About this guide

Our software and services help forward-thinking firms to build the investment propositions of the future… But how, exactly? What does launching – and running – an investment platform with Seccl entail? What considerations do you need to bear in mind? And who does what?

In this short introductory guide, we’ll explore the ins and outs of running an investment proposition on Seccl.

We’ll tackle some of the key questions you might have; and outline the additional roles and responsibilities that this exciting step will bring.

While we hope you find it useful, we realise there’s nothing quite like a conversation. If you have any questions about what you’ve read, or want to talk through some of the points it may raise, do get in touch.

Who do we work with?

Helping firms of all sizes to take control

Lowering the barriers to entry

Our sector is being held back by old tech, dismal processes and misaligned interests. Together they create pointless complexity for financial planning and investment professionals, and provide outdated, overpriced experiences for customers.

They also create unnecessarily high barriers to entry for those customer-centric firms looking to bring new investment propositions to market.

In short, launching a new investment platform – or embedding a new investment proposition within an existing user journey – has been more difficult, more expensive and more time- consuming than it ought to be.

Our low-cost, hyper-efficient software and services are designed to change all that, providing the affordable infrastructure on which all manner of firms, large and small, can build the next-generation of investment platform.

Size isn’t everything…

Legacy providers would have you believe that launching and running an investment platform is time-consuming, complex and expensive – only suitable for large, well- established firms with deep in-house expertise and even deeper wallets.

We beg to differ. The size of your firm – whether measured in assets under management (AUM), headcount, recurring revenue or any other metric – is no longer the limiting factor it once was.

In our fast-changing, technology-enabled world, it’s ambition that matters. The businesses that aim high, put their customers first and build for a future beyond tomorrow will be the ones that succeed.

Powering the future of wealth

With our embedded investment engine at their core, companies of all shapes and sizes can launch new investment platforms in record quick time – strengthening their proposition, growing their revenue, lowering their costs and improving their customer experience.

Operating across the entire wealth management landscape, we support all kinds of firms — from fledgling start-ups, to large and well-established financial advice businesses and everything in between.

In particular, we can help…

— Small, medium and large financial advice or discretionary fund management businesses, looking to take control of their online experience

— New and existing financial adviser consolidators, eager to create consistency and efficiency across their acquisitions

— Start-up wealthtechs, on a mission to bring innovative investment or advice propositions to market

— Established fintechs or neobanks, looking to embed an investment journey within their proposition

— Adviser technology providers, interested in creating a seamless advice journey with their own embedded platform

Redefining what good looks like…

We’re helping a diverse range of firms to reimagine their business – and their client experience. With Seccl, you can…

- Build more valuable businesses

Reduce internal operating costs. Either capture the value, pass on in full or share with clients - Integrate your systems and tools

Cut out the back and forth and manual processes, to reach new levels of internal efficiency - Take control of your proposition

Choose fee structure, client bank and investment universe, with full propositional flexibility - Improve your digital offering

Build a lightning-fast – and entirely paperless – investing and advice journey - Serve new clients

Advised, XO or hybrid, wealthy or aspiring… cater for all, with full platform flexibility - Lower your costs

Deliver a better service, for less, by translating efficiency savings into real client cost-savings

Key considerations

You don’t have to be big, but you do have to be ready…

Before taking the leap, you need to be comfortable that you’re ready to launch – and run – an investment platform of your own.

It’s important that you seek qualified, independent advice before operating a platform, so that you are sure of what permissions you may or may not need — and are fully ready for the responsibilities it entails.

For those that are serious about the idea, none of the considerations we outline here should pose a material, let alone insurmountable, burden to launch. If this sounds too much like hard work, then, well, perhaps that tells you everything you need to know!

Are you prepared for the responsibilities?

By becoming a platform operator, your business will be voluntarily taking on a number of roles and responsibilities. We outline some of the more significant ones later in this guide.

It’s important that you’re aware of and fully understand these responsibilities — and that you’re comfortable you have the right people and plans in place to carry them out.

Do you have the necessary permissions?

There are definitely regulatory implications with operating a platform. In particular, it’s likely that you’ll need the following permissions:

- Arranging (bringing about) deals in investments

- Arranging safeguarding and administration of assets

- Making arrangements with a view to transactions in investments

- Permission to control client money

Note: you’ll need to make sure that the required permissions apply for all investment types that you’re looking to offer. In particular, if you are looking to offer our SIPP product then you should include the ‘personal pension scheme’ investment type.

