Wondering how to take a great idea and make it real? This guide’s for you…

About this guide

So, you’ve got your sights set on a new investment or advice fintech. Exciting!

Perhaps you’re creating a platform that makes it easier for people to invest in the areas or causes that they care about.

Maybe you’re hoping to bring investments, pensions or financial advice to a new or once hard-to-reach area of the market.

Or it could be you’re just looking to build a cheaper, more efficient and easier-to-use version of the many investment platforms that have proven so popular over the last few years.

You might have the beginnings of a fantastic team – or maybe just a group of talented co-founders to help get things underway.

And you’ll probably have some funding in the bank – whether that’s pre-seed venture or hard-earned savings from a previous life.

But what next? How do you take a great idea – one you’re convinced will shake up the industry for the better – and make it real? How do you launch a successful, scalable fintech in this corner of the market?

If these are questions you’ve asked yourself, or others, then this is the guide for you.

Any questions or feedback? Let us know.

Otherwise: good luck!

Mary Agbesanwa

Fintech Growth Lead, Seccl

A bit about Seccl - who are we?

We’re a custodian and investment technology company that powers firms at the cutting edge of financial advice and wealthtech.

We help ambitious fintechs to launch new investment propositions more quickly and easily than ever before, by building directly onto our affordable and scalable investment API.

After launching to the market in 2018, just a year later in 2019 we were acquired by the £10 billion Octopus Group, home to award-winning companies including Octopus Energy and Octopus Ventures.

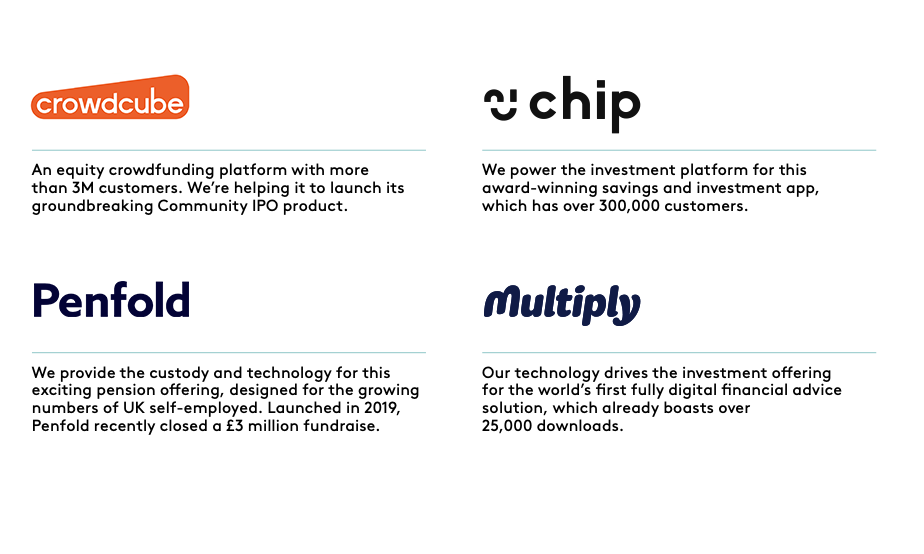

We’re already powering some of the most innovative and fast-growing firms around today, including…

What’s in store

Thanks to developments in technology, it’s easier than ever to start and fund a new business. But there’s a lot to think about – in this market especially.

For example, while you might have your basic value proposition down, you may have given less thought to the finer details of your investment proposition – or what it means for you commercially, operationally and technically.

Similarly, you might need a helping hand thinking about which elements of your solution you should buy, and which you should build. And to build anything at all, you’ll need to hire a team of high-performing engineers and product managers, and create a team structure that can get the best out of both.

Then there’s the smaller matter of operating within a highly regulated environment, with all the trappings of initial authorisation and ongoing compliance that go along with it.

Over the course of the next few chapters, we’ll try to break down some of these areas in turn, identifying some of the key questions you’ll need to ask – and directing you towards some potential answers where we can.

Now, of course, it’s far from exhaustive: no short guide to launching a business could ever be. But we hope it’s helpful at flushing out some of the main areas you’ll want to be thinking about.

Permission to launch

What regulatory permissions will I need – and how do I get them?

When it comes to launching a new investment fintech, it’s not enough to simply build your product and start marketing it.

The financial services sector is one of the most heavily regulated around (and with good reason). Before you can even think about getting your service in the hands of your users, you’ll need to ensure your business is built on the right regulatory foundations – and, in

particular, has the necessary permissions from the Financial Conduct Authority (FCA).

