There’s complacency in the air. The world is rapidly changing – politically, socially, environmentally – but the platform sector remains pretty much unchanged.

“Success breeds complacency. Complacency breeds failure. Only the paranoid survive”, are the famous words of Andy Grove, former CEO of Intel, who once led the company’s transformation from a relatively small memory chip startup to the CPU giant it became.

Much has changed since 1998 when Grove’s words were first published, but the sentiment remains true. Rather like Intel losing its grip on the CPU market in more recent years, I fear the platform market might well be falling into complacency, at the very time when we’d expect it to soar.

So what exactly is going on?

The current platform landscape…

There is plenty of change happening in the platform space – even if some of that change is happening slowly. Perhaps the biggest shift we’ve seen over the past few years is the proliferation of API (Application Programming Interface) technology, and the subsequent reduction in client costs (advised and otherwise). This has undoubtedly shifted some control of the platform experience to the customer, resulting in much more consumer-led business models.

However, there is still some tug-of-war at play. In my view, the platform market remains polarised between firms hoping to achieve success through improved customer outcomes –made possible through lower costs, growing AUA capacity and investment in technology – and (sadly) those who end up exploiting consumer ignorance to protect value within their legacy models.

In addition to changes in pricing models, the last few years have also seen a rapid emergence of new, digital advice offerings – partly due to the need for advisers to adapt post-COVID. What was once a 95% offline, 5% online model is now much more hybrid in nature, giving rise to new operating models in the client management, model portfolio and platform markets.

Non-advised customers also have much more choice in terms of better connectivity and ever-more niche (yet extremely viable) propositions. And this is just the beginning – especially as I suspect we’ll start to see FCA acceptance of less-regulated guidance models in the coming years.

So, what’s the problem?

