Pass data seamlessly between your systems

Cut out rekeying, reduce errors and deliver a smoother client experience – all with out-of-the-box integrations that connect key tools across your advice tech stack.

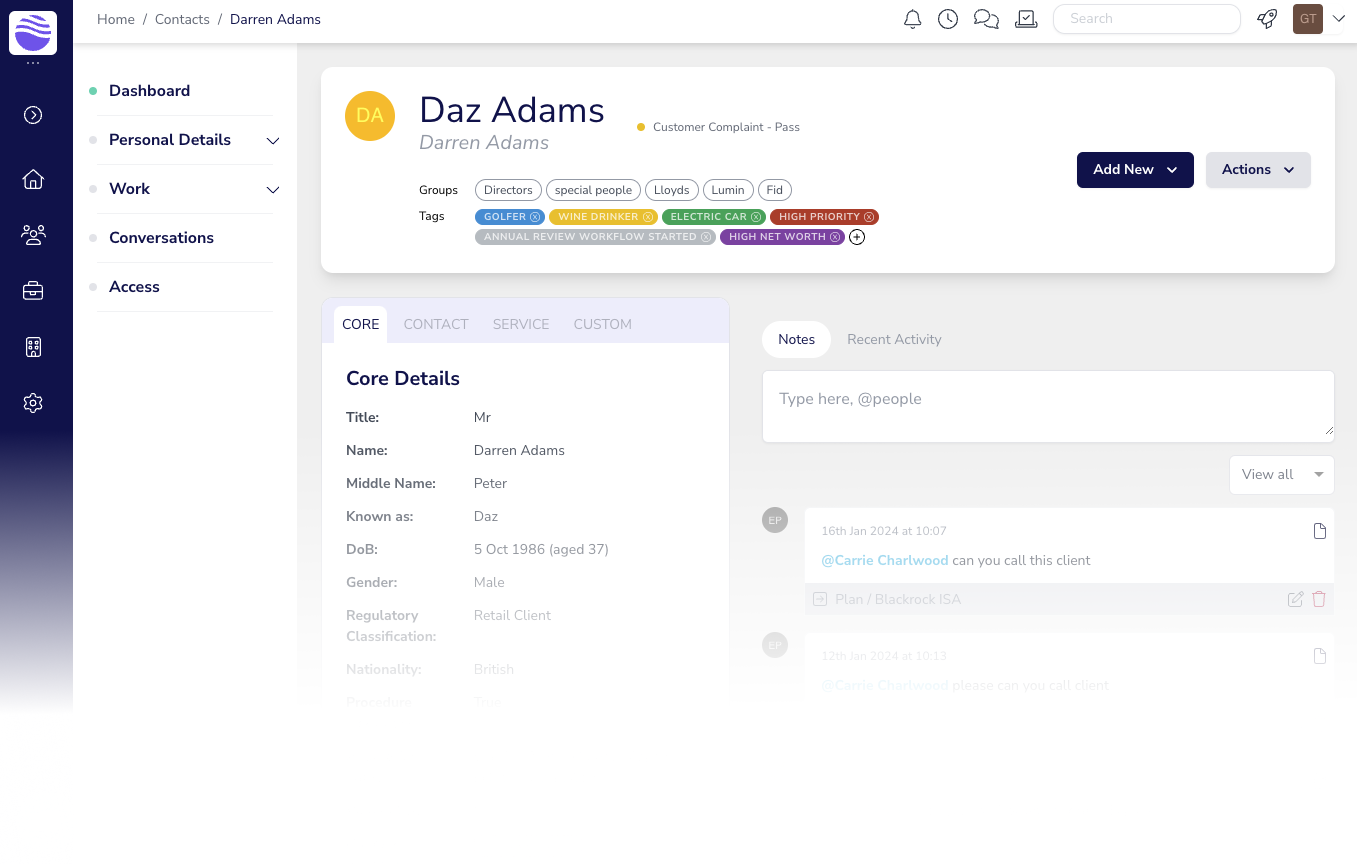

CRM and back-office

Meet advisers where they work

Our CRM and back-office integrations connect Seccl directly to the systems advisers rely on every day – removing duplication, reducing manual effort and keeping data in sync across the entire advice journey.

From onboarding to valuation and reporting, advisers can operate more efficiently, with fewer errors and smoother client experiences – all while staying within the platforms and workflows they already know.