Getting your house in order

The FCA defines an investment platform as “a service which:

- Involves arranging and safeguarding and administering investments; and

- Distributes retail investment products which are offered to retail clients by more than one product provider; but is neither:

- Solely paid for by adviser charges; nor

- Ancillary to the activity of managing investments for the retail client.”

So, while you might not think of yourself as one – you might, for example, be designing a pension vehicle, or only offering investments as an ancillary part of your core service – the simple fact is that if you want to allow people to invest, you’ll need the appropriate permissions to do so.

So what are they? Every firm will be a little different, but you’ll likely need all of the following permissions:

- Arranging (bringing about) deals in investments: i.e. making arrangements to buy, sell subscribe or underwrite investments

- Arranging safeguarding and administration of assets: i.e. arranging for one or more other firm to safeguard and administer client money and assets on behalf of your clients

- Dealing in investments as an agent: i.e. instructing the buying and selling of investments on behalf of your clients

- Making arrangements with a view to transactions in investments: i.e. allowing your clients to enter into transactions

- Permission to control client money: i.e. holding bank account, credit card and/or debit card details, including the ability to take Direct Debits

The exact permissions required will be dependent on your business model and the extent to which you choose to outsource services, as opposed to appointing a third party provider.

How do you get these permissions?

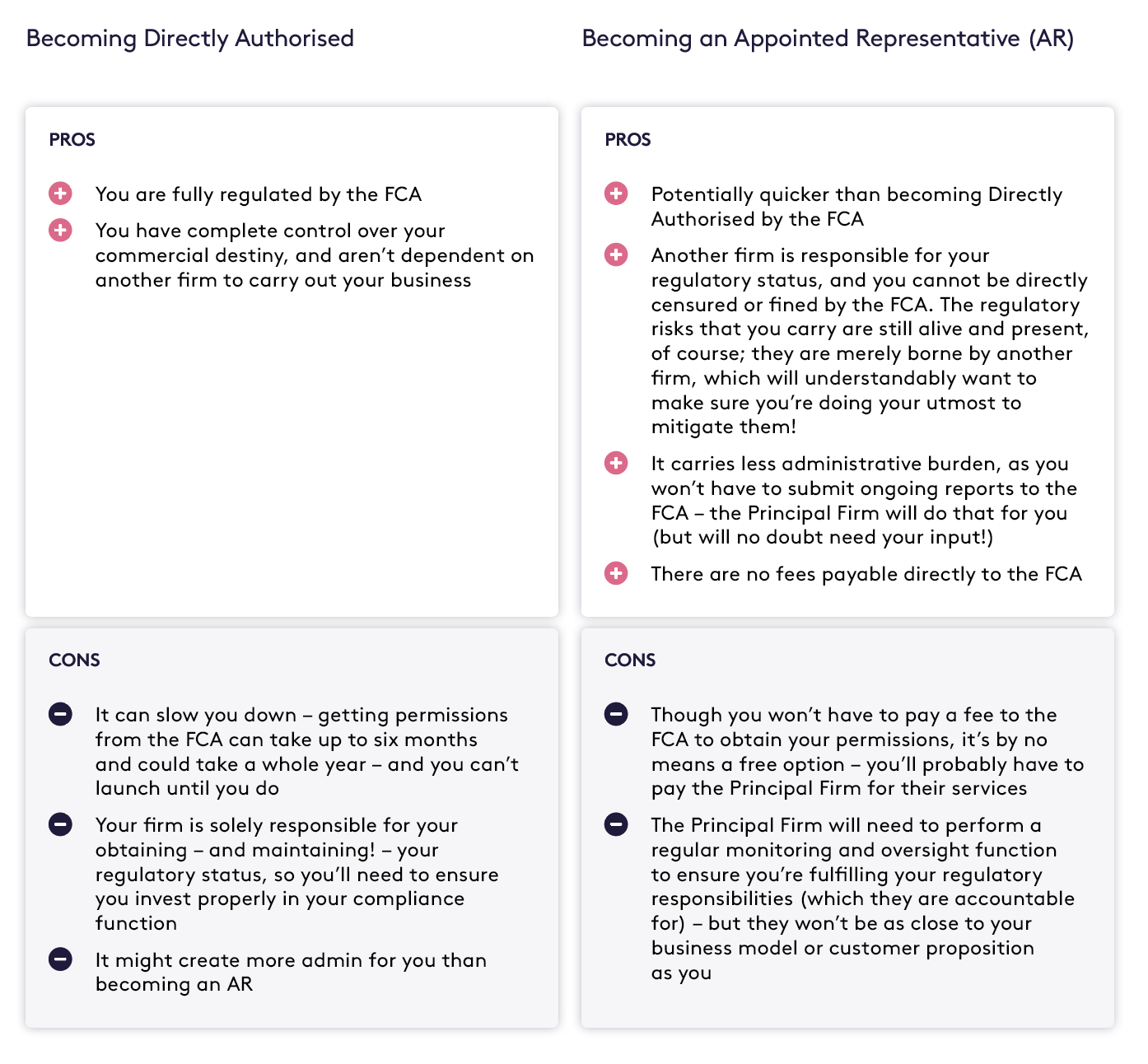

If you’re planning to launch an investment platform but don’t yet have the required permissions, you essentially have two choices. You can either apply to the FCA to obtain them (becoming ‘Directly Authorised’ by them in the process), or you can become an ‘Appointed Representative’ (or ‘AR’) of a firm that already holds them.

Become Directly Authorised (DA)

If you’re already regulated by the FCA – for example, if you already operate a personal finance app, but without an investment proposition – you can apply for a ‘Variation of Permissions’, which will cost you around £2,500.

Alternatively, you can form a new corporate entity (which if you’re starting out you’ll of course need to do anyway) and apply for the permissions afresh – this will cost you around £5,000.

This option is often preferred even by those who are already in market, because of the simplicity of the ‘clean slate’ that it provides.

As James Dingwall, Founder and CEO of compliance specialist Thistle Initiatives, explains…

“Many may prefer to establish an entirely new corporate entity to minimise the potential for conflict and help simplify their accounting.”

In both cases, the FCA will aim to make a decision to accept or reject your application within six to nine months – assuming it’s complete and they don’t require any more info (otherwise that timeline will stretch to 12 months)

Become an Appointed Representative (AR)

