In this document…

We’ll explore the challenges of the adviser-platform relationship, reveal the key findings of our research and pose some alternatives for a future relationship.

We’d all like to think that the relationship between advisers and their platforms would be harmonious. But is it?

Are platforms providing the slick and efficient experience that advisers crave? Is their service responsive and meeting expectations? We’re here to find out. We’ve conducted research with advisers to explore the nature of this all-important relationship. And if you hadn’t already guessed from the title, our findings suggest that there’s certainly room for improvement…

If you’re interested in what the future of the adviser-platform relationship could look like, this paper’s for you.

Introduction: advisers and platforms… a match made in heaven?

Over the last few decades, platforms have become one of the most important tools in a financial adviser’s growing armoury…

To put in perspective how vitally important they are, just think about how many other tools command such frequent and in-depth usage. In fact, Larry Page, the founder of Google, coined a neat mental shortcut for assessing the value of a service (and its worthiness of their acquisition…).

In what he calls the ‘toothbrush test’, he asks whether the service is ‘something you will use once or twice a day’ – the idea being that, if it is, then it’s fairly embedded within our daily habits and course of everyday life. Well, by that measure, it’s fair to say that adviser platforms are strongly embedded within the everyday life of the UK advice firm.

Platforms are fundamental to ‘business as usual’, playing a crucial role in the management of client portfolios. They allow fast and affordable access to a nearly total range of investment options, and empower advisers to build sophisticated, holistic financial plans that would otherwise be too costly and cumbersome to implement.

94% of advisers place 50% or more of their new business on a platform, while as many as 20% choose not to place any client assets off-platform at all… (Defaqto)

To put this into numbers, 94% of advisers place 50% or more of their new business on a platform, while as many as 20% choose not to place any client assets off-platform at all1. And for that vast majority of firms who rely on them for the bulk of their clients’ portfolios, it’s probably fair to say that platforms will be used all day, every day, in one way or another, by any combination of administrators, operations staff, paraplanners or indeed advisers themselves.

Testing the relationship

While platforms fulfil a vital role in the running of a modern advice business, are advisers satisfied?

The relationship between advisers and platforms, then, is a centrally important one. But is it a happy one?

While platforms fulfil a vital role in the running of a modern advice business, are advisers satisfied? How responsive do they feel that platforms are to their needs – and how attuned are they to the issues that they face?

And, perhaps most importantly of all, how likely are they to carry on with the platforms they use, or ‘break up’ in search of another more worthy match?

These are just some of the questions we posed to around 250 financial advisers and their teams in January 2022, as we tried to gauge the health of this most important relationship, and see if there really is trouble in paradise.

The results show a complicated relationship. While respondents were united in their belief that their platforms help them to deliver great service to their clients, and that their providers are typically responsive to their needs, signs of frustration are clear to see.

In particular, the findings point towards a ‘honeymoon period’ in which platforms impress with great initial customer service, only for it to deteriorate over time as the realities of an ongoing relationship emerge – and the desire to switch seems to grow.

Let’s dive a little deeper…

Our methodology

In conjunction with research agency Opinion Matters, we surveyed 250 UK-based employees who use an investment platform as part of their role within financial advice companies or discretionary fund management companies.

We sampled companies that use a platform provider to manage their client’s investments, but who don’t run their own platform using a third party custodian and/or technology provider – with at least 50% of the sample from companies with funds of more than £100 million under management.

Research was conducted between 11th and 17th January 2022. Opinion Matters abides by and employs members of the Market Research Society which is based on the ESOMAR principles.

