Over the last few months, we’ve been working with the fantastic team at the lang cat – a consultancy renowned for producing genuinely interesting research and opinion on the adviser market – on a paper of our own. It’s called Advisers Assemble! and we’re really excited to bring it to you. Go take a read – and tune in to our launch event to hear more!

What’s it all about?

We’re continuously talking with firms that are interested in running their own platform – whether that’s because they want to manage a key aspect of the customer experience that they currently can’t, to bake in some greater operational efficiencies internally, or just do away with the clunky, paper-based systems they might currently be lumbered with.

But it’s no surprise we have a lot of those conversations – after all, it’s what we do. It’s all too easy to exist in an echo chamber, and we were really interested to see just how many firms really are looking into operating a platform of their own.

So we asked the lang cat to do some research for us. This paper brings together some of the key findings from that research, which included a survey of nearly 200 advisers and in-depth chats with around 15 firms.

Well, go on, what did you find?

We won’t spoil the surprise too much, but here are a few choice headlines to tease you in…

- There’s growing interest in operating a platform among advisers and DFMs

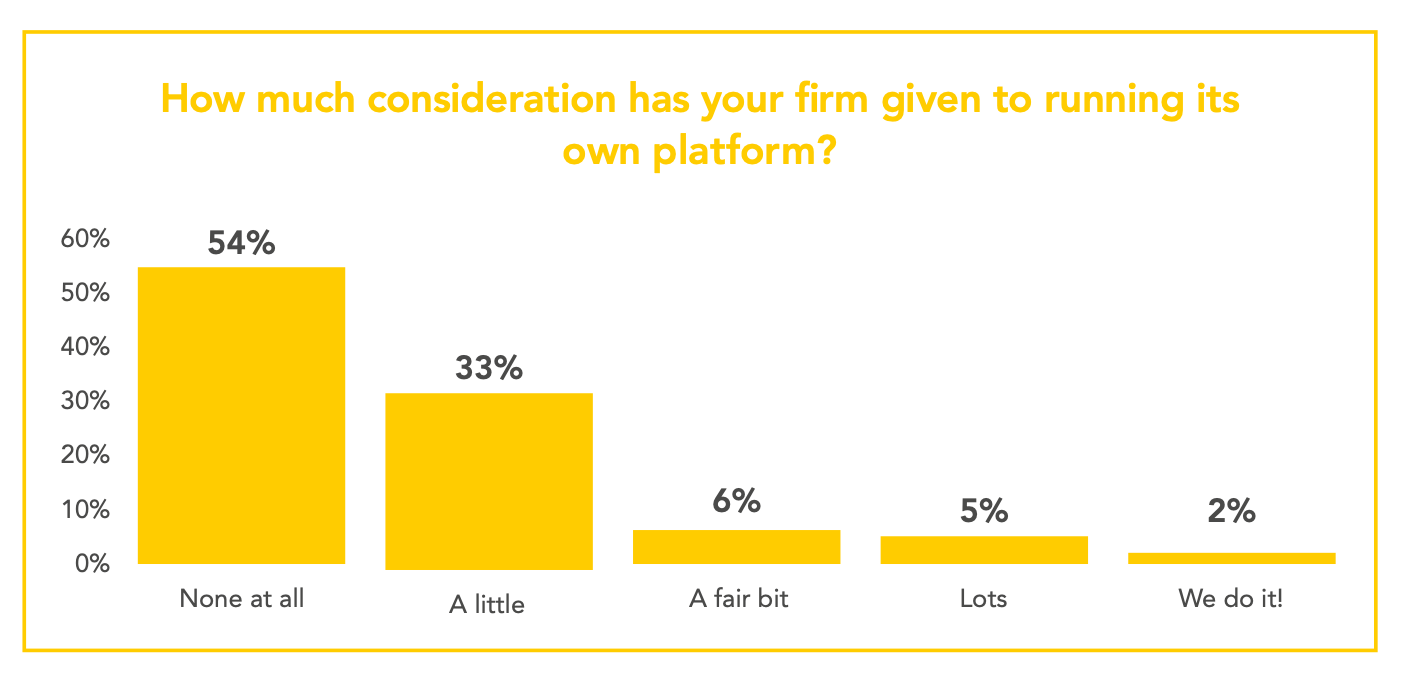

According to the research, over 40% of the market have given some thought to ditching a third-party platform and operating their own.

“Clearly operating a platform won’t be right for many firms”, explains Mark Polson (Principal at the lang cat), “but 40% is a chunky minority of the market that’s looking into it. Big shifts in our sector don’t come all at once, and I suspect twenty odd years ago we’d have seen a similar proportion of firms beginning to consider using a platform for the first time. It certainly feels like we’re seeing a new category forming, which allows firms to take greater control of the platform experience.”

