A custodian with the backing of Octopus

When it comes to choosing a custodian, financial resilience is important. We're young and nimble, but also have the backing of Octopus - the £multi-billion financial services and energy group…

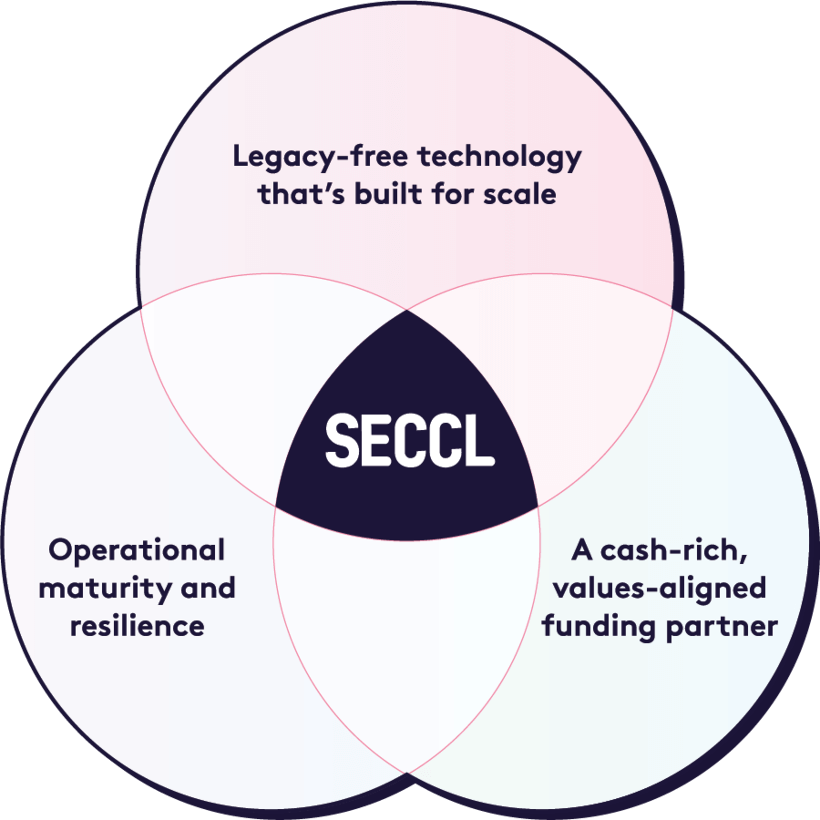

Visit OctopusOur role as an FCA-regulated custodian is at the very heart of our offering

Technology that makes us, we think, the most automated custody and trading solution in the market

Our robust processes, rigorous controls, and deep expertise in custody, regulatory compliance, and CASS

Bolstered by our cash-rich, values aligned funding partner, Octopus

Safeguard your clients' cash and assets, for a max cost of 10bps

Custody isn't about size - whether that's assets, headcount, or any other metric - it's about substance.

When it comes to choosing a custodian, financial resilience is important. We're young and nimble, but also have the backing of Octopus - the £multi-billion financial services and energy group…

Visit Octopus

As an FCA-regulated 'full' custodian, we protect the cash and assets of hundreds of thousands (soon to be millions) of people, following the FCA's Client Assets Sourcebook (CASS) rules.

We think we're the enterprise-scale custody partner of choice for firms looking to future-proof their operations. Download our guide to find out why.

To deliver our custody services, we built our own proprietary system from scratch. We call it 'Core'. It's supported by a number of integrations with key third parties in the investment value chain.

of trades we route to market are processed as 'straight through'