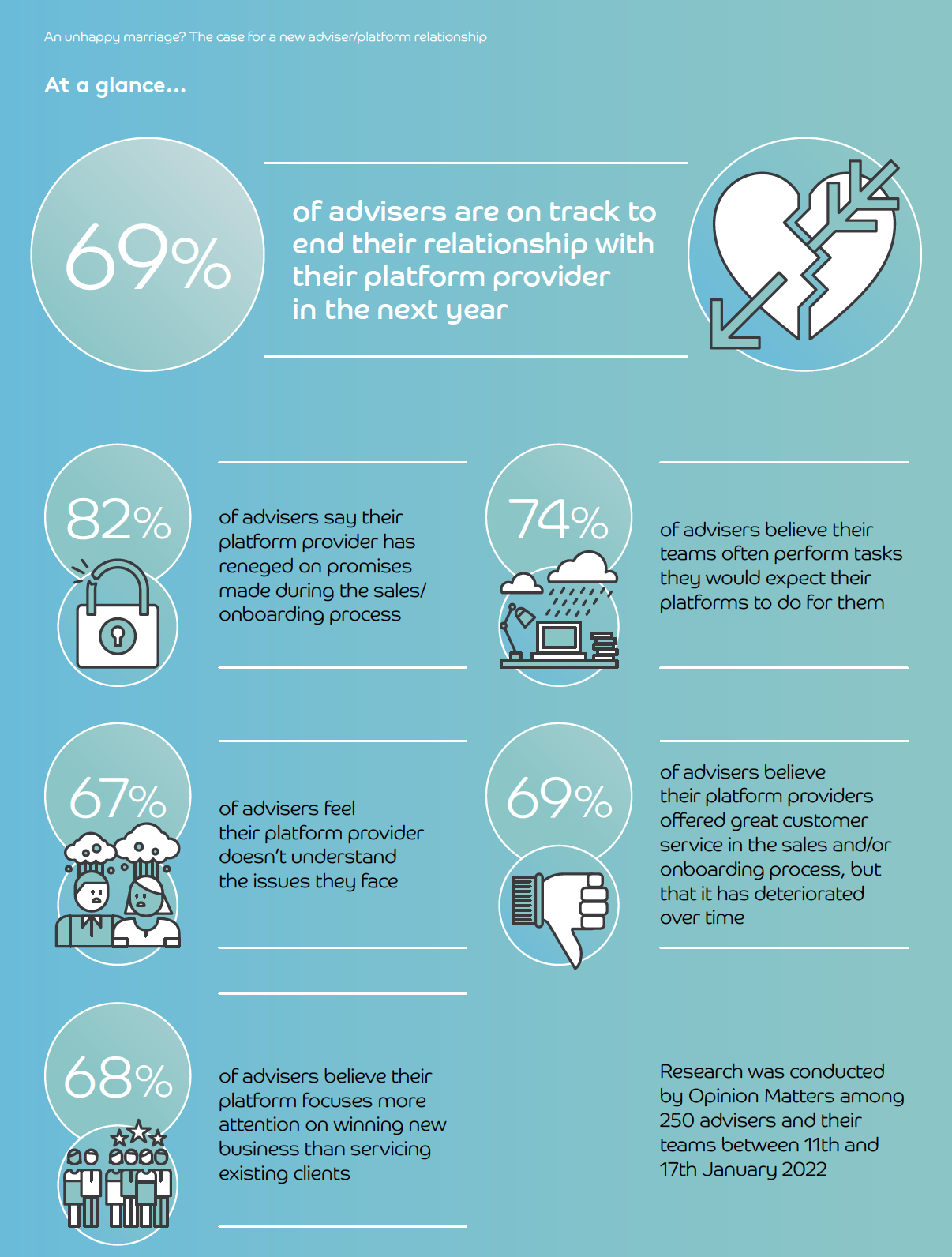

At a glance

A closer look: the key findings…

Most advisers find value in their platforms…

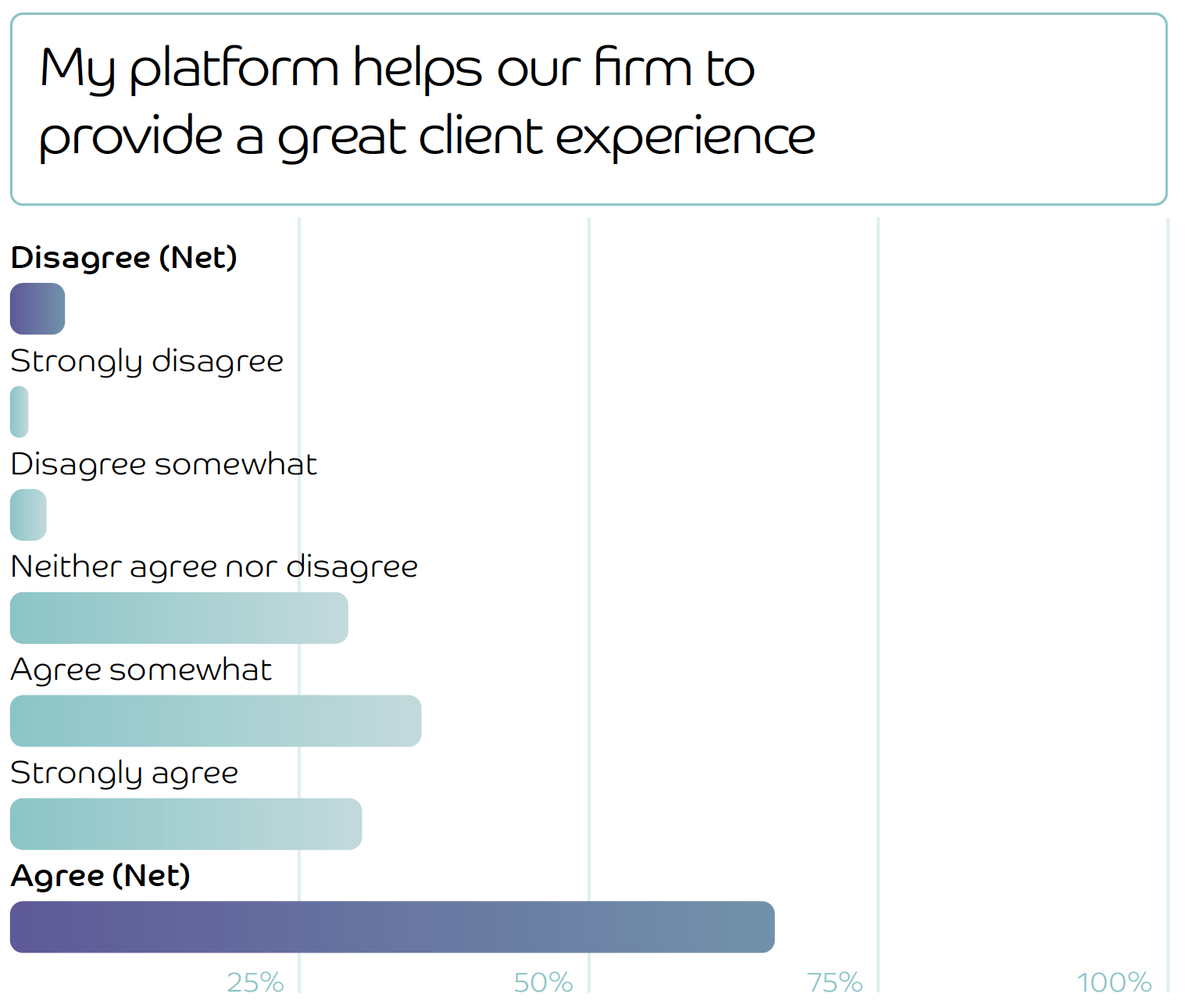

Let’s start with the positives. First of all, two thirds of respondents (66%) agree that their platforms help their firm to provide a great customer experience – with around 30.4% agreeing strongly, and another 35.6% agreeing somewhat. Only 4.8% disagree.

On one level this isn’t surprising. It speaks to the central importance of platforms in allowing advisers and their teams to build, execute and maintain financial plans on behalf of their clients. By the same token, however, it seems noteworthy that nearly a third of respondents (29.2%) remain ambivalent, given precisely how vital their role is.

