Stay compliant and keep clients informed

From valuations and illustrations to tax packs and contract notes, let us handle the heavy lifting – so you can focus on the overall customer experience.

Ad hoc reporting

Generate accurate reports instantly

We produce all ad hoc reports, documents and illustrations automatically – triggered by activity on the account or generated on demand through our API or professional portal. These are all branded with your firm’s logo and colours.

-

Illustrations.

Our proprietary illustration engine creates compliant PDF product illustrations across all investment strategies and account types – helping advisers and clients make informed decisions -

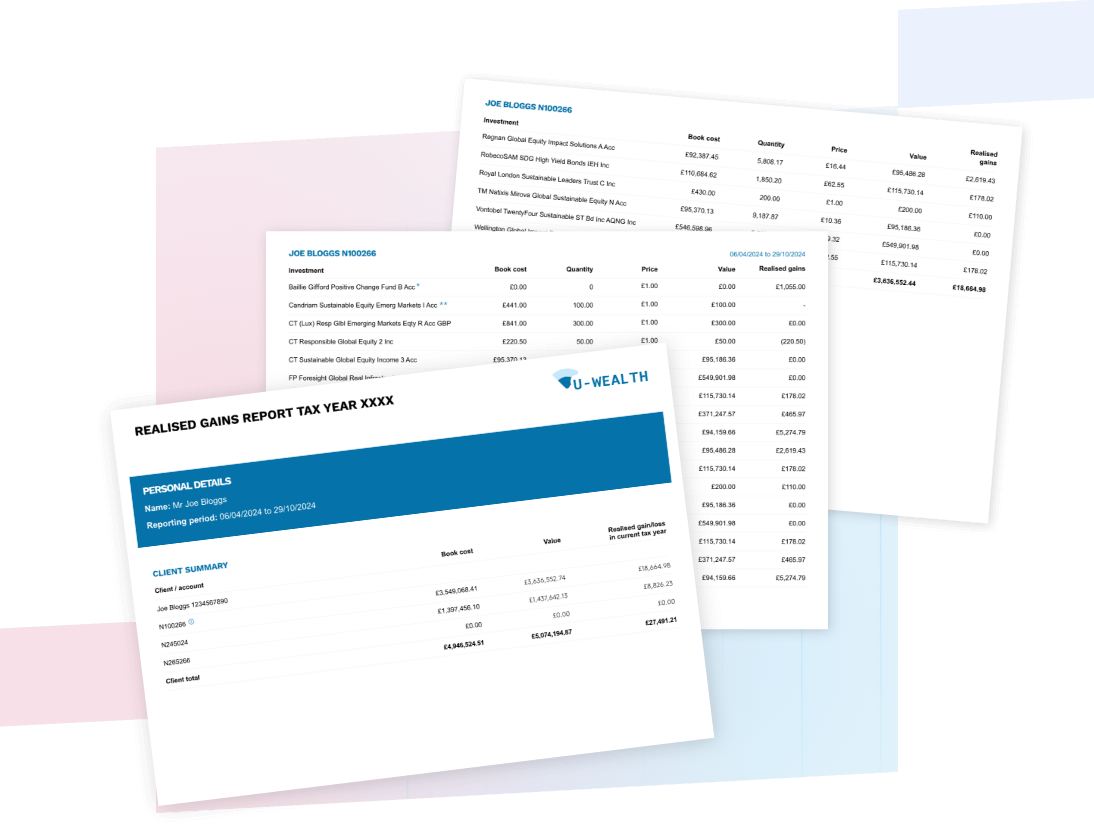

Capital gains tax (CGT) reporting.

Our in-house CGT tool calculates realised and unrealised gains, giving advisers clear insight for tax planning and end-of-year reporting. -

Client documents.

We automatically generate and distribute key client documents, including contract notes and pension communications – all fully digital and stored securely for reference.

Periodic reporting

Deliver clear, consistent updates – on time

We handle all scheduled client communications, providing regular statements and tax documentation that keep clients informed and compliant.

- Valuation statements. Annual and quarterly statements give clients a clear picture of their investment performance, holdings and transactions over time.

