Don't let legacy platforms hold you back

Existing platforms are overpriced resellers of outdated technology. Cut them out, take control and offer your clients the excellent digital experience they demand.

Putting planners back in control

We think that those closest to the customer should control the customer experience. It's why we help...

-

Financial advisers

large and small, to future-proof their businesses with a seamless platform experience…

-

Advice consolidators

to create consistency and efficiency across their acquisitions…

-

DFMs or wealth managers

to manage and distribute their investment models – or launch an independent platform of their own…

Clients include

How can we help?

Don’t compromise on client experience

Delivery models are changing. With more and more of the customer journey conducted online, it’s vital that your digital proposition can match the high-quality in-person service your clients have come to expect.

Don’t let your reputation be damaged by the shortcomings of a service you can’t control. Deliver an experience that’s fast, paperless, and doesn’t involve endless back-and-forth with platform admin teams. Choose control over compromise.

See it in action

Build a business fit for tomorrow’s clients

The world has changed beyond measure over the last two decades. But platforms are stuck in a time warp. Systems that don’t connect. Data that’s a mess. Platform upgrades that only lead to a downgrade in service. And repeat.

Don’t damage your business with twenty-year-old tech. Supercharge it with modern software that helps you to boost your efficiency, expand your client bank and flex your proposition to their changing needs. Choose digital over analogue.

See success stories

Lower your costs, improve your service

Platforms are too expensive. Powered by the legacy technology of third-party vendors, propped up with their own costly operations teams and pushed for profit by shareholders, they represent poor value for money.

Don’t put up with oversized platform margins for undersized performance. Remain competitive on price – and strengthen your proposition – with the most transparent and affordably priced platform software and services in the market. Choose low cost over high fees.

See what clients could save

Why Seccl?

Code-free. Admin-light. Cutting-edge.

-

Make your team more efficient

Minimise rekeying by integrating with your favourite back-office (IO, CURO, Xplan), and cut out the back and forth with platform admin teams.

-

Go fully paperless

From T&Cs to transfers, direct debits to drawdown… remove every paper form and wet signature from the the entire investment and advice journey.

-

Launch without a single engineer

Our brandable professional and client portals mean you can launch a platform of your own without any in-house technology team. A totally code-free solution.

-

Work with subject matter experts

No platform experience? No problem. We’ll provide expert technical support to help you get to market fast, then pair you with a dedicated account manager to help you scale.

-

You focus on clients, we’ll sort client money

We’ll take care of CASS and handle the client money obligations, while our investment operations team will do the heavy lifting for you. No need for a big new admin team.

-

Access leading functionality

Fully digital pension. Transparent view of client transfers. Instant payments that are sent to market in under 10 seconds. XO and advised clients on a single platform. And more to come – fast.

Who's it for?

No firm is too small to benefit

Assets certainly aren’t everything. But as a rough proxy, if your firm currently manages – or has aspirations to manage – £250 million (or more) of client assets, there’s a potentially strong commercial case for you to take more ownership of the platform experience.

That's because our efficient technology minimises the need for manual processing, while we do the heavy lifting when it comes to custody and client money. Our dedicated customer support team will also give you hands on support to help you launch and grow.

It would have been unachievable for a firm of our size to have our own platform three or four years ago. Seccl has made it possible.

Even if you’ve decided that it’s not right for you, there’s no reason not to explore one of the affordable, paperless adviser platforms that we power…allowing your clients to reap the benefits of a low-cost, high-tech platform without any additional effort or responsibility on your part.

Getting started

From first look to full launch in just a few months

Prep and permissions

After a series of demos (check out our intros here) and the usual DD, we’ll guide you through the process for obtaining new permissions (if you need any).

Deep-dive workshop

An intensive, full-day kick-off workshop to fully understand and document your needs, culminating in a full plan detailing the nature and scope of your integration.

Fee-free integration

As well as guiding you through your technical integration, we’ll offer you support on your regulatory, compliance and legal tasks, too. All at zero cost.

Launch

We work with you to onboard your first new assets, and migrate any existing books across to your new platform.

We launched and migrated one client’s book as little as four months after our first conversation. Can you beat them?

