At Seccl, we aspire to be honest, inclusive, creative, disruptive, and relentlessly focused on our customers’ needs. Sure, many other businesses might say the same – but we have another passion that we don’t think is shared widely enough in our industry: efficiency.

We want to become the most efficient business in financial services – always striving to do more, by expending less human effort. However, we operate in an industry where many incumbent firms are both massively profitable and shockingly inefficient.

As a result, we sometimes find it hard to get others as excited as we are about doing more, for less.

So why exactly do we care so much?

Well, first of all, there’s a huge commercial benefit: cost. Thanks to the efficiency gains that our technology provides, we’re one of the cheapest custody and trading solutions on the market, starting at just 0.1% of client assets per year (and tiering down for larger portfolios). If we had to use more resources – human or otherwise – to do the same work, it would be impossible for us to charge so little and so, in a very real way, our efficiency powers our affordability.

And low pricing doesn’t just make for good business. It’s also crucial to our mission: we want to cut costs so that more people, of all backgrounds and levels of assets, can access the worlds of investing and financial advice.

What’s more, much of our best-in-class customer service is the result of us expending our efforts in the right places – and wasting less on low-value tasks that technology can complete just as well.

Our transfers workbench, for example, automatically keeps clients up to date, while also saving time for our customer team. Our bank API integration, meanwhile, automates tens of thousands of payments for our cash operations team, while also allowing us to accept instant deposits. Clients can now transfer money from their bank account to their Seccl-powered platform – and have it executed in the market – in under ten seconds. It means we can also accept correctly instructed bank transfers right up until the last minute of the Tax Year (which, for advisers, means no more hurried chasing of clients come the end of March…).

What makes us so efficient?

If cost and customer benefit are the ‘why’ of our efficiency, that leaves the ‘how’ – and the answer is surprisingly simple. We automate.

We understand that computers are faster and more accurate than people at repetitive data entry, and that people have better things to do. We also know that, while our team is brilliant, the efficiency gains that come from simply ‘working harder’ or throwing people at problems soon become non-existent.

To illustrate the point, let’s take a few examples from within our operations team.