Service is responsive - but let down by technology…

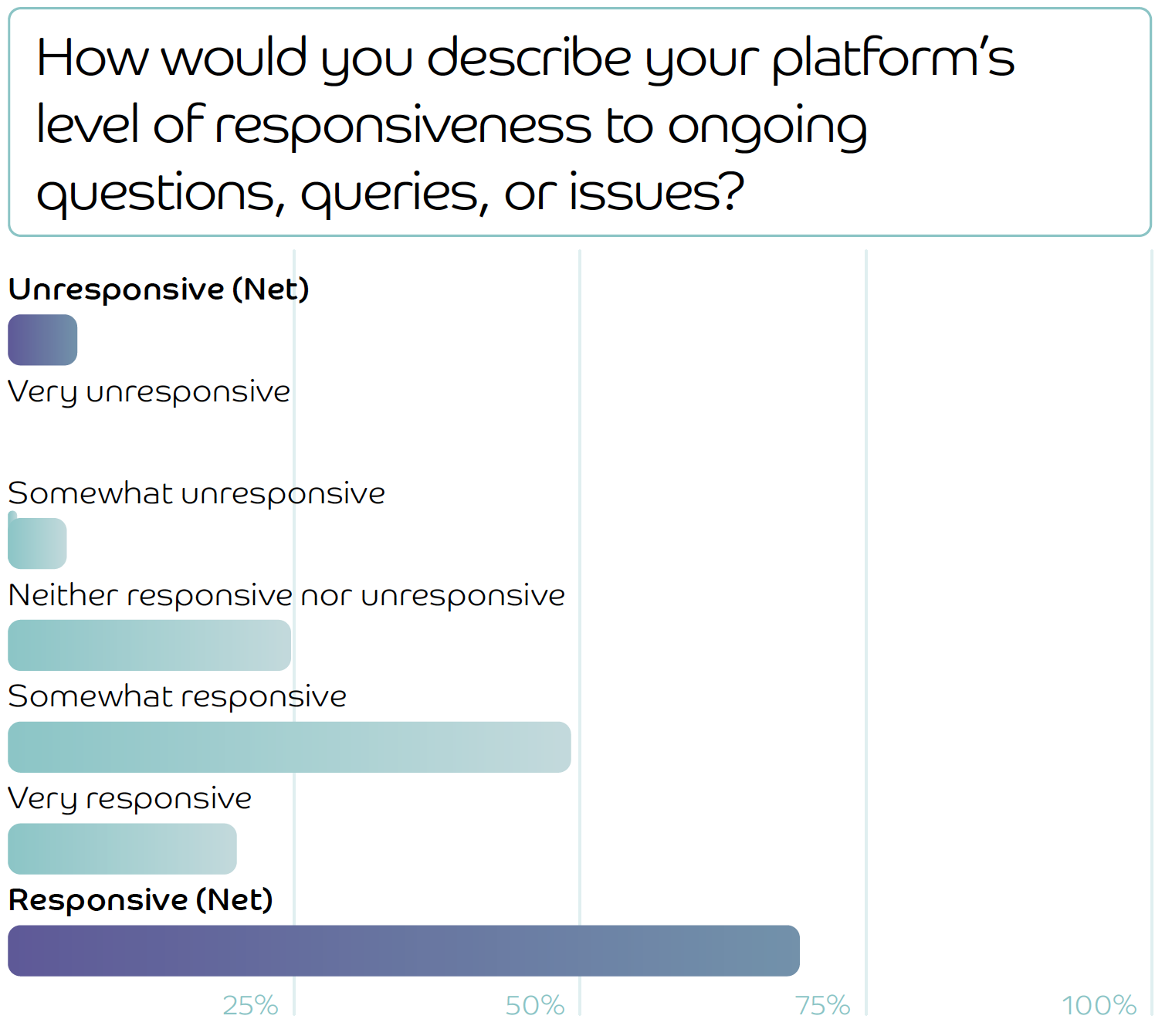

As well as proving helpful to firms in their delivery of a great client experience, it’s also clear from our survey that most firms think the support they receive from their platform is timely.

Only 6% of respondents would describe their platform as either somewhat or very unresponsive to ongoing questions, queries or issues, while as many as 69.2% would characterise them as either very or somewhat responsive.

At the same time, however, it’s worth noting that an overwhelming majority of those surveyed complain that their staff has to do more of the administrative heavy lifting than they would like.

