The opening credits

Introducing Seccl

Since the advent of platforms twenty-ish years ago, financial advisers have been making a steady ascent to their rightful roles as the superheroes of our industry. They’re the ones on the front line, creating financial plans that change lives for the better and building relationships that last a lifetime.

But they’re only as strong as their kit allows. Batman needs his Batmobile. Superman needs his cape.

Tony Stark needs his Iron Man suit. Advisers – whose superpower has always been to give an outstanding service and experience to their clients – have, we think, been let down by their software.

Things are changing, though – and it’s those changes that we want to explore in this paper, brought to you with the help of our friends at the lang cat.

Spurred on by advancements in technology, we’re seeing more advisers and investment managers looking to take control of their destiny, improve the overall client experience, and build more efficient, affordable and sustainable businesses in the process. How? By operating a platform of their own.

This paper will explore some of the reasons why they might want to. It will chart the developments that are making it possible. It will unpack the different options at their fingertips (from ‘white label’ platforms through to those operated by firms themselves).

And it will address some of the new tasks and challenges they’ll have to consider along the way. This isn’t a small decision for any firm, so we hope it helps provide you with some answers (or at least identify the big questions).

So, switch off your mobiles, load up on the popcorn and enjoy our own (low-budget) blockbuster!

Sam Handfield-Jones

Co-CEO, Seccl

With special guest appearance by the lang cat

For some time now, the lang cat has been tracking and writing about how the industry – that is to say, the morass of platforms, providers, fund managers and producers of kit that planners use – is changing how it serves the profession. This change is real, profound and driven by the profession, which is exactly how it should be.

One result of the industry fracturing and reshaping itself around the needs of advisers, planners and wealth managers – the intended audience for this paper – is that you now have greater control in putting together the ‘stacks’ of technology that allow you to serve your clients in the way you choose, rather than in the way a provider’s marketing department thinks you should.

As you’ll read in this paper, you can now configure investment platforms to make them suit your business. That’s been possible for very large firms for some time – fine if you have the resources of Bruce Wayne and a bat cave from which to pursue your ambitions, but less fine for everyone else. But water flows downhill – and the ability to make a platform in your own image is more accessible than ever before. That doesn’t mean it’s simple, and like great power always does, comes with additional responsibilities.

You’ll hear all about that from the Seccl folks. For our part, we researched just under 200 predominantly independent advice and planning professionals – representing firms of all sizes – on how things fit together for them, where platforms sit, and what they’d do if someone offered them the chance to put their own platform proposition together.

Seccl paid us to do this, so there is an inherent potential for bias. But we had the freedom to create our own question set and used this to make sure that we were asking ‘unslanted’ questions. We’re happy to discuss the research methodology with anyone that cares to. We were also allowed to shine in at various moments to give our opinion on the subject of advisers operating their own platform, and seized on this with gusto.

Our findings? Operating a platform comes with challenges and won’t be for everyone. But half of all respondents tell us they feel either not at all or only slightly in charge of the platform experience their clients receive. It may just be that we’re going to see an increasing number of advisers and DFMs suiting up as platforms in future.

We’re always keen to hear from advisers and planners about their experiences – so if you want to talk about anything in this paper, then just fire up the cat bat signal.

Enjoy the paper.

Mark Polson

Principal, the lang cat

Setting the scene

Us humans are notoriously bad at assessing the speed and impact of change. As Bill Gates famously said, “we always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten”.

And it works backwards too. Developments that once felt game changing quickly become, well, a bit old hat. Back in 2007, the iPhone was mind-blowing. Now everyone has one (or something better, if you’re an Android fan). Similarly, using said iPhone (or Android) to book an Uber to arrive at your door in three minutes seemed pretty immense back in London 2012. Now you can’t move for Priuses.

The same is arguably true of platforms. These days, the idea of running an advice or DFM business without one would seem baffling – so central are they to business as usual. But when these new-fangled systems first hit our shores from Down Under in the early 2000s, their impact was just as seismic.

Then and now, platforms are utterly invaluable in allowing advisers to easily manage all aspects of a client’s portfolio – helping them deliver financial plans that would have been nightmarish to execute in the disparate, pre-platform world of the life companies and their products.

Platforms have also catapulted advisers to the centre of the industry by allowing them to access the entire investment universe quickly, easily and affordably. Advisers now have more control over the advice process – building far stronger relationships with their clients in the process.

“The big platforms aren’t investing in the technology at anywhere near the level they need to. The bigger they get, the less they will listen to the needs of small and medium sized businesses. The lack of choice doesn’t help our business or our clients.” - Directly authorised IFA firm, £500m+ AUI

Time for a reboot?

While in other industries technological change has continued at a relentless pace – transforming how we live, work, travel and consume, to name a few – here in platform land, the story hasn’t exactly been one of continued disruption… more ongoing maintenance.

In fact, the software that underpins the platform market is pretty much unchanged. It’s still patched together with huge amounts of administration and manual effort – both on the platform and on the adviser sides, where long- suffering admin teams continue to make do with tooling that seems more 2001 than 2021.

Similarly, the technology providers that underpin most platforms in the market typically maintain separate code bases for each one. It makes for a complex and ever-expanding web of technology to audit and improve, which in turn means changes are slow to implement and wholesale innovation is increasingly difficult, expensive and, yes, undesirable.