It might be that you already have these permissions by virtue of your usual course of business (for example if you’re already a discretionary investment manager).

Or it might be that you need to apply to the FCA to have them added (more on that opposite).

Do you have the required capital?

You might be required to hold more capital in reserve by deciding to operate your own platform.

Whether or not you do will depend on your existing status and business model — and the future scope of the assets that would be administered on your platform.

If you are a BIPRU or IFPRU investment firm, you will already be required to develop and maintain an Internal Capital Adequacy Assessment Process (ICAAP).

Launching an investment platform may not, in itself, fundamentally change your capital requirements calculations or processes (although you will have to account for the change in business model in your ICAAP). But if the assets of another firm (or many firms) are to be managed through your platform, then you’ll likely need to hold additional capital.

How do you get the right permissions?

Firms who would like to launch an investment platform but who don’t have the required permissions, essentially have two choices on how to obtain them.

Many may prefer to establish an entirely new corporate entity, to minimise the potential for conflict and help simplify their accounting. Applying for the relevant permissions, in this case, costs £5,000 in application fees to the FCA.

Alternatively, firms can apply for a Variation of Permissions for their current business — a path that will cost them £2,500 in application fees to the FCA if they are adding a new fee block.

In both cases, the FCA will make a decision to accept or reject your application within six months (provided it’s complete — otherwise it’s within 12 months).

To find out more, take a read of our dedicated guide, ‘Permission to launch’…

How does it work?

We’ll handle the custody. You focus on the customer.

In other words, it’s not as hard as you might think. Appoint us to handle some of the more challenging aspects of running an investment platform, like custody and client money, and focus on the all-important job of giving a great service to your clients.

