I don’t know about you, but I’ve found the last year a bit of an emotional rollercoaster. Lockdown 1 (the original and best of the series, in my view) brought with it immediate challenge, but also that unique optimism and camaraderie that only a shared crisis can.

Fast forward a few months and that initial positivity had faded, as reality slowly set in. Since then, my spirits have been up and down like a poundland barometer in British Summer Time.

I was interested, but not surprised, then, to read recently that financial advisers have also come on their own emotional journey – from optimism to concern (probably with a trip to the lands of hysteria and hope along the way).

Research by the team at the lang cat found that while around 9 out of ten advisers were still positive about their ability to serve existing clients remotely, over half admitted to finding it ‘significantly harder’ to acquire new clients during the pandemic – and “were not confident about the long winter months ahead.”

“Over half of advisers aren’t confident about the long winter months ahead.”

And it’s not hard to see why. There’s no mistaking that face-to-face dialogue is more difficult remotely. Video calls are stilted and unsatisfying. Let down by dodgy WiFi and held back by an inability to make proper eye contact, forging a connection is hard.

As the feline researcher in question, Mike Barrett, commented, “technology is quite impersonal and [can’t replace] typical relationship building. It’s tough for clients to build trust with someone they have never met.” Technology, it seems, has filled a gap – but perhaps not left us whole.

I’d agree. But I’d also suggest there’s another way of looking at this. If all we ask of technology is for it to help us do exactly what we were doing before, but online, then I don’t think we’re asking enough.

Technology mustn’t be an afterthought

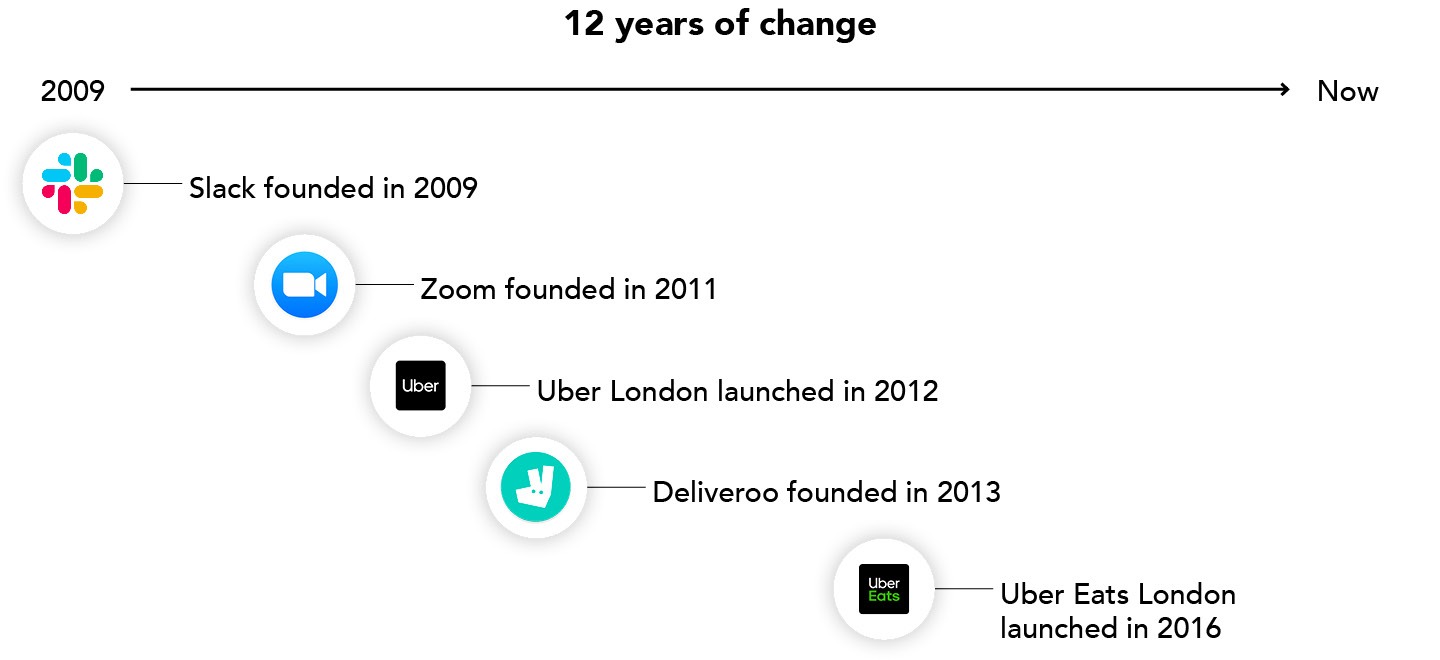

All around us, technology-first companies are transforming the way we live, eat, travel, work and play. They’re doing so not by translating offline experiences into online ones, but by reshaping them entirely.

Traditional verticals are being challenged, as companies that embrace technology are better placed to move horizontally into new markets. Before you know it, your personal driver is delivering your lockdown lunch, and that online shop you once only thought of buying books from suddenly powers much of the cloud infrastructure behind the modern world. Well, that escalated quickly.

Now, I realise this probably sounds a bit esoteric to a financial advice firm that’s thinking of its Q4 new business targets. And I’m not for a minute suggesting that firms New Year’s Resolutions should include hiring a full-stack engineering team.

But I do think that entrepreneurial firms would do well to take stock of their existing technology, data, and how they’re using both – to see if they can’t make improvements that yield transformational results.

Creating a tech-first culture

This isn’t rocket science, of course. When I asked 100-odd advisers about it at a virtual event earlier this summer, a staggering 92% said that lockdown had made them more likely to reconsider their firm’s technology approach.

Financial advisers and wealth managers are naturally entrepreneurial, commercially-driven people – many of them business owners in their own right. And so driving efficiencies and creating new revenue streams will be second nature. But how, practically, can technology help?

Financial advisers and wealth managers are naturally entrepreneurial, commercially-driven people – many of them business owners in their own right.

P1 Investment Management

Well, one of our clients – P1 Investment Management – provides the perfect example. Not content with a siloed set of systems, few of which integrate, they took matters into their own hands.

“Lots of platforms try to be all things to all people, by providing a full spectrum of tools that an adviser might want to use. But they struggle to integrate with the tools they actually use already”, P1’s CEO, James Priday, told us.

“When coupled with the fact that we wanted to control the onboarding journey, it was clear we had to look for a different solution. And that was to create a platform ourselves – one that was built around our needs, and those of the third-party advice firms that we work with.”

P1 now has nearly 20 advice businesses using its newly-developed platform, which serves as an important business line in itself.

What’s more, they also have their own ‘D2C’ proposition alongside their core client work – broadening their acquisition pool and demonstrating that the divide between ‘modern fintech’ and ‘traditional wealth management’ is only what you make it.

Because, really, change is as much about mindset as it is toolset. It’s clear that within P1, ‘digital skills’ aren’t seen as the preserve of developers or engineers (in fact, they don’t have any on the payroll) – but are fostered across all sorts of functions.

This doesn’t mean your planning team needs to learn Python. But they might want to be given the chance to understand broadly how APIs work, or how querying databases using SQL might be just as useful as knowing your way around an Excel pivot table.

Put simply, for entrepreneurial, inventive and forward-thinking businesses, technology offers plenty of opportunities for business growth. Just think – what could it do for you?

If you’d like to know more, our ‘provider cheat sheet’ and ‘Rethinking technology’ webinar could help. Take a look!