I was interested to read an interview with Heather Hopkins, CEO of NextWealth, last week, in which she shared some surprising research around the popularity, price and commercial viability of in-house platforms.

For those who are new to the topic, there is a growing trend among ambitious, forward-thinking advice and investment management firms to do away with their third-party platform and run one of their own, instead.

Unlike white labelling a platform, this approach sees the firm take on certain other responsibilities and enter a direct contractual relationship with the underlying client for the provision of platform services (cutting out the third-party), while typically appointing a custodian to supply the essential supporting services like custody, client money administration and investment technology.

Our own research conducted earlier in the year with the lang cat showed that over 40 per cent of firms were considering this route – with 11 per cent giving it a lot of thought.

I was surprised, then, to read that appetite has, anecdotally at least, started to ‘dry up’ – driven by the perceived amount of work and operational cost involved.

It builds on earlier research from NextWealth, which suggested that the average cost of an adviser-operated platform was 4 basis points higher than a third party’s, at around 28bps.

Now, Heather and I have debated together on a number of panels over the last year or so, and so she won’t be surprised to hear that I take a different view!

In particular, I think it’s important to clarify the nature of the firms that make up their sample – namely large, vertically-integrated businesses, whose in-house platforms have been built on outdated, legacy tech.

To argue that this pricing is characteristic of the entire category of platform ownership is, in my view, potentially misleading. After all, it’s a plain and simple fact that those looking to in-house their platform on modern technology should expect to cut costs, not add to them.

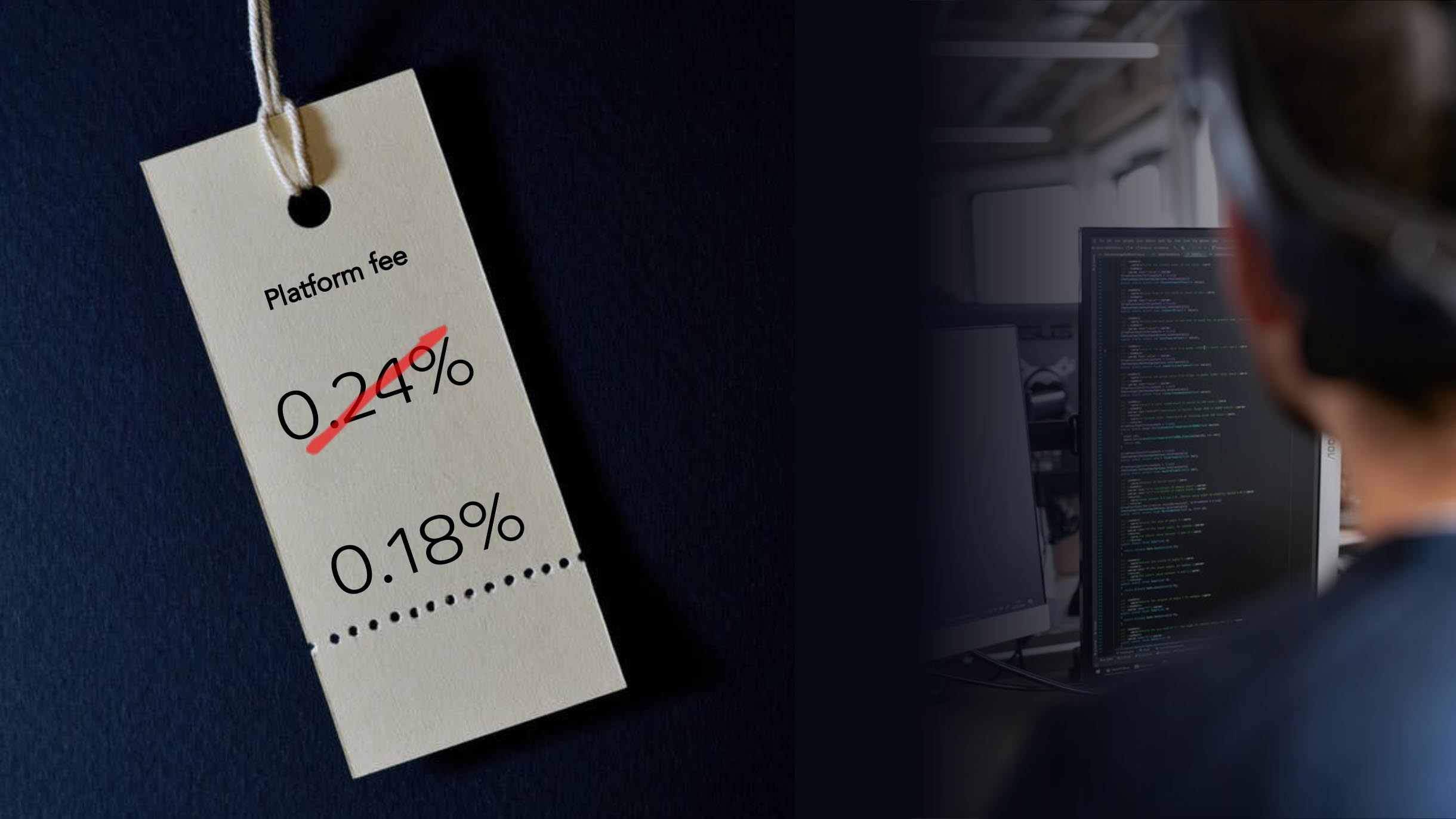

Data from our own client base confirms this. The average cost paid by a client of an in-house platform powered by our custody and investment infrastructure is around about 20bps.

The maximum platform fee offered by one of our clients (accounting for asset thresholds) is an extremely competitive 25bps (and that includes some other services, too). The lowest, meanwhile, is an absolutely market-thrashing 15bps.

‘But surely they must be making a loss?’, you might ask. Well, no. It is true that some firms choose to pass their in-house platform service on at cost, but it’s also true that other firms can charge around 20bps and still create a margin.

The reason for all of this is, of course, technology. The significant (though well overdue) proliferation of APIs and cloud-based systems in recent years has changed the nature of platform ownership for good. So much so that to compare today’s ‘new breed’ in-house platforms with those of the large VI firms is to compare apples with oranges.

Tech is taking away the heavy lifting

What, then, of the notion that operating your own platform creates an insurmountable operational and regulatory burden? Well, it’ll come as no surprise that we would challenge this, too.

If a firm were to replicate the teams and processes of their existing platform, then we’d certainly agree. But, again, technology means they don’t have to.

Much of the work that would traditionally be done by platform administrators can nowadays be automated by an underlying custodian and technology provider. To put it in perspective, the operations team here at Seccl can manage 29x the number of client payments per year than a comparative platform.

Which means that firms looking to launch and maintain a platform in-house can do so without hiring any extra administrative staff. (I’m not just talking theoretically, by the way; firms like IronBright have proven this to be true.)

Let’s not forget, either, that firms can appoint others to handle client money on their behalf, and so their obligations in this regard needn’t be onerous.

Finally, it’s worth reiterating that firms can do all this while also looking to improve their service. Just look at P1, whose P1 Platform has been voted number one for service by advisers time and again in the lang cat’s quarterly adviser service ratings. Which isn’t surprising, really – the closer the platform provider is to the end client, and the better the underlying tech, the better you’d expect the overall experience to be.

All of this boils down to a simple fact that bears repeating: technology has transformed the playing field – removing the need for unnecessary manual intervention, reducing the cost to clients, and lowering the barriers to entry for firms that are looking to future-proof their business, by achieving new levels of operational and organisational efficiency.

Among these firms, the appetite for a platform of their own is far from drying up; it’s growing day by day.