About this guide

We believe ‘embedded investments’ (or ‘embedded wealth’, as you might hear it called) is fintech’s next great frontier.

It’s an exciting – albeit nascent – trend that can bring exciting opportunities for ambitious brands and create seamless, intuitive user experiences for a new generation of investor.

If you’re a neobank, a fintech operating in an adjacent category, or even an ambitious brand operating in a completely different vertical altogether, this guide is for you – providing a brief introduction to the topic, exploring its roots in embedded finance and unpacking its potential impacts.

We demonstrate how companies of all shapes and sizes can deploy embedded investment propositions to create a new revenue stream, bolster profitability and make the most of their existing brand loyalty.

And we reveal research showing the consumer demand for investment offerings from brands that don’t operate in this space today. All of which begs the question… are the leading investment platforms of tomorrow hiding in plain sight?

Any questions or feedback? Let us know. We’d love to hear from you.

Mary Agbesanwa

Fintech growth lead, Seccl

The journey so far… Embedded finance

Before we explore where we think the market’s headed, let’s take stock of where we are now – and recap on the embedded finance trend that has fundamentally transformed customer experiences over the last decade or so.

Put simply, embedded finance refers to the trend of integrating financial products or services within an existing brand or user experience.

Of course, the trend of non-financial brands distributing financial services isn’t new. Store cards and insurance add-ons for car rentals, for example, date back over fifty years. But it’s only with the technological developments of the last few decades that brands have been able to seamlessly integrate these offerings within their digital experience.

It’s this practice of digitally embedding financial products within a non-financial brand’s online or in-app user journey that, we think, is the defining characteristic of ‘embedded finance’ – and helps to underscore its dramatic rise to ubiquity.

Today, companies operating in all sectors can easily and affordably integrate a broad and growing range of products and services, including…

Embedded payments

Payments provide perhaps the most obvious example of embedded finance solutions. Not too long ago, the checkout stage represented a break in an otherwise seamless online journey, as customers were directed onto a third-party platform or browser to complete their transaction.

But today’s consumer can expect companies of all shapes and sizes to provide fast, friction-free and fully integrated payment options – facilitating payments by card, digital wallet (for example Apple Pay or Google Wallet) or even credit options (more on that below).

In fact, so commonplace is the phenomenon of embedded payments that more than half of shoppers would give up on a purchase if they encountered any checkout friction. In other words, it’s now the price for entry.

Embedded insurance

The distribution of insurance products in a retail context provides a great example of the evolution of embedded finance as a whole.

After all, consumers have been able to purchase insurance policies in a retail context for over 70 years. For example, coin-operated insurance vending machines were a common sight in North American airports during the 1950s and 1960s, capitalising on the pre-flight nerves of early air travellers.

As Accenture note in their brief overview of embedded insurance, “purchasing life insurance at the airport before a flight was ‘Version 1.0’ of embedded.”

Over the coming decades, insurance policies would come to be sold alongside other physical goods at the point of in-person purchase. And they still are. Head in store to buy an electrical appliance and it’s likely you’ll be offered an extended warranty; while sales agents at car dealerships or rental companies will no doubt offer you insurance policies on the forecourt or at the counter.

But today, insurance products are distributed seamlessly as part of the online purchase journey, too. Whether you’re buying train tickets on Trainline or plane tickets on Skyscanner, hiring a car on Zipcar or Turo – or even ordering a Tesla – rarely should you be forced to look elsewhere…

Embedded credit

The distribution of loan facilities has followed a similar evolution to that of insurance policies. Consumers have been able to purchase goods ‘on finance’ for many decades, either through store cards (sometimes referred to as ‘private label credit cards’) or through credit facilities offered by third-party banking or credit institutions.

Today, credit can be offered instantly and efficiently as an online payment option, as a rapidly growing number of brands look to sell goods and services on a ‘buy now, pay later’ (BNPL) basis – allowing customers to pay for their purchases over a number of instalments.

Popularised by Klarna (at one time Europe’s most valuable private tech company), consumer uptake of BNPL offerings has surged on the back of the coronavirus pandemic and the ecommerce boom that it generated.

While sometimes controversial – Deliveroo raised eyebrows in the autumn of 2022 when it announced a partnership with Klarna that allowed diners to spread the cost of purchases over £30 – the demand for embedded credit looks set only to grow in today’s high inflation environment.

| Then | Now | |

|---|---|---|

| General characteristics |

|

|

| Payments |

|

|

| Insurance |

|

|

| Credit |

|

|

A trend that’s here to stay

Estimates on the size of the embedded finance market vary wildly, but all commentators agree on one thing: it’s large – and growing. According to PwC, “the market for embedded finance applications is projected to grow fivefold, from US$54.3 billion in 2022 to US$248.4 billion, by 2032”.

