This document is designed for adviser firms, DFMs and platforms looking to use Seccl as their SIPP provider. It’s not designed for end investors or customers.

A SIPP is a Self-Invested Personal Pension. Our SIPP will provide your end customers with a simple, tax efficient way to invest their savings ready for retirement.

Introducing Seccl

We’re the Octopus-owned embedded investment platform that’s helping more people to invest – and invest well.

Our sector is being held back by old tech, dismal processes and misaligned interests. Together they create pointless complexity for financial planning and investment professionals, and provide outdated, overpriced experiences for customers. We’re on a mission to fix it.

We help forward-thinking financial planners, wealth managers and investment platforms to reimagine their business and client experience – empowering them to build more sustainable and valuable operations, and meet the digital demands of the future, not the baseline expectations of the past.

A regulated custodian and ISA/SIPP provider, we combine the disruptive mindset to shake things up with the substance to not screw them up.

We’re proud to be part of Octopus, the £12.5 billion group that’s on a mission to breathe new life into broken industries, through companies like Octopus Energy, Octopus Investments and Octopus Money.

Our services are designed for:

- Adviser technology platforms

- Financial advisers and consolidators

- Start-up wealthtechs

- Neobanks and established fintechs

We’re already powering some of the most innovative and fast-growing firms around today, including…