Our trade error rate - which we aim to reduce by a further 75%

seconds to receive money from client's bank and be ready to invest in the market

total transactions processed in 2024

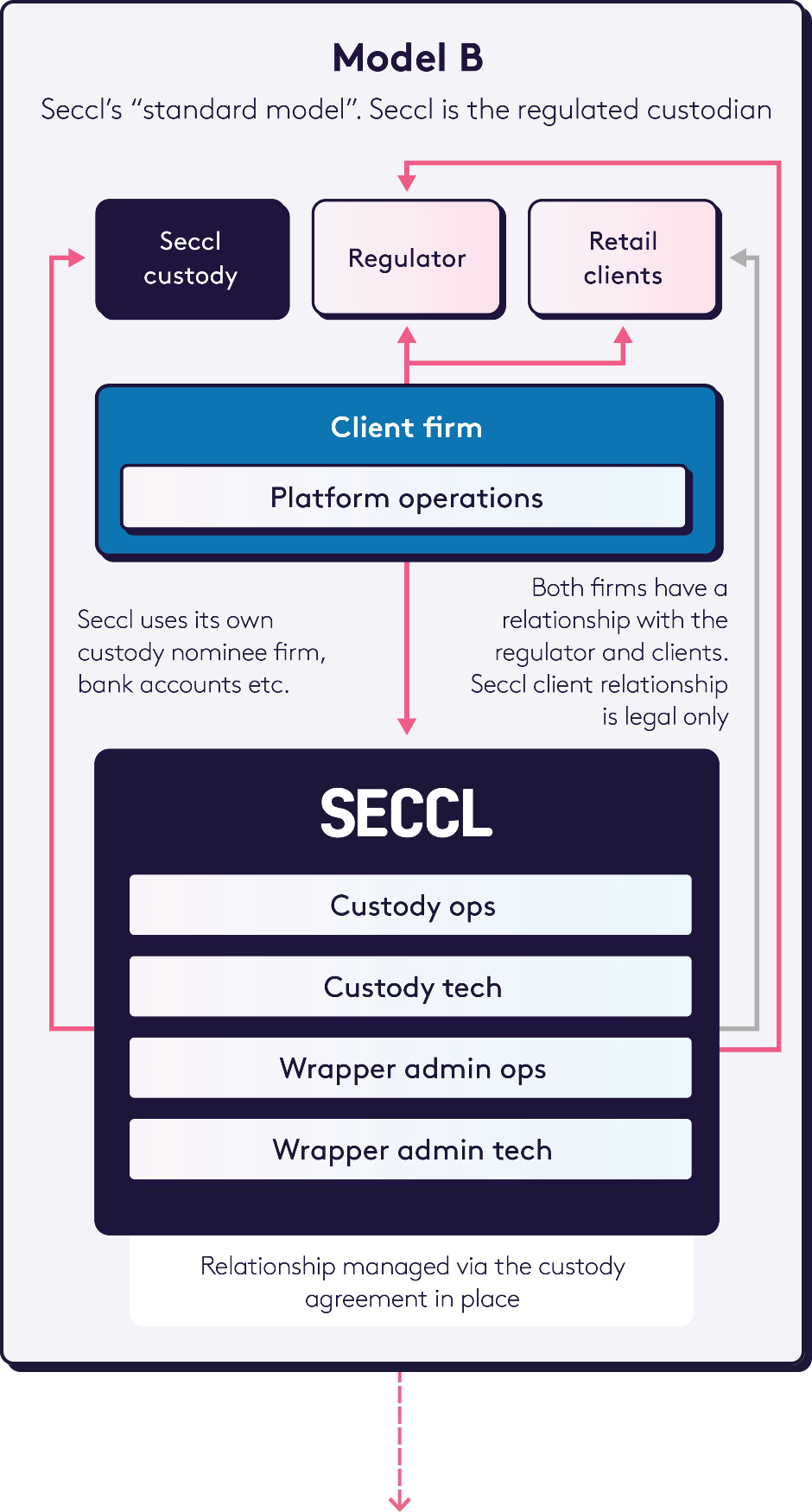

At Seccl, we typically run a model B custody arrangement - though we are open to delivering either.