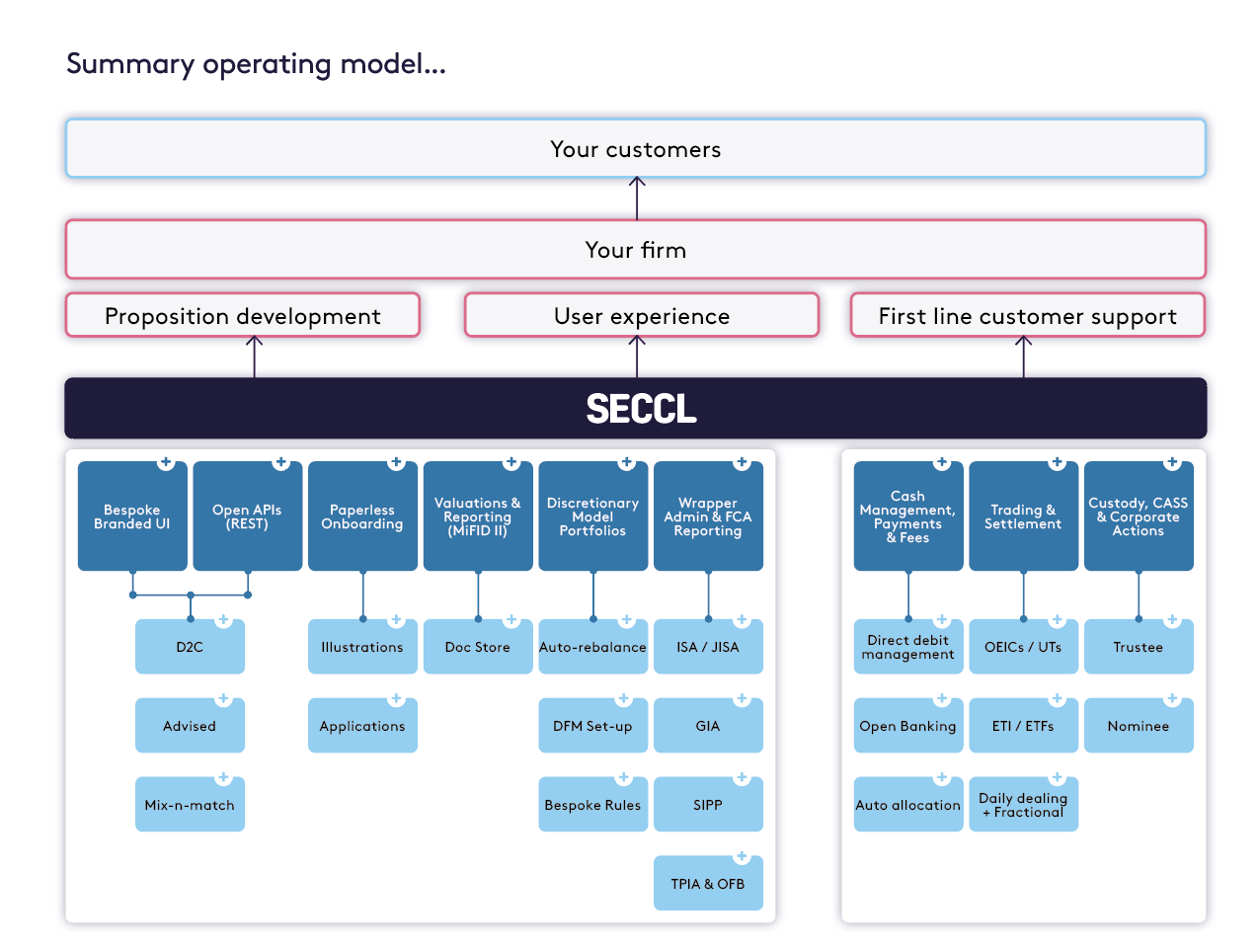

Our operating model

Under our model – a ‘model b’ arrangement – firms can appoint us to fulfil all client money and custodian obligations, along with the technical process of trading and settling investments.

They can embed these services how they like. Firms without their own in-house tech teams can take our ‘off-the-shelf’ professional and client portals and get to market quickly with a ‘no-code’ solution. Alternatively, they can harness our fully-documented APIs to integrate their preferred third-party interface (along with any number of other API-first tools).

Firms with their own technology expertise, meanwhile, can use those same APIs to build their own client experience directly on top of our software and services.

A best-in-breed partnership

At a high level, this model hands control of the overall customer experience over to the investment platforms we power – while we work behind-the-scenes to provide the underlying investment infrastructure on which this experience rests.

Investors benefit from an improved, streamlined and cost-effective investment proposition, delivered by a brand they know and trust; while firms reap the rewards of a more efficient, easy- to-use platform, built around their business and run under their control.