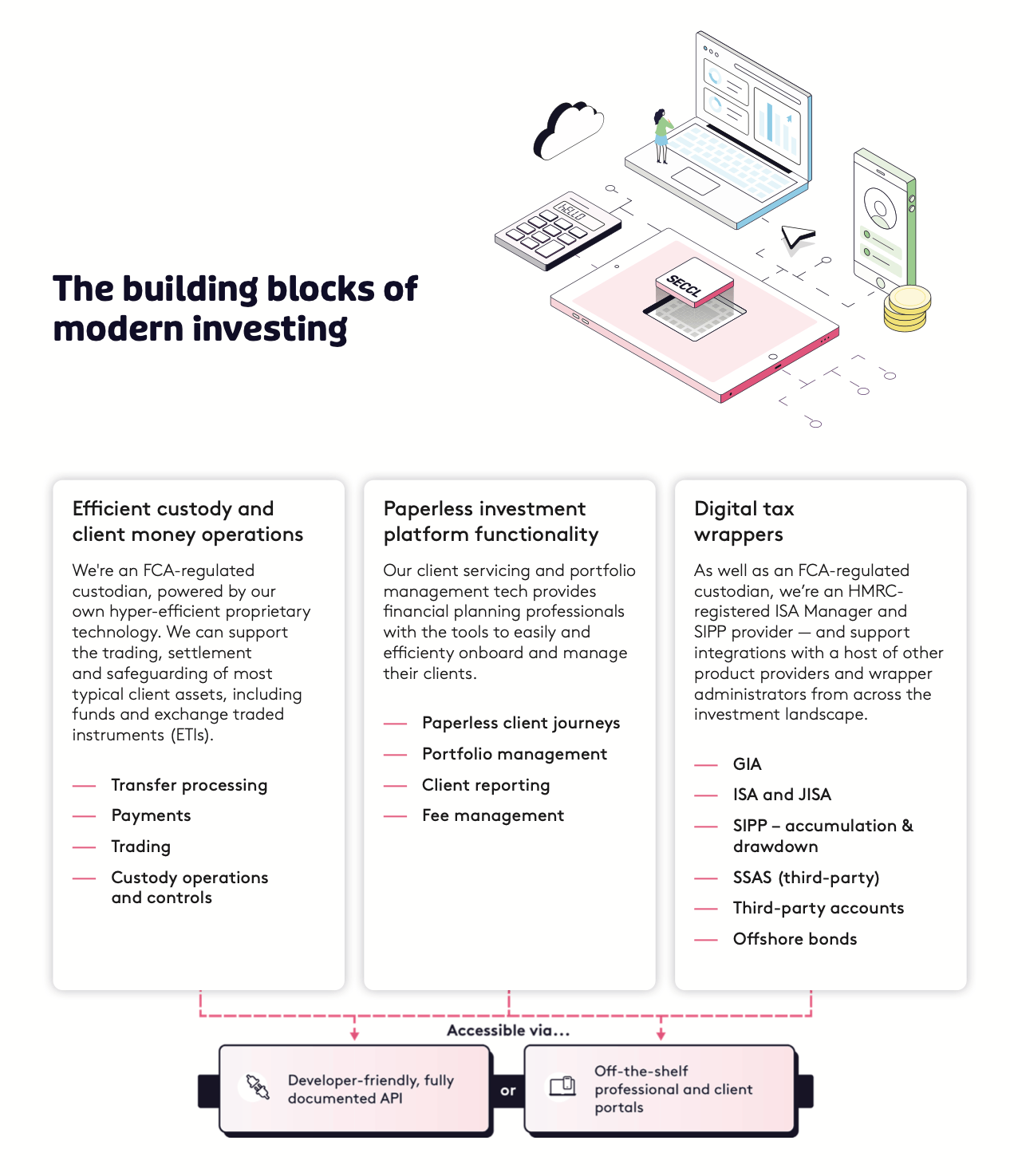

How we help

Everything you need to launch a leading investment platform

Our embedded investment solution combines a range of software and services that help ambitious firms to launch investment platforms more quickly and affordably than ever before…

Our overall aim is to reduce the cost of advice and support advisers to deliver better service to end clients.

First-class technology solutions have been key to the success of Söderberg & Partners in Sweden and we are delighted to now be able to bring this approach to the UK. Seccl will form the foundation of our legacy-free platform and we will continue investing in technology in the months and years to come.

