Wow advisers with the seamless journey they deserve

CRM, planning tool, cashflow modeller, risk profiler… whatever your adviser technology solution, embed it in the advice journey with a platform capability of your own.

Advisers love your technology. Why send them anywhere else?

Financial advice is complicated enough, without multiple systems getting in the way. Our software and services can help adviser technology providers to strengthen their proposition, create seamless customer journeys and delight advisers in the process.

-

Planning tools

Allow financial planning professionals to execute the cashflow models and financial plans they’ve used your tool to build…

-

CRMs

Forget clunky platform integrations. In fact, forget integrations altogether. Have your advisers transact directly from your CRM…

-

Tech-powered DFMs

Don’t just distribute your models through other platforms; use your own platform to distribute your models…

How can we help?

Forget fragmented. Say hello to seamless…

In most spheres of life, technology has ushered in smooth and seamless online experiences. But the advice journey is still as fragmented as ever – typically involving five standalone systems in the delivery of planning and portfolio management, and two platforms (source: the lang cat).

It doesn’t have to be this way. Why shouldn’t advisers be able to execute financial plans in the same tool they used to build them? Or transact from within the CRM they know and love? With our platform tech embedded within your product, they can.

Strengthen your adviser relationships

As a forward-thinking technology provider, you work hard to make life easier for advisers. But your efforts are being compromised by legacy platforms and their clunky (or non-existent) integrations.

What if you could delight your adviser clients – and deepen your relationship – by owning more of the toolchain? Seccl makes it possible. Cut out the back and forth with platforms and keep advisers using the tool they know and love: yours.

See success storiesWhy Seccl?

Built by engineers, for engineers

-

Launch quickly with our API

100% of our technology is available through our publicly documented API, which regularly handles over 1.5 million daily requests.

-

Strip out inefficiency

We’re building the most efficient investment engine around – one that replaces manual process with intelligent automation, supporting nearly 10,000 investors per ops team member.

-

Reduce costs, grow revenue

Our ultra-low-cost custody and investment engine (typically 5-12 bps all-in) allows you to reduce the cost for advised clients and grow your own revenues in the process.

-

Get dedicated support

Our technical experts will help you get to market fast with, while your own account manager will help you scale.

-

Let us do the heavy lifting

We’ll take care of CASS and handle the client money obligations, while our investment operations team will do the heavy lifting for you. No need for a big new admin team.

-

Embed new features, fast.

We develop new features and functionality at a market-leading pace (even building our accumulation pension in six months alone).

Getting started

From first look to full launch in just a few months

Prep and permissions

After a series of demos and the usual DD, we’ll guide you through the process for obtaining new permissions (if you need any).

Deep-dive workshop

An intensive, full-day kick-off workshop to fully understand and document your needs, culminating in a full plan detailing the nature and scope of your integration.

Fee-free integration

As well as guiding you through your technical integration, we’ll offer you support on your regulatory, compliance and legal tasks, too. All at zero cost.

Launch

We work with you to onboard your first new assets, and migrate any existing books across to your new platform.

We launched and migrated one client’s book as little as four months after our first conversation. Can you beat them?

Get startedWorking together

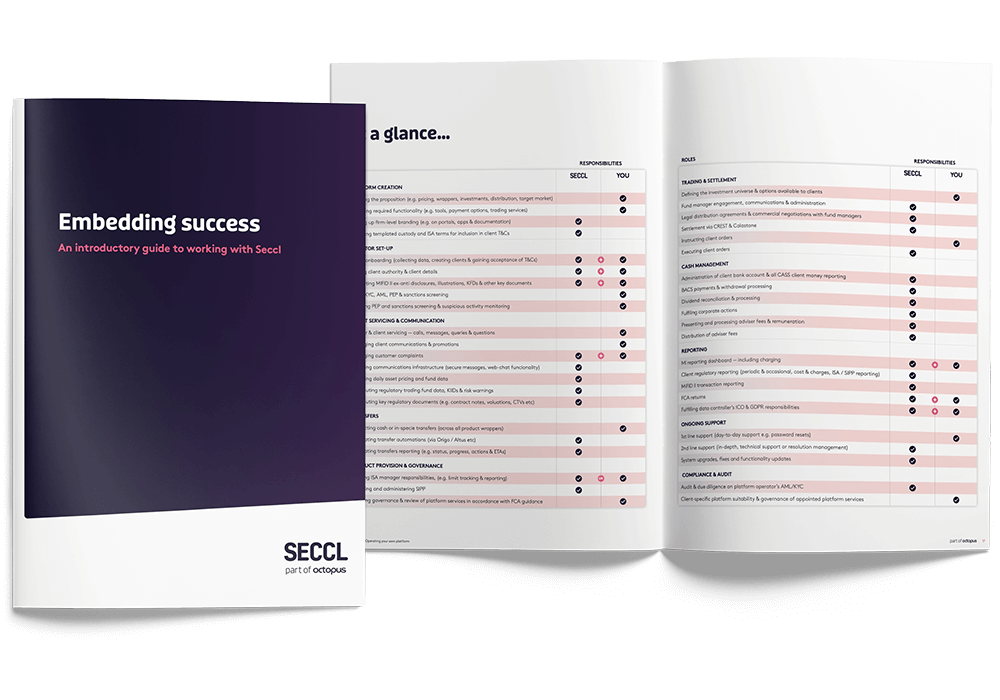

A guide to working with Seccl

To find out more about the ins and outs of what’s involved – and, in particular, who’s responsible for what – take a read of our introductory guide to working with Seccl.

Ready to begin?

Get started with Seccl today

Ready to take the next step? Our team is here to help you get started with Seccl.

Contact us today to discuss your requirements, request a demo, or learn more about how Seccl can support your business.

Get in touch