Manage models and portfolios with ease

Our portfolio management tools give firms full flexibility to design, run and maintain discretionary or advisory models at scale – with built-in automation, oversight and compliance.

Discretionary models

Empower DFMs to manage portfolios efficiently and compliantly

Our discretionary model service allows discretionary fund managers (DFMs) to create, amend, publish and transact across their portfolios, all within a single, connected system.

This single-source setup gives DFMs total control over their model management – while maintaining full regulatory alignment and operational efficiency.

- Model creation. Build and maintain models with defined asset allocations, growth assumptions and metadata such as risk ratings and commentary.

- Controlled access. Set availability by firm or adviser group, ensuring the right models are visible to the right users.

- Suspend rebalances. Pause and review model changes before implementation – supporting four-eye checks and governance.

- Clone and edit. Duplicate existing models for faster setup, or make precise edits via UI or API.

- Governance built in. Capture the DFM as the investor decision maker to ensure accurate transaction reporting to the FCA.

Advisory model services

Support advisers who manage portfolios on a client-by-client basis

Our platform also supports advisory model management – where advisers recommend portfolio changes but must seek client consent before implementation.

With both discretionary and advisory models supported, firms can build investment propositions that suit their governance model, client base and commercial strategy.

- Model management. Create and maintain advisory models to define preferred allocations.

- Rebalancing. Rebalance client accounts attached to advisory models individually, ensuring every action is client-approved.

- Audit and oversight. Maintain a clear record of all advice actions and permissions for regulatory assurance.

Rebalancing

Automate model changes and keep portfolios aligned

Our rebalancing engine calculates and executes trades automatically when model updates occur – reducing manual work and minimising time out of the market.

- Automated execution. Generate all buys and sells automatically, based on model drift or instruction.

- Linked transactions. Our system matches the settlement dates of buys and sells, reducing time out of market and improving client outcomes.

- Ad-hoc rebalances. Trigger one-off rebalances at the investment account level for added flexibility.

- Full visibility. Every rebalance creates an event ID, providing a complete audit trail.

- Operational oversight. Our operations team monitors all pending orders and rebalance events daily to ensure smooth processing.

This blend of automation and control means firms can scale efficiently, without compromising accuracy or governance.

