Use the future-proof pension that’s built to scale

Power every stage of the retirement journey with a fully digital, low-cost and automated pension: one designed for efficiency and built for scale.

Accumulation and drawdown

Harness a wide range of growth and income solutions

The Seccl SIPP provides an efficient and affordable pension for investors in both their accumulation and drawdown stages.

-

Help save for retirement:

our intuitive, low-cost accumulation solution is perfect for those building their pension for later life -

Support a variety of drawdown options:

single, regular or ad-hoc flexi-access drawdown (FAD), UFPLS, PCLS, full, partial and regular crystallisation. Annuities (processed as a transfer out) can also be arranged online

Note: D2C drawdown is coming soon. Until then, drawdown functionality is only available for advised clients.

Paperless simplicity

Make every pension journey paper-free

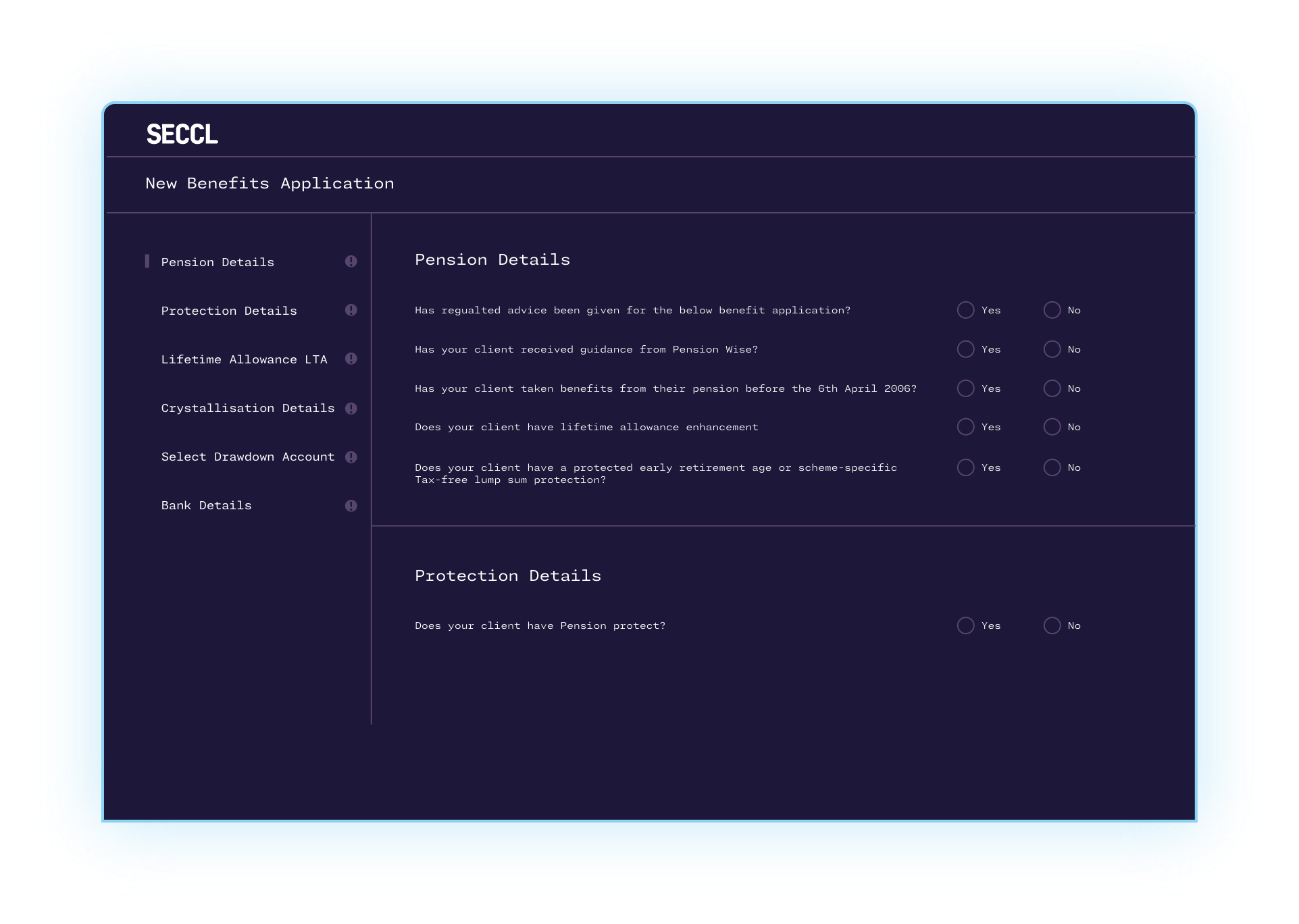

From application to drawdown, there’s not a single piece of paper in sight. Our digital pension journey is simple, intuitive and fully automated.

- Onboard clients effortlessly: capture personal details, expression of wishes, contributions, transfers and declarations through a guided online journey

- Facilitate seamless drawdown: our decumulation functionality follows the same principles that underpin our entire platform – fully digital and completely paperless

- Record allowances digitally: store and update lifetime and lump sum allowances online

Digital efficiency

Cut manual errors with straight-through processing

Our pension technology eliminates unnecessary admin, ensuring a faster and more accurate experience for firms and clients alike.