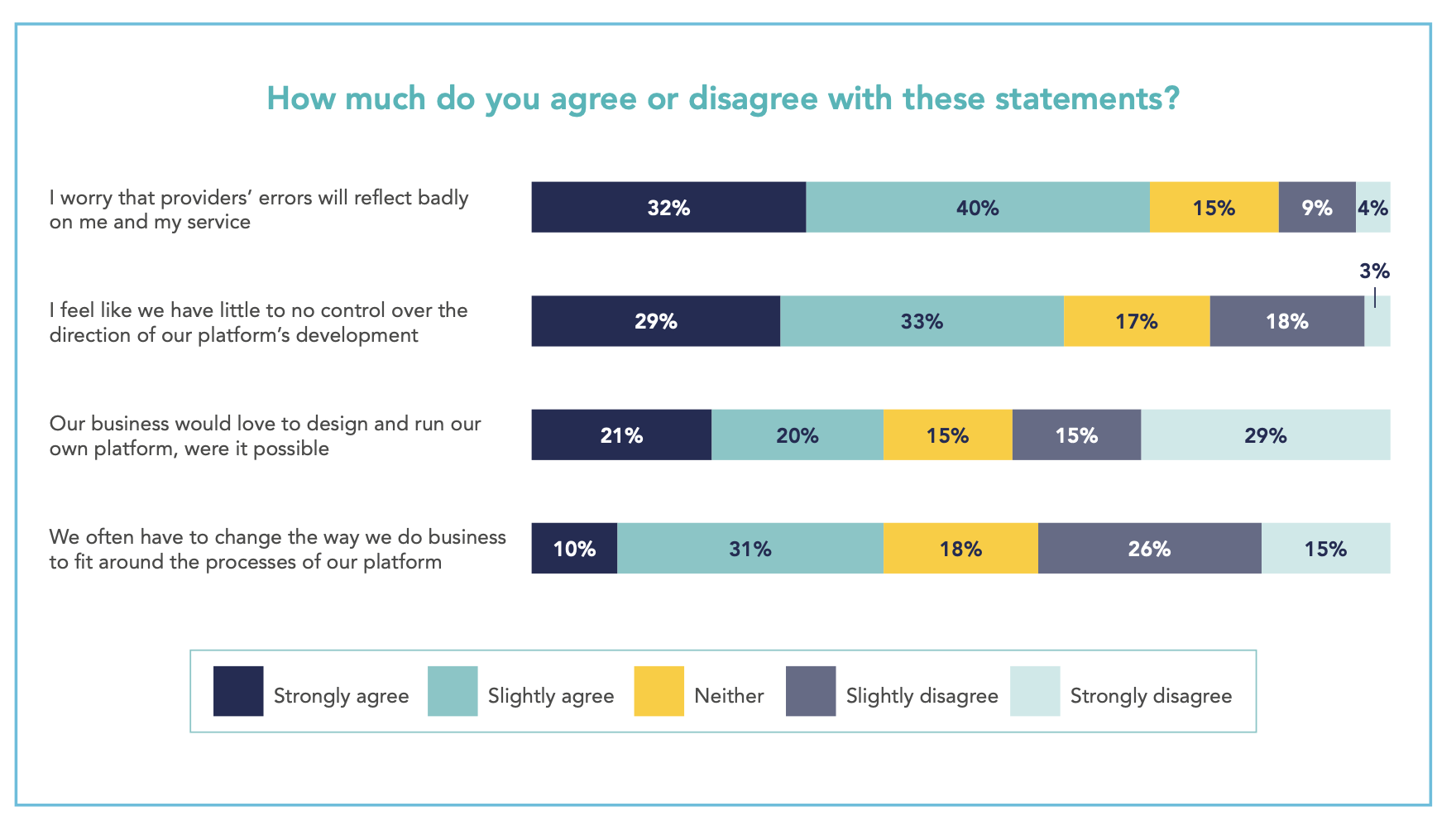

As part of the adviser research for this paper, our friends at the lang cat asked respondents to agree or disagree with a series of statements, and the results illustrate our point nicely:

Over 60% of respondents feel they have “little to no control over the direction of our platform’s development”. This is a profound issue: platforms exist to make advisers’ lives easier in serving their end clients, and if the provider’s development agenda doesn’t match the firm’s, then the disconnect can compound over time to cause significant frustration.

The lang cat also asked firms in a separate question how responsive platforms are to new functionality requests. Only 6.5% had had a request executed smartly. 35% had it done ‘eventually’ and 32% were left whistling down the wind, hoping for a glimpse of red cape. It doesn’t matter whether platforms want to respond in a timely way – most of them simply can’t.

“This is a profound issue: platforms exist to make advisers’ lives easier in serving their end clients, and if the provider’s development agenda doesn’t match the firm’s, then the disconnect can compound over time to cause significant frustration.”

Just over 40% of respondents agreed or strongly agreed that “we often have to change the way we do business to fit around the processes of our platform”. It’s no surprise that another 40% agree to a greater or lesser degree that they would love to design and build their own platform, were it possible. Spoiler: it is.

One further statement is worth highlighting: 72% of respondents worry that “providers’ errors will reflect badly on me and my service”. These responses speak to control or the lack of it; a theme to which we’ll return in a moment.

“It’s no surprise that another 40% agree to a greater or lesser degree that they would love to design and build their own platform, were it possible. Spoiler: it is.”

“Whoever holds these APIs, if they are worthy, shall have the power of innovation.”

The transformative changes that we’ve seen in other spheres of our lives have emerged thanks largely to one single, three letter acronym: API.

An API, or ‘application programming interface’, is essentially a bit of code that allows one set of software to easily talk to another.

The reason APIs are so important is that they dramatically lower the barriers to innovation. Thanks to APIs, it’s easier than ever for businesses to develop genuinely next-level stuff, because they don’t get bogged down and distracted by rebuilding what already exists.

