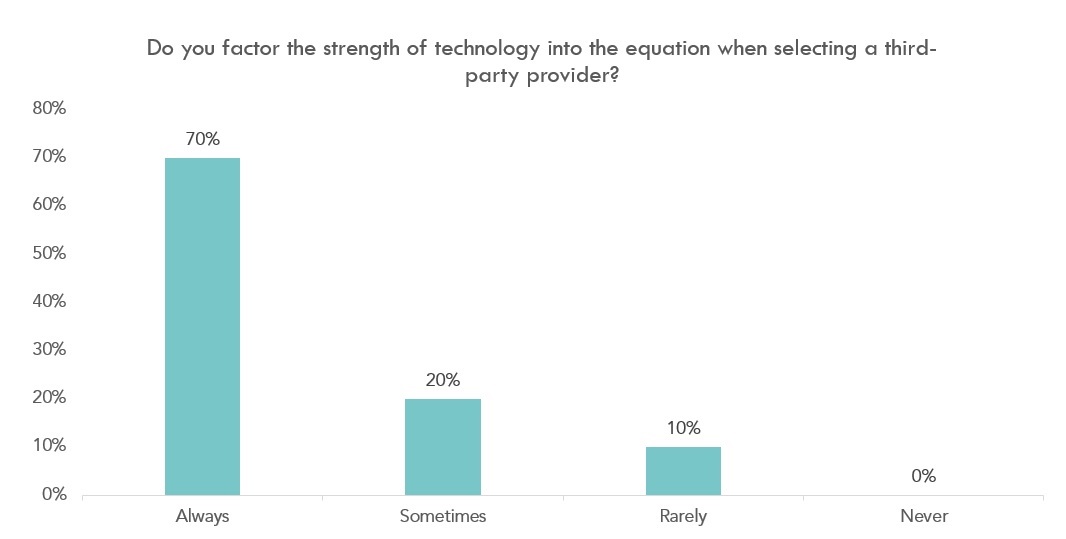

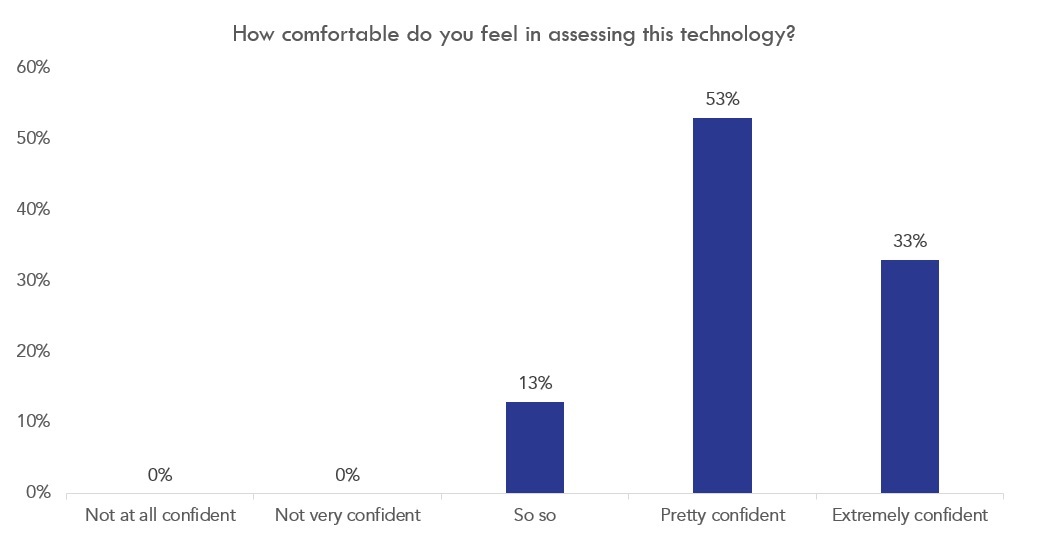

During the talk, I did a quick poll so see how people felt about this last one. I asked: do you factor the strength of technology into the equation when selecting a third-party provider?

… and how comfortable do you feel in assessing this technology?

The results confirmed what I suspected – that most people understand the importance of technology in choosing a platform provider, but almost everyone could be more confident when it comes to assessing it.

Why is technology so important?

It would be an understatement to say that technology has changed a lot over the past three to five years – especially in the wealth management space. In 2021, it’s no longer just about making life easier in the back-office (though that’s as important as ever) – it’s about the changing needs and expectations of the customer. Nowadays, clients expect experiences to be…

-

Super-fast

-

Paperless and friction-free

-

Always updating and improving (not stuck on v.1 forever)

-

Mobile-optimised

But I think most would agree that the technology they use is a world away from that! According to a 2019 report by Origo, most firms use five standalone systems in the delivery of advice, planning and portfolio management, as well as two investment platforms – creating a clunky mix of tools that struggle to integrate and just make more manual work for long-suffering admin teams.