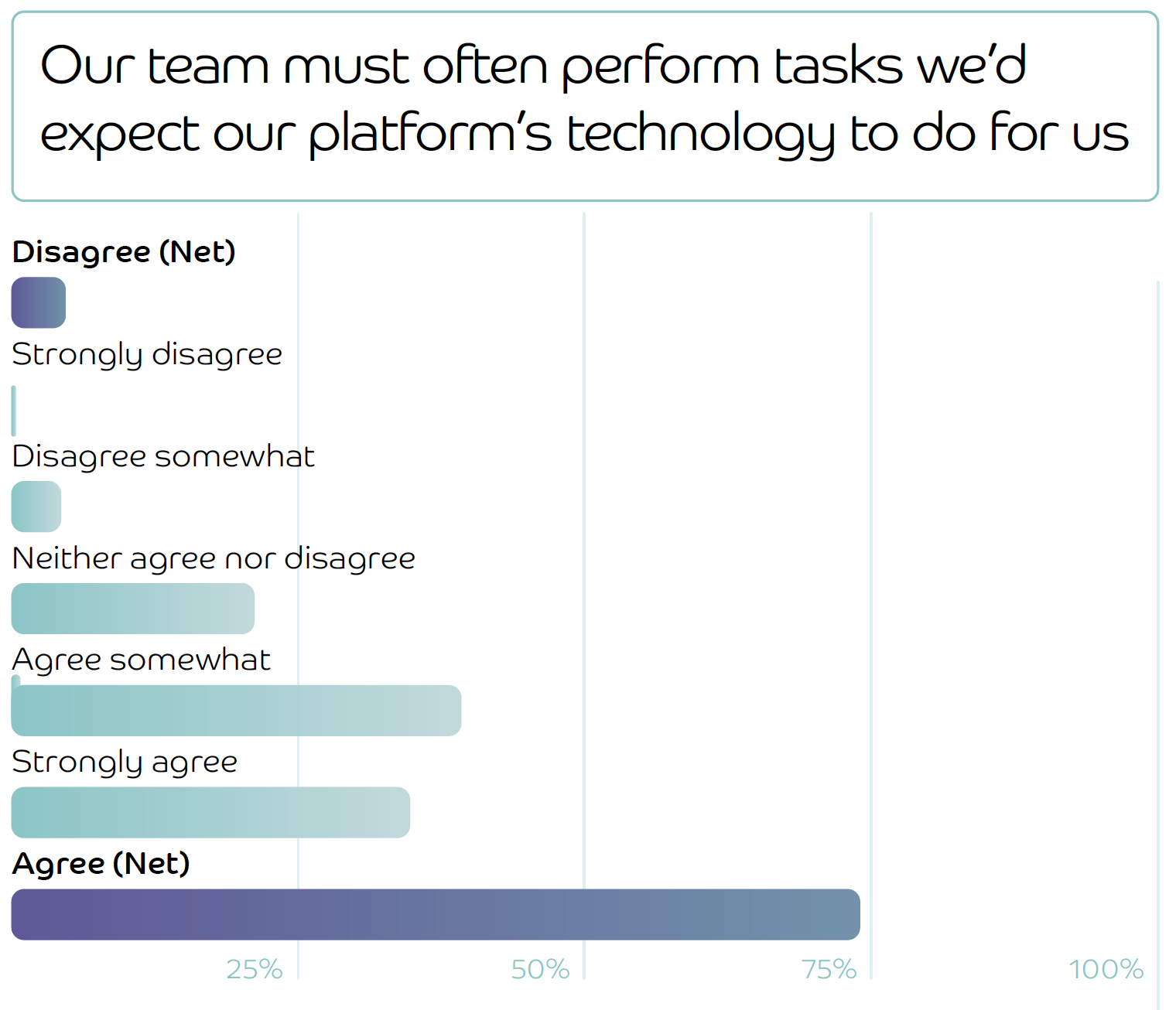

Nearly three quarters (74%) of respondents agreed that they must often perform tasks that they would expect their platform’s technology to do for them – with an overwhelming 34.8% strongly agreeing.

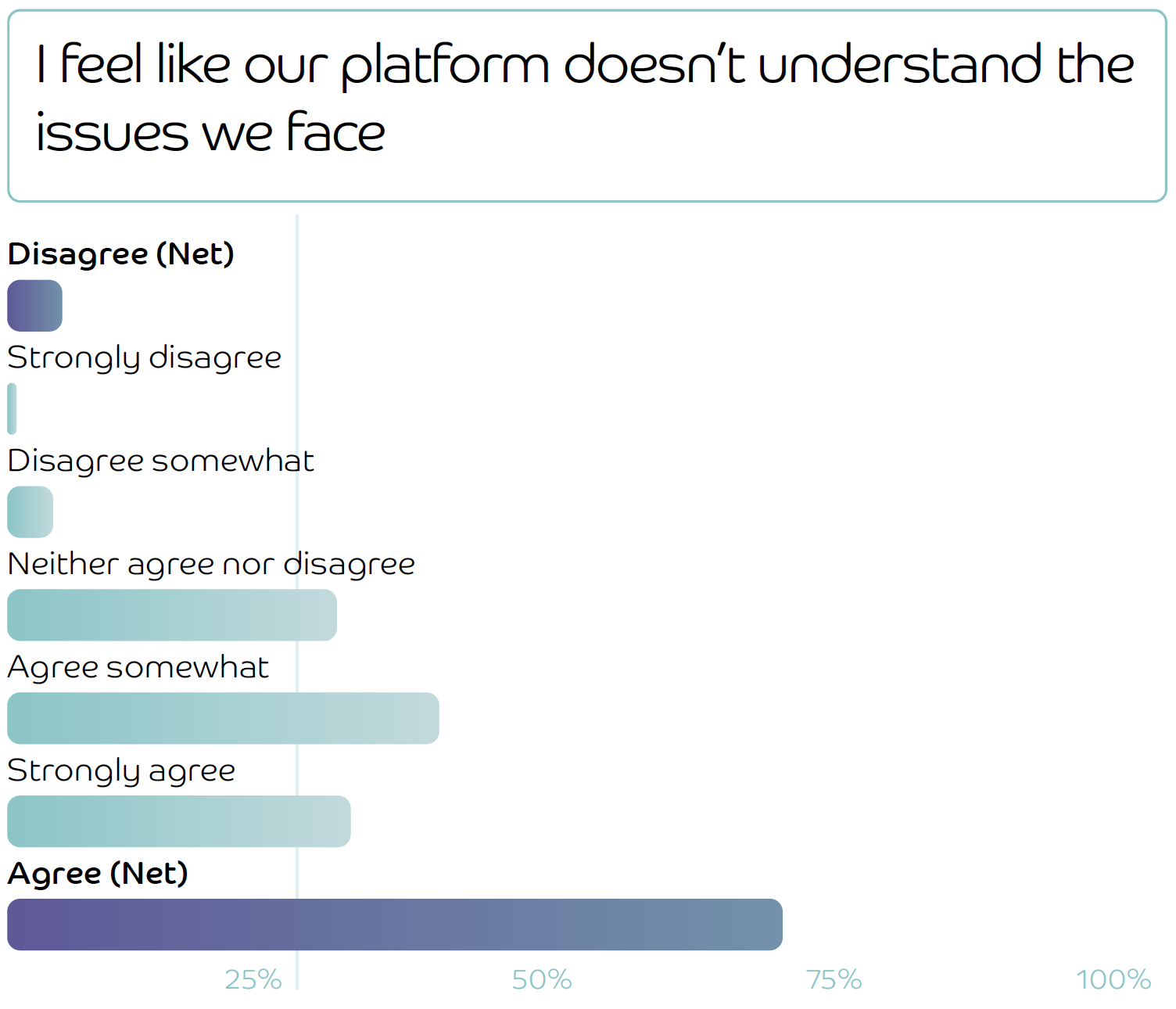

Meanwhile, just under 7 in 10 advisers and their teams (66.8%) agree that their platform provider doesn’t understand the issues that they face.

This brings to mind an all-too-familiar picture of a relationship built on well-meaning, highly qualified and committed platform support staff, but let down by insufficient technology, creating gaps that advisers have to fill.

In other words, firms end up throwing people at problems – which is never a sustainable solution for a business that wants to scale. It also brings a lot of resentment into the mix, adding to the work of already busy teams who want to do their best for their clients, but are constantly let down by their tech.