Nick Raine

CEO, Söderberg & Partners Wealth Management

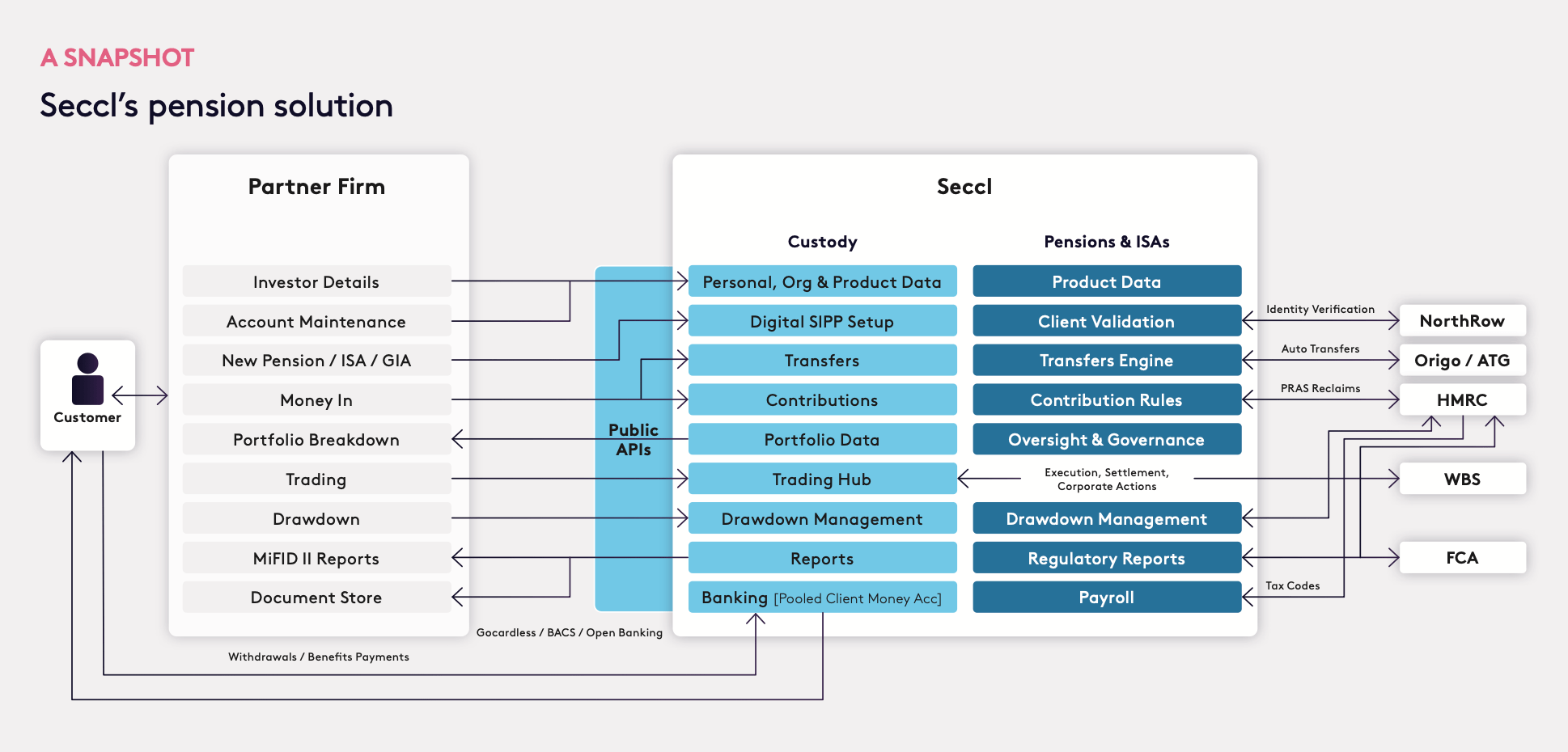

The Seccl SIPP: an overview

Tax wrappers have a crucial role to play in sound financial planning. Affordable and easy-to-use wrapper products are, then, an utterly fundamental part of the infrastructure of investments and advice.

It’s why we’re an HMRC-registered ISA and SIPP Manager — offering wrapper administration as a core part of our service proposition, alongside our regulated custody and investment technology.

The Seccl SIPP is the latest and arguably most important addition to our range of product wrappers; offering, we think, a market-leading level of scalability and efficiency.

A custom-built SIPP

Cutting-edge systems, fit for the future

Why did we choose to build our own SIPP? Well, for the simple reason that traditional SIPP offerings just aren’t fit for purpose.

Many traditional pension products are either partially or fully paper-based. They’re inflexible and clunky to use, built on old ‘legacy’ tech, and are administered through ‘off-the-shelf’, third-party systems that are slow, difficult and expensive to change.

We wanted to start again with a blank canvas. The result? A market-leading SIPP that’s fully digital, inherently flexible and infinitely scalable — the right foundation to support the ever-changing needs of advisers and their customers.

Meet the future

Cutting-edge systems, fit for the future

In its initial launch stage, the Seccl SIPP provides an intuitive and easy-to-use online application journey, capturing…

- The client’s personal details, including their expression of wishes for death benefits

- All contributions and transfers

- Full range of investment options

- The client declaration — including a summary of the information they have provided, and a means to accept the terms and conditions and key features

It also provides for ample client flexibility — with functionality to allow end investors to increase, reduce or pause contributions at any time, and receive both single and regular contributions on any working day.

The Seccl SIPP can support clients through accumulation and decumulation (though the latter is currently only available to clients of financial advisers).

As with our accumulation functionality, our decumulation technology has been designed with flexibility at its core, allowing the firms that we power to make income payments to the client quickly and easily.

As with our accumulation functionality, our decumulation technology will be designed with flexibility at its core, allowing the firms that we power to make income payments to the client quickly and easily.

And throughout the entire pension journey — from paying in, to paying out — the whole process will be entirely automated. Not a piece of paper or manual process in sight.

What makes us different?

