If you’re a financial adviser, the prospect of transferring assets from one platform to another probably makes you shudder.

In our conversations with advisers, we’ve heard every sort of transfer-related horror story. Assets being left behind or ‘lost in transit’? Par for the course. Transfers taking months or even years? Join the club. We’ve even heard of cash and assets being sent to the wrong continent!

As Kate Harris, Head of Operations at Seccl-powered IronBright platform, puts it: “generally, transfers have always been renowned in the industry for being horrendous.”

“Transfers have always been renowned in the industry for being horrendous.”

So, what’s the problem exactly?

In part, the transfer’s headache is a function of the sheer number of parties involved in processing a transfer. As well as the new platform that’s looking to rehome the client’s cash and assets, there’s of course the old platform that’s been tasked with relinquishing them – and the many fund managers in between, whose job it is to re-register the assets from one to the other.

Ask any adviser, and they’ll probably tell you that each of these different actors will blame the other(s) for the delay – leaving them to fend for themselves in an ever-more infuriating game of telephone whack-a-mole.

Now, technology has certainly helped to speed things along. Electronic re-registration systems like the Altus Transfer Gateway (ATG) – with whom we integrate here at Seccl – have started to replace the traditional mountain of paperwork, so that transfers can now be processed in days and weeks, rather than months and years.

But the slow pace of processing client transfers is only one part of the problem. The other is the sheer lack of transparency, which means advisers (and their clients) are kept in the dark as to their progress.

With no easy way to track where their clients’ cash and assets are in the journey from one platform to the other, it falls on advisers and their operations teams to ask – resulting in hundreds of emails each week, and cumbersome spreadsheets used to track the progress.

This admin nightmare is unsettling for clients (who, understandably, want to know exactly where their money is) and frustrating for advisers. It’s also totally avoidable.

Although we can’t control all of the actors in the transfers process, we can control the information that we make available to the advisers who use Seccl-powered platforms. And, given that the info they need already exists, it seems bonkers not to let them have it.

So we sat down with our existing platform customers to design a solution – one that would reduce the unnecessary back and forth and provide advisers greater clarity on the progress of their clients’ transfers.

