At Seccl, we’re lucky enough to work with some of the most innovative and ambitious businesses in the investment and advice industry.

It’s an exciting place to be, where the perceived divide between ‘fintechs’ and ‘traditional wealth management’ firms falls away – and instead is replaced by a community of forward-thinking businesses of all shapes, sizes and pedigrees, all using technology to do better by their clients.

To bring to life just how exciting it is, we thought we’d showcase some of the fantastic work that our clients have been getting up to over the last few months.

Penfold: doing it for the freelancers

In January of this year, the number of self-employed UK people passed 5 million for the first time. It’s a major milestone, reflective of a growing preference for flexibility in where, when and how we work – one that may only have got stronger since lockdown.

But while the last few months might have proven once and for all that there is a way to work flexibly, they’ve also cast a light on possibly the biggest single challenge faced by the self-employed: financial security.

Though freelance life can bring you freedom and choice in abundance, stability can be hard to come by. Your income may well fluctuate month to month, and you won’t have the benefit of a regular employer pension. Which means that, without careful planning, your retirement savings can all too easily fall behind.

That’s where Penfold comes in. They’ve built a pension specifically to cater for the needs of the self-employed – allowing them to quickly and easily save whatever they like, whenever they like. It can be in regular installments, lump sums, or both – and users can pause or change their set-up instantly online.

With an awesome product that solves a burning need among a clearly defined target segment, it’s no surprise the company’s off to a great start.

It’s growing rapidly, with continually terrific customer feedback (99% of its TrustPilot reviews are rated ‘Excellent’ – with the other 1% being a mere ‘great’. Something for them to work on, then 😉).