To draw on our earlier example, Silicon Valley developers didn’t have to re- create existing maps or geo-location infrastructure before launching Uber – they just plugged straight into Google Maps. Nor did they entirely build the debit card plumbing to take your fare at the end of the trip – they just hooked up to a payment provider like Stripe.

What does it mean for platforms? Well, an investment platform infrastructure that is built in a modular, API-first way is easier to maintain, automate, integrate and continuously improve.

Let’s take a look at what kind of changes are happening…

“I don’t think it’s about asset size, more how the business operates and what they want to achieve.” – Directly authorised IFA firm, £500m+ AUI

Flash forward: present day

“The barriers to running a platform are now lower than ever, thanks to low-cost and low-complexity infrastructure.”

Cloud-hosted, API-first systems are already starting to improve the platform experience – and make it more affordable – by streamlining processes with automated, easy-to-maintain software. But they’re bringing another less obvious change too.

The barriers to running a platform are now lower than ever, thanks to low- cost and low-complexity infrastructure. Custody is increasingly commoditised. Trading and settlement are more automated. Wrapper management is less operationally onerous.

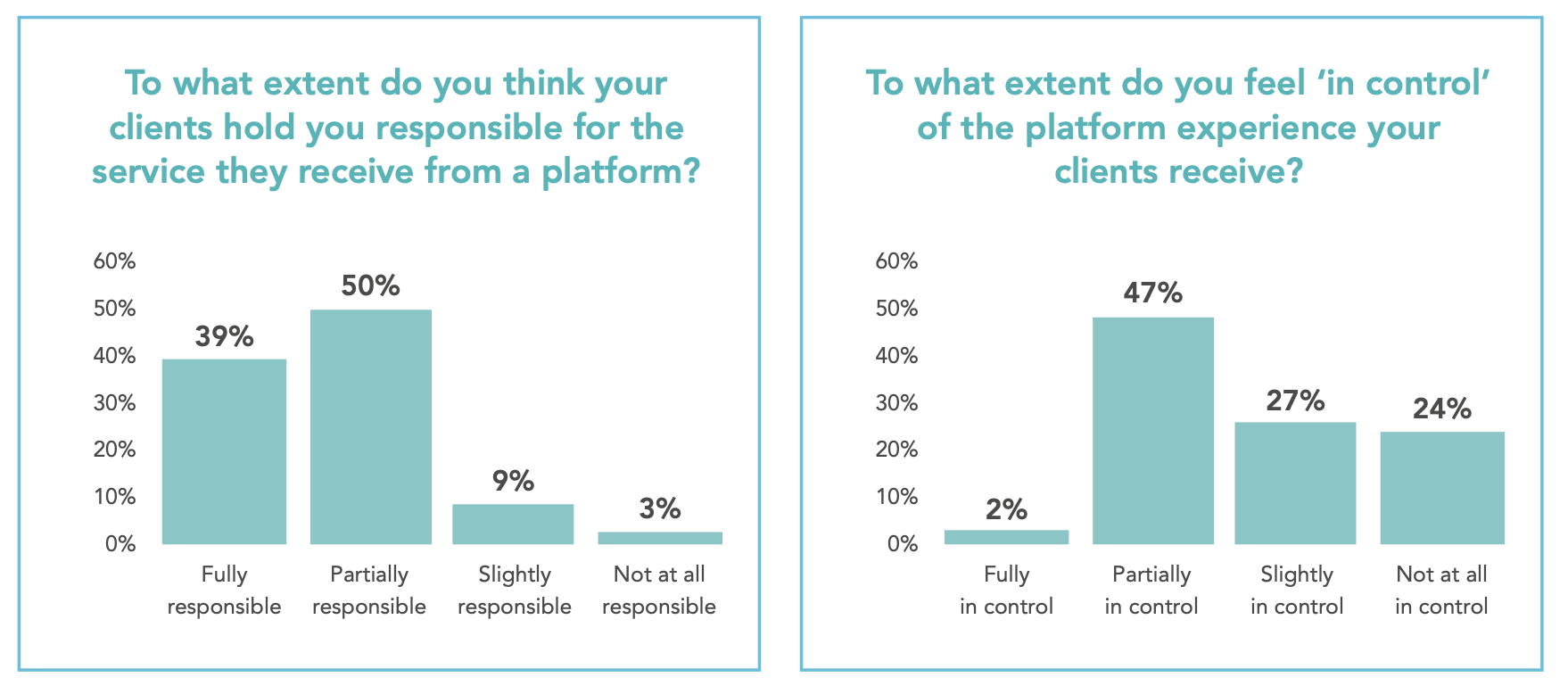

All of which means that firms can, if they wish, get closer to controlling the platform experience. After all, it’s an experience their clients hold them responsible for already. We know this from the lang cat’s research findings:

“Nearly 90% of firms think clients hold them at least partially responsible for something they do not feel in control of.”

Nearly 90% of firms think clients hold them at least partially responsible for something they do not feel in control of. This is a big deal. Bruce Banner isn’t presented with the bill for rebuilding whichever city his large, green counterpart just smashed – and neither, we’d say, should advisers be on the hook for something that’s core to their system, but beyond their power to really influence.

So, what does ‘taking more control’ mean in this context? (Platforms that is, not hulks.)

For some it might mean ‘white labelling’ an existing platform – a roomy term that we’ll unpack on page 10.

For others it might mean ditching a third-party platform altogether and instead shifting their admin resource over to operating a platform of their own – whether uniquely for their business, or as a new, marketable platform that they can distribute to other firms, too.

It’s this model that we operate, and it’s one which is often poorly articulated and understood. We’ll put that right in a moment.

For now, suffice to say platform ownership can provide firms with an opportunity not only to control the customer experience, but to fully own the customer relationship too – removing the separate legal relationship their old platform has with their client and replacing it with their own.