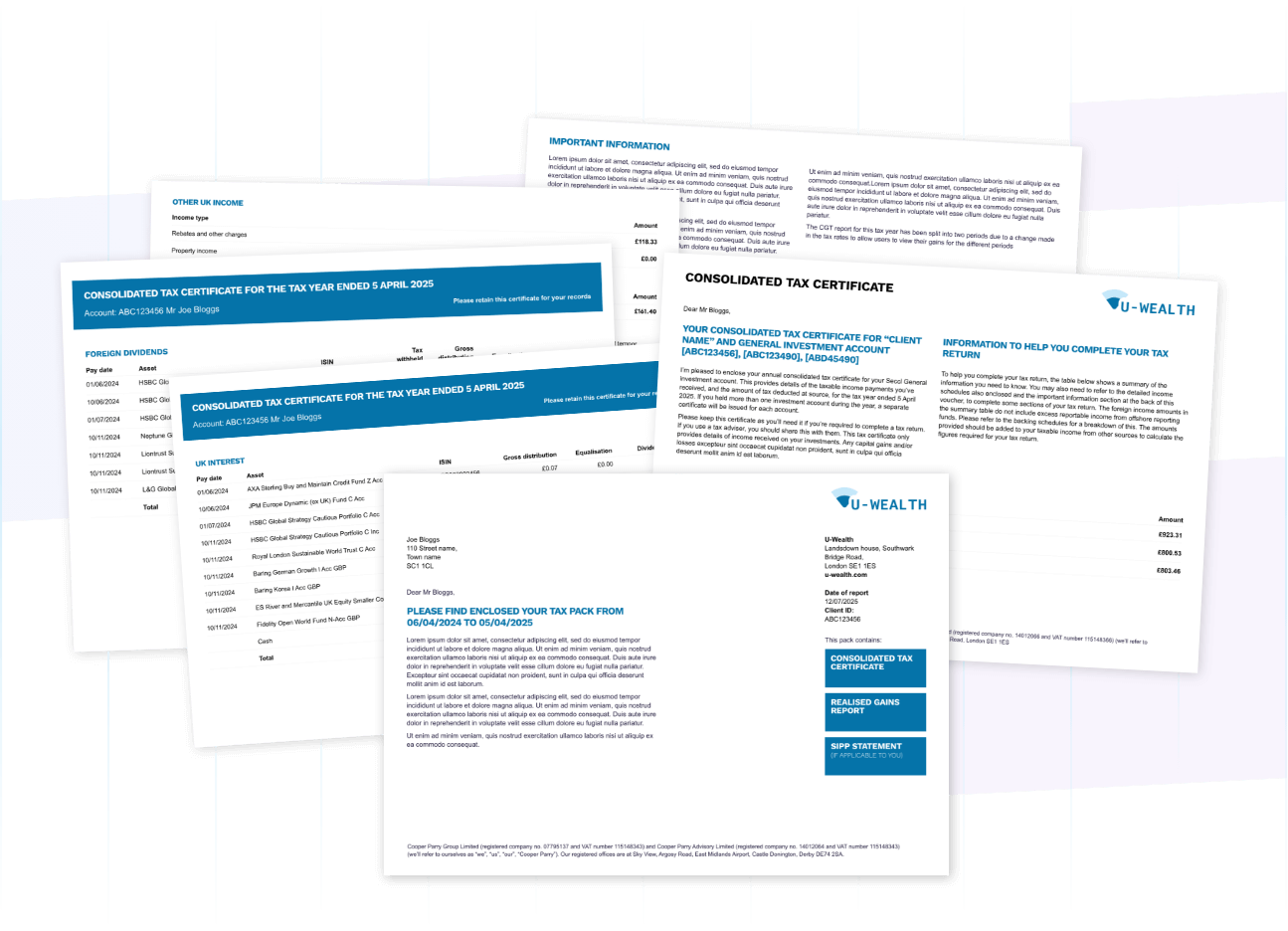

- Tax packs. Comprehensive tax packs – including consolidated tax certificates (CTCs), pension contributions and CGT reporting – give clients everything they need to complete their returns.

- Wrapper declaration replay. We provide automated wrapper declarations to support accurate reporting across ISAs, SIPPs and other account types.

Built for transparency

Simplify your reporting obligations

Our client reporting tools are designed to meet all FCA and HMRC requirements, while providing a seamless experience for both firms and investors.

With all data sourced directly from our systems, every document and statement is accurate, timely and traceable – ensuring a complete audit trail at every stage.

Ready to begin?

Get started with Seccl today

Ready to take the next step? Our team is here to help you get started with Seccl.

Contact us today to discuss your requirements, request a demo, or learn more about how Seccl can support your business.

Get in touch