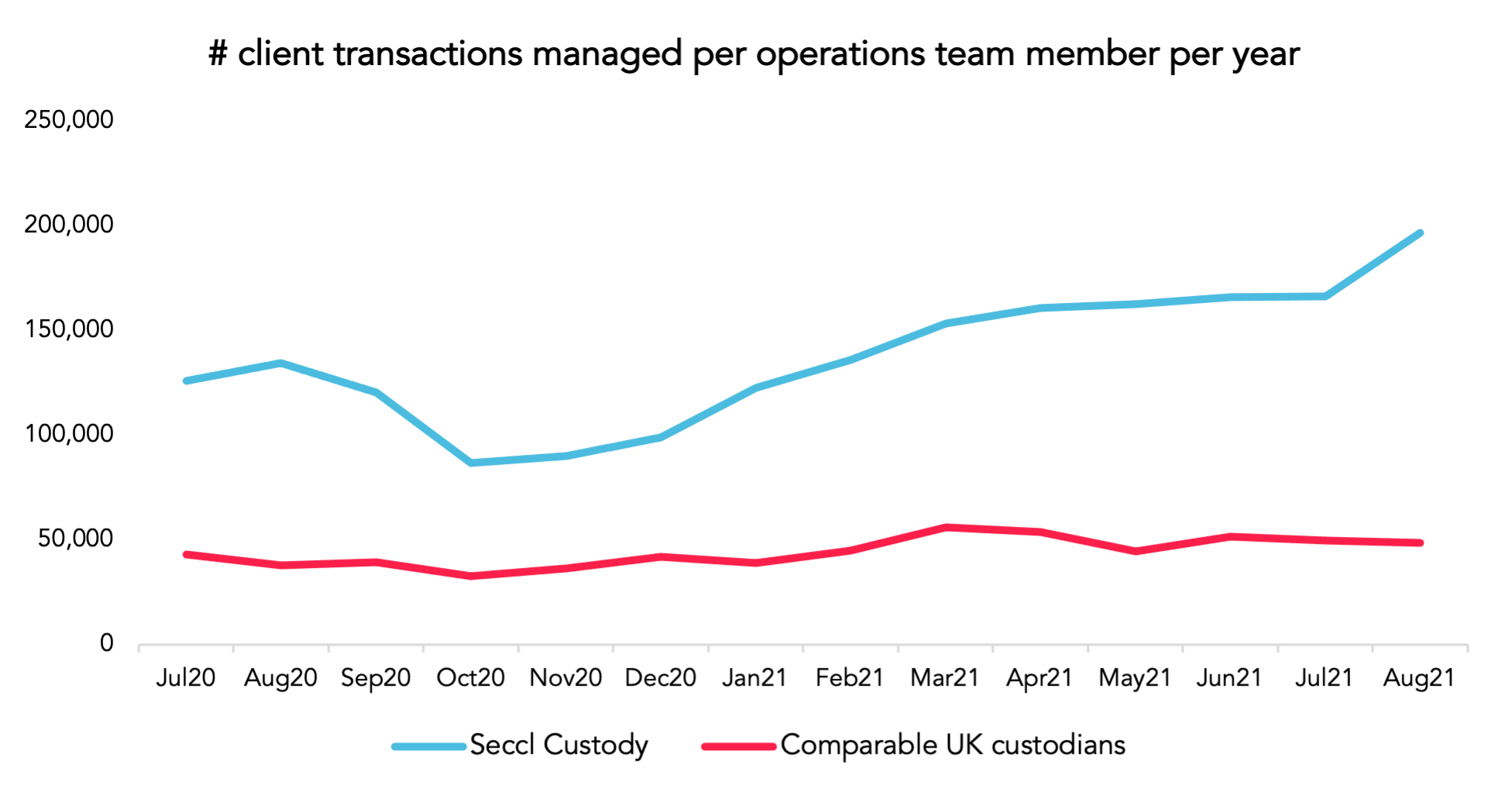

As a custodian, one of the ways we measure our efficiency is by counting how many client transactions (payments, asset transfers and buy and sell orders) each full-time operations employee can process every year.

The difference between our line and that of ‘comparable UK custodians’ shows we’re 3x more efficient – facilitating three times as many transactions with the same resources.

Their line stays flat because they throw people at problems: more transactions mean more manual work that they hire people to do. When we see more demand at Seccl, on the other hand, our technology mostly covers it automatically.