And while embedded payments, credit and insurance policies have become an expected part of the everyday retail experience, we think the emerging trend of embedded investments looks set to be just as disruptive…

The next frontier: Embedded investments

As we have seen, the last five to 10 years have witnessed a dramatic upsurge in the breadth and depth of elegantly embedded financial services. But the journey has involved a number of less-than-seamless experiments along the way.

The same is true in the sphere of investing and wealth management. While some retail brands have launched investment propositions in recent years, they typically remain – at least in the UK and Europe – separate to the overall customer experience.

The state of play… Disjointed white labels

Take John Lewis, for example. It launched its own investment offering in the summer of 2021, allowing customers to open and invest in a stocks and shares ISA, junior ISA and general investment account (GIA).

The new investment range is one of a number of steps John Lewis is taking to diversify its future revenue streams and meet its ambitious strategic goal of generating 40% of profits from new, non-retail areas by 2030 – alongside sustainable housing and outdoor living.

With a loyal following and a well-established financial services division (it claims its Partnership card is already the UK’s biggest retail credit card), it’s a smart and logical step.

“Just about every survey or opinion poll suggests John Lewis is one of the most, if not the most, trusted and admired brands in the country” explained Sky’s Ian King when the move was announced. “Providing investment services, where trust is more important than almost anything, is therefore a logical brand extension.”

But while it makes sound strategic sense, it’s worth noting that the proposition remains largely unembedded from the core retail experience – launching as a standalone ‘white label’ of Nutmeg, the UK-based investment platform and ‘robo-adviser’ that was acquired by JP Morgan around the same time.

Although it recently announced a trial promotion allowing select customers to earn 1.25% cashback on qualifying online spends, which can be deposited into the John Lewis Junior ISA, it’s still some way from the level of elegant and easy-to-use sophistication that has come to characterise the broader embedded finance trend.

According to Yourmoney.com, “John Lewis confirmed it will track spending based on it recognising online shopping transactions linked to the same email address for both its shopping account and the Nest Egg JISA.” In other words, far from a full and seamless integration.

The future… Seamlessly embedded investing

In our view, consumers will come to demand the same integrated experience from an embedded investment proposition as they would of any other financial product or service – be it payments, insurance, lending or otherwise.

And the journey to fully embedded investment offerings is already well underway – spearheaded in particular by the US and Asia.

PayPal, for example, has successfully broadened its reach beyond payments, allowing its customers to buy, sell and hold crypto investments from within their existing accounts.

“The growth of so-called ‘superapps’ like Grab, WeChat and AliPay calls into question the entire notion of sector verticals…“

Based on its US company filings, the proposition seems to be gaining substantial traction; as of the end of March 2023, it claimed combined total of $943 million in cryptocurrency assets – a 56% quarter-on-quarter increase.

The trend is particularly pronounced in China and South East Asia, where the growth of so-called ‘superapps’ like Grab, WeChat (owned by Tencent) and AliPay calls into question the entire notion of sector verticals. For nearly a decade now, these apps have worked to bring together a hugely diverse range of services – communication, travel, retail, payments and, yes, investments – within a single self-contained user experience.

A sign of things to come? Penfold x Just Eat

Launched in Oct 2019, Penfold is a fast- growing pension provider that’s on a mission to help the many millions who aren’t saving enough for a comfortable retirement.

After starting out by tackling the needs of a very particular target market –the UK’s 5 million self-employed, the vast majority of whom don’t save into a pension – today they have broadened their proposition to support a wide range of over 50,000 of individual savers, both through private and workplace pensions.

Building on their rapid early growth, Penfold announced a partnership with Just Eat in June 2021 to offer a simple pension for its food couriers. “We’re passionate about making your Courier experience the best it can be”, Just Eat explained. “That’s why we’ve partnered with Penfold, to help Couriers on the Just Eat network stop worrying about the financial future and focus on today.”

While trialled as a promotion – with couriers given an introductory bonus to go off and start their pension journey on the Penfold app – it’s easy to imagine how the service could be embedded directly within the Just East app in the future. Particularly given both companies are ambitious, fast-growing technology companies that are no stranger to the principles of API- first technology…

“We started with the UK’s 5m self-employed, as 86% weren’t saving into a pension. Penfold is now open to everyone and we’ll soon launch workplace pensions to broaden our customer base even more. With £7trn held in UK pension funds, but millions still not saving enough, the market is huge and ready for disruption.”