Instead of obtaining the required permissions directly from the FCA, some firms choose to become an Appointed Representative (AR) of a ‘Principal Firm’, and essentially ‘piggyback’ off theirs.

As an AR, you still need to be FCA approved, but you won’t be required to hold the permissions yourself. Here, the third-party acts as a sort of protective umbrella for your business, which can be particularly useful when you’re just starting out.

The main benefit of using a Principal Firm is that it helps you get to market quickly, rather than having to wait up to a year to become Directly Authorised. Once you’ve launched, you can either stay an AR indefinitely, or you can gain permissions from the FCA further down the line.

Comparing the options

There are pros and cons to each option, and what’s right for you will depend on the size and scope of your business – as well as how quickly you want to get to market.

If you decide to become an AR

If you decide that your best option is to use a Principal Firm, you’ll want to choose a trusted partner that can not only help you get to market quickly, but keep you on the straight and narrow once you are.

To save you some legwork here are some Principal Firms that come highly recommended:

Resolution Compliance: An ‘umbrella firm’ for insurance brokers, equity crowdfunding platforms, peer- to-peer lending platforms, consumer credit firms and corporate finance firms.

RiskSave Compliance: Award-winning provider of full ‘regulatory hosting’ solutions, allowing firms to undertake a wide range of activities, catering for both professional and retail clients.

P1 Investment: The ethical investment firm and platform provider that performs a Principal Firm function for innovative investment platforms such as Chip, Wombat and Strawberry Invest.

Hitting the target

How do I make sure I stand out in a crowded market?

So you’ve decided on your regulatory route to market, and are equipped with the necessary permissions to launch an investment platform. Now it’s down to business.

In this chapter, we’ll explore some of the key factors that, we think, can contribute towards a strong and sustainable commercial venture. And it starts with a clear focus on exactly who you’re building for.

The shift to firms operating their own platforms might seem revolutionary today but, as with all change, it could soon become unremarkable – simply the most recent, (we’d say) overdue, stage in the platform market’s development.

It won’t be right for everyone, and we’ll explore some of the key considerations that you’ll want to bear in mind later in this report. But for the right firm, it could be the next logical step in the journey to building a self- sufficient, future-proof business that’s fully in control of its own destiny.

Defining your target market

The retail wealth market is enormous and growing. In the UK alone, more than £500 billion is managed by financial advisers – while more than £200 billion is invested on a ‘self-directed’ basis by DIY investors on one investment platform or another.

And, taken together, both of these markets still only scratch the surface of the £11.4 trillion that the ONS estimates the UK’s combined household wealth to have grown to in 2021.

