The so-called ‘advice gap’ is something we talk about a lot here at Seccl. Unfortunately, when it comes to their money, not enough people are able to get the qualified help they need.

And, what’s more, it’s those who most need help who are least able to afford it. Many advisers – as many as 84%, in fact – would turn away prospective clients with less than £100,000 of assets because, to put it bluntly, they’re just not wealthy enough.

This is no reflection on the goodwill and hard work of financial advisers, of course. Instead, it just goes to show quite how inefficient are the many processes, systems and tools that they and their teams are lumbered with.

It’s exactly these inefficiencies that our newest client, DIGI, aims to tackle, in a bid that we can fully get behind: to build ‘modern advice for all.’

An exciting partnership

A venture between existing Seccl client P1 Investment Management and IT firm Nebular Holdings, DIGI aims to provide a full-service adviser support solution – combining a full-service adviser platform, a discretionary fund management (DFM) service, and easy-to-use client management tools.

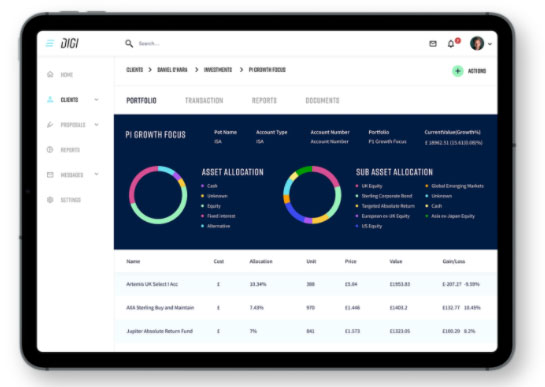

As you might have guessed, the DFM offering will be powered by P1 – who will provide a range of professionally managed investment portfolios through the DIGI platform, which will include hybrid, passive and ethical portfolios.

The platform, again unsurprisingly, will in turn be powered by our own custody, trading and settlement engine; we’ll act not only as custodian, but also provide the portfolio management technology and order execution functionality that advisers will need to serve their clients.

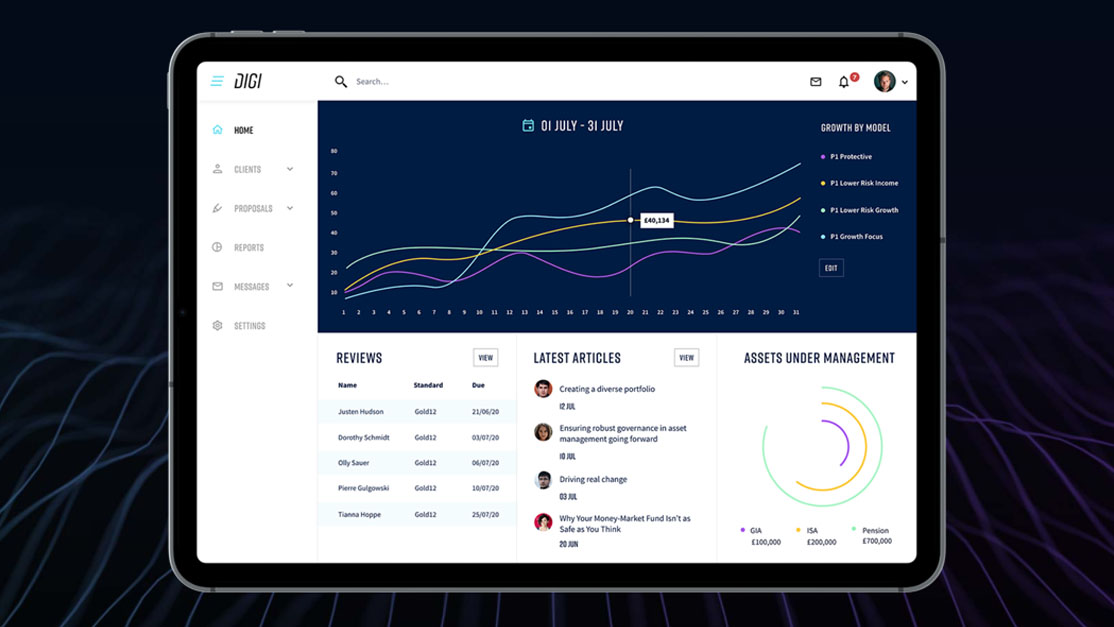

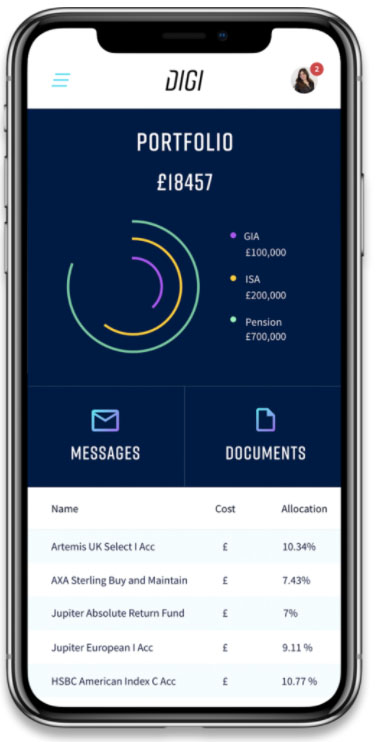

And to bring it all to life, DIGI has developed its own adviser and client portals, allowing each advice firm to ensure a consistent look and feel across all its customer communications.

The team has also created a suite of client-facing reports that can be easily customised to reflect each firm’s unique tone of voice – supported by a series of plug-ins that will allow advisers to compose and merge these reports natively from within Microsoft Office applications.

Throw in integrations with widely used adviser CRMs, and you have a slick, tech-enabled proposition that has the potential to drastically improve the efficiency of day-to-day adviser operations.

The all-in-one solution will be priced at 0.35%, dropping to 0.1% per annum, which includes the cost of the platform, investment management, tax wrappers and technology.

A sign of things to come?

It’s been a real pleasure to work with Paul and the team over the last few months, as they bring their ambitious and innovative service to market at a speed that would have been unthinkable a few years ago.

As Digi’s founder, Paul Hughes, says, “the launch of DIGI marks a significant change in the world of Advice Fulfilment. Utilising Secc’sl APIs, we were able to launch a platform designed exactly to our requirements in a fraction of the time and cost usually associated with such a build.

“We are also pleased to have been instructed by several other firms to help them build their own bespoke platforms – something that is now feasible for any wealth management firm that has the ambition to do so.

“The only limitation going forward will be the imagination of the people designing their investment platform products. It is a truly exciting time, and we love being a part of this changing landscape.”

James Priday, P1’s CEO, agrees. “We too find it very exciting to be enabling firms to launch their own platform products – an activity we think will increase in the marketplace going forward, and which we are well placed to support.

The DIGI product is soft launching through a handful of firms in the first instance, with a wider market launch expected in January 2021. Based on the interest at launch, we’re sure it’ll do well!

To see more of the innovative firms that we work with, check out some of our recent client spotlights.