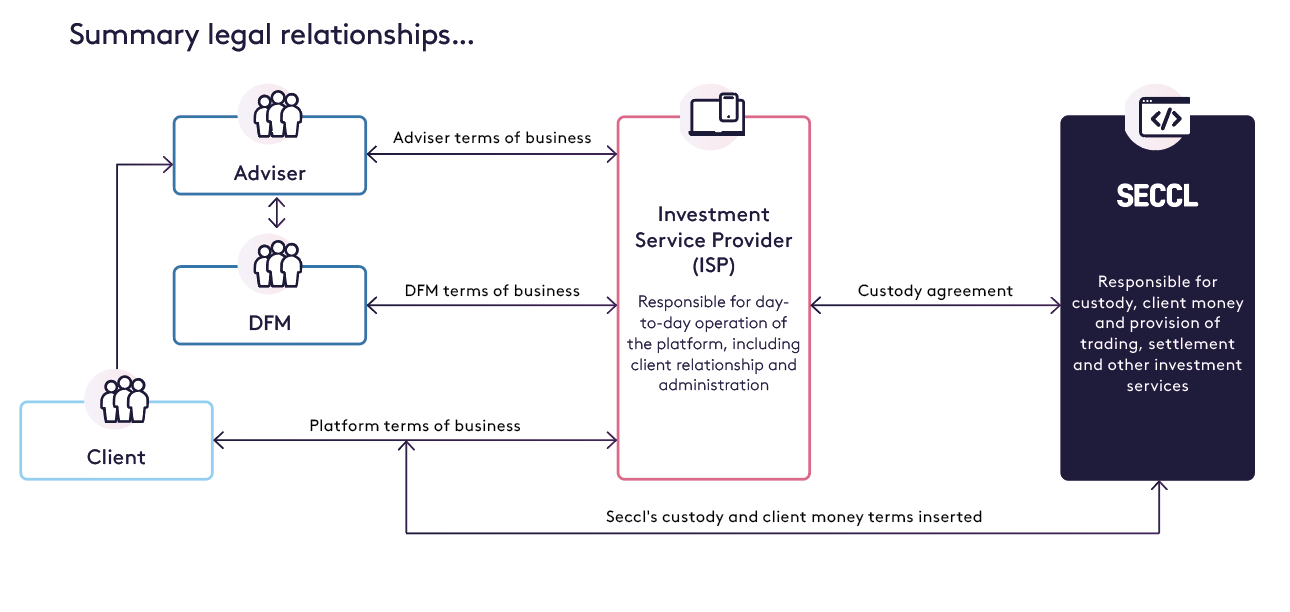

Legal relationships

The relationship between Seccl as custodian, you as investment platform, and your clients as investors would be outlined in the platform terms that clients accept when they sign up to use and invest with the platform.

While we have no direct customer relationship with the end investors who use your platform, our custody and client money terms would be inserted into those terms of business for your clients to sign.

Who does what?

Regulatory position

The FCA defines only one role when it comes to the provision of an investment platform — namely that of a ‘Platform Service Provider’ (see excerpt below).

Under our model, both parties would fall under this definition – and so share the regulatory burden of platform service provision. It’s why you’ll need a number of permissions to be able to run an investment platform, which we outline on p.6.

You can find out more about the regulatory considerations involved in our complementary guide, ‘Permission to launch: What permissions will you need to run an investment platform, and how do you get them?’