The lang cat says…

‘Owning’ the platform is an exciting concept. It also brings with it new responsibilities.

For example, admin moves from the provider to the firm; how manageable that is will be a function of how solid the technology is.

Similarly, the removal of the tripartite legal relationship means there’s more reliance on that between firm and client. Your firm needs to be rigorous in setting and maintaining it – as well as being ready to stand behind it when things don’t go right.

These aren’t bad things – in fact they can be empowering if you’re looking to take greater control of the platform experience and customer relationships. But they do need careful consideration.

How big do I need to be?

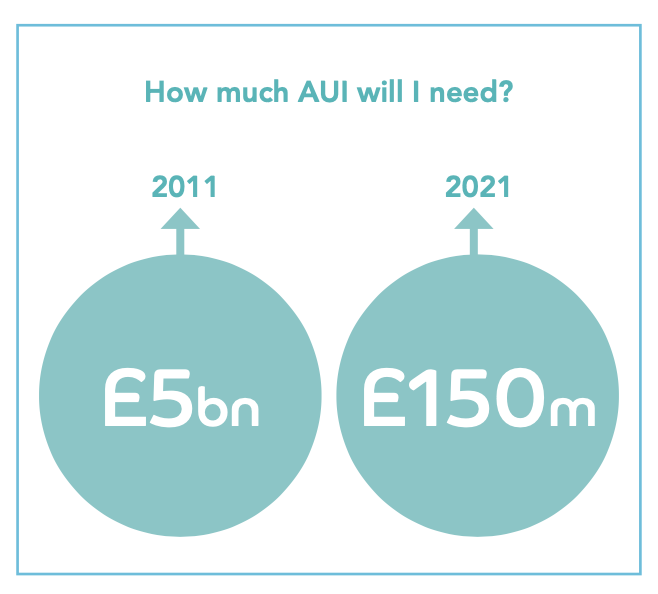

Historically, the decision to launch a platform has been the preserve of only the very largest firms or national networks – those with many billions of AUI, and with large in-house teams focused on platform administration.

But the streamlining, automating effect of technology has changed the economics of the market for good, making it a viable option for far smaller firms. While assets aren’t the sole consideration, we believe firms with as little as £150m under advice can make the exercise commercially viable – and potentially without hiring any additional headcount. See the interview with Damien Rylett of IronBright on page 17 for more on this.

The next step in the quest for control

The shift to firms operating their own platforms might seem revolutionary today but, as with all change, it could soon become unremarkable – simply the most recent, (we’d say) overdue, stage in the platform market’s development.

It won’t be right for everyone, and we’ll explore some of the key considerations that you’ll want to bear in mind later in this report. But for the right firm, it could be the next logical step in the journey to building a self-sufficient, future-proof business that’s fully in control of its own destiny.

Building the universe

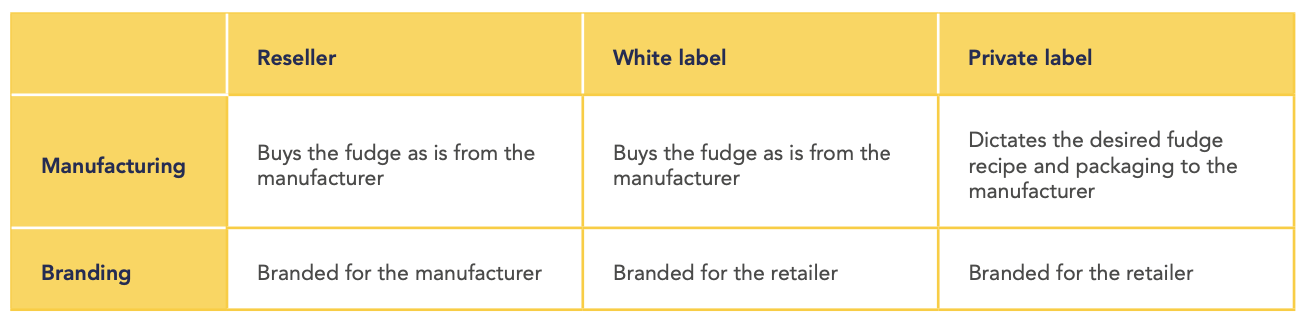

The universe of options within the platform space is growing and can be complex. In particular, the concept of ‘operating your own platform’ often gets conflated with another concept: that of a ‘white label’ platform.

We think there’s a difference between the two models – and that some clearer definition of terms will help firms to understand what option is right for you.

What do we mean by ‘white label’?

The term ‘white label’ is often used without definition – and can infer a whole host of operating models, all of which can be quite different from one another, and also different to what we define as ‘operating a platform’.

For some, it means simply distributing an existing platform offering under your own brand – in the same way Tesco would sell its travel insurance, for example. Put your logo on the client portals, choose your colours to match your brand and away you go. This is something that certain mainstream platforms let you do easily enough – and it may be just what you’re after.

“I think it’s brilliant and that’s the future… firms will pick and choose what services they want to offer to their clients. There’ll be the bits that benefit them, but then they don’t have to pay for the bits that don’t benefit them. It’s the future of advice, and technology is going to play a much bigger part in giving advice in the future, so if you can tailor the technology you use for your client experience, then absolutely I think that’s the way forward.” – Network firm, £150m AUI

But for others, ‘white labelling’ implies a further step – an opportunity to exert some control beyond the cosmetic. You might get to influence the pricing or change some of the terms which the client signs.

For clarity, we’ll refer here to the first as a ‘white label’ platform, and the second as a ‘white label plus’. (Can you tell we’re a custodian and not a brand agency?)

How does it differ from operating a platform of your own?