74% of respondents agreed that they must often perform tasks that they would expect their platform’s technology to do for them

There’s a ‘honeymoon period’ for platforms, too…

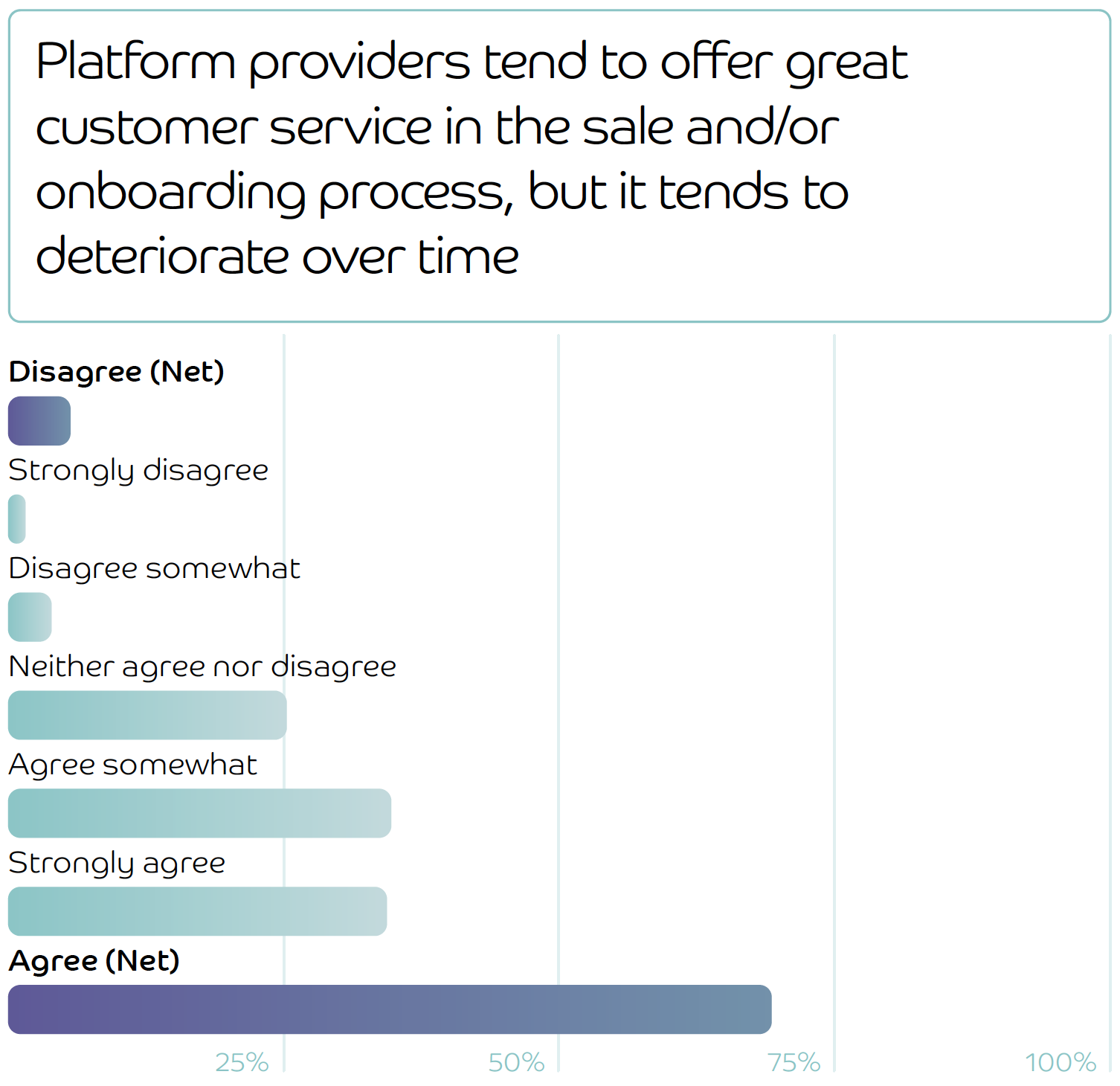

Almost 70%2 of those surveyed agreed that while platform providers offered great customer service in the beginning, that level of support tended to diminish over time – suggesting that the ‘honeymoon period’ is just as real for advisers and their platforms as it is all other relationships…