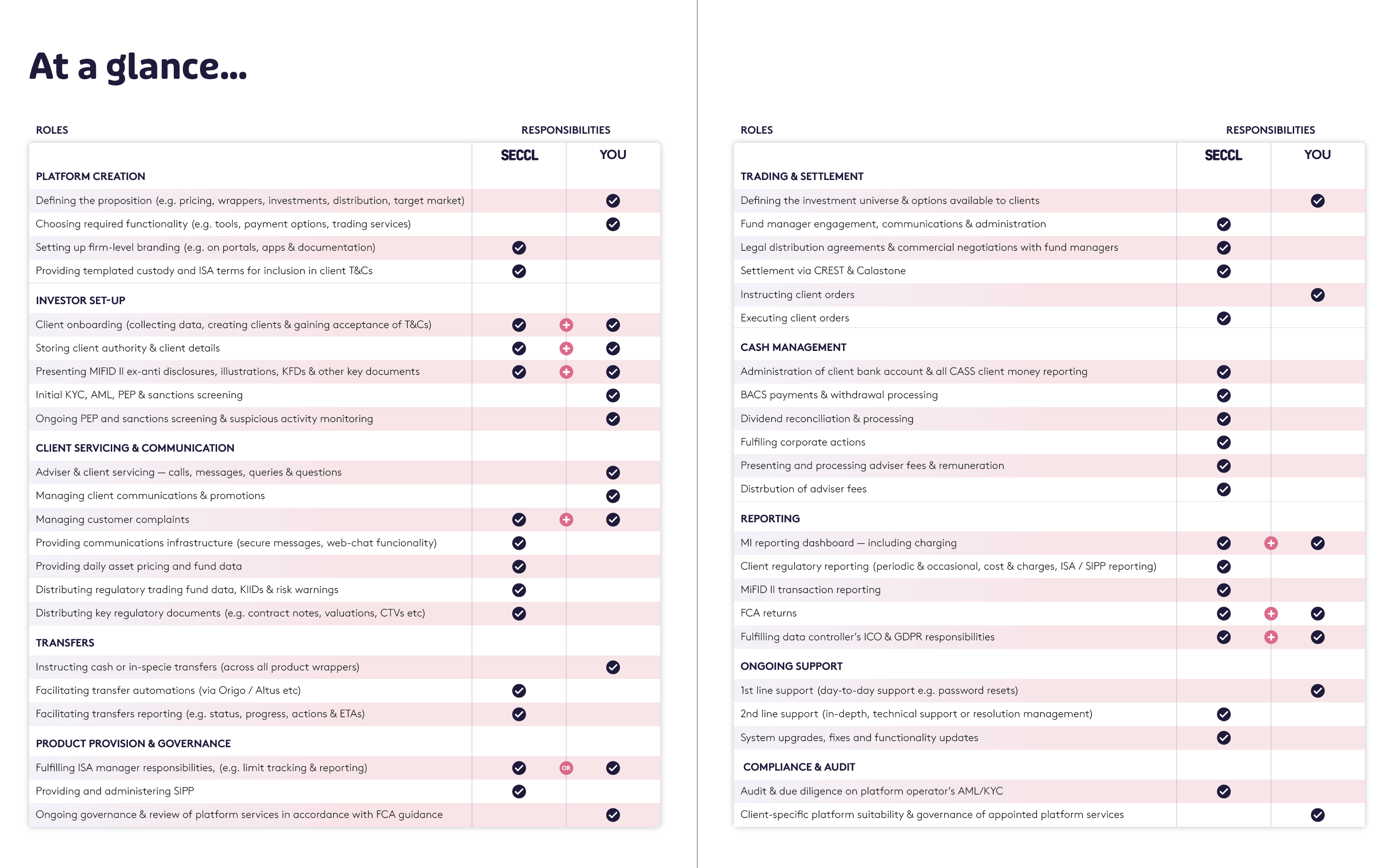

Shared responsibilities

This shared regulatory burden comes to life in a set of shared responsibilities, which we outline over the course of the next few pages.

We provide some of these services, while you as a ‘platform operator’ or ‘investment service provider’ (‘ISP’) fulfil others.

The snapshot on pp.14-15 provides a high-level summary of these combined roles and responsibilities.

What’s a Platform Service Provider?

" A firm providing a service which:

a. involves arranging and safeguarding and administering investments; and

b. distributes retail investment products which are offered to retail clients by more than one product provider;but is neither:

c. solely paid for by adviser charges; nor

d. ancillary to the activity of managing investments for the retail client ”FCA Handbook (Glossary)

1. Platform creation

One of your most important early tasks will be to define your platform proposition — for example the pricing, wrappers, investment options (from our pre-defined universe), distribution strategy, target market — and choose which elements of system functionality you’ll require.

We’ll provide terms and conditions for our custody service, to be incorporated into your own platform terms and conditions that your clients will need to sign with you.

You’ll be responsible for creating other key platform policies (for example your privacy, data protection and conflicts of interest policies).

If using our off-the-shelf portals, we’ll help you in implementing the look and feel of your platform.

2. Investor set-up

It’ll be your job to onboard clients as well as to gain and record client acceptance of the various terms and policies – either through your own custom-built interface, or through our professional and client portals.

This includes clients’ ISA declarations, which though technically the obligation of the ISA manager — us, by default — will be delegated to you to fulfil at the point of client set-up.

You will be responsible for initial and ongoing KYC, AML, PEP and sanctions screening. However, as regulated custodian, our AML responsibilities are equal and equivalent — and so while we’ll place reliance on you to perform adequate checks, we’ll need to understand and take comfort in your own processes.

For this reason, we’ll need to conduct due diligence on your policies and procedures, and carry out regular audits to make sure robust controls are in place.

For the avoidance of doubt, you would be liable for costs or losses arising from fraud or criminal activity.

3. Client servicing and communication

You will be the first point of call for all queries and calls from those using your platform (which, depending on your proposition, could be end investors or financial planning professionals – or both).

We will provide the infrastructure that will support ongoing service and client communication — including providing template service messages — but we will not market to or otherwise communicate to clients directly.

If relevant, financial advisers will be able to select assets from a pre-defined universe which you, as platform operator, will control — with close-of-business pricing and fund data provided by us.

We will automatically provide Key Investor Information Documents (KIIDs), contract notes, valuation statements, consolidated tax vouchers and product cancellation notices via the secure messaging hub in each client’s portal.

4. Transfers

You’ll be able to instruct cash or in-specie transfers, either through our professional portal or directly through the API, which we will facilitate and report on via our transfer gateway integrations with Altus and Origo.

5. Product provision and governance

We provide and administer an in-house SIPP wrapper, but also support other third-party products. By default, we will operate as ISA manager — but we’re open to platform operators assuming this responsibility instead.

The ongoing governance and review of wrappers, products and instruments, in accordance with PROD, will fall to you.

6. Trading and settlement

The trading and settlement of investments is one of our core services, which we will fulfil via our nominee company, Digital Custody Nominees Limited.