Source: Financial Conduct Authority (FCA)

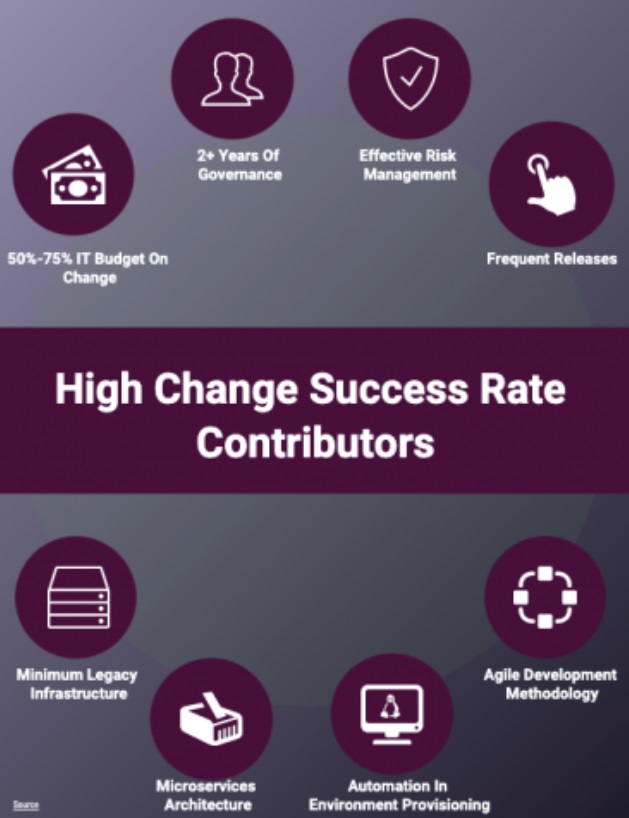

To illustrate how crucial technology has become in financial services, the FCA published a review in February 2021, which sets out findings about how financial services firms manage technology change, and the impact of change failures.

The review showed that firms relying on high levels of legacy tech were more likely to experience failed and emergency changes.

So, along with clients, there is growing expectation from the Regulator for advisers to choose tech that’s scalable and appropriate for their clients’ needs.

Long story short, it’s important to build platform technology that can change easily. Here are a few questions to ask about your platform provider…

1. Are they cloud-based?

Cloud-based technology is…

-

Infinitely affordably scalable

-

More secure

-

Faster at employing deployment and automation

Automated provisioning of the environment is made easier by the technology being cloud-based. However, 78% of financial technology solutions are still not hosted in the cloud…

2. How often are they releasing updates?

Release frequency is one of the biggest indicators of just how technology-oriented a company actually is.

A regular release schedule shows that a firm isn’t reliant on legacy technology infrastructure, values customer experience (they’re constantly looking out for ways to improve), and suggests that they’ve built up their dev ops capability, and are able to move with agility.

To put this into perspective, Amazon releases new code every 11 seconds…

3. Can they quickly set up new instances?

Set up should be fast or automated with no “bespoke builds” – which inevitably bring with them great expense and lengthy lock-in periods. (You can achieve this much easier when you’re cloud hosted, so all of these things are connected.)

4. Is their pricing competitive?

It can be time and resource intensive for firms to onboard new clients on legacy software, which is why hefty upfront integration fees and long contract times have become the norm.

A competitive firm should have no set-up costs, no long contract lock-ins, and be flexible and affordable. All of this demonstrates that the firm’s set up in a modular way that means they can service you efficiently without throwing people at problems.

5. Are they API first?

This is perhaps the most important question to ask. For those unacquainted, API stands for “application programming interface” – a protocol that basically allows two pieces of tech to talk to each other.

APIs are changing the game. Not only do they provide a secure and standardized way for applications to work together, but they’re also democratizing the platform industry – allowing smaller firms to run their own tech.

The firm should be able to share a well-documented API that shows what they do and how you can embed this into your own functionality. It’s harder to build an API layer on an existing technology layer, so an API-first platform is what you should be looking for.

What we do at Seccl…

At Seccl, we’re passionate advocates of technology – and of the democratizing power of APIs. If you want to get up to date with APIs and how they work – as well as their impact on the advice and wealth management sector – we’ll be running an API Academy, so stay tuned. Sign up to our insiders list to be notified!

Lastly, while you’re here, why not download our tech market cheat sheet, or read our blog on operating your own platform?

If you have any follow-up questions, do get in touch. I’m always up for a chat!