Retirement planning is probably the most crucial aspect of most financial advice. It’s also, though, one of the most complicated.

While the prospect of an increasingly long and healthy life is one to be thankful for, it does raise a challenging question: how do I avoid running out of money?

After all, it’s no longer unreasonable to hope that your retirement will last 30, maybe even 40 years. It’s a hell of a long time to go without a salary, which makes the need for sound forecasting all the greater.

And so, retirement planning is complicated enough as it is, without technology getting in the way. Which is why we’re especially keen to remove as much complexity from the process of delivering it as we physically can.

With that in mind, we recently released a fully paperless drawdown pension; and we’ve since followed it up with our very own illustration tool – built right here in Seccl, in as little as six weeks. We’re excited to tell you all about it.

So, what does the tool do?

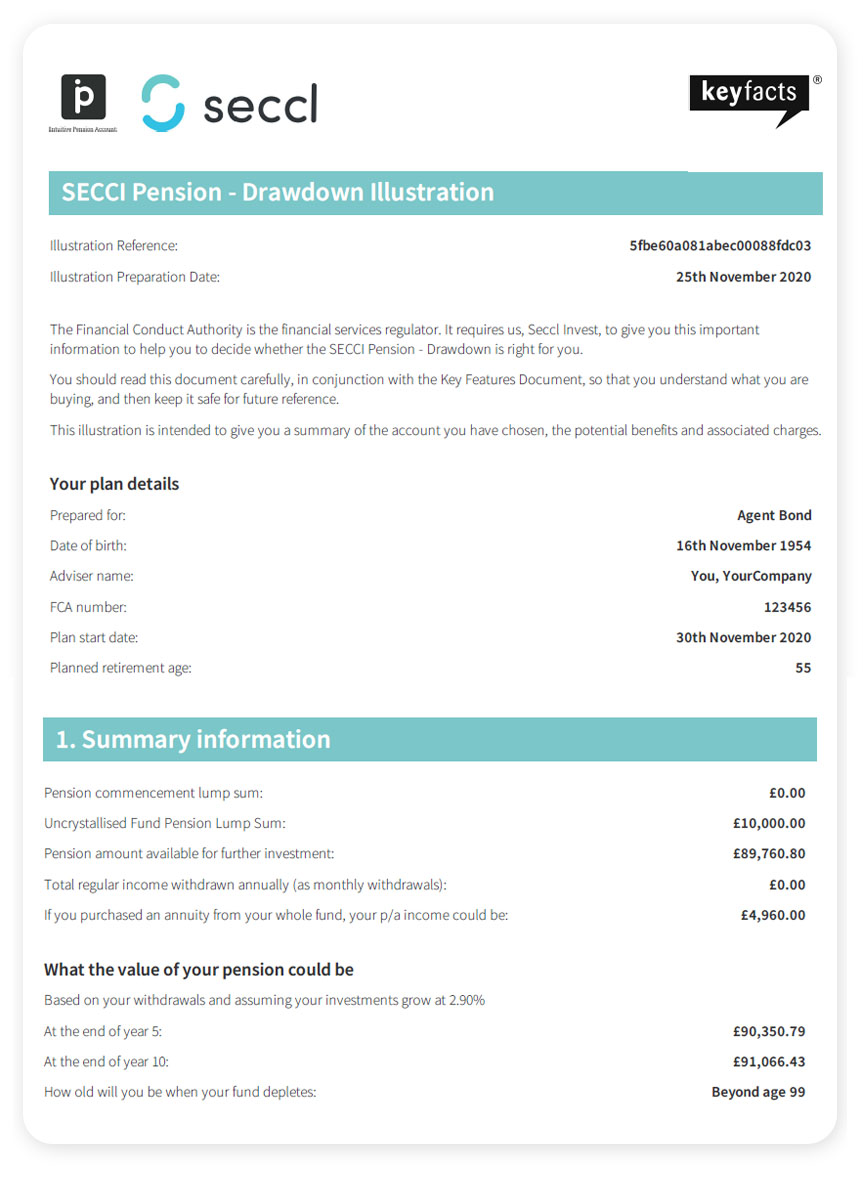

While the calculations that power a client illustration are highly complex, we think creating one should be anything but. After all, it’s just a form that spits out a PDF.

And given just how central these illustrations are to the delivery of financial advice, we’ve tried to make the journey as simple and speedy as we can: every few minutes saved adds up to massive efficiency gains in the long-run.

The whole form takes around 3 or 4 minutes to complete, assuming you have all the information to hand – which is a lot faster than any other illustration tool we’ve experimented with.

