Before Christmas we introduced you to Raindrop, one of our newest clients that’s on a mission to help freelancers save for retirement.

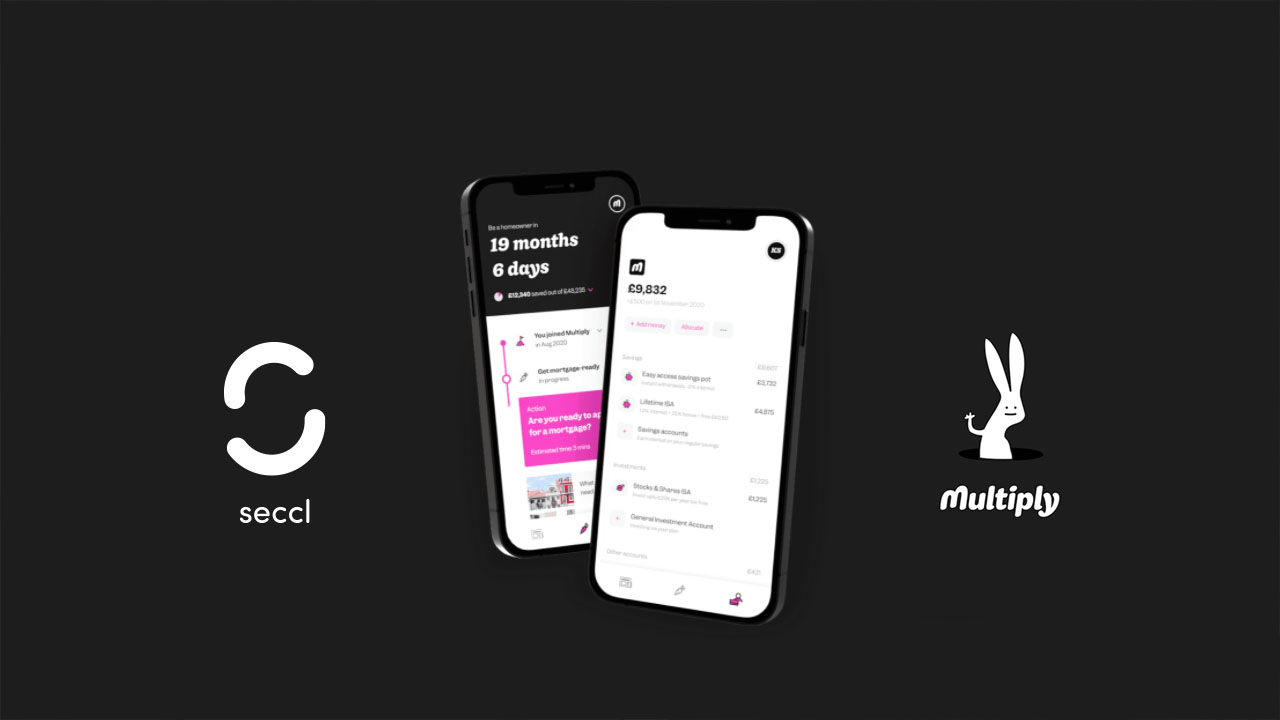

A few weeks on and we’re delighted to lift the lid on our work with another hugely exciting business that’s making dramatic waves in the fintech space: Multiply.

Who are Multiply?

In July 2019, Multiply became one of the first financial advice apps (and the first that’s consumer-facing) to be approved by the Financial Conduct Authority (FCA).

Since then, the team has created plans around more than £1 billion of assets and debt, and made 11,000 individual recommendations – through an impressively simple and easy-to-use mobile app built around an AI-powered chatbot.

Thanks to the app’s slick UX, it takes no time at all to provide a full overview of your financial situation, identify the key goals you’re striving to meet with your money, and get your hands on a financial plan.

Until recently, though, the rest has then been up to you. The app didn’t have the functionality that would allow you to put those recommendations into action then and there – and so users would have had to leave the app and follow the steps on their own.

That’s where we at Seccl have been able to help.

A seamless, end-to-end advice journey

Over the last few months, we’ve been working with Multiply to create and embed their own investment offering within the app.

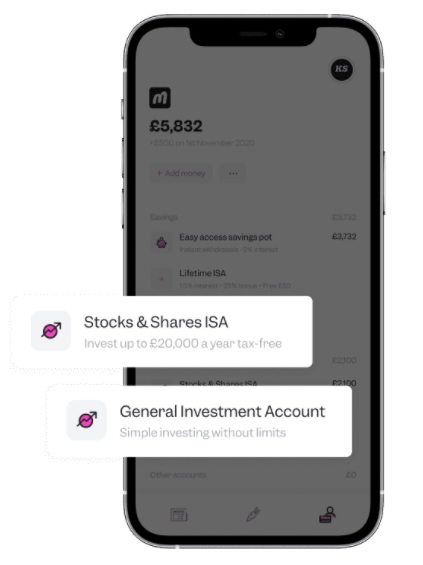

From now on, when the app’s recommendations include investing through an ISA or GIA, Multiply will be able to facilitate these directly, via a custom-built universe of 27 funds, accessible through five risk-rated model portfolios.

All of which means that recommendation and implementation can follow seamlessly on from one another to create a fast and friction-free end-to-end advice experience. As AltFi put it in their recent article, “the dream of a fully-regulated robo financial advisor is here.”

It’s the perfect example of how innovative, customer-centric firms can use our API to quickly and affordably launch new and exciting investment solutions – without having to build their own from scratch.

They can get on with what they do best (creating amazing user experiences for the customer segments they know best), and leave us to do the same (we at Seccl act as custodian and ISA manager, while our investment API routes orders for execution in the market).

We think it makes for a special partnership.

Bridging the advice gap

If you hadn’t guessed, we’re hugely excited about Multiply’s innovative approach, and the potential that it brings.

So-called ‘robo-advice’ has been the talk of the industry for many years now. But until now there’s really been very little robo, and even less advice.

Most of these solutions have been pure-play investing solutions, which, though perhaps useful for experienced or passionate DIY investors, offer little in the way of support for those who are instead looking for the helping hand of a considered financial plan.

Multiply changes all that. It can now genuinely claim to offer anyone, regardless of their wealth or affluence, a fully digital and eminently affordable financial plan (users pay a platform fee of 0.30% of the value of their assets per annum – as well as an initial £1 fee for their up-front recommendations, and a £1 monthly fee for their ongoing advice).

As Multiply’s CEO, Vivek Madlani, puts it: “We want to empower everyone to achieve their goals, regardless of their current wealth or financial situation. And allowing more people to act on low-cost investment advice is central to that mission.”

What could be more exciting than that?

To see more of the innovative firms that we work with, check out some of our recent client spotlights.