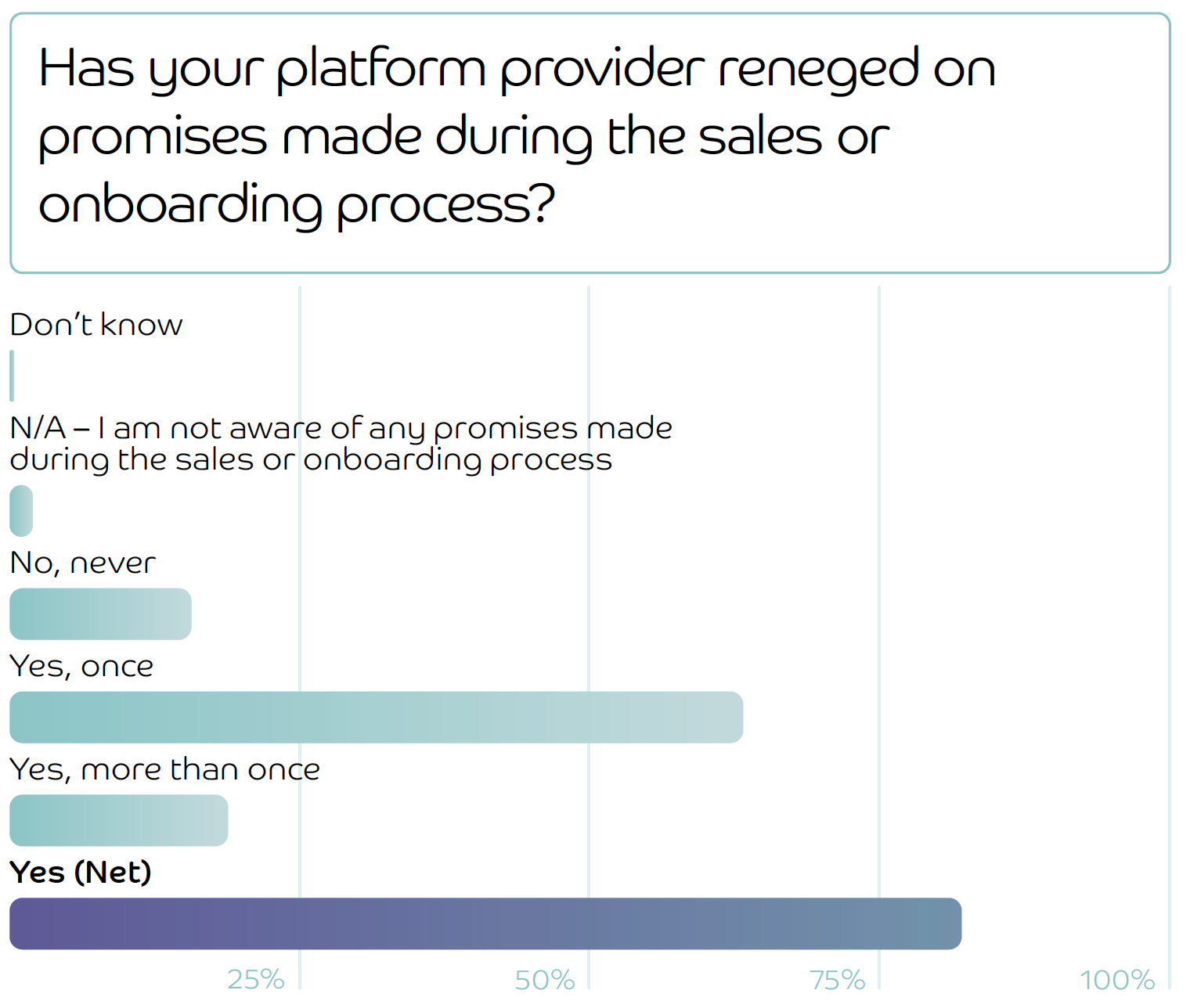

By the same token, it also seems that the vast majority of platform providers have reneged on promises made to their clients during the sales or onboarding process – 82% to be exact.

In all walks of life, it’s difficult to build a relationship without trust, and yet it seems like the majority of platforms seem to be getting theirs off on the wrong foot by backtracking on promises made at the outset.

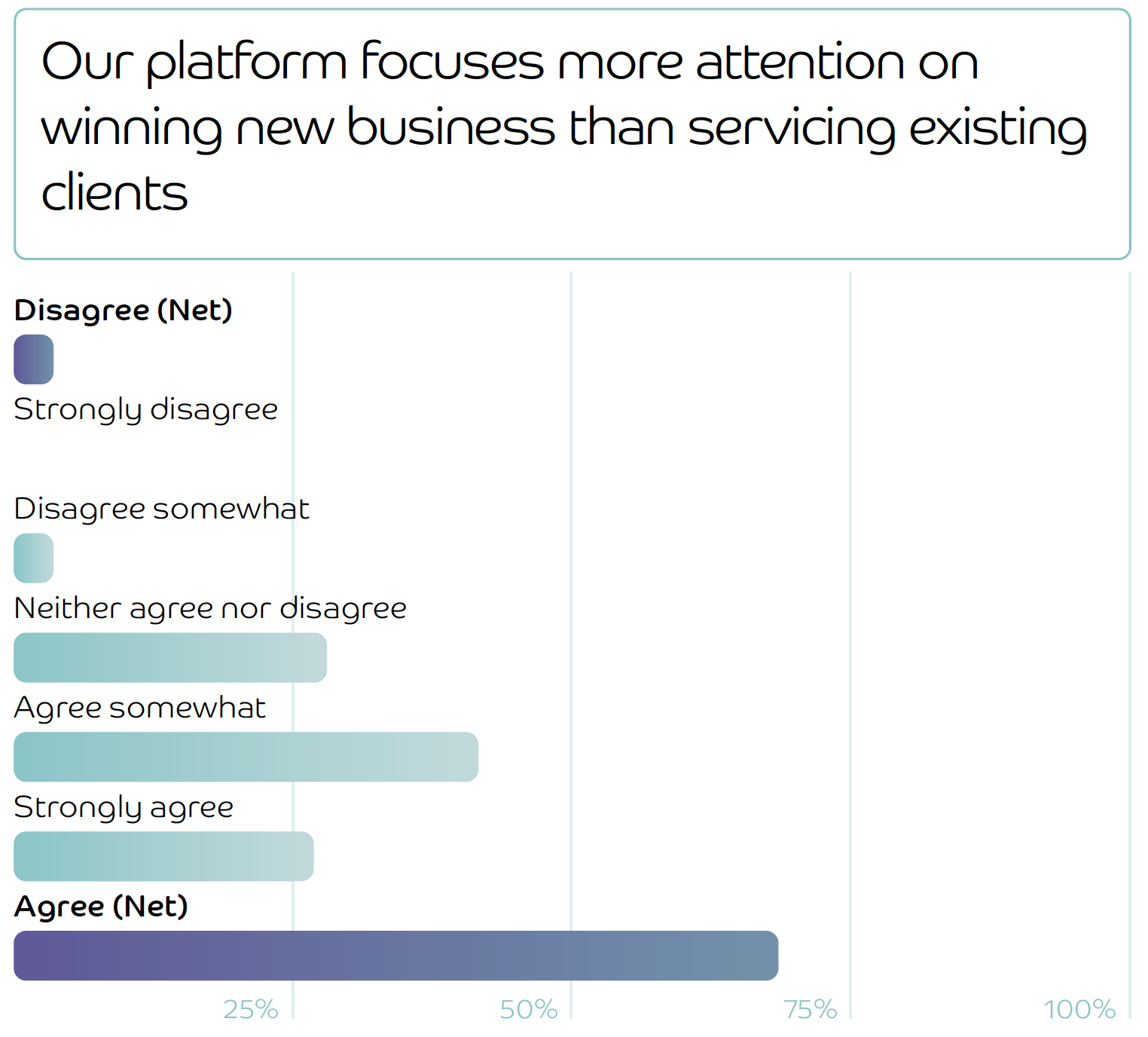

Here’s the kicker. Almost 70% of respondents thought their platform providers focused more on winning new business than servicing existing clients, which perhaps pulls all the other statistics into focus – if platform providers are spending more of their attention and resources on new clients rather than nurturing the ones they already have relationships with, is it any wonder that so many firms feel like they’re having to pick up some of the slack to meet their fundamental needs?