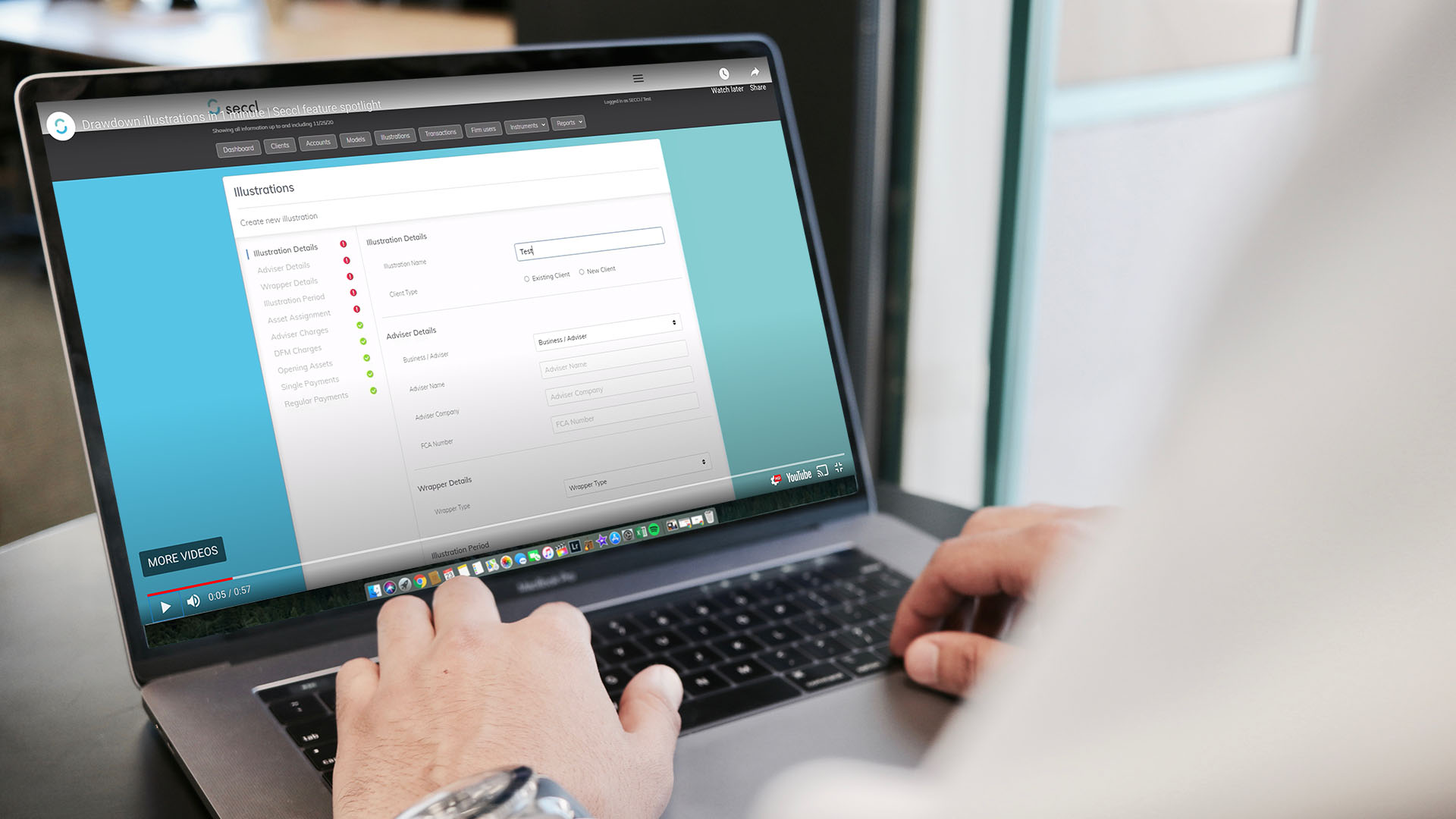

Once created, the illustration will automatically download in the background, so you can carry on using the platform, and the output is, we think, clear and easy to read. You can see the process for yourself in our video below.

From idea to reality in superfast time

Before we build anything at Seccl, we put all of our product development ideas through a so-called ‘shaping’ exercise. It involves taking a particular problem, kicking the tyres on it, defining its scope, and then exploring a potential solution.