At the point of contracting with us, you will define (from our pre-defined universe) the list of assets that your platform users will be able to trade. Our fund list spans over 1,000 funds from over 100 fund managers — and additional funds from providers with whom we have an existing relationship can be quickly added.

We’ll always investigate ways of working with new fund managers upon request. We’ll base our decision on whether we can administer the asset compliantly and digitally.

We’ll handle all aspects of fund administration, facilitating order execution through Calastone for funds and Winterflood Business Services for exchange traded instruments. Our order execution policy will form part of the terms you’ll need to sign with your clients. We will also oversee all distribution agreements with fund managers, too.

DFM platform users will be able to create and maintain model portfolios, link them to client accounts, and rebalance them at any time.

7. Cash management

Cash management is a core Seccl service. As such, we will handle client money in our dedicated client money account, facilitate payments and withdrawals, undertake all dividend reconciliation and payments, and handle corporate actions.

Depending on the payment methods you choose to support, it’s worth noting that you might be responsible for administering some of these (for example Direct Debits).

Advisers and other platform users will be able to move client money between accounts and wrappers via our professional portals (or any other interface that you choose to integrate).

We will calculate and deduct client-level service fees on your behalf, based on their daily portfolio valuations during the previous month. Our fees will be invoiced directly to you, outside of client portfolios. We will also pay adviser fees directly to any firms using your platform (but will need you to provide their bank details in order for us to do so).

8 Reporting

We’ll provide you with the standard MI reports that you would expect. We’ll also provide all reporting and alerts required of us in our role as custodian (and ISA manager, if applicable) — including CASS returns, transaction reporting, suspicious activity, regulatory breaches, all MiFID reporting, and pre- and post-sale illustrations. You will then be responsible for fulfilling any onward reporting that’s required of you.

As an FCA authorised firm you’ll have to provide your own returns to the FCA (or provide them via your Principal if you’re an appointed representative).

Finally, as joint data controllers, both registered with the Information Commissioner’s Office, we will each need separately maintained privacy and data policies — and will both be responsible for complying with the relevant responsibilities and duties under the GDPR.

9. Ongoing support

You would be responsible for providing day-to- day system support to users of your platform (for example password resets or simple ‘how-to’ explanations) — while we will of course handle more sophisticated queries, system fixes or functionality updates.

10. Compliance and audit

As mentioned, we will need to conduct due diligence on your AML/KYC processes and procedures, to gain comfort that adequate systems and controls are in place.

By the same token, due diligence, governance and oversight of the platform services that you appoint us to provide will need to be undertaken by your compliance function (though we’ll happily support by providing any information you might need).

If you’re an advice firm looking to transfer clients across to your new platform, you’ll also have to evidence that you have fully considered the options available, and that your decision to move clients onto your own platform is indeed suitable in each case.

At a glance: roles and responsibilities

Getting started

From first look to full launch in just a few months

Contrary to what established incumbents might have you believe, it needn’t take years or cost millions to launch an investment platform.

With our scalable, modern and legacy-free technology, it’s simpler, faster and more affordable than ever. We’ve outlined the high-level launch journey here.

How fast, you ask? Well, we launched and migrated one client’s book as little as four months after our first conversation… Can you beat them?

- Prep and permissions

After a series of demos and the usual DD, we’ll guide you through the process for obtaining new permissions (if you need any). - Deep-dive workshop

An intensive, full-day kick-off workshop to fully understand and document your needs, culminating in a full plan detailing the nature and scope of your integration. - Fee-free integration

As well as guiding you through your technical integration, we’ll offer you support on your regulatory, compliance and legal tasks, too. All at zero cost. - Launch

We work with you to onboard your first new assets, and migrate any existing books across to your new platform.

The launch checklist

- Have you got the right permissions?

- Are you clear on all the responsibilities?

- Have you done all your due diligence?

- Have you put together the business case?

- Do you know how you’ll structure the business?

- Have you considered how you will price it?

- Have you fully costed the ongoing management?

- Do you have the right skills internally?

- Have you got enough support staff?

- Have you put together a training plan?

- Is there strong governance and oversight in place?

Ready to go?

We want to power the new generation of forward-thinking, customer-centric investment platform. If that’s you, then get in touch to start your launch journey today…