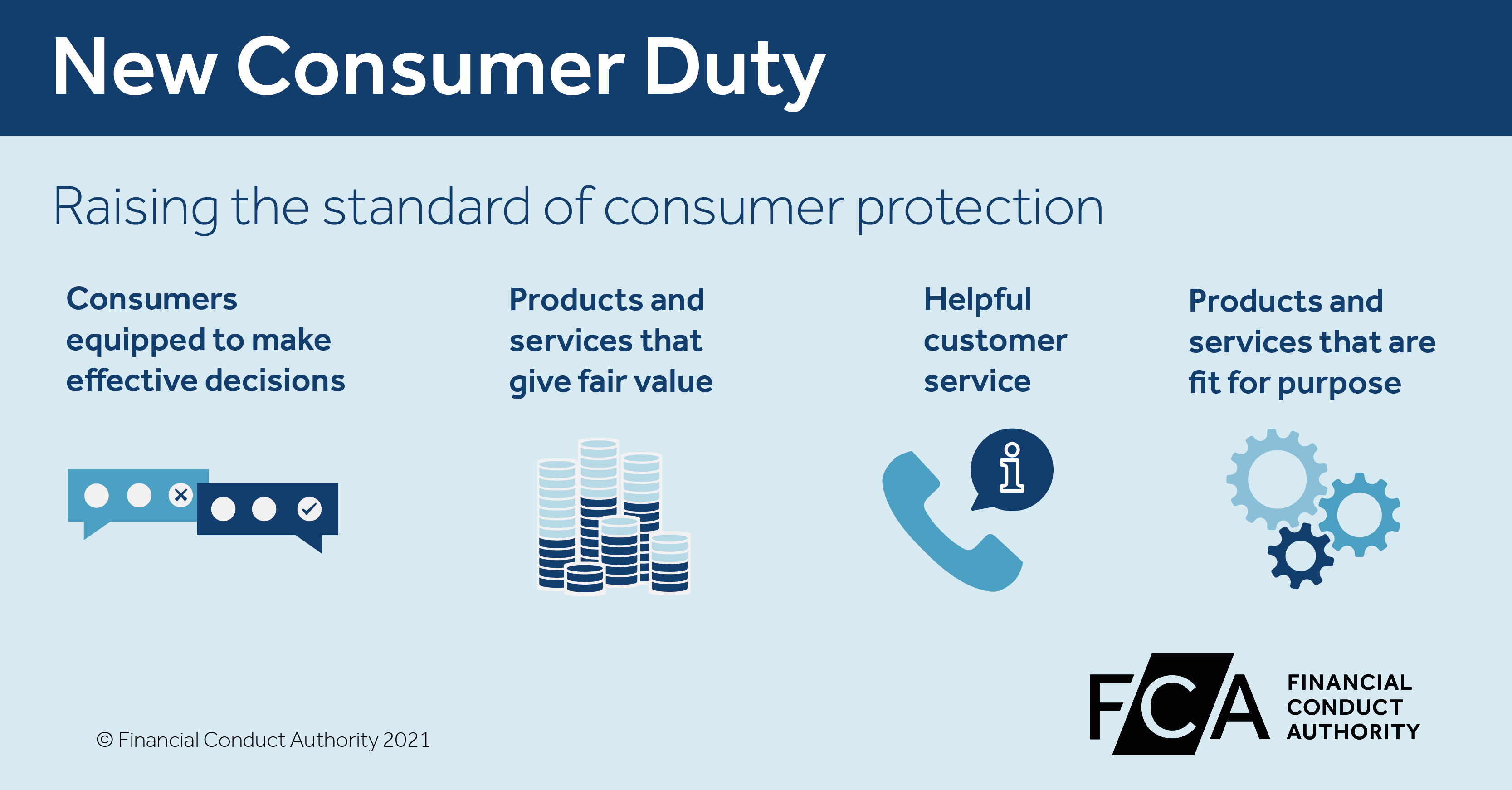

The combination of the New Consumer Duty and evolving technology (such as APIs) are set to redefine the market, perhaps as more transparent platforms and the RDR did a decade ago. However, firms’ ability to embrace and grow through these changes will be highly dependent on their technology choices, as well as how willing they are to adopt a truly customer-centric culture.

And in my view, many firms just aren’t there yet. Too much of our existing platform market has its roots in doing the old thing a wee bit better, rather than in rethinking the whole problem to come up with truly innovative solutions. These firms may enjoy some short-term success in terms of scale and deep pockets, but they’ll still be spending all their time wrestling with old-school business models, legacy technologies and broken cultures – which will only lead to failure down the line.

After all, if we were to go back to the drawing board (which is the kind of proactivity that Consumer Duty requires), we would quickly realise that most of the work of advice and investment management can be automated, and that embracing technology built with customer journeys and outcomes in mind is the only sustainable way to proceed.

We should be optimistic, though. For a start, these customer-led technologies will introduce entirely new routes to market – we could see the emergence of “adviser-as- a-platform”, “DFM-as-a-platform” and even “client-services-as-platform-services” models, each offering completely different experiences, but all 100% aligned with customer interest.

To take one example, the “adviser-as-platform" model will allow larger advice firms to operate a platform with much more control, creating more opportunities for a truly unique proposition built on 100% digital infrastructure, with better scope for integration and much lower costs. The benefits to both firms and their customers will be difficult to ignore.

Complacency has no place in the future of platforms

Similar to what Stripe and Shopify have achieved in the payment and commerce spaces, there are endless possibilities for DFM, advice firms and fintechs looking to target niche (and not so niche!) parts of the market using software like what we build here at Seccl. However, firms relying on version variants of ageing infrastructure and weighty corporate apparatus won’t be part of the succeeding cohort.

After all, looking at the numbers, the cost of such infrastructure (in addition to branding and overheads, as well as 30-40% profit) results in a massive markup for the customer, typically in excess of 200%.

If we’re to draw on the wisdom of Andy Grove once more, “Businesses fail either because they leave their customers or because their customer leave them.” It’s hard to see why customers would stick around for a sub-par user experience and astronomical costs, when they could go elsewhere.

Modern, connectivity-led technologies are creating amazing possibilities for advice and investment firms, and we’ll only see more innovation in this space over the coming years.

To hark back to Grove’s original quote, I for one am extremely paranoid – and I believe that’s the right way to be if we want to avoid complacency, while continuing to create and run the customer-orientated firms of the future. Bring it on!

To find out more about working with Seccl, or to request a demo, please get in touch.