Faced with such an inconceivably large total addressable market, it might be tempting to build a broad catch-all proposition that can sweep up as many different target segments – and assets – as you can.

But in our experience, a more modest approach can pay dividends; often the most successful fintechs are those who launch in the most targeted fashion.

By focusing on a tightly defined target audience,these firms can acquire a deep understanding of their segment’s individual pain points, design unique services to help solve them, and wrap it in a user experience and marketing strategy that is more personal, authentic and effective than any ‘generic’ offer could hope to emulate.

What sort of investment platform are you building?

While selecting your key ‘launch segment’, there’s another (closely connected) question you’ll want to think about, too: exactly what sort of ‘investment platform’ is it that you’re looking to build?

As we’ve seen in the first chapter, the FCA’s definition of an ‘investment platform’ is broad – covering any proposition that allows someone to buy and sell investments. It’s a catch-all that sweeps up all manner of solutions.

For example, do you think you’ll be building a ‘trading app’ that allows DIY investors to invest directly into equities, perhaps even on an instant basis?

This could be perfect if your audience takes a passionate interest in particular companies and likes to actively manage their own portfolios; perhaps they’re even investing ‘thrill-seekers’ who are looking to capitalise on the volatility of the markets to achieve quick wins (or just as quick losses, too).

But it clearly won’t be right for those for whom investing is simply a means to an end – such as saving for their kids’ education, or building a retirement nest egg – rather than a passion or pursuit in its own right.

Using your target audience as a starting point, try to work out what your high-level investment proposition should look like – as this will inform the big decisions you’ll have to make around your product offering and commercial model.

Speaking of which…

Nailing your niche

Launched in Oct 2019, Penfold is a fast-growing pension provider that’s on a mission to help the many millions who aren’t saving enough for a comfortable retirement.

That’s a large and pretty lofty ambition – one that cuts across many different customer segments. But, rather than trying to be all things to all people from day one, they opted to start out by tackling the needs of a very particular target market: the UK’s 5 million self-employed (and counting) – 86% of whom don’t save into a pension at all.

Armed with clear insights into their customers’ unique challenges – notably a less stable and more unpredictable income stream than their employed counterparts – the team were able to achieve cut- through with a solution that’s far more flexible than traditional pension pots: one that allows users to quickly and easily save whatever they like, whenever they like, as well as pause or change their monthly contributions to match their fluctuating income.

It’s no surprise, then, that they’ve gone on to achieve rapid success – recently closing a £3m funding round on Crowdcube, on the back of impressive growth statistics (the business grew their assets by as much of 140% in as little as four months) and partnerships with the likes of Starling Bank.

With this early success under their belt, they’re arguably far more robustly positioned as they now look to broaden their horizons and enter the mainstream workplace pensions market.

“We started with the UK’s 5m self- employed, as 86% weren’t saving into a pension. Penfold is now open to everyone and we’ll soon launch workplace pensions to broaden our customer base even more. With £7trn held in UK pension funds, but millions still not saving enough,

the market is huge and ready for disruption.”

Building the business

What should my investment proposition actually look like?

So, you’ve got permissions to launch. Your target market is defined. Their pain points are well understood, and you’ve conceived a high- level solution to help alleviate them. Get you, your investment platform’s taking shape!

Now it’s time to put some meat on the bones of your proposition, by asking some of the big practical questions you’ll need to answer before launch.

Which account types and tax wrappers will you offer?

If you know exactly who you’re targeting, this one should be easy to answer: will you be facilitating investments from individuals, couples, companies, charities – or all of the above?

If it’s individuals you’re catering for, will you allow them to invest through one or several tax wrappers like an ISA (or Junior ISA, if you’re targeting parents), SIPP , SSAS or investment bond – or simply through a ‘General Investment Account’ (GIA), in which all investment growth or income will be taxable?

The particular options you choose will depend on the audience you’re looking to cater for – as well as the cost and operational requirements of each.

What’s your investment universe?

So you’re going to allow your users to invest. But in what? Directly in equities? In mutual funds? In exchange-traded funds (ETFS)?

Clearly your customers’ needs will greatly influence your choice, but there are important commercial and operational considerations for you to bear in mind, too – chief among them being the transaction costs for routing investments to the market.

For example, while fees for investing in ETFs are typically lower than fees for investing in mutual funds, it’s worth noting that funds carry no transaction costs.