Why care? Key commercial opportunities

The notion of an embedded investment journey holds obvious benefits to consumers – a streamlined, value-additive service provided by a brand they know and trust. But what’s in it for firms? What might drive firms to look beyond their current strategic focus and enter a new and complex market?

Grow revenue and profitability

For some, it might be commercial imperative; a need to bolster the bottom line and overcome challenges to their core business.

For example, the launch of a John Lewis investment offering came amid the challenging retail backdrop of the post-Covid recovery. Since then, rising inflation has since added £180 million to the company’s annual cost base, driving a pre-tax loss of £234 million at the end of January 2023 (compared to £27 million the previous year). In this context, it’s perhaps easy to understand the retail giant’s desire to generate 40% of its profit from non-retail means over the next seven years.

Elsewhere, as the technology climate sours and investor demand for profit grows stronger day by day, embedded investments provide fintechs and neobanks with a path to profitability.

“Their issue is revenue. In consumer and small business banking, there are two ways to make money. One is lending and the other one is investments.“

Simon Low, partner at Oliver Wyman, on Monzo

While the last decade has seen these firms achieve remarkable success in acquiring customers at considerable scale – with leading challenger banks now claiming many millions of customers each – translating this scale into revenue, and maximizing the lifetime value of these customers, has proven far trickier.

Take Monzo, for example. The company has raised around £1 billion from investors since inception and now boasts around six million customers – but is yet to turn a profit on an annualised basis. For the year to February 2023, it posted a pre-tax loss of £116 million (down slightly on £119 million a year earlier).

“Their issue is revenue,” explains Simon Low, partner at the retail and business banking practice of consultancy firm Oliver Wyman. “They have much lower cost bases, much better customer experience, but they don’t have enough revenue because in consumer and small business banking, which is largely what they do, there are two ways to make money. One is lending and the other one is investments.”

By strengthening their existing customer proposition with a seamless, intuitive investment journey, they could seek to monetise their millions-strong customer base and grow sticky revenue – driving additional loyalty and engagement in the process.

Exploit brand loyalty and capture market share

This last point – driving engagement – is also key. While the need to protect and extend profitability provides an obvious burning platform, some companies also have a more positive and proactive opportunity at their fingertips.

With a trusted reputation to rely on, and a large and loyal customer base for distribution, well-known consumer brands are uniquely placed to reach a new audience that incumbent investment platforms seem unable or unwilling to cater for.

