The last twelve months have shown just how crucial technology can be in keeping the show on the road. But as thoughts turn to life post-Covid, what next for ambitious, forward-thinking advice firms?

How can they build on the experience of 2020, and better use technology to improve customer experience, reduce costs and build stronger, more sustainable businesses?

Well, one way could be to re-evaluate their approach to that fundamental piece in the adviser tech puzzle: the platform.

I recently took part in Citywire’s second Virtual Fintech Forum to discuss that very topic. (You can see the first one here!).

In a thirty-minute webinar – which you can watch here – I explore the disruptive, democratising trends at play within the platform market. I also explain how more and more firms of all sizes can own more of the value chain and get a piece of the platform action.

While large firms or national networks have always been able to build and operate their own platform – controlling the customer experience and earning the revenue that comes with it – new technology means that now smaller firms can look to benefit, too.

For firms looking to own their destiny, it could be a logical and important next step. Tune in above to find out more.

Operating your own platform: an introductory guide

If you still want to find out more about the why, how and who-does-what of operating your own platform, you should check out our guide. It’s a quick and easy read, which gives a useful intro to a topic that will be new to many.

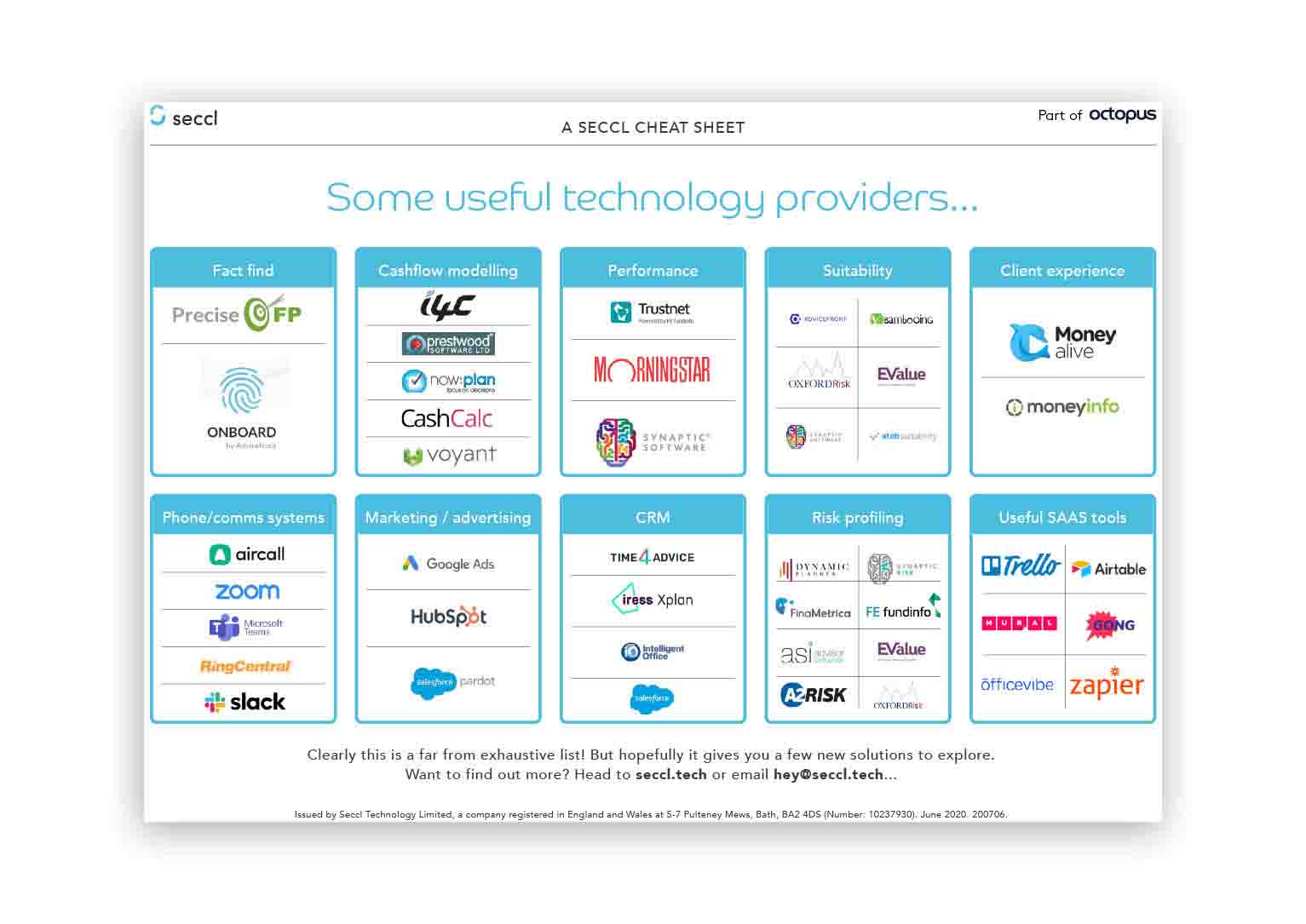

A tech market overview

When it comes to technology, it can be hard to know where to start, or who to go to for what. That’s why we’ve pulled together a simple cheat sheet showing just some of the many providers out there with solutions that could help your business…

So if you’re looking to get a broad grasp of what’s available, you could do worse than to check it out… I hope you find it useful!