In short — our technology. Our low-cost, hyper-efficient and (genuinely) API-first technology infrastructure handles millions of requests every day, and powers the portfolios of around 160,000 investors.

We design for change

From day one, the Seccl system has been built using an approach that involves anticipating potential areas of change and packaging them into unique services – rather than building technology to meet a set of static requirements

This means that when we inevitably need to change things, we can do so at pace and with a high degree of confidence, since the impact of the change is restricted to a small and well- defined area of our system.

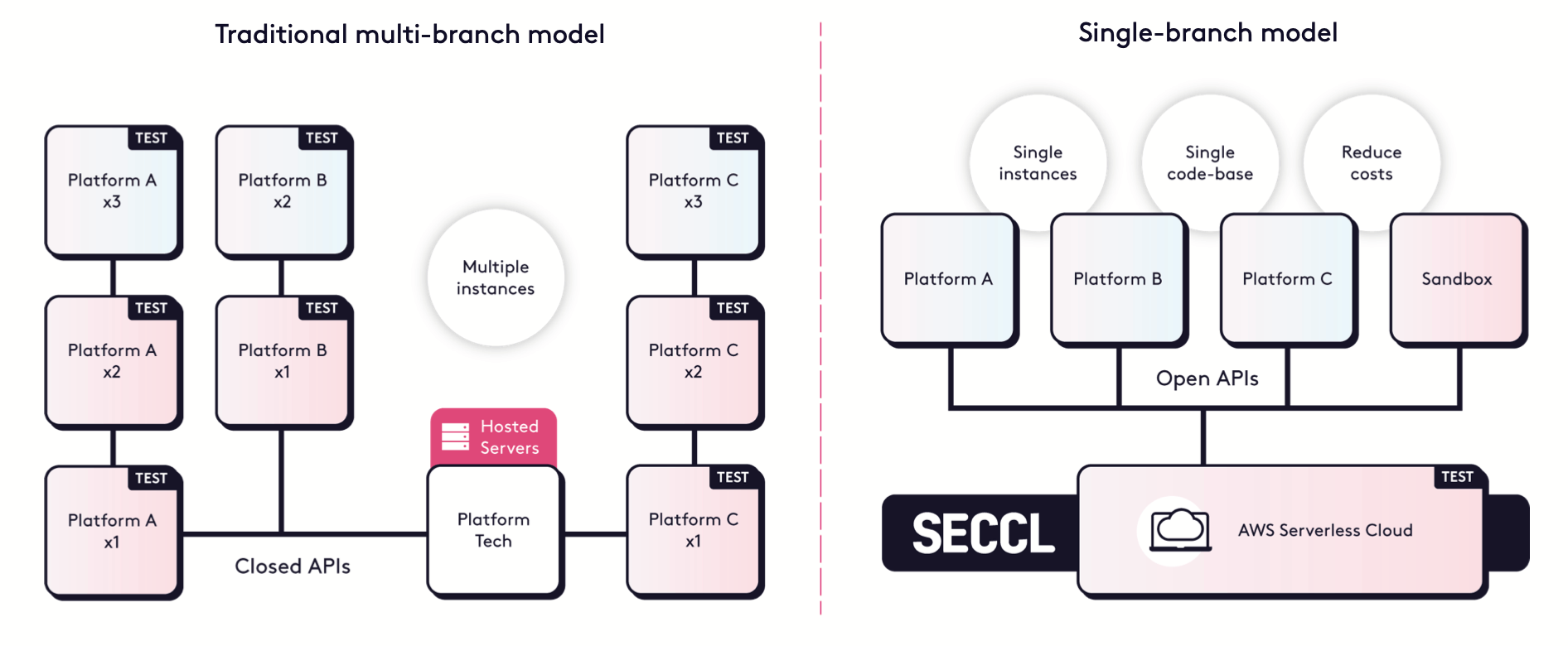

We maintain a single instance

As well as anticipating change through our architecture, we also massively reduce the

cost and time of new development work by maintaining a single instance of our code base.