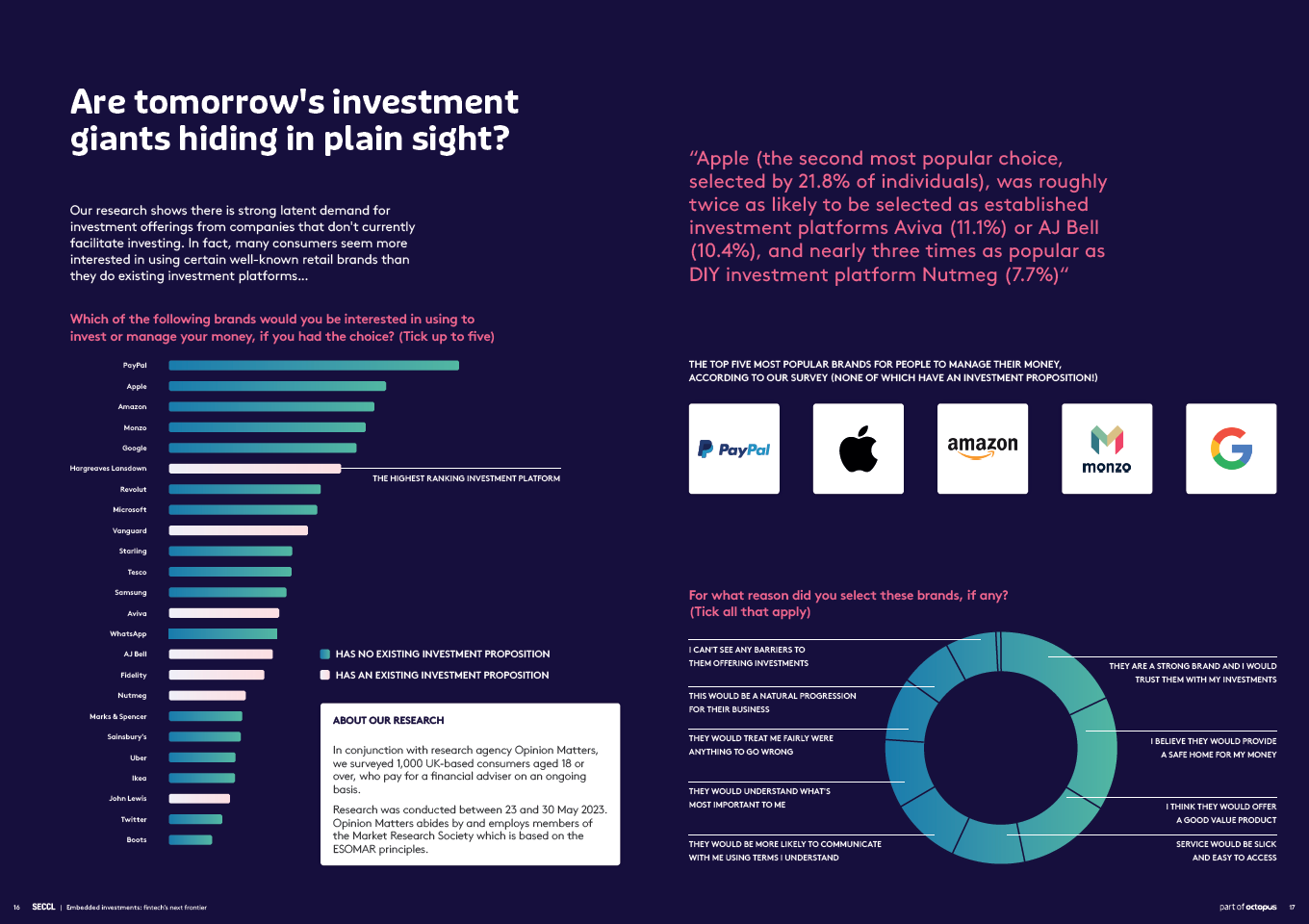

This is resoundingly borne out in research we conducted to support this guide. We asked 1,000 consumers, aged 18 and above, which brands they would be interested in using to invest or manage their money – providing a list of well-known companies, including both established investment platforms and other consumer brands that don’t currently have an investment proposition.

Remarkably, none of the top five brands selected by consumers actually facilitate investing today.

In fact, Apple (the second most popular choice, selected by 21.8% of individuals), was roughly twice as likely to be selected as established investment platforms Aviva (11.1%) or AJ Bell (10.4%), and nearly three times as popular as DIY investment platform Nutmeg (7.7%).

The trend is particularly pronounced for younger investors. Among those aged 55 and above, Hargreaves Lansdown (36%) and Vanguard (13%) both featured in the top five, suggesting that the importance of existing financial services credentials falls dramatically with age.

Interestingly, when asked to justify their selection, by far the most popular response – selected by 40.7% of respondents – related to the fact that ‘they are a strong brand and I would trust them with my investments.’

All of this confirms a simple but powerful story: there is a strong but latent consumer appetite for investment propositions, particularly among the next generation of would-be investors, from brands that don’t currently operate within the wealth arena.

Could the biggest investment platform around in 2030 be hiding in plain sight?

Why now? Key drivers of growth

In our view, the retail wealth landscape will be radically reshaped over the next five to 10 years, as brands from all sectors look to build on their established loyalty to develop new and fully integrated investment propositions. But why now? What are the key trends that are making such shifts possible and increasingly inevitable?

It comes down to two things. First, technology and its role in breaking down barriers to launching new embedded investment propositions; secondly, a large unmet demand for investing solutions among a new generation of would-be investors…

API-first investment infrastructure

The dramatic growth of embedded finance propositions has been made possible by the proliferation of ‘application programming interfaces’, or ‘APIs’.

An API is essentially a bit of code that allows one set of software to easily talk to another – dramatically lowering the barriers to innovation in the process. Armed with an ecosystem of API-first, integration-friendly finance providers, it is easier than ever for businesses to embed their products and services within their customer journeys.

Instead of building an entire payments or e-commerce infrastructure in-house, for example, companies of all sizes can simply integrate with Stripe or Shopify – while those eager to facilitate BNPL purchases can quickly deploy Klarna within their online experience.

Until recently, though, this same integration-friendly infrastructure has been lacking in the world of investments. In fact, wealth management has lagged substantially behind other areas of financial services in its adoption and deployment of modern architectural practices.