Many firms look set to switch

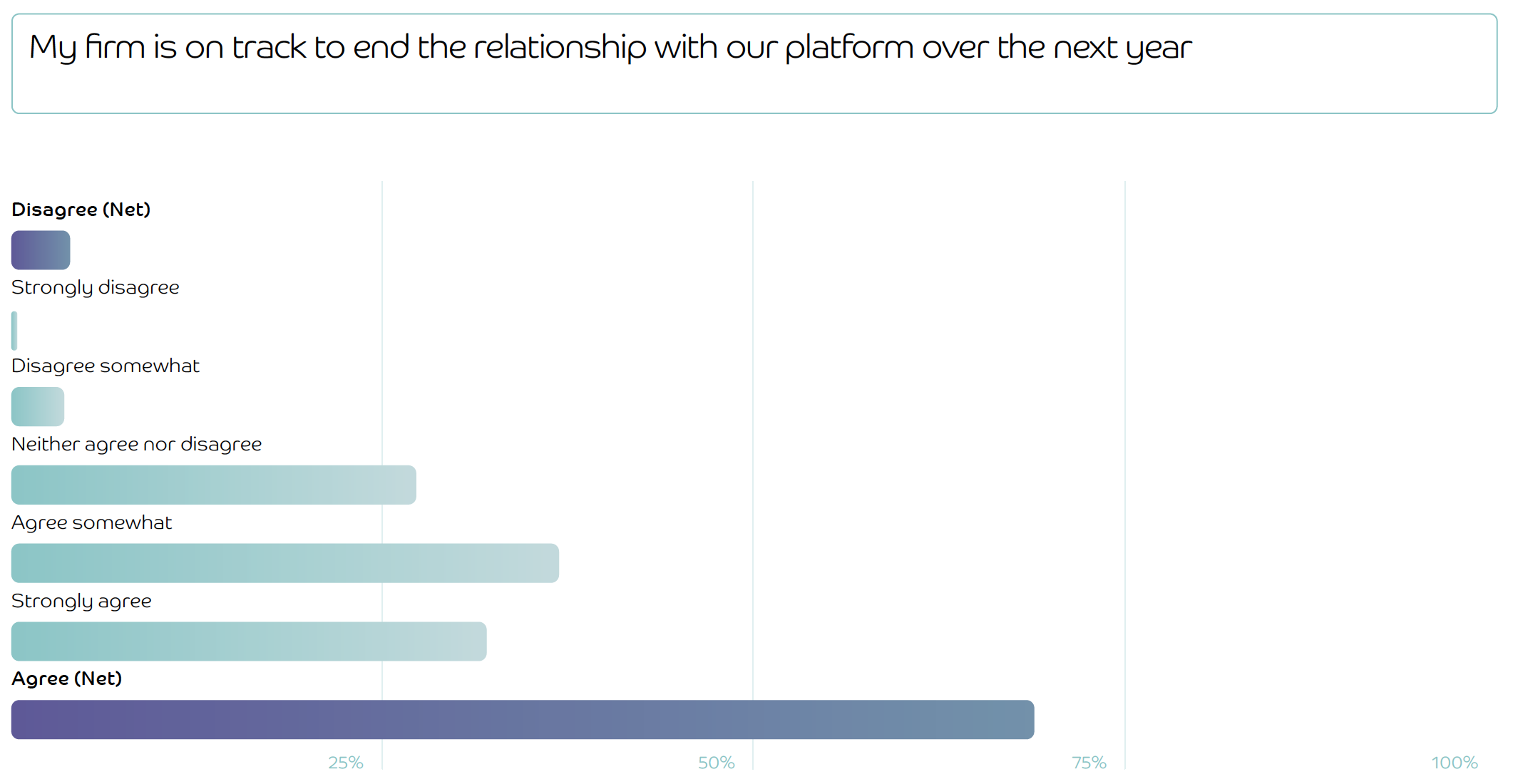

Perhaps the most interesting and significant trend to emerge from our survey is the propensity of firms to switch platform provider over the coming year.

As many as 68.8% of firms agreed that they are on track to end their relationship with their platform – a huge proportion suggestive of growing discontent that’s rapidly bubbling to the surface.

Now, of course, whether this relates to their primary platform or merely one of the stable of platform options used by a firm (Defaqto research shows that on average firms use a total of 2.8 different platforms, with 1.4 preferred providers)3 remains unknown.

Whatever the case, however, the finding would suggest that we’re about to witness significant platform movement – which might involve either switching to another third-party platform, or perhaps even to move to an in-house model that our separate research shows is growing in awareness and popularity (more on this in the next chapter).

68.8% of firms agreed that they are on track to end their relationship with their platform

Towards a new relationship

As our survey demonstrates, there are many reasons why a firm may not be totally happy with their current platform providers – but one systematic problem seems clear for all to see: technology.

Put simply, the speed of technological advancement that we’ve seen in other industries hasn’t yet been reflected in the platform experience of advisers and their teams.

Many of today’s platforms are powered by outdated technology stacks, each built on a separate code base that is maintained typically by a small number of technology providers – creating a complex and ever-expanding web of technology that these providers have to audit and improve, meaning that change is slow and costly to implement.

As a result, much of the overall advice and investment journey is still patched together by huge amounts of administration and manual effort.

Adviser teams have to rekey client data between systems, payments aren’t automated, and fund transactions often involve a range of time-consuming tasks – to name a few examples – all of which costs time and money, and damages client relationships.

Much of the overall advice and investment journey is still patched together by huge amounts of administration and manual effort.

New beginning: how APIs can break the deadlock

The transformative change that we’ve seen in other areas of our lives – think Uber, Deliveroo, online banking platforms and the endless stream of new and innovative apps for just about everything – has emerged thanks to the magic of APIs. An API (Application Programming Interface) is essentially a bit of code that allows one set of software to easily talk to another.

To illustrate the point, let’s take an example from another sector entirely. A taxi app might use APIs to plug straight into Google Maps to track your location, for example – saving them the costly and time-intensive task of having to build new geo-location infrastructure from scratch. That same app can also plumb into an existing payment provider to take your fare at the end of the trip.

So, what does this mean for advisers and their relationships with platforms? Well, investment infrastructure that’s built in a modular, API-first way makes for easier automation, integration and continuous improvement.