Traditionally, software vendors have tended to deploy different branches of code for each of their clients – meaning they have to replicate work for as many branches as they maintain. It duplicates effort, adds cost and wastes time.

We ship features fast

Our modern architecture, our independence from traditional providers and our strong, well- aligned backing from Octopus makes for an unrivalled speed of feature development.

For example, in September 2022 we launched our own fully digital accumulation pension after as little as six months of build time.

This was followed in 2023 – and after just another six months of build – by our fully automated drawdown pension.

We release code daily

Most investment platforms tend to package up fixes and new features into infrequent ‘big bang’ releases. The trouble with this approach is that it tends to bring a whole lot of banging and crashing with it, too – creating lengthy downtimes (planned and unplanned), unexpected problems and, sometimes, costly rollbacks.

Modern technology firms favour a continous deployment approach – regularly testing and releasing code into a live environment. In September 2023 alone, we made 124 deployments of code to production – 95% of them ‘new’ (as opposed to fixes of recently introduced functionality). That’s six deployments per working day.

In a nutshell: why Seccl?

-

Genuinely API first

Our API isn’t an afterthought — it’s the driver of all of our technology. Take a look at our API reference and quickstart guides to see it first hand.

-

Fully paperless

Our efficient, API-first technology stack means we can provide a completely online, paperless and affordable SIPP solution.

-

One efficient code base

Unlike traditional providers, who maintain separate instances for each client, we have just one. Every client gets every update, automatically.

-

We ship features fast

Forget never-ending release cycles: our engineering team deploys pretty much every day, and we build whole new features in weeks, not years.

-

Free from legacy tech

We’re not lumbered with old and clunky legacy tech; we’ve rebuilt investment technology from the ground-up using publicly documented APIs.

-

Scalable and resilient

Our cloud-based systems architecture, built on AWS, means we can scale incredibly quickly and resiliently. Our technology is future-proof.

-

Expertise and dedication

Our pensions team has a combined 30+ years of direct pensions experience. We like to work in partnership, to design, implement and maintain a SIPP solution that’s right for you.

-

Backed by Octopus

In 2019 we were acquired by Octopus, the £12.8bn group of companies that includes Octopus Energy, Octopus Investments and Octopus Money.

Diving into the detail

Legal structure

The Seccl Personal Pension Scheme has been established under the trust deed and rules. This scheme has been designed to enable partner firms to white-label the product under their own branding.

Scheme establisher, operator & administrator

Seccl Custody Limited

Scheme Trustee

Digital Pension Trustees Limited

HMRC registration date

3rd February 2022

Pension scheme tax reference

20005619RK

Regulatory structure

Establishment and operation of a SIPP is a regulated activity for which specific permissions are required. SIPPs have been the focus of significant regulatory scrutiny in recent years, and the FCA have made clear that they expect SIPP operators to meet particular requirements in a number of areas.

Additionally, an operator must remain aware of, and comply with, complex tax rules.

The regulatory structure of Seccl Personal Pension is as follows:

FCA

Products established under the scheme will be provided by Seccl Custody Limited, a

firm authorised and regulated by the FCA. Appropriate returns will be made to FCA in respect of the product, including product sales data.

THE PENSION REGULATOR

Seccl Personal Pension is in the process of being registered.

HMRC

As a registered pension scheme, appropriate returns will be made including tax reclaims, event reports, and operation of PAYE on benefit payments.

Eligibility

To open a Seccl SIPP, applicants must be over 18 and resident in the UK for tax purposes — or have existing UK pension savings. The application process is completed online.

There is no maximum age, however there is no tax relief for clients aged 75 or older. Grouped arrangements are not permitted, and auto-enrolment is not allowed under relevant legislation.

Our drawdown functionality is currently only available to clients of financial advisers.

Product charges

As well as our custody fee, which starts at just 0.1% and tiers down to zero for larger client portfolios, we charge the following SIPP-related product charges.