Firms looking to embed an investment proposition have had a limited pool of incumbent software providers to choose from, built on outdated technology stacks, with integrations that can take several years to implement and cost millions. Put simply, the barriers to entry have been prohibitively high for all except those with exceptionally deep wallets and an unwavering strategic commitment.

The tide is turning, however, with a new generation of API-first investment infrastructure partner promising to fulfil the same role in investments as cutting-edge technology providers have done elsewhere in financial services. By relying on these providers for the provision of custody, tax wrappers, and investment operations, firms of all sectors and sizes can aspire to launch a new investment proposition in record quick time.

Strong appetite, weak uptake

“It’s a perfect storm: a large, growing but still largely untapped pool of potential investors, with a strong demand for money management solutions, but a lack of certainty around who can help and how. In this context, embedded investments can provide a compelling solution…“

Let’s be clear: more people could use a hand managing their money. Research by the Mental Health Foundation conducted in 2022 demonstrated that the UK population is experiencing widespread levels of hopelessness in response to financial concerns – with more than one-third (34%) feeling anxious, and almost three in ten (29%) feeling stressed in the previous month.10

And with inflation recently hitting its highest level in 40 years and the cost of living crisis continuing to bite, financial worries seem destined to continue.

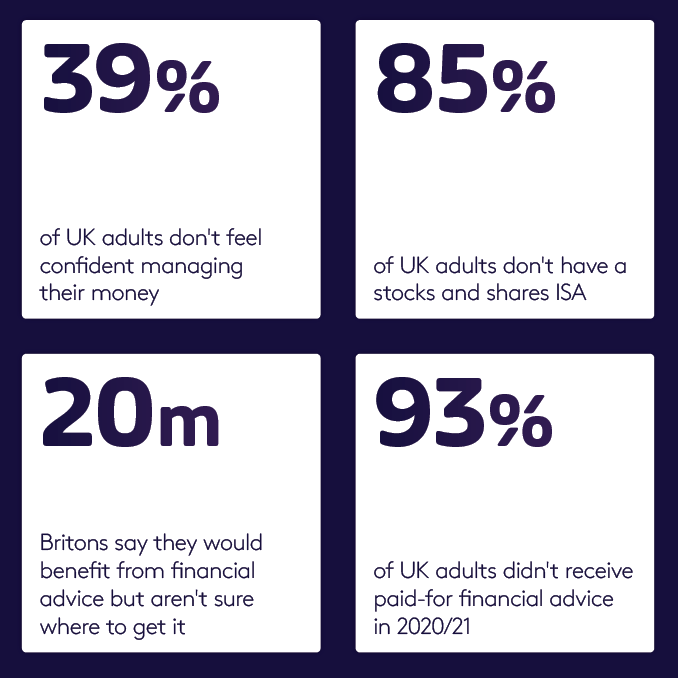

Yet uptake of investment and advice solutions remains notably low. Although the UK’s Financial Capability Survey showed that 39% of adults don’t feel confident managing their money, another 2021 report by OpenMoney found that just one in 14 people (7%) paid for advice over 2020/2021. Meanwhile, only 15% of UK adults have a stocks and shares ISA.

It seems a lack of investor appetite is not the issue, however. The same OpenMoney report showed that 20 million Britons feel they would benefit from financial advice but aren’t sure how to access it; while, according to the Royal Mint’s 2022 Gen Z Investment Report, two fifths of young people said the pandemic brought to light the value of having secure finances and, as a result, over a third have taken it upon themselves to learn about investing as a way of helping grow their money.

So what’s the takeaway? We think it represents a perfect storm: a large, growing but still largely untapped pool of potential investors, with a strong demand for money management solutions, but a lack of certainty around who can help and how.

In this context, we believe that embedded investments can provide a compelling solution. With the right journey, customers who remain too nervous or unsure to experiment with unfamiliar investment platforms – or to consider investing at all – can be met at their point of need and guided by a brand they already know, trust, and love.

With a new technology infrastructure making it easier than ever for brands to embed investment offerings within their customer journey, and with a strong and growing appetite for new money management solutions, embedded investments has the potential to transform the way we invest.

“It’s a perfect storm: a large, growing but still largely untapped pool of potential investors, with a strong demand for money management solutions, but a lack of certainty around who can help and how. In this context, embedded investments can provide a compelling solution…“

How can we help? Introducing Seccl

We’re the Octopus-owned embedded investment platform. Our engineering allows forward-thinking firms to remove the hassle, lower the cost and improve the overall experience of investing — empowering more people to invest and be treated well.

