If you’ve visited the Seccl site recently, you might have seen a new page to appear on our main navigation: pricing.

You won’t be surprised to hear that it’s one of the most searched for items in our online FAQs – and it’s always been our plan to put our pricing on the main site. And now we have!

(If you haven’t seen our FAQ section, by the way, go check it out; it answers a whole host of questions you might have about us or our proposition, and is particularly useful if you’re doing some initial due diligence on us.)

A new operating model

As a reminder, we’re a custodian and investment technology company. Taken together, our digital custody service, tax wrappers, trading and portfolio management technology and user interfaces can empower forward-thinking financial advisers and investment managers to operate their own platform.

Unlike a traditional white-label adviser platform, our model sees firms themselves taking on the responsibilities of the platform operator – and so benefit from the greater efficiency, improved client experience and revenue that come with it.

But it’s not just established advice firms or DFMs who can look to benefit; our API can also help ambitious fintechs of all sizes to launch new investment or advice propositions more quickly and affordably than traditional custody and trading solutions might allow.

In both cases, though, it’s likely that elements of our proposition (and pricing) will be new to some firms. And that’s where our new page could help.

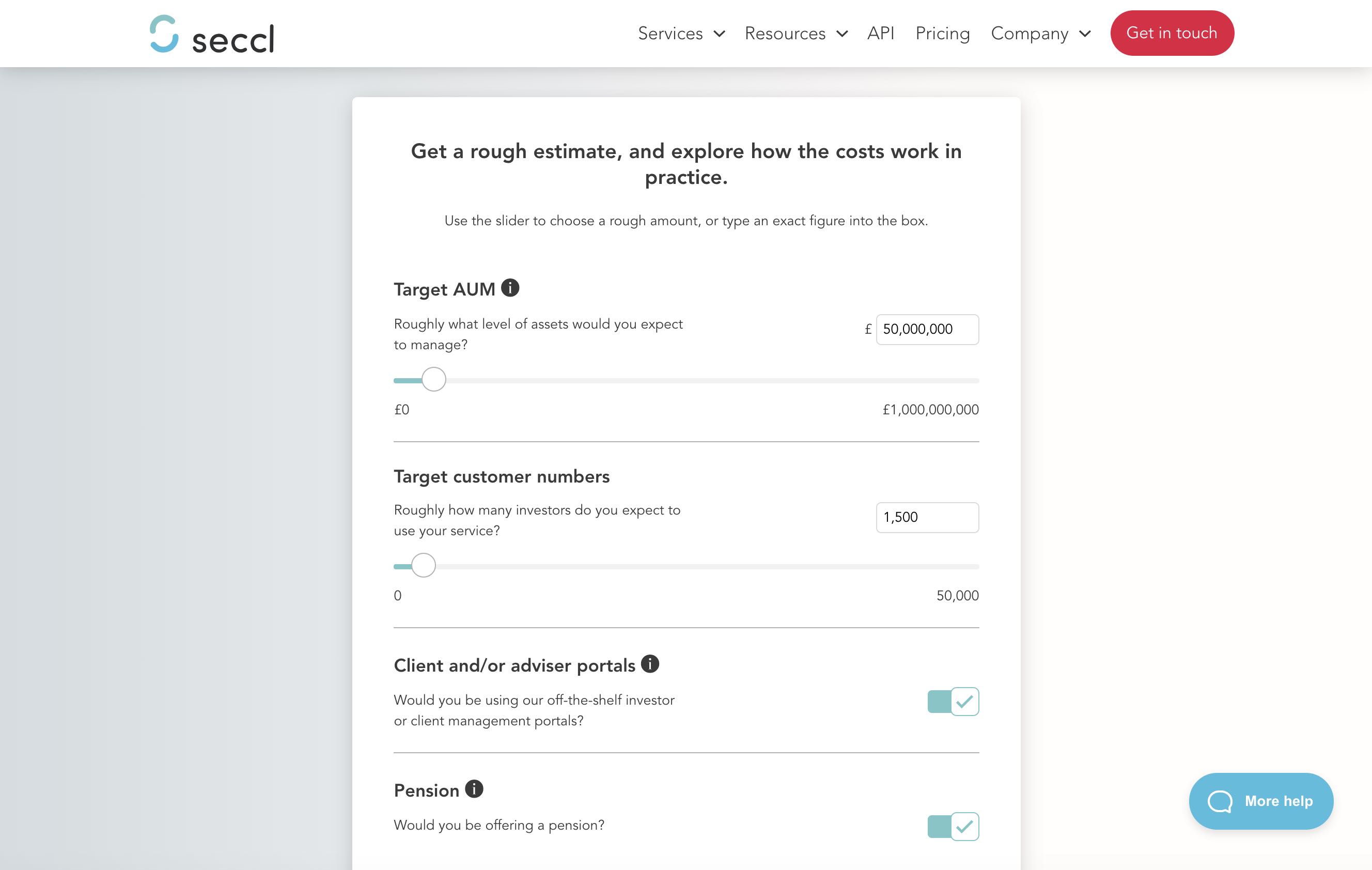

Exploring the costs involved

With our calculator, you can very quickly get a feel for how it all works. Simply plug in some rough answers to a few questions, and we’ll provide a top-line estimate. You can then have it sent to your inbox so you can refer back to it later.

I should note that it’s a guide – a rough ballpark, based on a number of fixed assumptions (and some rounding, too). It’s intended mainly to illustrate some of the areas of charging, so take it with a pinch of salt! For a more accurate picture, get in touch.

It also doesn’t account for the operational costs involved with running your own investment platform – for example, the administrative or customer-facing staff you’ll probably need to maintain it. We haven’t attempted to include them here as you’ll be far better placed to judge these than us.

To learn more about the new and perhaps unfamiliar roles and responsibilities, be sure to take a look at our introductory guide.

Have your clients pay less, for better

While it doesn’t promise total accuracy, our calculator does demonstrate just how affordable it’s become to operate your own investment platform.

With no up-front costs for implementation, and a headline rate starting at just 0.1%, we want to democratise the platform market and help more and more firms of all sizes to secure a foothold.

For advice firms and DFMs, it means your clients won’t pay over the odds for a third-party service that neither of you are completely happy with.

For new digital businesses, it means a chance to get low-cost, plug-and-play access to the financial markets.

And for clients everywhere it could mean annual cost-savings that, over the course of a lifetime, add up to substantial sums.

What’s not to like?

Transparency’s good

All good relationships are forged on a strong foundation of trust. And when it comes to building it, we think transparency is a good place to start.

We don’t want to hide our costs behind an ‘enquire now’ button – but instead want to make them available to help firms consider their options.

We believe in fair pricing, displayed openly – and hope you’ll find the new page useful.

Go take a look, and get in touch to let us know what you think!