Investing in exchange traded instruments will bring behind-the- scenes charges that quickly add up (particularly if your customers are making lots of frequent trades, each racking up its own separate processing fee). Unless you’re charging these back to customers (which you may not feel comfortable doing), you’ll need to factor these into your overall commercial model.

And it’s worth considering the overall size of the investment universe you make available to your customers, too.

Offering a larger universe could give you a competitive advantage – after all, you’ll be providing clients with a greater range of investments than other providers on the market.

But it’ll no doubt be more costly and complex to run, so this trade-off might be worth considering.

What trading options will you support?

Depending on your choice of investment universe, you might also have another decision to make: just how will you allow your investors to buy and sell?

Funds are typically priced and transacted on once a day – meaning these orders will all transact at the same price, irrespective of the time that customers made their requests (so long as the order is placed before that day’s cut-off – otherwise it will achieve tomorrow’s price).

But for investments that trade on-exchange, you’ll have the option of allowing your investors to trade on a live basis, or to bulk up all the various client orders within a certain time frame and send them all to market en masse (at Seccl, for example, we send to market all of the orders from across our client investment platforms at 15.30).

If you’re looking to build a high-frequency trading app, through which customers are trying to “time” the market on particular equities, then clearly you’ll need to opt for live trading.

But for investment platforms that are looking to help their investors build wealth over the long-term, intra-day fluctuations are far less important (as the old adage goes, “time in the market is more important than timing the market”) and bulk orders are generally seen to suffice.

How will you get money onto the platform?

Will you support investments via debit card, bank transfer, Direct Debit, or Open Banking methods? Or all of the above?

This might sound a bit trivial, but it can be fundamental to your fortunes as a business. The mechanisms you provide to allow investors to place money with you can determine just how easy you are to use, and can massively influence behaviours for the good (encouraging regular investing) or bad (making it easier to churn).

But, again, your decision will want to take account of operational considerations, too, such as the ongoing cost and compliance implications of each.

Debit cards, for example, can make for a supremely quick and seamless payment experience. But they’re also ripe for money laundering abuse, if proper processes and controls aren’t put in place to ensure that any money is only withdrawn to the bank account from which it was first invested (what’s called a ‘closed loop’).

Similarly, the monthly ‘pull’ of a Direct Debit mandate is a powerful way to ensure your assets grow through regular investments – but each can carry a processing charge of around 50p.

There’s also the consideration of whether you’ll only accept ‘new money’ or will allow investors to transfer over existing portfolios that they might hold with other platforms.

Clearly, the second approach holds the key to substantial growth (particularly if those portfolios have been built up over many years) – but, you guessed it, carries not insubstantial operational complexity and cost, too.

Finally, how will you make your money?

As well as considering the cost implications of your investment universe, trading options and payment mechanisms, you’ll also need to think about your commercial model – how will you make money?

Will you charge advice fees, transaction fees or a platform fee? Will you join an incumbent partnership – could you offer your software out to existing banks, pension providers or wealth managers – or are you focusing solely on direct-to-customer distribution?

As all of this hopefully goes to show that there are a whole host of factors you’ll want to consider when pulling together your initial business plan – with each potential solution bringing with it additional questions along the way.

While you might not have all the answers, the more clarity you can create before you launch, the fewer headaches you might have to endure later down the line.

Our take? Start small…

Of course, no one knows your audience better than you but, as before, a good rule of thumb when starting out is not to try and to do it all – at least not at first. We’d suggest you’re far better off choosing a few options and doing them well, before branching out when you’ve achieved some success.

Crunching the numbers: our online pricing calculator

To get a feel for the costs involved in launching and running an investment platform – and how different variables can affect the overall affordability of your model – check out our free online pricing calculator.

Head to seccl.tech/pricing to get a rough estimate, and explore how the costs work in practice

Tackling the tech

What should I build in-house, and what should I buy off-the-shelf?

The clue’s in the name. All successful ‘fintechs’ harness technology to drive innovation, efficiency and, at the end of the day, customer satisfaction. Tech will be crucial to your success.

But don’t worry, you won’t need to build the world’s leading software team overnight. And, by the same token, even if your founding technology team is the best around, it would be impossible for you to build everything yourself. And nor should you have to.

The proliferation of APIs

Over the past two decades, Application Programming Interfaces (APIs) have significantly lowered the barriers to entry and innovation – across all industries – by allowing start-ups to plug in other services more easily and affordably than ever before.