We’re building deep, practical connections with the industry’s most forward-looking providers to deliver the seamless advice and investment ecosystem that modern firms demand.

Power advice with a truly modern operating system

A fast-growing, technology-led entrant to the adviser CRM market, Plannr is built from the ground up to make advice operations faster, simpler and more connected. Designed around the adviser experience, it replaces the disjointed tools of the past with a single, intuitive system that helps firms run more efficiently and serve clients better.

Our deep integration with Plannr allows advisers to onboard clients, create accounts and manage investments directly within their back-office – bringing advice and investment administration together in one seamless, automated workflow.

Integration highlights

Today, advisers can...

- Import client data and create skeleton client records in Seccl

- Generate account illustrations for SIPP, ISA, JISA, GIA and joint GIA accounts

- Create full client records and open accounts directly from Plannr

- Capture digital T&Cs and direct debit mandates in-platform

- Carry out integrated AML and KYC checks (including NorthRow)

- Trigger automated onboarding updates and notifications

It all adds up to faster, more consistent and fully digital onboarding journeys – where data flows freely, duplication disappears and advisers can focus on what matters most: their clients.

Integration highlights

- Collect and import client data directly from moneyinfo

- Capture risk assessment questionnaires and direct debit mandates

- Accept client terms and declarations digitally

- Generate illustrations for SIPP, ISA, JISA and GIA accounts

- Track onboarding progress and trigger automated notifications

Simplify onboarding for advisers and clients alike

Our client onboarding integration with with moneyinfo’s adviser and client portals delivers market-leading efficiency and a seamless experience for clients – one that’s fully branded and accessible on any device.

Advisers can gather clients’ acceptance of suitability, declarations and T&Cs in a single online journey – removing rekeying, speeding up onboarding and cutting out weeks of back and forth.

Keep data accurate, without the admin

Our integration with Intelligent Office ensures key account and remuneration data flows automatically between Seccl and IO – removing manual updates and improving data accuracy across the advice process.

Advisers get a single, consistent view of client holdings, valuations and income, directly within the system they use every day. The result? Less duplication, fewer errors and more time to focus on clients.

Integration highlights

- Daily synchronisation of account valuations and remuneration data

- Automatic population of client records in IO

- Improved reporting accuracy and audit readiness

Maintain a single source of truth across systems

Integration highlights

- Daily synchronisation of account valuations and remuneration data

- Secure, automated data exchange between systems

- More consistent, compliant client records

Our Curo integration gives advice firms real-time visibility of client portfolios, valuations and income – all without manual rekeying.

It keeps data consistent between Seccl and Curo, helping firms manage clients more efficiently, reduce admin effort and improve oversight across their business.

Portfolio management

Add sophistication to your investment management

We support a deep integration with portfolio management system Portfolio Cloud, built specifically for third-party investment managers and discretionary fund managers (DFMs).

It streamlines model creation, amendment and rebalancing, while providing portfolio performance reporting and benchmark comparison. DFMs can interact directly with client portfolios, simplifying oversight and improving operational efficiency.

Integration highlights

- Create fixed allocation models (with floating models on the roadmap)

- Upload models via CSV for fast setup or edits

- Run aggregated rebalances across multiple accounts

- Rebalance at the individual account level

- Bulk switch assets in and out of models

- Restrict models to specific nodes – ideal for segregating clients

- Suspend rebalances if you need to pause activity

- Enable role-based approvals for rebalances

- Track and monitor model drift

- View real-time trade status updates

- Provide secure access to third-party DFMs

Together, these tools help DFMs manage portfolios with precision and agility – reducing manual intervention, improving transparency and supporting a more scalable investment process.