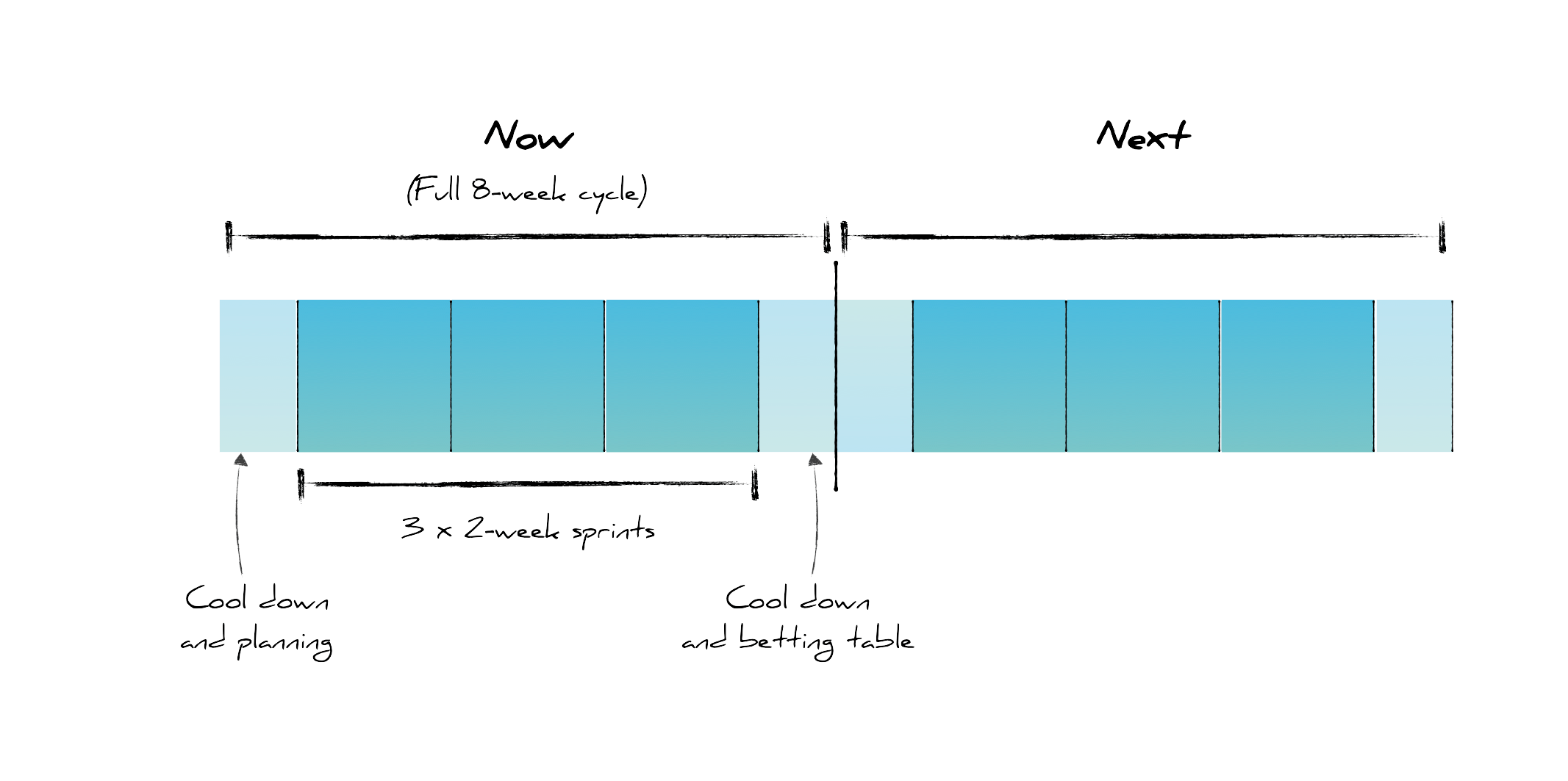

Our ‘shaped’ ideas are then taken to what we call the ‘betting table’, where the business decides which to pursue, and how much time it’s willing to ‘bet’ on each one. (Our Head of Product, Paul, recently explained the process in helpful detail here – take a look).

It’s worth mentioning that as part of this exercise, we try really hard to establish whether we need to build anything at all. In fact a lot of what we shape will never see the light of the day; and while it might seem odd to say, that’s actually a fantastic outcome. It means we haven’t wasted any of our precious engineering capacity building the wrong thing.

Our eight-week development cycle made up of two weeks for 'shaping' and 'betting' and six weeks for building

Anyway, in this case, we were looking to shape the optimal illustration tool: one that easily and efficiently allows advisers to summarise the projected value and sustainability of their clients’ retirement income (or when they might run out of money), as well as the costs and charges associated with their advice and investment recommendations.

We started with the assumption that we needn’t build anything at all. There are plenty of existing tools out there, offered by stand-alone businesses who specialise entirely on illustration software.

But our research showed that these tools were expensive, had unwelcoming contract lock-ins and produced illustrations that, in our view, weren’t the easiest to use or understand. Advisers were telling us that it could take anything from 15 to 25 minutes to create a single illustration – which just felt way too long.

Put simply, we felt this was the quickest, most affordable and most flexible way of supporting our current and future financial adviser clients. So we dedicated our last six-week development cycle to doing just that.

To find out more, or to get a demo, get in touch – we’d love to talk.