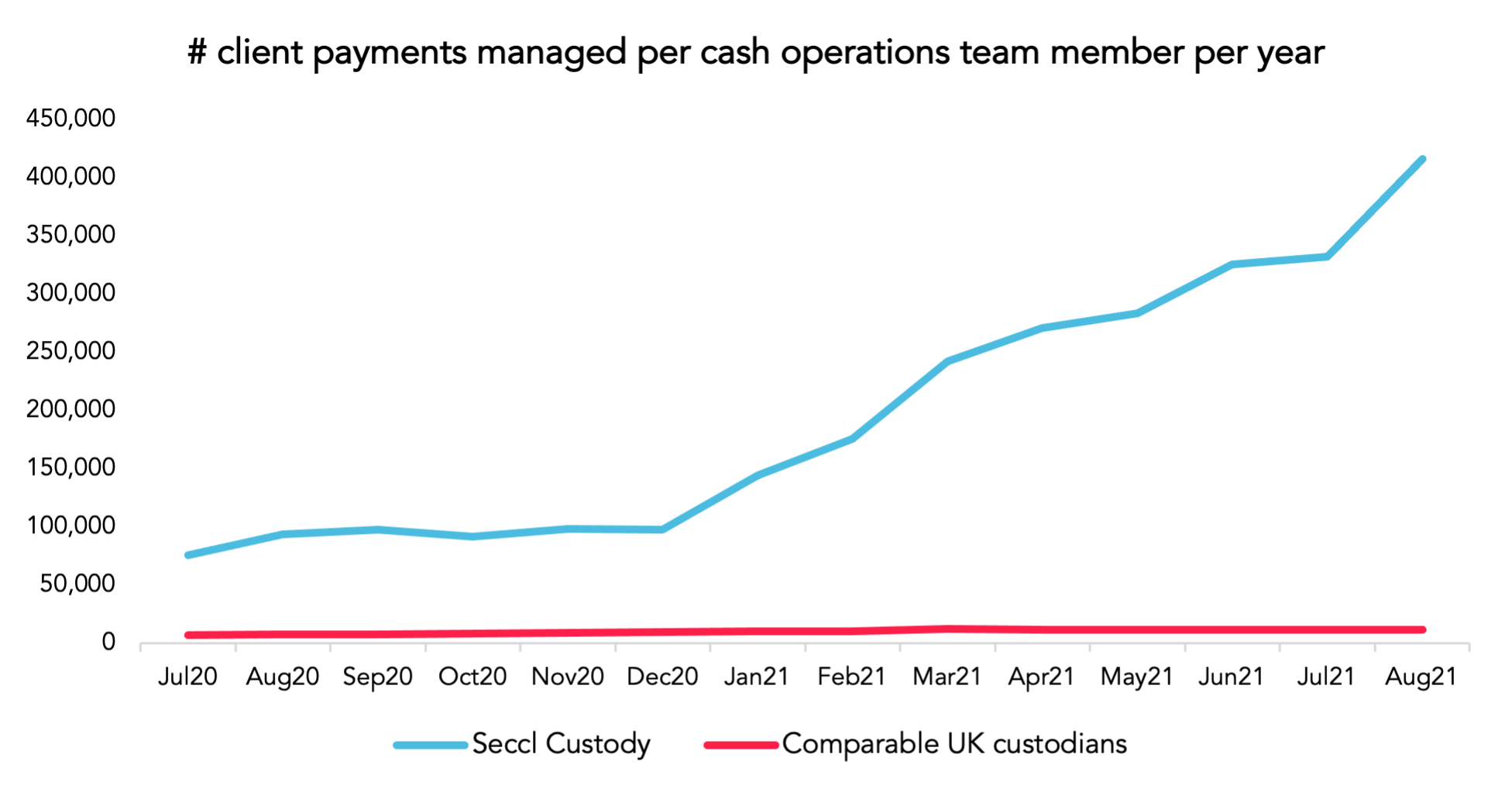

Now let’s look at the effect that the fully automated ‘instant deposits’ we mentioned earlier have on our payments efficiency.

It turns out that payments are particularly manual for platforms – so in this case we’re 30x more efficient than others in the industry.

It goes to show the power that ‘intelligent automation’ can wield on internal processes – and overall efficiency.

Change is needed

Thankfully, it’s not just us who see the importance of efficiency across wealth management and financial services.

In its recent research, Calastone (the global fund communication network) showed that nearly every firm in the market is struggling to settle their fund transactions (a key investment process), and that it’s causing problems. 59% of respondents said that late settlement annoyed clients, while 40% said they were failing to meet regulatory obligations as a result.

While Calastone is taking the lead here, we do believe the ‘automate intelligently’ principle applies beyond just settlement. From payments – where our instant deposits are changing the game – to orders, dividends and corporate actions: at nearly every step of the investment life cycle, everyone involved would benefit from automation.

Put simply, the financial services industry needs an efficiency overhaul, driven by the automation of repeatable processes.

Why should other firms care?

Adopting new technologies and orienting a business around efficiency are difficult, cultural changes. So, why would firms that make multi-million-pound profits every year (whether they’re efficient or not) spend time worrying about it?

For the answer, they need only look to the future and ask: “just how sustainable is my business in the long term?” In today’s fast-moving, technology-powered world, the single biggest mistake that any firm can make is to rest on its laurels. And the surest foundation of any plan is the knowledge that tomorrow isn’t promised – today’s dominant incumbent can quickly become tomorrow’s abandoned dinosaur.

“Tomorrow isn’t promised – today’s dominant incumbent can quickly become tomorrow’s abandoned dinosaur”

Take an example from outside our sector. In 2010, the CEO of Time Warner dismissed the idea that a tech-led challenger might pose a credible threat to its long-term profitability by saying, “it’s a bit like, is the Albanian Army going to take over the world? … I don’t think so”. That challenger was Netflix. Fast forward to the present, and the rest is history – all thanks to its instant-access, low-cost, tech-led model. Who’s laughing now?

Just as Netflix, Spotify, Google, Amazon and others have turned their industries upside down, so too will hyper-efficient, automation-obsessed disruptors displace financial services firms that can’t move on from legacy technology.

Just think: pen and paper still remain widespread in wealth management, even in our 21st century, where APIs (Application Programming Interfaces) have transformed nearly every other industry.

As challengers leverage new technologies, incumbents will ignore them – and the efficiency they bring – at their peril. If they don’t adapt, they will almost certainly get left behind.

“Hyper-efficient, automation-obsessed disruptors will displace financial services firms that can’t move on from legacy technology.”

What does the future hold?

While dinosaur firms should be worried, everyone else should be excited about a future where all repeatable processes are seamlessly automated, and tech-led ways of working are standard. Just imagine…

Gone will be the days of waiting ages for payments to be allocated – instant command of your money will be the new normal. With APIs now commonplace, everyone will be able to easily integrate with each other, instead of duplicating work. The industry will look less like a battlefield of wasted resources, and more like an ecosystem of mutual benefit and healthy competition – with loads more meaningful choice for investors.

The lower costs of running basic processes will allow charges to be cut across the board – and even made transactional rather than percentage based – enabling access for people with fewer assets.

And, behind the scenes, all operations staff will ‘work by exception’ – spending their energy on the few cases that don’t fit the system’s rules, rather than manually executing routine transactions. As a result, they’ll be freed up to communicate more transparently with customers and innovate creatively to meet their future needs.

Sounds good, right?

The final word

We care deeply about efficiency and the automation that makes it happen. It frees up human time to innovate and adds infinite value for customers.

Make no mistake, we’re not perfect – we’ve still got plenty of distance to cover on our journey to build the new and more efficient investment infrastructure of the future.

And we know we can’t do it alone. It requires an entire community of forward-thinking innovators, working together in partnership. So, if this is something that interests you, too, then get in touch – we’d love to hear from you.

Onwards!