You can find out more about our pricing – including our minimums – by heading to seccl.tech/pricing.

SIPP CHARGE – ACCUMULATION

Annual charge of 0.05% paid monthly, with a minumum of £12 + VAT and maximum of £48 + VAT per year

SIPP CHARGE – DRAWDOWN

An additional annual charge of 0.10% paid monthly, with a minumum of £48 + VAT and maximum of £120 + VAT per year

OTHER CHARGES

Transfers in £15 each

Seccl will issue a monthly invoice to each partner firm. Partner firms can choose to pass pension fees directly to the end investor or to charge a different fee to investors subject to our approval.

Plan anniversary

The anniversary date for all new clients joining the scheme will be 12 months from receipt and acceptance of the first payment into the plan.

Regular statements

Statements will be produced annually at product level by Seccl.

Annual statements will be issued in respect of each plan to include, as appropriate, and added to the client’s online document store:

- Portfolio breakdown

- Quarterly valuations

- Investment growth

- Pension savings statements / annual statements — Schedule of contributions

- Schedule of transfers

- Statutory money purchase illustration or drawdown review illustration (if applicable)

- Disclosure of charges, including adviser charges

Regulatory requirements

Our SIPP has flexible reporting requirements to support structured documented processes in line with PROD and MIFID II.

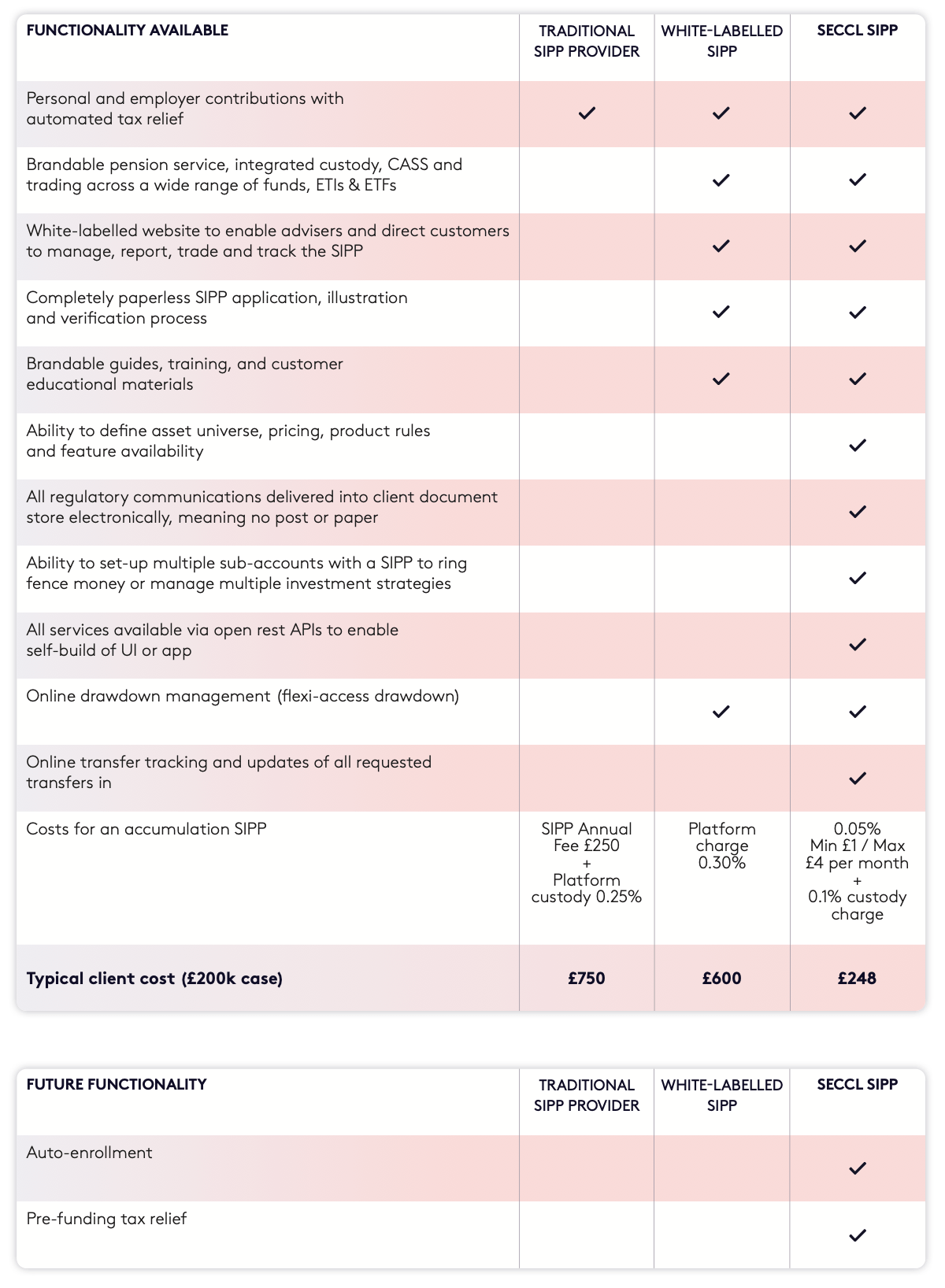

The Seccl SIPP: how it compares

Seccl will take each partner firm through a design and development process, in which the pension product will be defined, validated, and built.

While our building blocks are standard, they can be used in a unique combination to enables firms to create flexible solution for their customers’ needs…

Permitted & non-permitted investments

We will only permit investments that fall within the FCA’s definition of a “standard” investment, i.e., an investment that is realisable within 30 days and can be readily and accurately valued.

Legislation may also affect particular asset types and render them unacceptable.

Permitted investments

Investments we allow within the pension scheme are as follows:

-

Equities