Introducing the transfers workbench

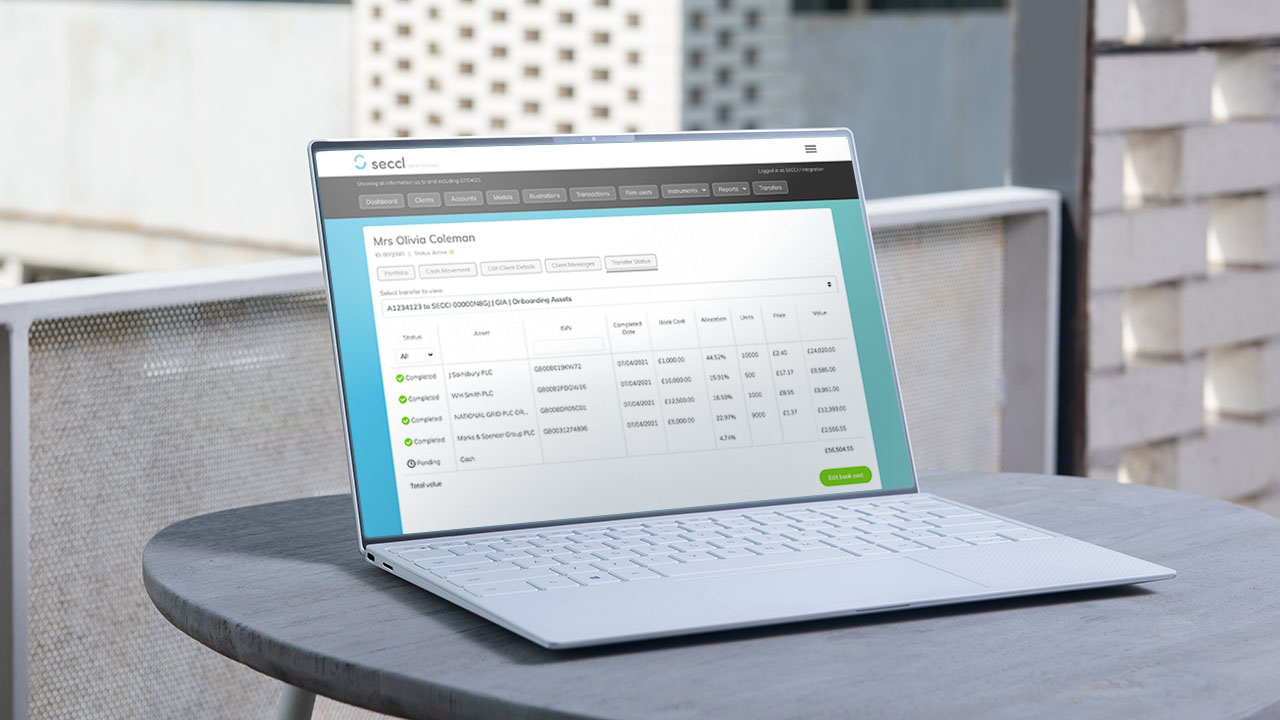

Our new transfers workbench is a simple yet powerful dashboard, which allows advisers to find all the top-level information they might need on each of their clients’ transfers.

When they first arrive at the workbench, advisers will be able to see all of the transfers that are currently underway, across all clients – along with key details such as their status, previous provider, estimated value and the total time that has elapsed since they were first instructed.

They can then click into an individual transfer to find an asset-by-asset breakdown of the progress – helping them to quickly identify which assets have successfully moved across, and which are still in transit.

Advisers can also see the estimated values of these assets – so they can provide clients with peace of mind as to why their account might be showing less than at their previous platform – and quickly toggle between different wrappers, to cut down on clicks along the way.