Portfolio Cloud

Add sophistication to your investment management

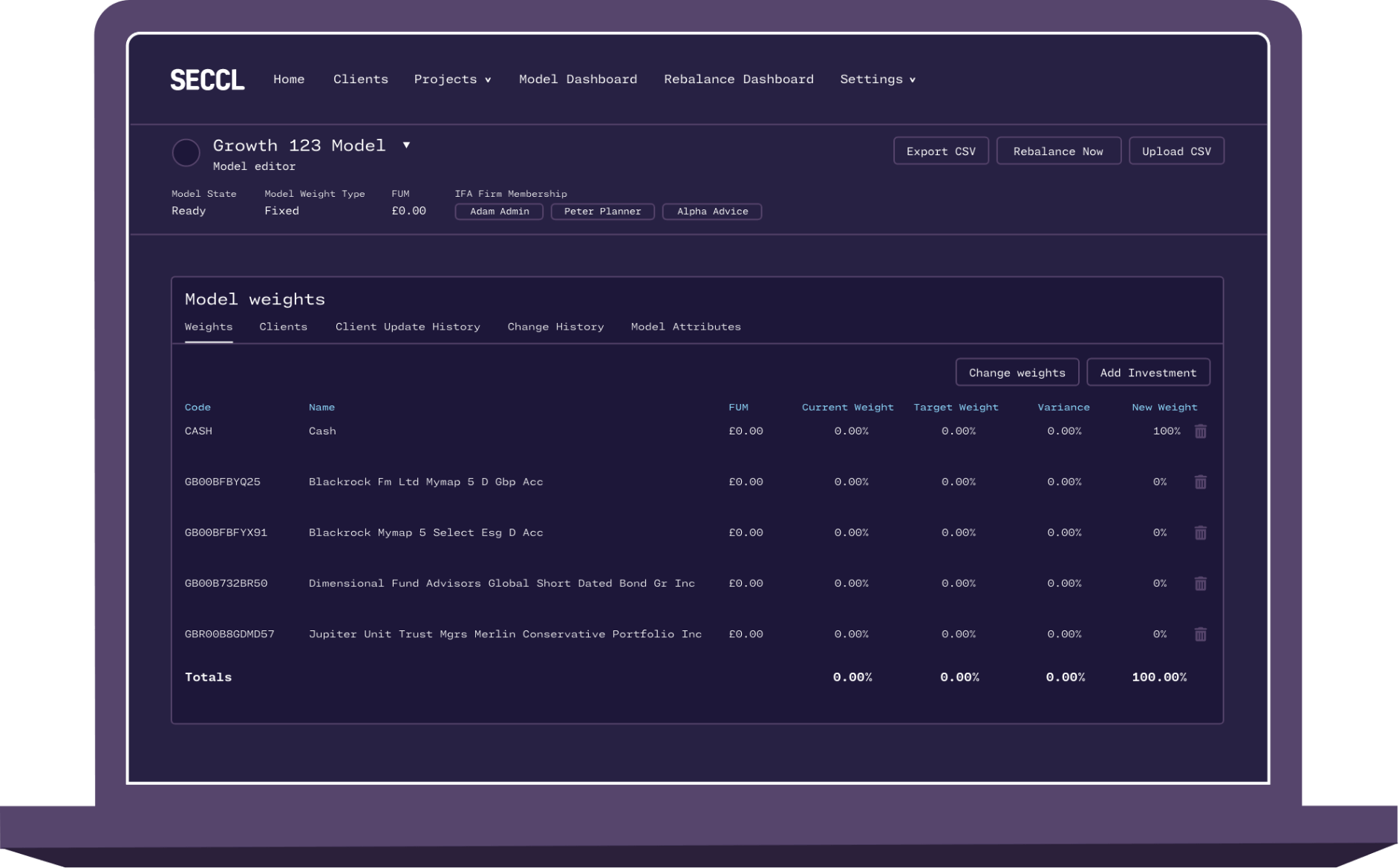

Portfolio Cloud is our integrated portfolio management system – built specifically for third-party investment managers and DFMs.

It streamlines model creation, rebalancing and oversight, giving DFMs and adviser firms greater control, visibility and efficiency – all within a single, connected platform.

Together, these tools help DFMs and adviser firms manage portfolios with precision and agility – reducing manual intervention, improving transparency and supporting scalable growth.

- Model creation. Build and maintain fixed allocation models (with floating models on the roadmap).

- Fast setup. Upload models via CSV for quick creation or editing.

- Bulk rebalancing. Run aggregated rebalances across multiple accounts, or at individual account level.

- Asset switching. Swap assets in or out of models in bulk.

- Segregated control. Restrict models to specific nodes – ideal for segmenting clients or adviser groups.

- Governance. Enable role-based approvals and suspend rebalances when required.

- Oversight. Track model drift, monitor trade status, and give secure access to third-party DFMs.

Built for compliance

Stay aligned with regulation and reporting requirements

Our systems are designed with regulatory obligations in mind, automatically capturing the correct decision-maker logic for every transaction.

- Transaction reporting. We report all relevant details to the FCA daily, ensuring the correct investor decision maker (such as the DFM) is identified.

- Audit trails. Every model change, rebalance and instruction is timestamped and queryable via API.

- Governance checks. Suspend and review models before publishing to maintain oversight and prevent duplication or error.

Ready to begin?

Get started with Seccl today

Ready to take the next step? Our team is here to help you get started with Seccl.

Contact us today to discuss your requirements, request a demo, or learn more about how Seccl can support your business.

Get in touch