Must be listed on the HMRC recognised stock exchange or admitted to trading on a recognised European Economic Area (EEA) stock exchange.

-

Exchange traded Funds (ETFs)

Must be listed on the HMRC recognised stock exchange or admitted to trading on a recognised EEA stock exchange, EEA Domiciled, or within the FCA temporary permissions regime. UCITS and recognised on the FCA register.

-

Investment trusts

Must be listed on a recognised HMRC stock exchange list or admitted to trading on a recognised EEA stock exchange.

-

Funds

Must be recognised or approved on the FCA register. If EEA Domiciled, must fall under the FCA temporary permissions regime. Subscription/redemption payments must be made in GBP.

Non-permitted investments

Investments we do not allow within the pension scheme are as follows:

- Fixed income securities of all types,

including gilts and government bonds, corporate bonds, convertible bonds, PIBS and other loan stock. - Structured products (including both plan and deposit products)

- Commercial property

- Options and other derivative products

- Fixed-term bank accounts with terms of more than 30 days

- Unlisted equities

- Unlisted fixed income securities

- Limited partnerships

- Unauthorised unit trusts

- Trust-based property syndicates

- Hedge funds

- Offshore bond

Additional information

Terms and conditions and key features

While we hope this introduction provides a useful summary of the Seccl SIPP, do take a read of our full terms and conditions and key features document.

Compensation

The Seccl SIPP scheme is covered by the Financial Services Compensation Scheme (FSCS). This means that if we were unable to meet our obligations, and we received a valid claim against us in respect of the operation of, or winding-up of the Seccl Personal Pension Scheme, then the client may be covered for 100% of the first £85,000 of their investment

If our or the trustee’s external banking partner became insolvent, then the client may be covered under the FSCS for 100% of the first £85,000 of their money on deposit with that bank.

Get in touch

To find out more about how we’re helping firms of all sizes to take control of their destiny — and powering the innovative investment platforms of the future — head to seccl.tech, or get in touch via hey@seccl.tech.