Both these models differ from platform ownership, for a few reasons.

First – and arguably most importantly – because they don’t change the legal basis of the underlying platform relationship. No matter what it looks like, a typical white label or white label plus proposition will still see the client sign terms with a third-party platform.

The platform might never communicate with the client (at least hopefully!). And the client might never really even interact with this third party. But they are, all the same, legally one of its clients.

If that platform chooses, for example, to change underlying technology provider, you as the adviser have little recourse – unless you want to put your clients through the hassle of a long suitability and re-recommendation exercise.

If you choose to operate your own platform, on the other hand, your client signs terms with you – giving you real control over their platform experience.

That control is also made real by the fact you’ll be the one delivering it. With a platform of your own, both the administration of advice and the platform administration can be provided by your support staff, under your own platform agreement.

Which does Seccl offer?

Here at Seccl, we’re often thought of as a white label platform. It’s not surprising, given how loosely that term can be used – but it’s not the most accurate description, as we’ve hopefully made clear by now.

Instead, we provide the technology and infrastructure that allows a firm to launch and operate its own platform. They in turn might then offer that platform out on a white label basis to other firms if they wish.

The fudge initiative

grabs microphone…

We know this is a Seccl paper, not one of ours, but we asked if we could chime in with our very own chapter, and what do you know, we were allowed.

We wanted our moment in the spotlight because the definitions of what’s what in this part of the market are so poor, and the taxonomy so flabby, that it’s important to offer another perspective. We also want to ensure this paper has balance: Seccl is naturally bullish about its own proposition – it would be an awful shame if it wasn’t – but there is some baggage to unpack. That’s our job.

“We’re sick of not having control. We can’t run our business efficiently with platforms slipping and sliding all over the place.” – Discretionary/advisory firm, £1.3bn AUI

First things first – we agree completely with Seccl that white labelling has a set meaning – about altering the brand a product is sold under – and that is certainly an option in the traditional platform space. In fact all bar a few of the 26 platforms we regularly profile offer some form of it, usually for free.

So to use the phrase ‘white label’ for everything from a branding change right through to a fundamentally different relationship where the planning firm becomes the platform operator is a recipe for a big load of fudge. We like fudge, but not here.

If we were in retail, we might describe the options offered by Seccl and its competitors as ‘private label’.

If we were making actual fudge, we’d tell Seccl what flavours we wanted, what the sugar content should be (very, very high. We are Scots, after all), what the packaging should look like (cat themed, naturally) and then buy it on a wholesale basis so we could sell it on through retailers. And that’s pretty close to what firms using Seccl and other similar offerings do – we see this, for example, in the P1 Platform business. We interviewed James Priday of P1 as part of our research, and you can read his story on page 15.

Staying in retail for a minute, it’s worth mentioning that a business which takes a product as is and sells it on is usually known as a ‘reseller’. That might not sit nicely with how many firms reading this will see yourselves, but when it comes to the actual kit you recommend to fulfil the financial plans you set (and we all know the planning is the most important bit) then that’s your model if you use off-the-shelf platforms. Nothing wrong with that, by the way.

Let’s return to fudge.

That’s enough fudge. Stepping away from the sweetshop, we can see how the model above maps to Seccl’s segmentation of the market, and that makes some sense to us. The one difference is the ‘white label plus’ which sees the firm becoming an Appointed Representative of the platform.

We’d also point out that there are models in the market which allow firms to consume just some services from the platform and to negotiate a price on that basis. Such is the lot of anyone who tries to do segmentation – there are always one or two awkward ones that don’t fit in the buckets.

So let’s think about what these different models mean in practice, at least in our view.

In the traditional model, the dynamics are well known. You’re not fully in control of the experience your clients receive from the platform – 98% of our respondents stated that they felt at best partially in control – and this can lead to a combative relationship which at its worst can feel awfully like the old provider days. That isn’t to say that this is commonly the case; most platform relationships are pretty good. And although the firm doesn’t get to set the price to the end client, there are no shortage of special deals out there.

In the white label model, everything is much the same, except it’s your name above the door. In the due diligence work we do at the lang cat, white labelling (in this proper sense of the word) is commonly requested, though it comes a long way below good service and financial strength. We admit to wondering why so many firms are keen to put their own brand on something over which they have little control.

In the white label plus model, things start to change a little. This model is a sort of incubator for firms who aren’t ready to assume full permissions or ownership yet, either on size or business readiness grounds. So the firm does get more control, but its ability to really drive a wholesale price that it can mark up to generate additional revenue will be limited. All the legals, service, middle office, reconciliations and the rest of it still sit with the platform – which is either good or bad news, depending on your point of view.

In the full ownership model, life is fully different. As Seccl’s table shows, the firm is now responsible for admin and support, and the client signs terms with the firm rather than the underlying platform. That cuts out the old channel-clash issue – but naturally brings in new responsibilities. Admin resource can indeed shift over to operating the firm’s ‘own’ platform – but there is still an underlying provider (Seccl in this case), and that relationship will need managed.