It means that emerging companies no longer need to get bogged down and distracted by the job of reinventing what already exist – which, by definition, would be unlikely to give them real competitive advantage (particularly if it’s a relatively commoditised service that, although it might be crucial to their operation, is taken for granted by consumers).

Thanks to APIs, early-stage companies (and later-stage ones, too!) can simply integrate with other tools, and focus instead on what will set them apart.

Choosing what to integrate

So what technology, then, might firms wish to rely on third-party integrations for, and what should they build themselves?

The list of potential integration areas is practically endless. In my experience, though, the most typical areas that fintechs look for outside support in, at least initially, are payments processing (be it debit or credit card payments, Direct Debits or Open Banking) and anti- money laundering (AML) or ‘know your customer’ (KYC) verification services.

After all, both are absolutely essential services that will underpin any money management tool – you’ll need to get money on and off your platform, you’ll need to ensure that money isn’t from the proceeds of crime, and you’ll need to ensure that it’s sent by someone who is indeed who they claim to be.

But, while fundamental to your operation, they’re unlikely to give you any real competitive advantage: they’re simply the ‘price for entry’.

In the case of investment or wealthtech propositions, it’s also highly likely that you’ll want to integrate with a custodian and technology provider who can provide the actual infrastructure on which your users can invest.

The provision of custody, the administration of client money, and the routing of trade orders to market for execution and settlement are, again, all pretty arcane and specialised areas that allow you to get to market, but likely won’t create much meaningful customer differentiation when you get there.

Really the only thing you shouldn’t outsource is the overall user or customer experience that you’re looking to provide. But if building something doesn’t provide a key competitive advantage or materially reduce business risk, then I’d say you really have to ask why you’re building it.

Of course, the list of things that does and doesn’t meet that test might change over time, depending on your growth stage and target market. But the test itself remains the same.

Choose your partner wisely

When it comes to choosing which vendor to integrate with, you’ll obviously want to compare the costs of varying solutions – taking account of any expected growth in your customer numbers of transaction volumes as you scale.

But there’s another factor we’d recommend doing your due diligence on: philosophical alignment. While it sounds a bit trite, partners should be exactly that – organisations that share your values, ambitions and goals: relationships that are simply transactional and vendor-client in nature are likely to be far less successful in the long term.

It’s important to have a deep bond of trust between both businesses because, ultimately, the only way you can protect yourself is to align yourself with partners who think as you do.

As long as you’re both consumed by making sure that you’re doing the right thing by your customers while keeping them and yourself safe, you’ve got a really strong platform for growth for both businesses.

Scaling the team

What’s the optimal team structure when starting out?

You can’t build a world-class technology organisation without talented people. But how do you make sure you can get the best out of them? What are the key ingredients for a successful and productive team?

How to structure your team for growth

As a founder, you’ll probably have a clear vision of what your product needs to be. And this will be the rocket fuel that can power your business during the early days. But as you scale and move further from the work, it’s inevitable that you’ll need a high-performing team to take things to the next level.

So how do build one? Well, it starts with your mindset. You shouldn’t think of your team as a bunch of coders there to serve the needs of the business by pumping out features. If you want to build a business that genuinely innovates and changes the world, you’ll need an empowered team of missionaries (not mercenaries) who passionately believe in what you are doing.

Your team will most likely be an autonomous cross-functional unit of everyone that’s needed to understand, shape, design, build, deploy, maintain and iterate your product end-to-end. It will typically consist of engineers, including QA and DevOps, a product person, a designer, customer and ops people. Some of these roles will naturally be hybrids or shared to begin with.

They must be empowered to understand the customer and market as well as you do. Do this and you can harness the most powerful creative force known to humankind: the empowered team.

Keeping on the straight and narrow

How do I make sure we’re playing by the rules and staying compliant?

Compliance. It might not be the most exciting of topics, nor is it likely to be the motivating force that gets you out of bed in the morning – but it’s absolutely vital to your license to operate. And it needn’t be a headache, either.

To cut through the complexity, we asked our expert friends over at ComplyAdvantage to give you a lowdown on some of the key things you’ll want to be thinking about to keep your business on the straight and narrow.

As an investment platform, there’s no two ways about it: you’ll have a series of ongoing compliance responsibilities that are crucial to keeping your business on track. Fulfilling AML and financial crime obligations should never be seen as a box-ticking exercise – a one-size-fits-all approach simply doesn’t work in a sector as diverse and varied as ours.

Instead, it’s important to understand the underlying risks to your business and develop a robust framework for tackling potential criminality. Since leaving the EU, the UK’s AML and financial crime responsibility rules are administered by the FCA and incorporate a number of international standards, set by the Financial Action Task Force (FATF).