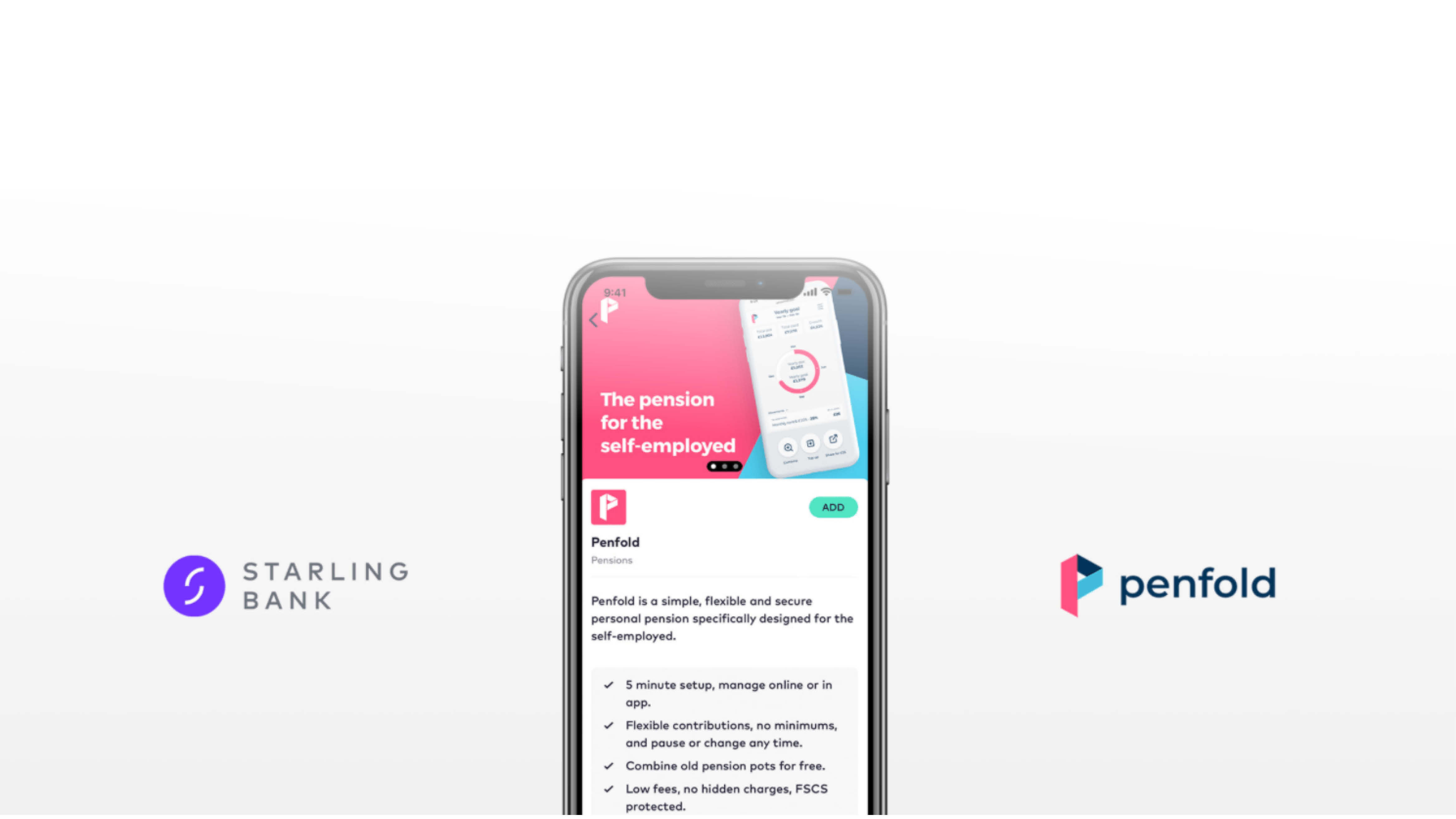

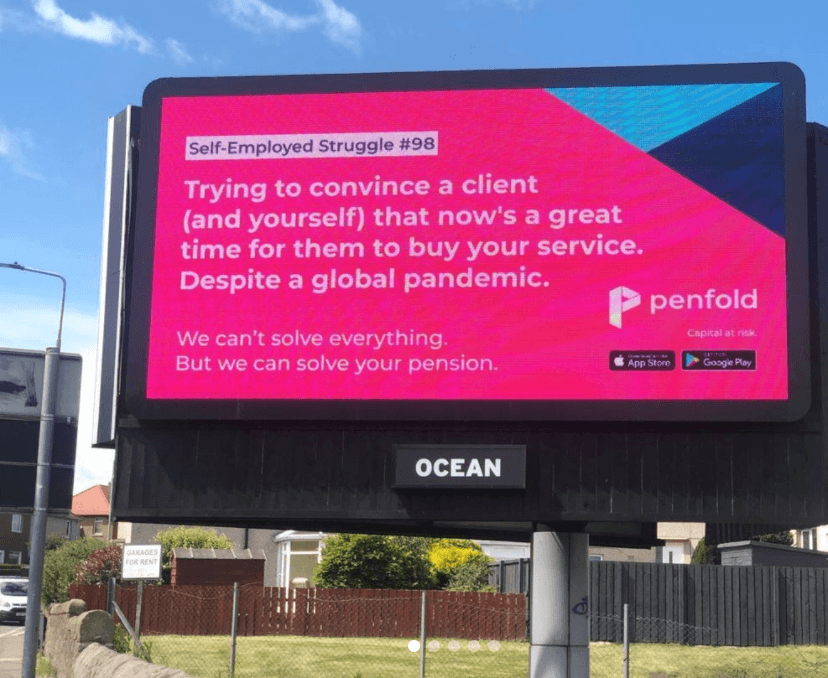

And that growth looks set to skyrocket, following the company’s first outdoor advertising campaign and an exciting partnership with Starling Bank.

As the latest addition to the Starling Marketplace – where the digital bank’s 1.4 million users can browse third-party providers and services (many of whom may well be self-employed or freelance) – Penfold’s future looks bright indeed.

Wombat: women in power

Wombat is another firm that’s looking to cater for an often overlooked audience – namely those who might be new to the world of investing.

With its unique thematic investment approach, slick mobile app, and rich suite of learning tools, the team provides a simple and engaging way for new investors to put their money behind the causes or companies that interest them.

Funds are grouped into themes, so that investors can quickly build a portfolio that reflects their own interests and causes. For example, the patriotic can back ‘The British Bulldog’, avid eaters can give a tip to ‘The Foodies’, and the ethically minded can choose ‘The Goodies’.

The firm recently introduced its latest theme, ‘Women in Power’ – Europe’s first ETF to focus on companies leading the field in gender equality, from having women in power, to equal pay, and a strong gender balance in the workplace.

As Michaela, Wombat’s Head of Growth, put it: “We want to make it both easy and interesting for everyone to invest. Launching this fund gives our users another opportunity to invest in companies leading on gender equality, and as a female in Fintech it’s crucial we are empowered to create the future for everyone.”

It’s just the latest step that Wombat’s taken to help remove traditional barriers to investing. Back in March, they began allowing their users to buy fractional shares of listed companies – so that those who might want to invest only £10 can still get access to the companies they love.

P1 Investment Management: championing the net-zero agenda

A strong ethical focus is a common thread among our clients. And few companies have a higher claim to championing ethically responsible investing than P1 Investment Management.

They recently created a systematic standard – the Net Zero Carbon 10 (NZC10) – to help funds better align their investment policies with genuine carbon-neutrality, not just emissions reduction.

P1 has been shortlisted in the BusinessGreen Leaders Awards

The team already has commitments from four fund managers, with total assets under management of just over £2.2 billion, to ensure their sustainable funds meet the NZC10 standard.

And with ethical investments rightly rising up the agenda (all the more so, no doubt, after Apple’s recent promise to become carbon-neutral by 2030), we’ll no doubt see that number continue to rise.

We weren’t surprised, then, to hear that P1 have recently been shortlisted for the Net Zero Now Award, for Decarbonisation Strategy of the Year, at the BusinessGreen Leaders Awards in 2020. We’ve got our fingers crossed for them.

To find out more about who we work with, or learn about how we could help you, do get in touch; I’d love to chat.