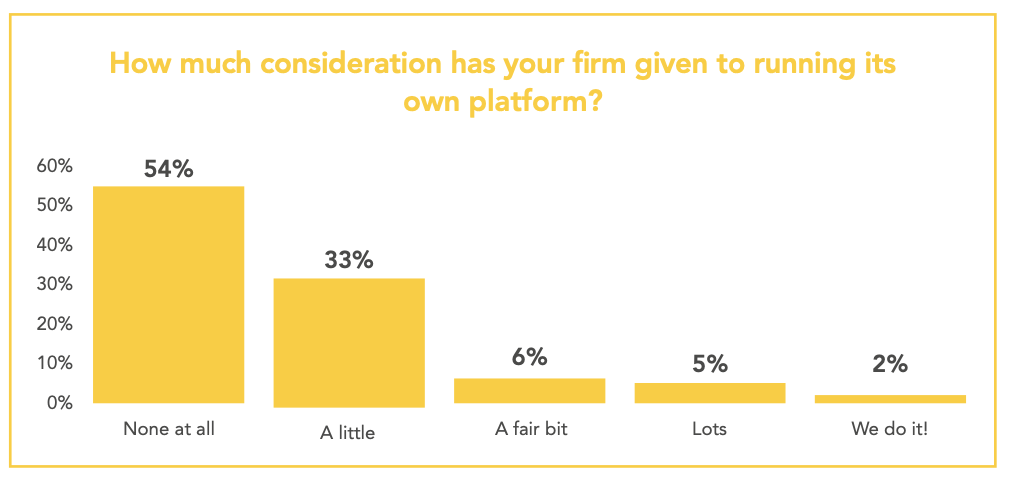

We’ll close our section by quoting some of our own research for this paper. We asked firms if they’d considered running their own platform. Here’s what our respondents said:

Just over 40% of firms have been considering the prospect of running their own platform, with 11% of firms giving it decent consideration and another 30% or so giving it a bit of thought. That’s a chunky minority at least aware of the possibility. It is still a minority though and the question naturally arises, then: are we all just running around worrying about something that won’t affect many firms?

We’re not so sure. Selling the benefits of this option is down to Seccl, not us. But it’s worth saying that big shifts in our sector, as in so many others, don’t come all at once. We have early adopters, and fast followers, and early/late majorities and laggards, just like any other industry. If you cast your mind back 20 years – those of you who are old enough – to the early days of platforms, we suspect if we’d asked, “how much thought have you given to stopping using life company products and instead placing new business on a wrap platform”, the figures might have been pretty similar.

“Just over 40% of firms have been considering the prospect of running their own platform, with 11% of firms giving it decent consideration and another 30% or so giving it a bit of thought.”

Origin stories

What about the firms who’ve been there, done that? As we’ve seen, firms might want to launch their own platform for a variety of reasons – so let’s hear from a couple of Seccl’s existing clients.

P1, an Exeter-based investment manager, built their platform to more easily manage their discretionary models, with their sights set on distributing it directly to advisers. The P1 Platform already supports around 30 firms, and was voted number one by advisers for customer service two quarters running in the lang cat’s adviser ratings for Q4 2020 and Q1 2021.

IronBright, the DFM arm of financial planning firm Brunel Capital Partners, set out to develop a fully paperless platform of their own; one that would give them control over tasks they thought themselves better placed to deliver, and so improve the service they could offer their clients.

#1 James Priday, CEO and founder, P1 Platform

P1 was spun out of an advisory firm about five years ago as a low-cost, efficient investment management firm. The original plan was to offer our model portfolio and bespoke portfolio services through third-party platforms. We then decided we wanted to start a platform of our own, so people could come to us directly rather than having to go through a third party. So that’s what we did. P1 is now an investment manager and a platform operator.

Getting started

It took a long time to find a provider we could work with, who provided tech that was both flexible and would allow us to develop as they developed – so we could create our own things and just plug them in. I suppose everything was built around flexibility – that for me was always the main driver.

We work very closely with Seccl and helped develop their UI, which we currently use. We also use Seccl for core trading, custody and settlement. That’s slowly changing as we’re developing our own reporting tools and bolting them into Seccl’s APIs, and into APIs of adviser back-offices.

What’s really impressive about Seccl is the speed at which you can get up and running on the platform and using the core tech. You can create your own tools or use the pre-existing suite to get going really quickly. Seccl removed the main barriers for us which were the vast amounts of money and time involved in setting up a platform.

Challenges

You’ve got to understand what you’re taking on. You can outsource some responsibilities, but you’re always going to be first port of call for servicing and issues. We’ve got a team that focuses on operations. That’s effectively working with Seccl, working on developments that Seccl are doing, helping them steer what they’re doing for us.

Some of that development has shifted in-house, with some additional reporting tools, so we’re having to learn about new areas, for example, building a tech stack. We’re starting that journey, and you’ve got to be prepared to put in the effort to understand how Seccl’s tech works, how you can bolt into that tech, and how you can evolve it for your needs.

The only other thing to mention here is compliance. We’ve had to seek legal advice around, say, platform agreements, how we’re contracting with the end client, and how we’re contracting with adviser firms using the P1 Platform. Then there’s specific industry compliance advice – Threesixty supports us on various elements.

“For me, it’s all about being able to design and react to things quickly, rather than relying on other people or a third-party platform to do things that we would actually like to do ourselves.“ – James Priday, P1 Platform

Triumphs

Yes, it’s a lot of work but you become master of your own destiny. Talking about Seccl, you can see the APIs, start architecting your own technology, look at other software and see how you can integrate. We can start looking at our roadmap of what we want the P1 Platform to be, knowing that we’ve got somebody there that we can just plug into whatever we build. For me, it’s all about being able to design and react to things quickly, rather than relying on other people or a third-party platform to do things that we would actually like to do ourselves.

Standing on your own two feet

You’ll need to think through how you’re going to deliver some of the underlying wrappers that you may want to deliver. With back-offices and third-party software too, I think you have got to understand that actually, you can’t just rely on the likes of a Seccl to be doing all of those integrations for you – you’ll still want to either buy in software or have that resource in-house. It’s not an effort-free route but you’re in control of how it plays out.