To comply with the core requirements, you’ll likely need to do the following:

- Appoint a Money Laundering Reporting Officer (MLRO)

All firms must appoint an MLRO – a senior person within the business who is tasked with putting measures in place to identify suspicious activity by clients or counterparties.

Their supporting responsibilities will also include:

- Developing and implementing financial crime related policies, procedures and controls

- Overseeing and conducting risk assessments and maintaining records

- Ensuring staff are trained to recognise financial crime risks

MLROs are integral to the prevention of fraud and financial crime within a business. However, it’s not uncommon for senior staff members to perform a dual role in smaller or younger companies.

- Fulfil Customer Due Diligence (CDD) and Know Your Customer (KYC) procedures

CDD and KYC checks are a continuous process, taking place not only at the point of onboarding a new customer, but across their entire lifespan on your platform.

During onboarding, companies should verify the identity of clients through national ID cards, passports and drivers’ licenses. Supporting documents, such as utility bills and bank statements, should also be provided. All of this can be done online.

During onboarding, you’ll also need to assess whether clients are Politically Exposed Persons (PEPS), which may make them higher risk – and create extra reporting responsibilities for you.

Ongoing checks should be performed on a periodic basis in line with the risk profile of your clients (which could be a function of their country of origin, domiciled status and transaction size).

- Report any concerns

Events that trigger suspicious activity should always be reported to the MLRO and escalated to the relevant authorities.

Incidents related to the suspicion of potential money laundering or terrorist financing have to be recorded as a Suspicious Activity Report (SAR) and sent to the UK Financial Intelligence Unit (UKFIU).

- Maintain customer records

To support the authorities in successfully prosecuting a crime, you must keep good and consistent data related to all areas of compliance, such as:

- Client CDD/KYC Data in CRM systems

- Transactions data

- Alerts data

- Case files for alerts, including details of investigations and decisions made.

- Copies of statutory reports such as SARs

- Internal reports leading to decisions on the nature of a relationship or potential exits

- Perform ongoing risk management

You’ll also be required to carry out an Enterprise-Wide Risk Assessment (EWRA), which details specific risks, how well current financial controls mitigate them and what needs to be done strategically to ensure that risks and controls are aligned.

When undertaking an EWRA there are a few areas you’ll want to consider:

- Risk appetite: the level of financial crime, reputational or regulatory risks that you’re willing to bear to meet your commercial objectives

- Inherent risk: the level of financial crime and linked risks posed by the type of business that you undertake

- Control effectiveness: the mitigating impact that your financial crime policies, processes

and procedures (in combination what might be described as ‘controls’) have on those inherent risks - Residual risk: what risks are left, leading to the questions of what actions might be taken to accept and mitigate them further, depending on your risk appetite

Your first EWRA will likely be pretty basic, given it will rely on limited data and expertise; how often you choose to refresh it will depend on your organisation, environment and risk appetite, but most organisations will typically revisit it once a year (or sooner if an event – positive or negative – has led to some significant change in context).

Putting it into practice

Five principles to bear in mind

Because of the many aspects of financial crime regulation, national variations, and the complexity and variety of modern business, each individual firm will need to work out its own plan for how to tackle these different areas of compliance and risk management. These are decisions each business of course has to make for itself.

However, there are five important principles of approach that they need to keep in mind as they do so.

- Focus on the goal

Compliance and risk management are there to help tackle financial crime, first and foremost. Keep that in mind when you are making decisions about your approach.

- Take a holistic view

Compliance and risk management support business success, and compliance and risk management support each other. They are not mutually exclusive.

- Integrate early

Do not wait to ‘add on’ a financial framework to your business model somewhere down the line; make sure it is fully integrated into your approach from the start to manage costs and client experience.

- Balance sustainability and flexibility

Ensure your framework has the resilience and scope to ‘flex’ in the face of changing circumstances, especially if you are looking to grow quickly or face an uncertain risk landscape. That will almost certainly require the intelligent use of technology.

- Find the right partners

Look for partners who are keen to deliver solutions that support your needs and meet your risks, and have the capability and capacity to respond with agility.