The wealth management sector is being held back by oldtech, dismal processes and misaligned interests. Together they create pointless complexity for financial planning and investment professionals, and provide outdated, overpriced experiences for customers.

We started afresh, with a low-cost, hyper-efficient and (genuinely) API-first technology infrastructure, which supports firms at the forefront of our changing industry.

Working around a principle of collaborative innovation, our technology and operations power the investment platforms of some of the UK’s most forward-thinking financial planning and wealth management firms.

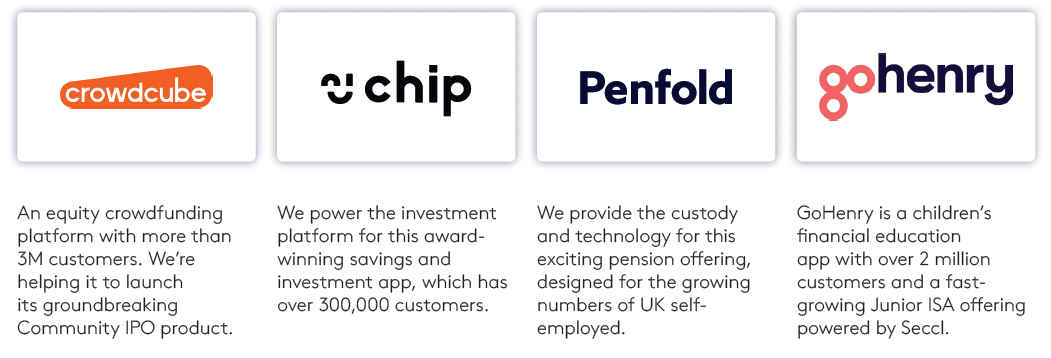

They also help ambitious, fast-growth technology businesses — such as GoHenry, Penfold and Crowdcube — to launch and maintain their investment propositions more quickly and affordably than ever before.

A regulated custodian and ISA/SIPP provider, we have the disruptive mindset and ambitious mission to shake things up, along with the commitment and substance to not screw them up.

We’re proud to be part of Octopus, the £12.5 billion group of companies that includes Octopus Investments, Octopus Energy and Octopus Ventures.

Clients include

Everything you need to launch a leading investment platform

Our embedded investment solution combines a range of software and services that help ambitious firms to launch investment platforms more quickly and affordably than ever before…

The building blocks of modern investing

An API-first approach to custody and client money

Seccl is an FCA-regulated custodian. With the help of our own proprietary custody and trading system, we safeguard the cash and assets of thousands of investors around the UK, on behalf of a growing number of firms, large and small.

Our UK custody service can look after most typical client assets, including funds and exchange traded instruments (ETIs), and is affordably priced.

Plug-and-play access to the financial markets

Our investment infrastructure and operations function can support

a feature-rich investing journey, allowing investors to access…

- Exchange traded instruments: We support the trading and settling of exchange traded instruments including investment trusts, direct equities and ETFs

- Extensive fund coverage: We offer nearly 900 funds from over 100 fund managers and counting

A growing range of in-house products and wrappers

As well as an FCA-regulated custodian, we’re an HMRC-registered ISA Manager and SIPP provider — and support integrations with a host of other product providers and wrapper administrators from across the investment landscape.

Software to support the management of clients

Our client servicing and portfolio management tech provides financial planning professionals with the tools to easily and efficienty onboard and manage their clients.

From first look to full launch in just a few months

Contrary to what established incumbents might have you believe, it needn’t take years or cost millions to launch an investment platform.

With our scalable, modern and legacy-free technology, it’s simpler, faster and more affordable than ever. We’ve outlined the high-level launch journey here. How fast, you ask? Well, we launched and migrated one client’s book as little as four months after our first conversation… Can you beat them?

-

Prep and permissions

After a series of demos and the usual DD, we’ll guide you through the process for obtaining new permissions (if you need any). -

Deep-dive workshop

An intensive, full-day kick-off workshop to fully understand and document your needs, culminating in a full plan detailing the nature and scope of your integration. -

Fee-free integration

As well as guiding you through your technical integration, we’ll offer you support on your regulatory, compliance and legal tasks, too. All at zero cost. -

Launch

We work with you to onboard your first new assets, and migrate any existing books across to your new platform.

Questions?

If you want to find out more about Seccl, take a look at our demo videos.

Alternatively, don’t hesitate to get in touch – we’d be happy to arrange an introductory call.