The recent ‘FinTok trend’ – a new movement where users post personal finance and investment tips on the popular social media platform – is a hotly debated topic, which seems to divide opinion both in the media and in day-to-day conversation.

No one knows this better than me – because I am one of those users. You could say I am a FinTok influencer, but more about that in a moment…

For those who don’t know, TikTok is a global platform that allows users to create and share 60-second clips to music, most commonly viral dance trends. However, there is a growing (and global!) audience for finance content.

According to an article published by the Guardian this summer, posts with the hashtag #stocktok had been viewed 1.4bn times, while #PersonalFinance content racked up more than 4.4bn views. These videos cover everything from budgeting to taxes, paying into an ISA and dealing with debt.

So, does this help or hinder the financial education of young people? Is FinTok an empowering, progressive new movement, or is it dangerous and irresponsible? The reality isn’t quite that black and white.

Just how influential is TikTok?

Well… it depends on who you’re talking to. The majority of TikTok users are under 25, and the average daily watch time per user on TikTok has recently overtaken YouTube – indicating both its popularity among younger generations and a growing preference for short-form content.

Unlike other social media platforms like Facebook and Instagram, you don’t have to have any followers on TikTok for people to find your posts – meaning it takes no time at all to rack up an impressive following and become somewhat of an influencer. This has led to hundreds of thousands of new creators amassing millions and millions of followers almost overnight and going on to make a living off their platform. Its power should not be underestimated.

However, with great power comes great responsibility. And who is responsible here, for the financial education of TikTok’s 1 billion active users? Information is not regulated, there is no client-adviser relationship, and no precautions taken for financially vulnerable users.

It’s easy to see that while one FinTok viewer may invest an affordable amount of money into an investment of adequate risk and end up with a sizeable portfolio decades later, another could invest a high amount into a risky asset and lose the majority (if not all) of their money.

My experience as a FinTok influencer

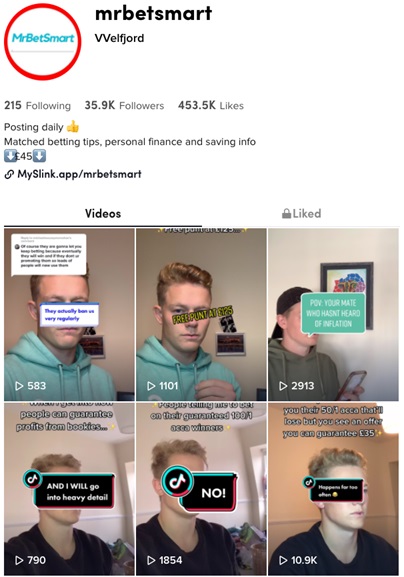

Alongside my day job as a Tactical Solutions Analyst for Seccl, I also run my own TikTok account – where I share details of my financial journey.

Alex’s channel on Tiktok - MrBetSmart

I started the account in October 2020, when I was stacking shelves in a supermarket, and the UK’s second lockdown was looming. After spending a bit of my spare time playing around on the app, I found a niche that seemed to be gaining some traction, but that very few people were talking about – ‘matched betting’, which also happened to be my side hustle.

‘Matched betting’ essentially breaks down the risks associated with gambling by taking advantage of bonuses and offers. To cut a long story short, it certainly can’t make you a millionaire (there is a ceiling to the number of offers you can make), but it has consistently made me a bit of extra cash on the side.

The idea behind my account was to break down the topic into manageable chunks and explain my methodology to help others do the same. My content included explaining terms, replying to questions and showing people how to make small profits. I saw the free organic reach on TikTok as a powerful tool I could leverage to build a brand.

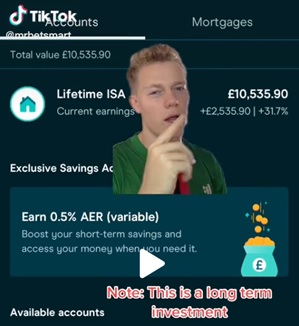

After a few months, my content started to diversify slightly, and I began to share more about my own financial journey. This varied from discussing my investment accounts (such as my LISA) to just explaining certain platforms and opportunities that were available to people that they may not have known about before. One video I made explained how the Governments help to save scheme could save people £1200 over the course of four years, which could be the first crucial step in someone becoming more financially literate.

All of this was a way of me sharing my own financial journey, rather than trying to give out advice, and it seemed people were paying attention.

So, what have I learned?

Today I have 35.9K followers, 453K likes on TikTok. Being a creator on the platform has given me unique insight into how the FinTok works, and how easy it can be to engage with and ‘hook in’ users. This has both positive and negative consequences…

On the bright side

Young people now have a fast and easy way to share their voice and build communities of followers. We know there is an ever-growing financial advice gap in the UK – and that the people most likely to need financial help are the ones least likely to get it. TikTok is a free and digestible way for people to expand their financial learning from the device in their pocket.

