Affordable, flexible, and always transparent.

Our legacy-free tech means we’re one of the most affordable and efficient custodians and investment technology providers in the market. You’ll only pay for what you need – and we’re always clear on what it costs.

Typical charging structure

An affordable solution that starts at 0.1%

Typically, clients will pay you a monthly platform fee to cover the cost of custody, trading and any investment activity; while we’ll separately charge your firm a custody fee (calculated on each of your clients’ portfolios), a fee for client or adviser portals (if you’re using them), along with any variable costs incurred (like trading fees, Direct Debits, transfers or wrappers).

Our custody fee is designed to be one of the most affordable in the market, starting at just 0.1% and tiering down to zero for larger portfolios. Our minimum charges are designed to be accessible, too: £75,000 per year in the first year, rising to £150,000 per year from year two onwards.

Try our calculator to see how it could compare, and learn more about the other costs involved. Or just dive straight into the detail.

Flexible and modular

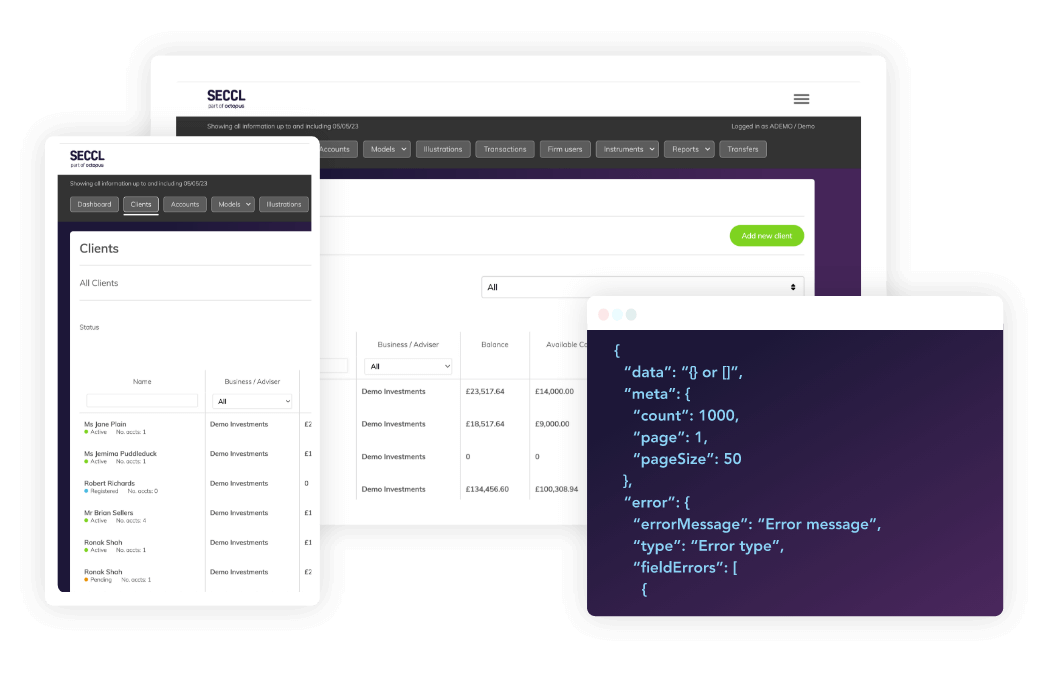

Take our off-the-shelf portals, or DIY with our API

Our custody service and investment technology can either be accessed through our off-the-shelf adviser, DFM and client portals – priced at £12,000 and £24,000 per year respectively, or through your own, custom-built interface that you connect directly via our API.

You’ll only pay for what you use – and there are no costs for integrating, no matter how you choose to.

-

0.1%

Starting custody fee

-

£12k

Annual professional portal fee

-

£0

Set-up cost

How much will I pay?

Try our pricing calculator

The detail

Our full pricing breakdown

Want to know the detail? We’ve outlined all the potential costs involved with using our service below.

Digital custody

| AUM per client | Price |

|---|---|

| £0 to £500k | 10 bps |

| £500k to £1m | 5 bps |

| £1m + | 0 bps |

Clients’ platform and adviser charges are calculated based on their end-of-day portfolio valuations during the previous month. There is a minimum custody charge of £75,000 per year in the first year, rising to £150,000 per year from year two onwards.

Client and adviser portals

Our portals for advisers are priced at £12,000 (+ VAT) per year, and client portals at £24,000 (+ VAT) per year. Note that, unlike our digital custody service, our client portals are subject to VAT. Any improvements to the interface will automatically flow into portals at no extra cost.

Other variable costs to think about

| Item | Cost |

|---|---|

| Direct Debit (per DD) | To be negotiated with DD provider, assume £0.20-0.50 |

| Fund transactions | No cost |

| UK ETF & Shares (bulk traded at the end of day) | 4 bps per trade (minimum of £4) |

| Account transfers (via Origo or ATG) | £15 per wrapper |

SIPP costs

| Account | Cost |

|---|---|

| Accumulation | Annual charge of 0.05% paid monthly with a minumum of £12 + VAT and maximum of £48 + VAT per year |

| Decumulation | Annual charge of 0.10% paid monthly with a minumum of £48 + VAT and maximum of £120 + VAT per year |

Get in touch

Ready to get started?

If you want to find out more or kick off a conversation, then get in touch – we’d love to chat

By submitting this form, you agree to our Privacy Policy and Terms.