Last week, we finally got to see how Vanguard’s new platform is faring in the D2C market – and the answer is pretty darn well.

Despite the widespread economic uncertainty of the coronavirus pandemic, Vanguard’s retail investment platform has gained an impressive 35,000 new customers in the last quarter alone, as its assets swelled to an impressive £11bn. What’s more, 35% of its client base are aged 30 or under, an 8% increase on last year.

To put this into perspective, market giant Hargreaves Lansdown has onboarded 23,000 customers in the past three months, meaning Vanguard has already outstripped its major opposition – and it was only launched in 2017.

Of course, Vanguard is no underdog – at nearly fifty years old, it’s one of the world’s biggest and best-known investment firms, and it currently holds around $8 trillion in global assets. However, the firm’s move to the UK market came relatively recently, and there’s no denying that its low-price, high-tech solutions are already causing some serious disruption in the D2C space.

So what’s Vanguard’s secret? And could the advice market possibly learn a thing or two from the platform’s success?

“A near-singular focus on cost” – Vanguard’s aggressive pricing model

Investment platforms have seen a surge in trading volumes since the start of the pandemic, fuelled by an increase in millennial and Gen Z investors with more money and time on their hands.

Vanguard has capitalised on this trend and carved out a bit of a niche for itself in the market. According to a Platforum analyst , the platform’s “near singular focus on cost gives it a really strong message, and its mutual structure helps with building trust. Combining this with the simplicity of the proposition, marrying up with younger age groups’ needs, Vanguard is proving to be an attractive offering to younger retail investors.”

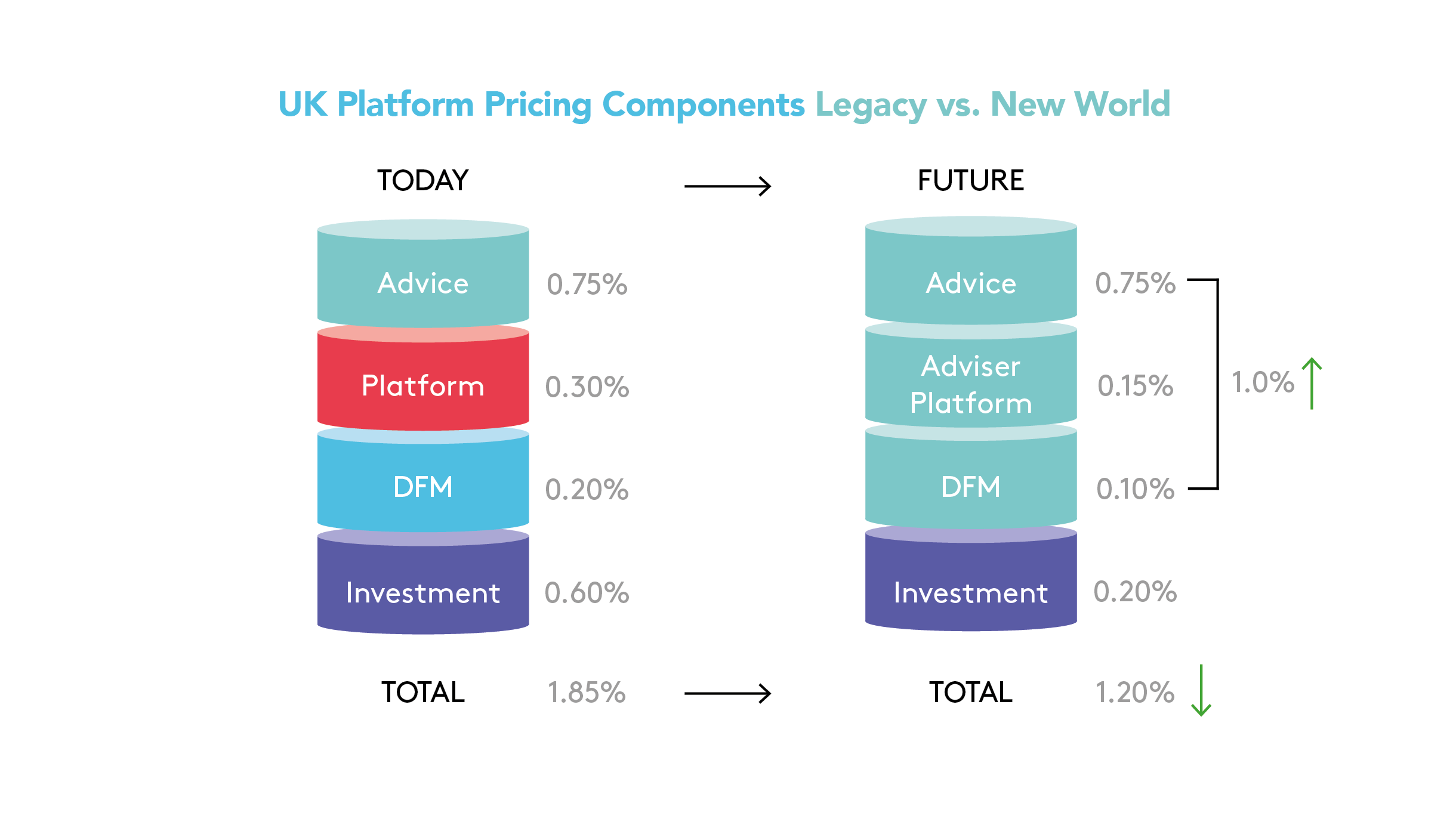

In my opinion, “focus on cost” is putting it lightly. The firm’s aggressively priced platform charges customers a third of the market leader – coming in at a slim 15bps, compared with Hargreaves Lansdown’s typical charge of 45bps.