#2 Damien Rylett, CEO, IronBright

Brunel Capital Partners is a financial planning firm with one office in Bristol and one in Wells, Somerset. It was founded in 2011 by me and three other guys who all worked together, today we’ve 22 people. Seven years ago we decided to take on investment management – which became IronBright – and we’ve also been working to establish our own platform using Seccl’s technology.

Settling into the driver’s seat

Control for us was key. I think it was not relying on others to do something that we thought was relatively simple and could either do ourselves or a piece of technology could do.

One of the great things is that it’s totally digital and paperless. I know everybody is claiming that, but a PDF form isn’t paperless – it’s a photocopy of a form. Our clients and ourselves literally do not need to fill out a single piece of paper to do anything on this platform: set a client up, set up wrappers, move money around, investments. It’s purely digital and you would not believe the time that’s saving along every part of our process. We are already starting to see huge benefits.

Effectively we have become the platform provider. So we charge our client a platform fee, we then pay Seccl for their custodian services and the user interface. If there’s a difference between the two, that’s the margin we retain. We’ve been able to maintain a margin, but also reduce costs to the client.

At the moment we provide platform services to our own clients. We have plans to package that up with our investment management services and talk to select IFA and financial planning firms.

“Our clients and ourselves literally do not need to fill out a single piece of paper to do anything on this platform: set a client up, set up wrappers, move money around, investments. It’s purely digital and you would not believe the time that’s saving along every part of our process.“ – Damien Rylett, IronBright

Going in with your eyes open

It is a lot of hard work. And you absolutely need the right permissions around administering and safeguarding assets to be able to run your own platform. You also need to be aware that although you are outsourcing elements of your role as a platform provider, you are still responsible for them, so there are regulatory requirements.

The move to a new platform is not an easy one and the move to a platform of your own is, unsurprisingly, harder still. Our ops manager effectively project managed this and had people working on all of the individual tasks and functions to ensure a smooth transition. You need to go into it with your eyes open – it’s easy to think you’ve done all your due diligence and tested every element, but don’t assume you have.

If you’re doing it purely for commercial reasons, then maybe think again. I think the commercial side of it, the ability to shave a few bps off, is a by-product. If it’s better for the client, it’s generally better for your business – but the clients come first.

I do think this is a real opportunity for small to mid-sized firms. If anybody is thinking about it and would like to have a chat, I’m very happy for them to get in touch with me.

With great power comes… new responsibilities

(Considerations for those thinking about operating a platform)

Choosing to operate a platform is a significant step, and it won’t be right for every business. There are key considerations you’ll want to bear in mind before you jump in – some regulatory, some strategic, some operational.

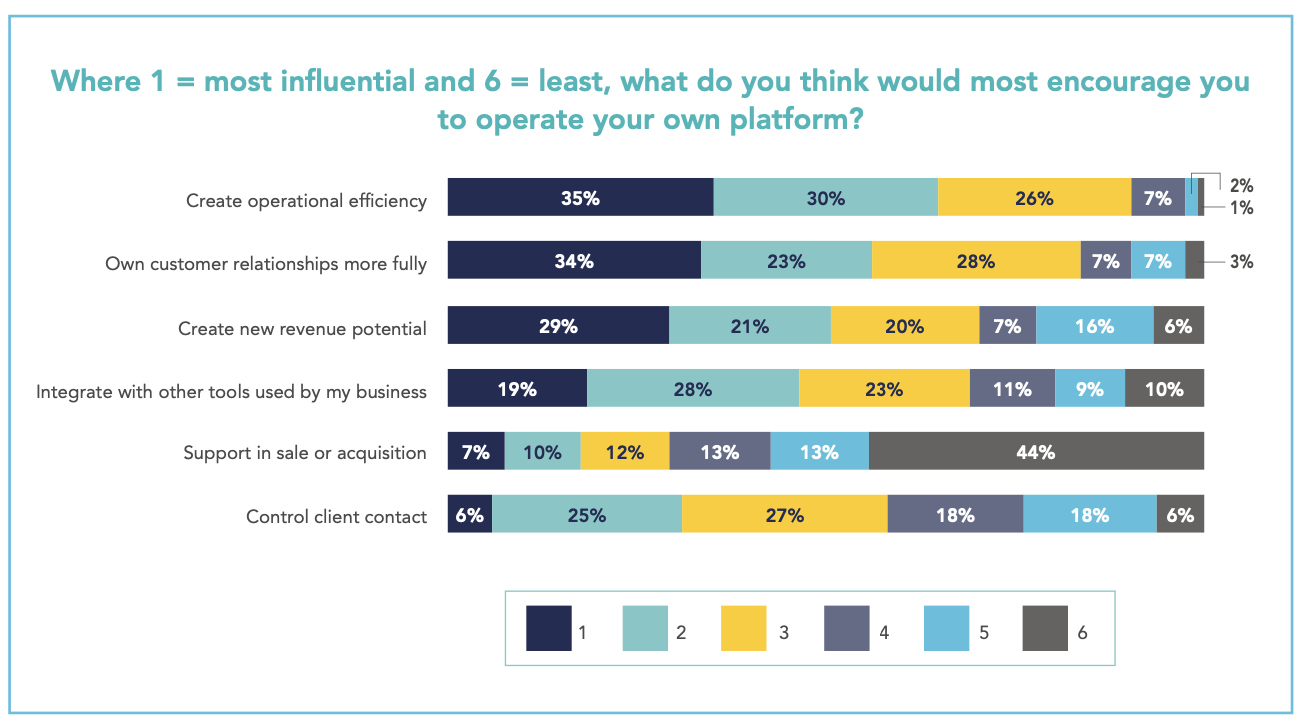

Before we look at those, let’s have one last dip into the research the lang cat ran for us to see what the firms they surveyed think might be the main advantages, ranked in order of their potential influence:

So – as so often happens – administration and customer relationships come to the fore.