-

Prevent input errors:

prescribed application flows prevent incorrect data entry, avoiding rework and delays -

Achieve straight-through efficiency:

over 80% of drawdowns are processed instantly and entirely digitally, meaning no income payment delays -

Keep costs transparent and low:

0.05% for clients in accumulation or 0.10% for those in drawdown, capped at £48 or £120 + VAT a year respectively

It all makes for a fast, efficient and affordable pension journey – empowering clients while dramatically reducing operational effort and risk.

Flexibility and transparency

Add peace of mind to retirement planning

Our pension offers clients and advisers the flexibility to manage contributions, income and costs on their own terms.

- Take income your way: choose from a variety of drawdown types, with flexible payment dates

- Contribute when you like: start, stop or adjust contributions anytime – and support one-off and regular contributions on any working day

- Cap your pension costs: maximise the value of your clients’ pensions, with transparent, predictable fees that are capped for both accumulation and drawdown

-

100k+

SIPP accounts

-

Zero

pieces of paper throughout the pension journey

-

7m+

pension transactions completed in 2025

-

80%+

of pension income withdrawals processed straight through

Technical expertise

Trust in 80+ years of pensions expertise

Our pensions team has nearly a century of combined experience in the pension industry – helping you stay compliant, resilient and ahead of the regulatory agenda.

Technical services team

Chris Smeaton,

head of technical services

Chris Smeaton,

head of technical services

Nearly 30 years in pension technology with senior roles at James Hay and Embark Group.

Anthony Clifford,

SIPP technical lead

Anthony Clifford,

SIPP technical lead

20+ years’ experience at Wealthtime, Abbey National and James Hay; holder of the PMI Retirement Provision Diploma.

Samina Kausar,

senior technical adviser

Samina Kausar,

senior technical adviser

30 years’ experience with Fidelity, TISA, M&G and AXA Wealth specialising in regulatory and legislative change.

Broader pensions expertise

They’re supported by engineering, operations and compliance specialists who bring deep pensions experience of their own – combining decades of technical, regulatory and development expertise to keep our digital pension running smoothly.

A compliance and regulatory expert with over 24 years’ experience at Seccl and Hargreaves Lansdown. Oversees second-line assurance, FCA liaison and compliance monitoring.

More than 30 years in pensions technology at Wealthtime, Abbey National and James Hay. Built Seccl’s pension architecture from the ground up, including the illustration engine and digital SIPP journeys.

9 years’ experience across Seccl, Hartley Pensions, M&G and Aegon. Oversees all pension administration operations, including new business, benefits, death and divorce cases, and HMRC/FCA reporting.

9 years’ experience at Seccl and Hargreaves Lansdown. Brings deep technical knowledge of SIPP architecture and digital investment journeys.

16 years in financial services at Seccl, Brightpearl and Virgin. Leads quality assurance for all pension features, ensuring stability and reliability across our automated journeys.

Full functionality

Benefit from a feature-rich pension that's fit for the future

| Core pension functionality |

|---|

| Paperless account application and set-up |

| Paperless benefit crystallisation and income instruction |

| Accept personal and employer one-off and regular contributions |

| Automatic investment processes (including tax relief) |

| Automated sell down to cover withdrawals |

| Multiple pension sub-pots available within the SIPP |

| Pause, amend and restart contributions online |

| Online transfer tracking and updates |

| Clone, amend and resubmit rejected transfers |

| Straight through integrations with Origo and Equisoft |

| Drawdown features |

|---|

| Fully online drawdown management |

| Flexi-access drawdown (FAD) |

| UFPLS |

| PCLS |

| Full, regular and partial crystallisations |

| Transfer-in drawdown pensions |

| Transfer-in beneficiary drawdown |

| Managed LTA and LSA factors |

| Payroll and pension payslip generation |

| Annuities (processed as a transfer out) |

| Reporting and documentation |

|---|

| All client regulatory communication delivered to the customer electronically |

| Proprietary illustration tool for all accumulation and drawdown strategies |

| Branded client pension regulatory documents - Account opening confirmation - Cancellation letters - Wake-up packs - Expression of wishes confirmation - Contribution letters |

| Seccl manages all HMRC and FCA reporting |

| Pension life events |

|---|

| Pension sharing orders |

| SIPP death processing |

| Annual allowance tax charge |

| Serious ill-health, early retirement lump sum |

| Other Pensions (with exceptions) |

|---|

| Small pots |

| QROPS |

| Third party SSAS and other SIPP providers |

Further info

Take a closer look at our pension

Our SIPP brochure provides an in-depth look at our features, functionality and key scheme details. It’s also ideal for other pension providers looking to do due diligence on Seccl before approving a transfer.

Digital pensions FAQs

Ready to begin?

Get started with Seccl today

Ready to take the next step? Our team is here to help you get started with Seccl.

Contact us today to discuss your requirements, request a demo, or learn more about how Seccl can support your business.

Get in touch