Cloud-hosted API systems are already starting to improve the platform experience and make it more affordable by streamlining processes with automated, easy-to-maintain software. In turn, the cost reductions throughout the journey are rapidly lowering the barriers to entry for firms looking to get closer to controlling and improving the overall digital experience offered by their platform…

Taking control of the platform relationship

Getting closer to the platform experience is an exciting concept that brings with it endless new opportunities for operational efficiency and customer service improvements. But ‘taking control’ will mean different things for different firms.

For some, taking control might mean ‘white labelling’ an existing platform. This term is often used without definition and can infer a whole host of vastly different operating models.

‘White labelling’ may be as simple and uninvolved as distributing it under your brand. Put your logo on the client portals, choose your colours to match your own identity and away you go. This is something most mainstream platforms let you do easily enough – and it may be just what you’re after.

Some ‘white labelling’ offers further opportunities to gain control beyond cosmetics. These platforms will also let you influence the pricing or change some of the client terms.

A white label platform will never let you change the legal basis of the underlying platform relationship, though, so the client relationship will be fully on their terms. This means that if your platform provider decides to make a major change to the terms of their offering (for example, pricing), you’ll have no control over their decision and will be on the hook to explain it to your customers.

For those who want to take fuller control of the overall platform experience, they might consider ditching a third-party platform altogether.

Instead, they could consider redeploying their existing support team (who will probably spend much of their time already liaising with third-party platform staff) to administering a platform of their own; one that’s fully paperless, friction-free and built on cutting-edge technology.

This option can provide firms with the opportunity not only to control the customer experience, but to fully own the customer relationship too – removing the separate legal relationship to their old platform and replacing it with their own.

But it also brings with it new roles and governance responsibilities, too – and might require a firm to obtain new or varied permissions. It’s not for every firm; but for those who want to take full control of their destiny, it’s certainly worth exploring.

Operating a platform allows firms not only to control the customer experience, but to fully own the customer relationship too

Case study | IronBright: taking control, with a paperless platform of their own

IronBright was founded in 2017 by the team at Bristol-based financial planning firm Brunel Capital Partners, to provide a more integrated, easy-to-understand and affordable advice and investment proposition.

As CEO Damien Rylett explains, “we just weren’t happy with existing DFM options out there. We wanted a simple, transparent and low-cost solution, that provided the financial planners at Brunel with more control and oversight of where their clients’ funds were going.”

But the team didn’t stop there. While connecting the delivery of advice and investments had allowed both IronBright and Brunel to provide their clients with an improved service, one key bugbear remained: the platform technology that underpinned the two.

So, what were the must-haves for their brand-new platform? Well, a fully digital experience, for one. “We wanted to get to a point where there weren’t any forms to fill out – a client just clicks a button to accept terms and conditions and then they’re loaded onto the platform.”

Seccl’s technology makes it possible. As well as acting as custodian and ISA manager, we provide IronBright with the investment technology and intuitive, fully branded client portals that allow for a fully digital experience.

Meanwhile, our open-API construction allows the platform to connect with third-party systems and tools more easily; advisers at Brunel and Pilgrim can already make use of an Intelligent Office integration, for example. It all adds up to a seamless platform experience for advisers and clients alike. As Damien puts it, “we’re really proud to have launched a platform with no paperwork to complete. The clients love it.”

“Our experience goes to show that you no longer have to be a large national network to take ownership of these areas – and I’d strongly encourage it to other ambitious firms looking to future-proof their operation. I’m not saying it’s easy, but something worth doing generally isn’t.”

“After setting up our own DFM, it seemed like the next logical step to launch our very own platform, too – allowing us to own and improve another key part of the overall client journey.”

Damien Rylett

CEO of IronBright

Case study | P1 Platform: improving service through cutting-edge technology

Operating a platform may not be right for your firm at the moment. But what if you still want to enjoy the benefits of a next-generation platform – one that’s affordable, fully paperless and easy to use?

Well, switching to a Seccl-powered platform could be the perfect option if you want to improve your current offering but aren’t quite ready to operate a platform of you own.

Take the P1 Platform, for example. It capped off 2021 by topping the lang cat’s Platform Analyser Rating for the fourth quarter in a row.

The team also scooped a win at 2021’s UK Platform Awards for best use of platform technology– testament to their winning combination of fantastic customer service, supported by efficient, cutting-edge technology.

P1 was spun out of an advisory firm about five years ago as a low-cost, efficient investment management firm.

Its original plan was to offer its model portfolio and bespoke portfolio services through third-party platforms. However, they decided they wanted to start a platform of their own so people could come to them directly rather than using a third-party, and so they could have complete control over the client experience.

P1 is now a multi-award-winning investment manager and a platform operator actively distributing its technology to advice firms around the country.

James Priday, CEO of P1 Investment Management stated, “It’s a lot of work, but you become master of your own destiny. For me, it’s all about being able to design and react to things quickly, rather than relying on other people or a third-party platform to do things we would actually like to do ourselves."

“All this would have been unachievable for a firm of our size three or four years ago," he continued. "Thanks to the operational efficiencies and digital processes that Seccl allows, we can operate our own platform without significant headcount – all while providing a better service than existing platforms.”

“All this would have been unachievable for a firm of our size three or four years ago."

James Priday

CEO of P1 Investment Management

Want to know more?

See how Seccl can help

At Seccl, we’re on a mission to rebuild the infrastructure of investments and advice. We provide firms of all sizes with affordable custody, trading and settlement services, feature-rich investment management technology, and a suite of paperless adviser and client portals.

Financial advisers and investment managers can combine these modules to operate their own platform – helping them to take control of their client relationships, improve their customer experience and own more of the value chain.

Elsewhere, technology-first businesses from all sectors can use our publicly documented APIs to get plug-and-play access to the financial markets – helping them to launch new investment propositions more quickly and affordably than ever before.

To find out more about how we’re helping firms of all sizes to take control of their destiny – and powering the innovative investment platforms of the future – head to seccl.tech.

References:

1 Defaqto, ‘Platform service review 2021’ (March 2021)

2 69.2% respondents strongly or somewhat agree with the following statement: ‘Platform providers tend to offer great customer service in the sale and/or onboarding process, but it tends to deteriorate over time’

3 Defaqto, ‘Platform service review 2021’ (March 2021)