Preparing for launch

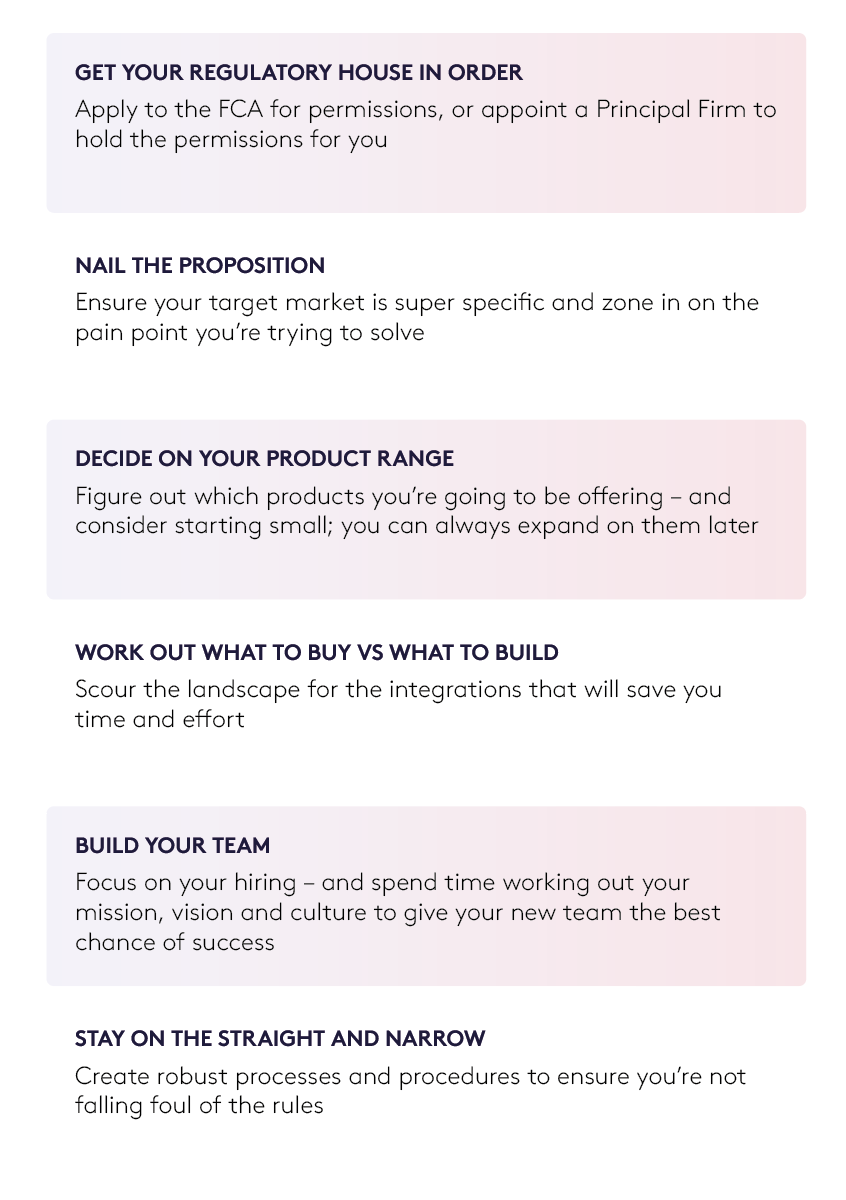

Here’s your go-to-market checklist…

So, you’ve got an empowered team behind you. You’ve figured out your regulatory requirements, defined your target market, worked out your initial operating model and key commercials, and considered the key ingredients of a robust compliance and monitoring framework. You’re ready to go.

And at the right time, too! Ours is the golden age of fintech: where financial freedom is being put back into the hands of consumers; where lower costs, innovative funding opportunities and efficient buy-and-build technology is allowing exciting new fintechs like yours to get up and running in a matter of months, not years. This is your chance to be part of a revolutionary era.

Of course, all of this means that you’ll be up against some competition. So it’s all the more important that you set off on the right foot.

So here’s your pre-launch checklist!

How can we help?

At Seccl, we’re on a mission to rebuild the infrastructure of investments and advice. We provide firms of all sizes with affordable custody, trading and settlement services, feature-rich investment management technology, and a suite of paperless adviser and client portals.

Financial advisers and investment managers can combine these modules to operate their own platform – helping them to take control of their client relationships, improve their customer experience and own more of the value chain.

Elsewhere, technology-first businesses from all sectors can use our publicly documented APIs to get plug-and- play access to the financial markets – helping them to launch new investment propositions more quickly and affordably than ever before.

If you’re looking to develop a new investment proposition, we’d love to hear from you. Check out our demos, browse our API documentation or just book a call with one of the team – we’d be more than happy to help.