At last: editable book costs

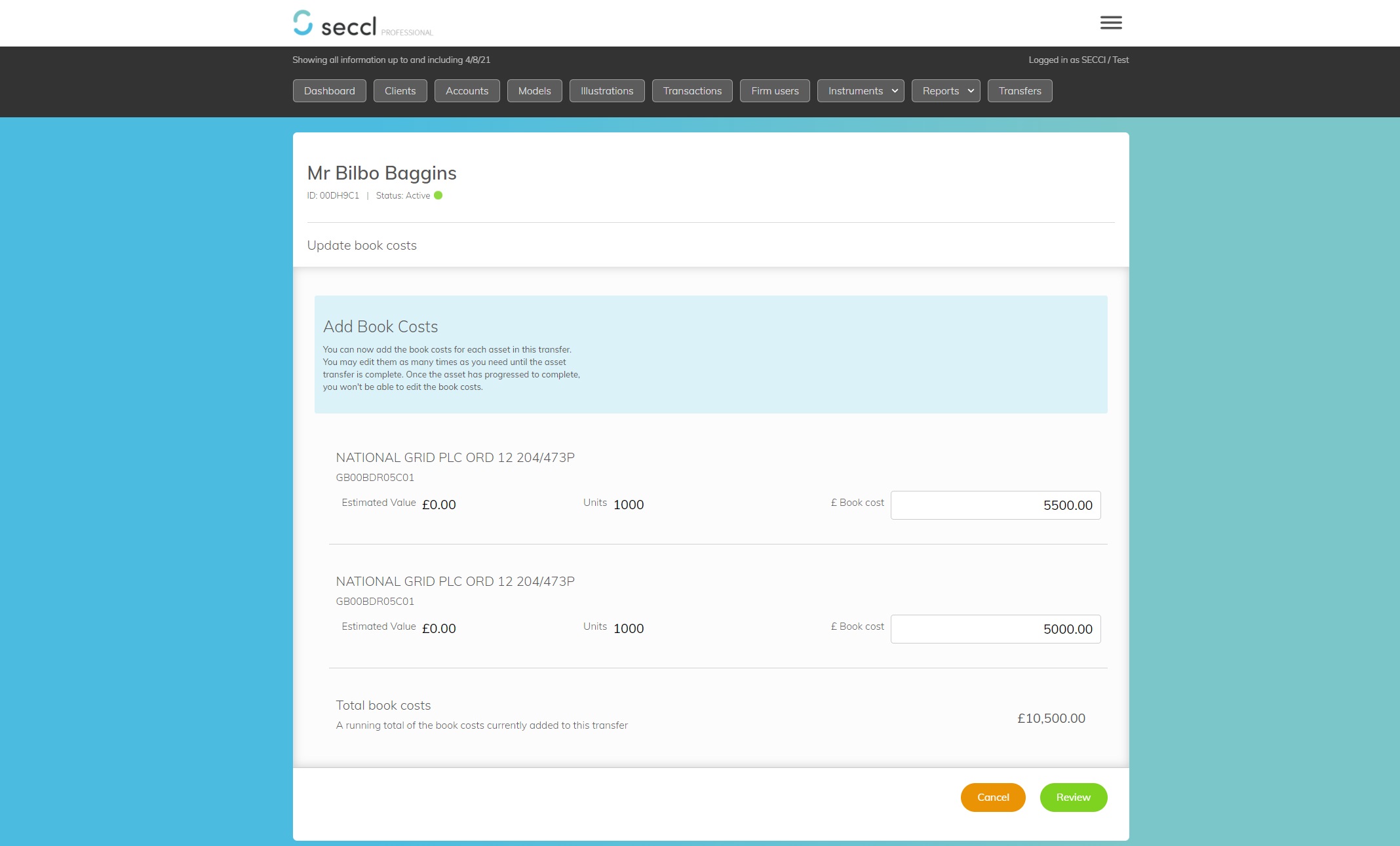

Having introduced some much-needed transparency into the previously opaque transfers process, we then turned our attention to the remaining piece of the efficiency puzzle: the hassle of updating book costs.

Although crucial for Capital Gains Tax reporting, book costs are generally neither passed on by the ceding platform, nor editable by advisers themselves. In fact, as far as we’re aware, there are few if any adviser platforms that allow advisers to input book costs directly into the system.

Instead, advisers are forced to provide platform back-office staff with the relevant details via spreadsheet, for them to be manually updated in the background – adding yet more friction and delay.

For advisers using Seccl-powered platforms, though, that extra admin hurdle has been removed; the transfers workbench will allow them to quickly and easily input the book costs of assets that are being transferred, without having to leave the system.

The system will also highlight which assets are missing their associated book costs, so that advisers can easily identify which gaps need to be plugged. Book costs are a burden no more!

Why is this all so important?

We’re confident that the transfers workbench will bring about a step change in the operational efficiency and customer experience of the platforms that we power. But don’t just take our word for it.

“Before, we had to keep our own spreadsheet, and make sure that the team checks for progress each day”, explains IronBright operations head, Kate Haris. “Now we can just head to one place to find all the transfers that are in progress and see where they are in the journey. It’s really helpful.”

Let’s not forget that it’s exactly this desire for efficiency and improved customer experience that leads many of our clients to operate their own platform in the first place.

Take the P1 Platform for example, which was recently named number one for overall service by the lang cat. “We chose to operate our own platform as we wanted to deliver a solution that was fast, efficient, paperless and completely transparent”, explains James Priday, CEO of P1 Investment Management.

“The new transfers workbench is another way in which we can be operationally efficient while providing transparency to adviser firms, by shedding light on what’s historically been a long-winded and opaque process.”

“It’s already saving our operations staff several hours a week, reducing transfer-related queries by 50%”

“It’s already saving our platform operations staff several hours a week, reducing transfer-related queries by 50%, and helping us to deliver the fantastic level of overall service for which we’re becoming well-known. It’s all part and parcel of our platform’s crucial role in helping us build the efficient – and self-sufficient – business of the future.”

“Industry-leading” functionality

While we’re really excited about the work we’ve done so far, we know we aren’t finished in this space. The transfers journey is still ripe for so much disruption, and there’s plenty more we’d like to do.

But one final thought to leave you on. We recently demonstrated our system to Altus, whose ATG technology we use behind the scenes to co-ordinate the electronic transfer and re-registration of client assets for their view.

“With its industry-leading transfers workbench, Seccl is taking a great and innovative step forward”, explained Howard Finnegan, their Sales Director.

“With its industry-leading transfers workbench, Seccl is taking a great and innovative step forward”

“Electronic transfers have gone a long way into transforming the process. But there is still much work to be done. Some parts of the transfer process still rely heavily on paper, which has a considerable cost and time impact.”

“By giving up to the minute, readily-available information on how a transfer is going, Seccl has set a new benchmark for what advisers and clients can, and should, expect from a platform transfer: a quick, paperless and completely transparent process.”

If you like what you see, want your own demo, or would like to find out more about operating your own platform, then don’t hesitate to get in touch.