Change the way millions invest, with your own embedded investment journey

Neobanks, savings apps and fast-growing technology firms from all sectors can use our scalable investment infrastructure to launch the investment propositions of the future…

Customer volume is great. Customer value is better.

Hundreds of thousands – maybe even millions – of customers trust your brand to deliver a service they love. Why not build on that trust, strengthen your proposition and grow your bottom line – with an embedded investment journey of your own?

-

Savings apps

Help your customers do more with their money, with your own seamlessly embedded investment journey…

-

Digital banks

Enhance your proposition, fulfil your purpose and strengthen your profitability, with a next-gen investing experience…

-

Non-FS brands

Take your brand loyalty into a new market, by disrupting the established investment and wealth management experience…

How can we help?

Grow your bottom line

The last decade has seen tremendous growth for technology brands – including fintechs, wealthtechs and digital challenger banks. But as the climate turns and belts tighten, the demand for positive profit numbers grows stronger day by day.

Embedded investments can provide a path to profitability. By strengthening your existing customer proposition with a seamless, intuitive investment journey, you can monetise your millions-strong customer base and grow sticky revenue – driving additional loyalty and engagement in the process.

See it in action

Build an investment journey customers love

Investments aren’t working – at least not for everybody. According to Boring Money, only 15% of UK adults have a stocks and shares ISA, while the UK’s Financial Capability Survey showed that 39% of adults don’t feel confident managing their money.

Embedded investments can provide the solution. With your own seamless, intuitive and jargon-free investment journey, you can harness your established trust and brand loyalty to guide a new generation of would-be investors on their path to wealth creation.

See success stories

Bring investment platforms into the future

Most established investment platforms are administration firms built on outsourced – and outdated – technology. Fast-growth technology companies, whatever their current vertical, have a chance to shake things up for the better.

Embedded investments are the future. Powered by scalable, API-first investment infrastructure, brands that don’t even operate in financial services today could run some of the most successful investment platforms around in 10-20 years’ time…

Start the journey now

Why Seccl?

Scalable technology built for a fast-changing future

-

Launch quickly with our API

100% of our technology is available through our publicly documented API, which regularly handles over 1.5 million daily requests.

-

Strip out inefficiency

We’re building the most efficient investment engine around – one that replaces manual process with intelligent automation, supporting nearly 10,000 investors per ops team member.

-

Absorb regulatory change

Our system is built on an architecture that isolates potential areas of change – preventing the need for comprehensive code rewrites. Change is constant; we’re ready for it.

-

Build on a scalable codebase

We maintain a single instance of our code base – with none of the overhead, cost and inefficiency of legacy codebase. We ship features fast and can scale to support millions.

-

An affordable way to grow revenue

Our ultra-low-cost custody and investment engine (typically 8-10 bps all-in – with zero up-front integration fee) allows you to get to market affordably as well as quickly.

-

Work with Octopus

We’re part of Octopus, the £multi-billion B Corp that’s on a mission to breathe new life into broken industries, through companies like Octopus Energy, Octopus Investments and Octopus Ventures.

Getting started

From first look to full launch in just a few months

Prep and permissions

After a series of demos (check out our intros here) and the usual DD, we’ll guide you through the process for obtaining new permissions (if you need any).

Deep-dive workshop

An intensive, full-day kick-off workshop to fully understand and document your needs, culminating in a full plan detailing the nature and scope of your integration.

Fee-free integration

As well as guiding you through your technical integration, we’ll offer you support on your regulatory, compliance and legal tasks, too. All at zero cost.

Launch

We work with you to onboard your first new assets, and migrate any existing books across to your new platform.

We launched and migrated one client’s book as little as four months after our first conversation. Can you beat them?

Get startedWorking together

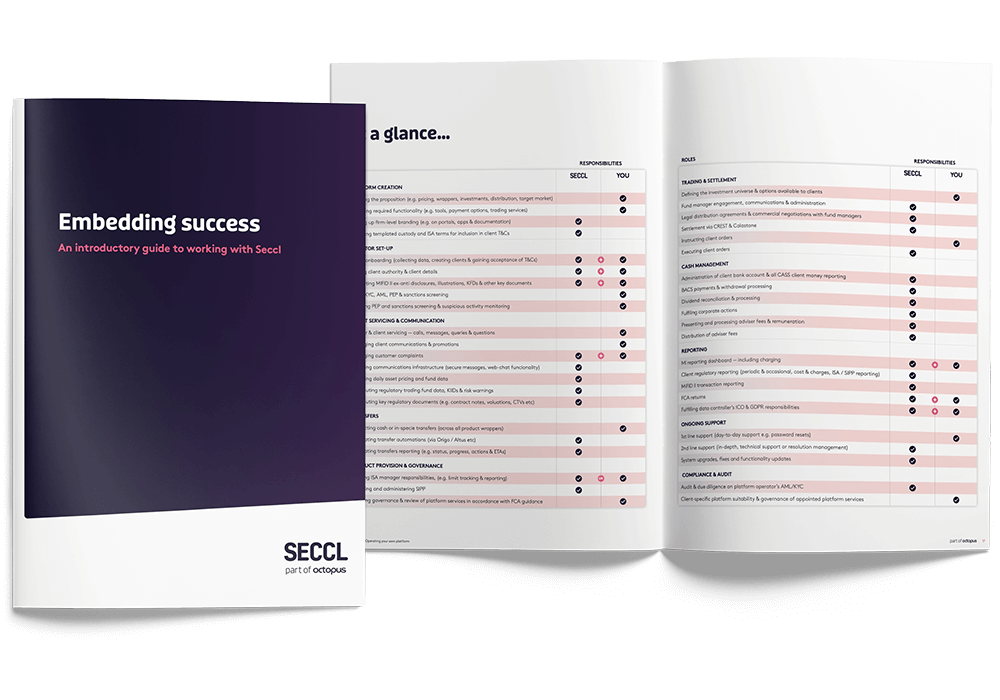

A guide to working with Seccl

To find out more about the ins and outs of what’s involved – and, in particular, who’s responsible for what – take a read of our introductory guide to working with Seccl.

Ready to begin?

Get started with Seccl today

-

Get a demo

See introductory walk-throughs of our portals or our API, or arrange your own.

Take a look -

Get a quote

Use our simple pricing calculator to get an idea of the costs involved.

Give it a try -

Get in touch

Book a call to find out more and see how we can help your business, fast.

Drop us a line