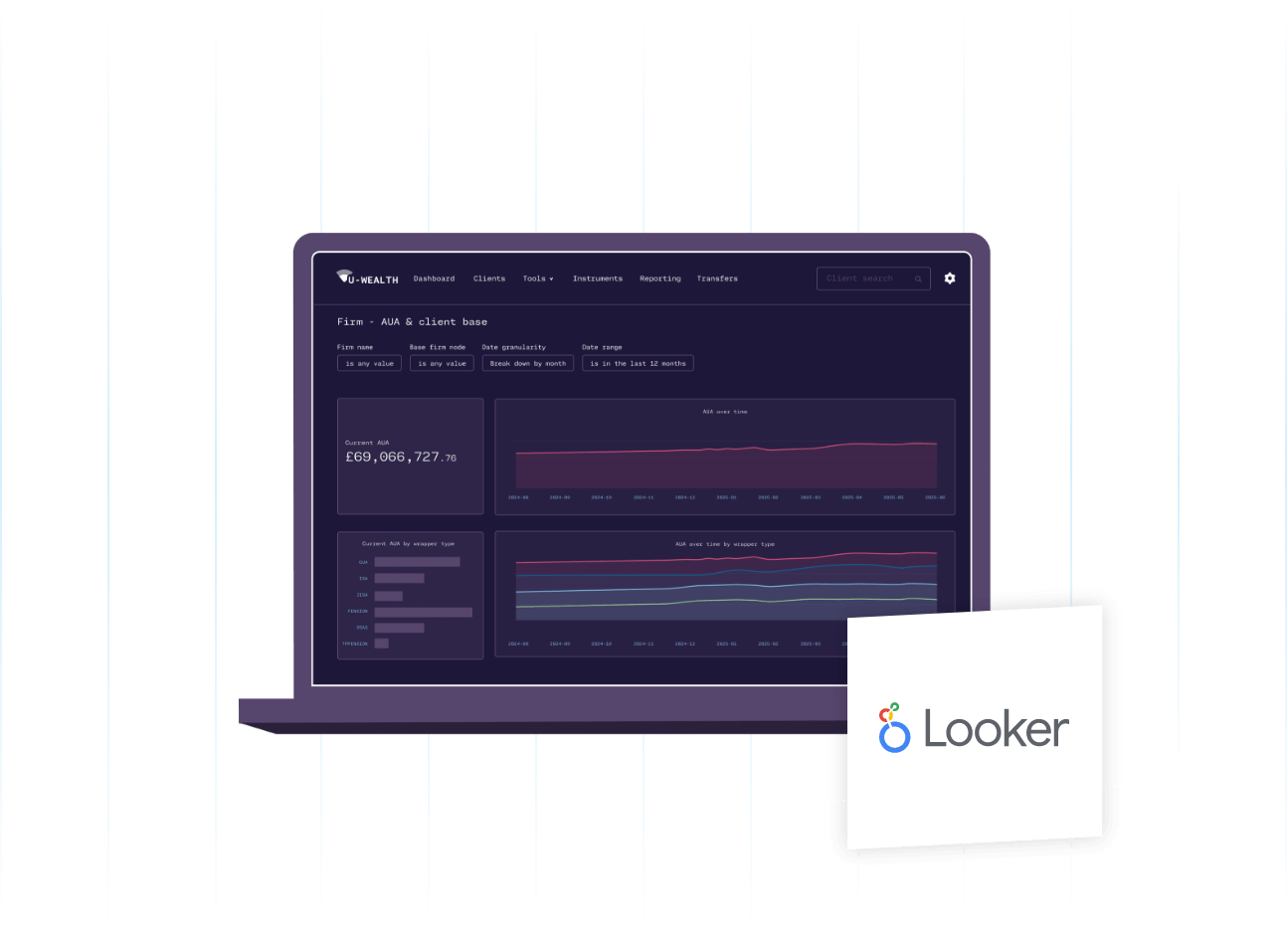

Reporting

Embed business intelligence in your platform

We’ve embedded Looker – a powerful business intelligence and analytics tool – directly within our professional portal. It lets you explore, analyse and visualise firm and client data to uncover insights and identify opportunities.

Access a range of adviser MI reports and dashboards, including:

- Accounts: all cash and holdings at account level

- Account holdings: portfolio positions across all clients

- Fees: breakdowns of platform and adviser fees

- ISA and JISA subscriptions: including remaining allowances

- Portfolio transactions: complete record of buys, sells and rebalances

- Regular payments: details of ongoing contributions and withdrawals

Built for connectivity

Integrate your advice tech stack

Our growing ecosystem of integrations allows you to connect the systems you already use – without the friction, rekeying or cost of bespoke builds.

Whether through our open API or pre-built partnerships, Seccl helps you deliver a joined-up digital experience for advisers and clients alike.

Explore developer resourcesReady to begin?

Get started with Seccl today

Ready to take the next step? Our team is here to help you get started with Seccl.

Contact us today to discuss your requirements, request a demo, or learn more about how Seccl can support your business.

Get in touch