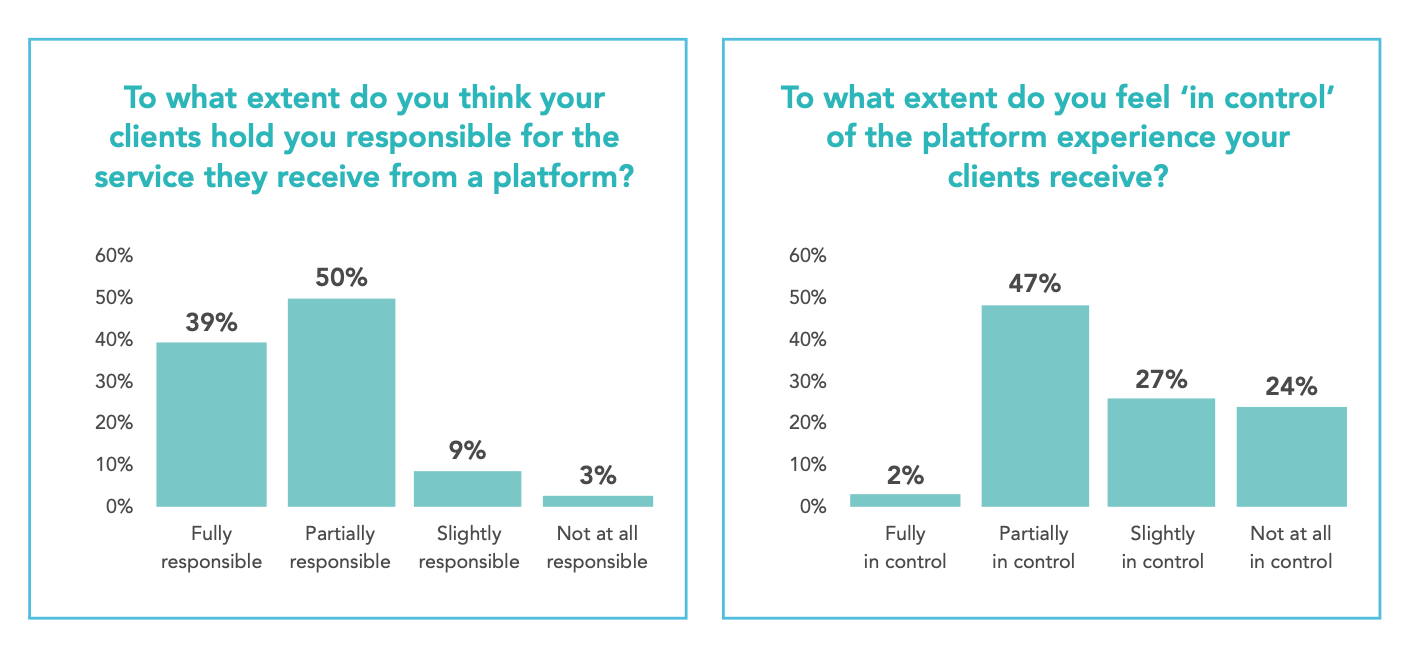

- Most advisers feel like they have little control over their platform

In fact, only 2% of firms feel fully in control of the platform experience. But, at the same time, nearly 90% believe that their clients hold them responsible for it – a mismatch that we find pretty interesting.

As Sam Handfield-Jones, our Co-CEO, comments, “this research shows that nearly all firms in our industry feel that their clients hold them responsible for a platform service that they don’t feel in control of. This is a big deal and, in our view, underlines exactly why we’re seeing more advisers and investment managers looking to take control of their destiny by operating a platform of their own.”

If you want to hear Sam and Mark chat through some of these findings – and explore some of the other key topics of the report – then be sure to tune in to our launch event.

Analysing – and clarifying – the market

Alongside the research findings, the paper also aims to bring some clarity to an area of the market that’s often shrouded in some pretty baggy terminology. In particular, we explore exactly what it means to ‘operate a platform’, and explain how the approach differs from ‘white-labelling’ – that other much-used but little defined concept.

We also try to unpack the pros and cons of some of these approaches, and set out what’s in store for anyone considering launching a platform of their own.

We’re under no illusion that it’s a big step that won’t be right for many firms, and so we’ve tried to cover off some of the key considerations for anyone exploring their next step in their platform journey, as well as shine a spotlight on some of the experiences – positive and challenging – of those who’ve taken the plunge themselves.

“It’s a big decision, and one that carries additional responsibilities and risks, too”, explains Sam. “But for the right firms, it can prove instrumental in improving the overall client experience, and building more efficient, affordable and sustainable businesses in the process.”

You can read the report here, and tune into the launch event here.