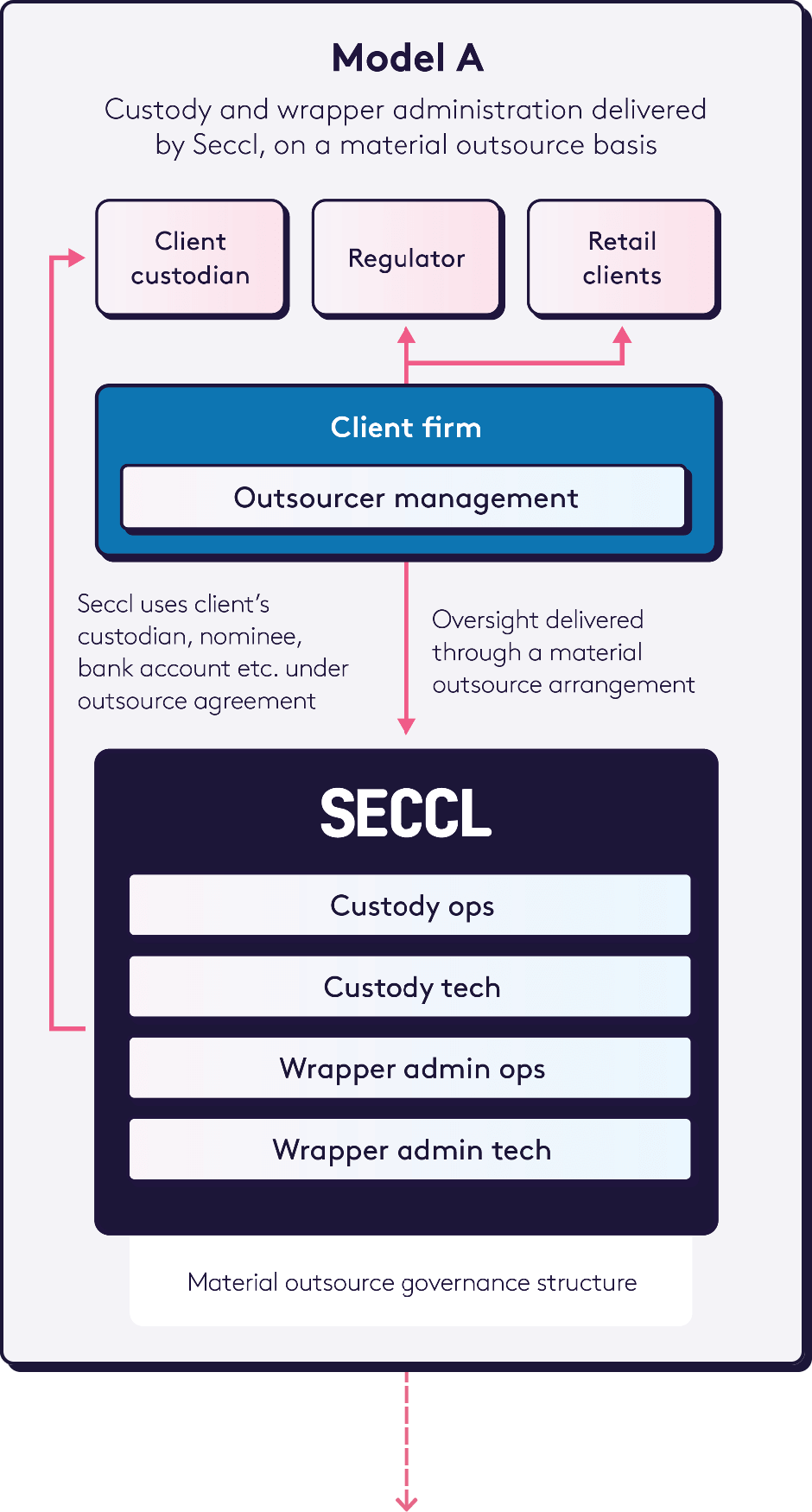

In an outsourced, 'model A' settlement and custody set up, a third-party maintains the books and records for the customer firm to allow them to fulfil their regulated activities, in their name. The customer firm holds the agreement with the customer and the regulatory responsibility.

In a 'model B' arrangement, a third-party (such as Seccl) is appointed to take on the regulated activities. The Platform Operator will arrange these activities on behalf of the investor but it's the third-party that has the direct legal relationship and needs the appropriate permissions.