Get startedWorking together

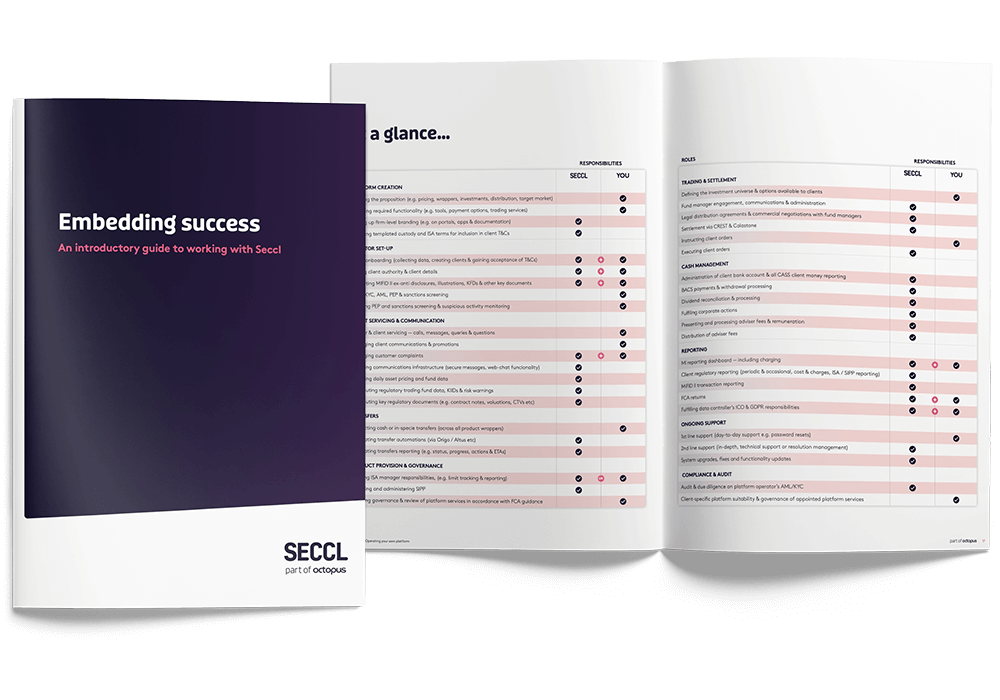

A guide to working with Seccl

To find out more about the ins and outs of what’s involved – and, in particular, who’s responsible for what – take a read of our introductory guide to working with Seccl.

Ready to begin?

Get started with Seccl today

-

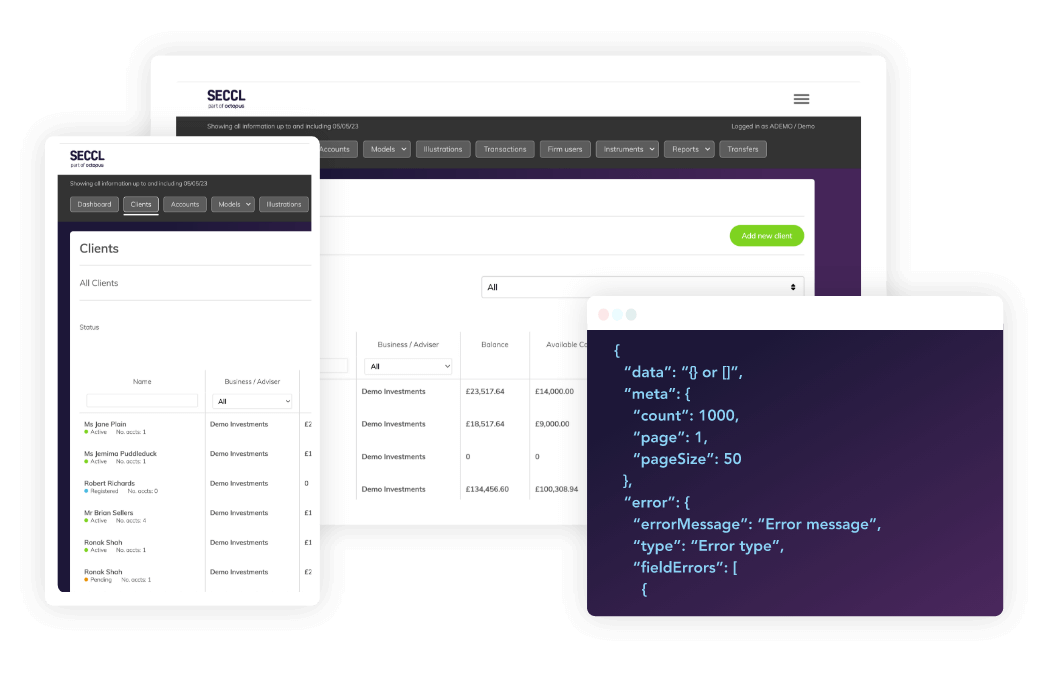

Get a demo

See introductory walk-throughs of our portals or our API, or arrange your own.

Take a look -

Get a quote

Use our simple pricing calculator to get an idea of the costs involved.

Give it a try -

Get in touch

Book a call to find out more and see how we can help your business, fast.

Drop us a line