Operational efficiency is a sweep-up term that catches all the frustrations we read about earlier in this paper, and client control is the other side of that coin. No surprise, then, that they rank so highly. It’s worth mentioning that these responses were consistent across firms who had and hadn’t put a lot of time into thinking about this model already.

It won’t come as a surprise that as a provider of these solutions, we think there are genuine advantages, and we want more firms to embrace them. But there is more to it than just signing up and then starting to earn basis points on platform charges. It’s a shift in mindset and in model. And your business needs to be ready to get the most from it.

We find that four key questions give a pretty good sense of a firm’s readiness to sling their webs and make the jump.

1. What’s your motive?

There are a number of different reasons you might choose to operate your own platform. You might be hoping to lower the costs your clients pay and create a consistency of service across the entirety of your proposition – improving client experience by taking on the administration yourself.

Your rationale might be a bit more commercial, with you hoping to create some business efficiencies by moulding your platform around your firm (rather than forcing your processes to fit around your platform).

Perhaps you’re a DFM looking for an easier way to manage your models. Or maybe you’re an advice firm that’s looking for a simpler way of managing less affluent or younger clients alongside your core client bank.

Or, regardless of what type of firm you are, you might be fed up with the service of another provider reflecting badly on your business.

“It’s a shift in mindset and in model. And your business needs to be ready to get the most from it.”

Whatever the reason, it’s important you’re clear on it upfront (and that it’s not a purely profit motivated one), so you can properly structure your proposition to suit.

2. Do you have the right permissions?

To operate your own platform, it’s likely you’ll need the following permissions:

- Arranging (bringing about) deals in investments

- Arranging safeguarding and administration of assets

- Dealing in investments as agent

- Making arrangements with a view to transactions in investments

You might have these already – for example if you’re a discretionary investment manager. But if not, you’ll need to apply to the FCA to have them added.

3. Are you clear on the responsibilities?

In opting for this route, you’ll be fulfilling platform-related administration tasks that would’ve otherwise been completed by the platform itself. It might be that you don’t need to hire any additional staff – after all, your admin team will already spend a good deal of time referring similar queries to platform customer services staff – but that will really vary from business to business.

You’ll be responsible for defining the proposition – determining the commercial model (pricing, terms etc), curating the investment and wrapper coverage, and selecting the desired functionality.

Now, the opportunity to do all this is arguably one of the main motivations for operating a platform in the first place, but it’s important you go into it primed for action and with your eyes wide open.

There’ll also be a compliance and governance implication. You’ll be responsible for ensuring effective anti-money laundering procedures – and will need to conduct due diligence and oversight of the platform services you appoint others to provide (for example custody, client money and technology). We’ve prepared an introductory guide to platform ownership which goes into more depth on some of these roles and responsibilities – you can find it at https://seccl.tech/guides/introduction-to-working-with-seccl/ if you want to know more.

4. Have you got the capital?

You might be required to hold more capital in reserve by deciding to operate your own platform. Whether or not you are will depend on your existing status and business model – and the future scope of the assets that would be administered on your platform.

If you are a BIPRU or IFPRU investment firm, you will already be required to develop and maintain an Internal Capital Adequacy Assessment Process (ICAAP).

The decision to operate a platform may not, in itself, fundamentally change your capital requirements calculations or processes (although you will have to account for the change in business model in your ICAAP).

the lang cat says…

We should talk about the room-dwelling elephant: the chance for firms to mark up the platform cost and to make additional coin. 50% of our survey respondents reckoned that the potential for more revenue from a platform ownership model was attractive. They’re not wrong: this is allowable so long as you genuinely are a platform operator as well as an advice firm.

Note that we said revenue, not profit; how profitable this shift is will depend on the capacity, skill set and scale of your firm, as well as how slick the technology from the underlying provider is. You should consider both sides of the ledger carefully before committing, and revenue is – in both our and Seccl’s view – the weakest reason for changing your model.

The endgame?

So why do advisers and DFMs choose to operate their own platform?

Improve client experience with a platform that’s fully paperless and more affordable. To operate a platform requires legacy-free technology, which makes for a platform that’s fast, friction-free and typically lower cost than the rest of the market.

Take control of client relationships by entering into a legal relationship with your client – and removing the need for a contract with a third-party platform.

Control your destiny by taking control of the platform technology stack and choosing which other systems you integrate with.

Integrate vertically and own more of the value chain. You’ll do what you do best – giving a great client experience – and remove external parties that get in the way.

Stay immune from platform M&A and the forced migrations they can bring. With a platform of your own, you’re in control and writing your own story.

the lang cat says…

Time to sum up. We agree with Seccl that there are advantages to this model, and we also agree it won’t be for everyone.

The main driver of desire to go down a different road seems to be operational in nature. It isn’t the case that every bit of ops is bad from platforms, but that firms which want to do a great job controlling the client experience from cradle to grave simply can’t do that through the traditional platform or even white label models.

We sense a degree of caution, and that’s a good thing. The platform ownership model requires more of a firm – certainly far more than slapping a logo on an existing retail platform. There are resource requirements – which may or may not need additional staff – as well as new regulatory overheads. Depending on how the firm wants to set up its technology stack, there may be wrangling of systems to ensure rock-solid connectivity between them – each integration needs care and attention. There may be costs to bear from elsewhere too – want to design your own client portal or bring one in? You’ll be on the hook for that.

But on the other side of the coin, there’s clearly a groundswell of positive attention – and it certainly feels like we’re seeing a new category forming, which allows firms to take greater control of their platform experience.

So, are we in the endgame of our white label movie? No, quite the opposite. This story is just getting started.