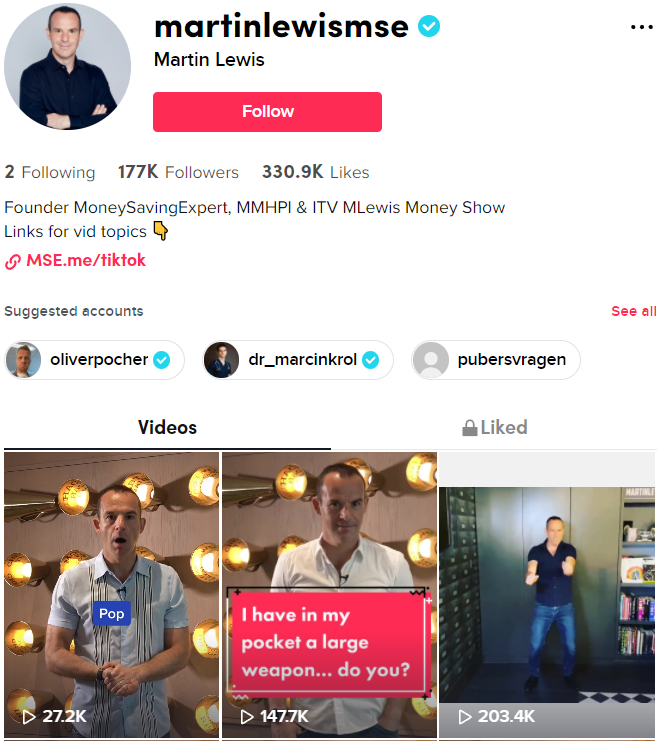

Plus, it’s not all random nobodies like me! Renowned figures in the personal finance space such as Martin Lewis have recently joined the FinTok space – sharing information about Lifetime ISAs, student loans, mortgages and more.

Perhaps the biggest benefit? Young people are thinking and talking about their financial future, and breaking out of the stuffy, text-heavy stereotypes of financial education and advice. They can swipe through saving tips in their study breaks, or get investment tips on the bus - it couldn’t be easier or more accessible.

What’s more, the short TikTok format seems to be what captivates the attention of a younger audience. Those who don’t have time to take a course or research personal finance can receive a slow trickle of information through an app on their phone, helping them to build up their financial knowledge and make the most of their earnings.

The negatives

Of course, the FinTok trend is also highly risky and potentially dangerous. Anyone with a spare few minutes and a smart phone can upload content at the click of a button – and that content has the potential to be seen by millions. As we know, you don’t need qualifications or professional experience to post online – and there are plenty of opportunities for misinformation in the finance space.

Recently, as more people have got wind of the FinTok trend, there has been a huge influx of scam content. This usually comes in the form of people showing off their money, cars and houses with promises of helping users become ‘financially free.’ Sadly, many of these accounts are fake – as are the lifestyles they promote. The creators use their content to gain trust and leverage an audience, and then package up their ‘advice’ into expensive courses and products.

A recent example of how wrong it can go is the Bitcoin/TikTok saga, where content creators drummed up support for very volatile and low liquidity crypto coins they had set up themselves online. Not only did the websites used to promote them look extremely legitimate, but many of these ‘currencies’ were also tied to good causes – an example being the ‘OceanCleanUpCoin’.

Once enough support was raised for these coins, the creator and all the ‘whales’ (meaning the largest holders of an asset) would ‘shill’ (sell their positions after a large increase in price) their coins and make a lot of money – leaving the common investor with an asset worth essentially 0.

Not only do young and first-time investors lose money in situations like this, but they also lose faith in investing, and the industry as a whole. Placed in the wrong hands, FinTok is not just bad for people’s wallets – it’s also bad for the reputation of the industry.

It‘s not all doom and gloom

If I could give one piece of advice to TikTok users, it would be to take the platform with a pinch of salt, and to also seek financial education from other reputable sources. If you’re going to take advice from FinTok creators, look out for the branded videos by reputable companies that are regulated by the FCA (Financial Conduct Authority).

I make videos for Plum – a savings app with various budgeting features and savings challenges – and every single video that gets posted is verified and checked against FCA guidelines. These guidelines help to ensure the adverts provide more accurate and responsible financial advice than the average user. Of course, it’s not a perfect solution, and there are areas where the guidelines are a bit shaky – but it’s a start.

The takeaway

I think it’s clear that while trends like FinTok can open up to the conversation around finance and reduce the barriers to education, they should be used with caution. There are plenty of well-intentioned creators out there who (like me) are using their experience to impart genuine advice and build a credible platform.

However, if TikTok continues to grow in popularity, there needs to be better regulations around financial content. Thanks to the sophistication of modern algorithms and the FCA oversight of branded content, I believe there is a future where finance tips can be shared on social media responsibly – and creators will think twice before hitting the ‘post’ button.