Of course, it’s not a like-for-like comparison. Vanguard has a leaner offering that’s limited to their own investment range, but it’s one that provides access to a broad array of passive and index funds, which will likely meet the needs of the majority of investors. This means the platform is well equipped to hit its sweet spot younger audience, many of whom seem to be looking for simple, pared-down investment products and tax wrappers. Young people aren’t just interested in meme stocks and high-risk investments after all!

Vanguard has also been smart about investing in tech, allowing the firm to reduce costs and capture market share successfully. Is this a success we can expect to see replicated in the advice space – and if so, how?

You don’t have to be a market giant to topple the opposition

Until recently, the financial markets remained the domain of the wealthy. But Vanguard’s low-cost investment proposition and subsequent retirement advice offering is stoking some serious competition in the industry, and lowering the barriers to entry for new investors.

To put it simply, Vanguard has invested in what the customer wants by capitalising on new and emerging technology to simplify its proposition, giving them full control over how they structure their pricing and allowing them to undercut the competition.

There’s a reason this is happening now. And I think it holds a lesson for advisers, too, when it comes to building a platform of their own.

Until recently, the barriers to entry and innovation have been too high, making platform ownership nothing more than a pipe dream for most investment and advice firms. But already, old distribution models, whereby advisers are limited to essentially selling products, are becoming outdated and redundant – while operating a platform has become more accessible (not to mention affordable!) for the average advice firm. New technology eco-systems can finally link together the key components of a platform and create an end-to-end process that adviser firms can control and own.

As a result, advisers will eliminate their reliance on costly, wasteful and sometimes inefficient third parties, while building their investment proposition from the ground up. They’ll have total say over how they structure their pricing, define their asset universe and manage the end-to-end customer journey – a feat that’s been pretty difficult to achieve until now.

Best of all, this new and improved model cuts out a lot of inefficiency in the value chain and reduces costs for both advisers and their customers.

Meet the heroes: firms stepping up and taking control of their platforms

We’re already seeing firms leading in this space, investing in off-the-shelf technology that allows them to offer services at a fraction of the cost of industry leaders, some of which we’re proud to partner with…

P1 Investment Management

P1 Investment Management is a discretionary fund manager (DFM) founded in 2016 that now offers a platform service to around 25 financial advice firms and several institutional investors. P1 currently has around £200m of assets under management.

After using third-party platforms for years, P1 realised that they were struggling to connect to the tools that they and their network of advice firms were using daily.

“We thought there must be a better way for a platform to link up with the huge universe of different financial planning tools, without actually providing them itself” – James Priday, CEO of P1 Investment Management.

“It would have been unachievable for a firm of our size to have our own platform three or four years ago. Seccl has made it possible.”

IronBright Investment Management

Founded in 2017 by Bristol-based financial planning firm Brunel Capital Partners, IronBright wanted to create an investment proposition that was integrated, affordable and easy to use. Their new platform proposition called for technology that would connect the delivery of advice and investments with a fully-digital experience and branded client portals.

Fast forward a few years, and the rapidly growing DFM manages around £150m of assets for Brunel and Pilgrim Financial planning.

“We’re always looking for ways to make ourselves more efficient and deliver a better service. After setting up our own DFM, it seemed like the next logical step to launch our very own platform, too – allowing us to own and improve another key part of the overall client journey.” – Damien Rylett, CEO of IronBright.

“Our experience goes to show that you no longer have to be a large national network to take ownership of these areas.”

Is it the start of a new era for advice firms?

What we’re seeing is that investment platforms – and the technology that underpin them – don’t have to be the exclusive domain of huge businesses like Vanguard. For the first time, operating a platform has become not just an option for small to medium firms, but a potentially profitable one, too.

What’s more, if larger platforms fail to invest in technology, we could end up witnessing a David-and-Goliath style twist in the tale, in which smaller firms start toppling the market giants.

Of course, it’s still early days. There’s no knowing how Vanguard or any other investment platform will fare in 2022 and beyond. But my guess? We’ll continue to see low-cost, niche propositions outstripping the incumbents, a trend which will make its way over to the advice space in the coming years. And about time, too.

For further market insights from Chris, click here. If you have any follow-up thoughts or questions, feel free to get in touch – we’re always up for a chat!