I was interested to read last week that a significant minority of people who use a financial adviser also invest in ‘side hustles’ outside of the scope of their main portfolio (and out of their adviser’s reach).

A recent survey from Boring Money showed that 1 in 5 advised clients hold an account with one of the UK’s top DIY investing platforms. Around 10 percent also hold cryptocurrency assets, while 4 percent have a peer-to-peer or crowdfunding platform account.

Some of the UK's top DIY investing platforms

So does this mean that they’re unhappy with the advice they receive? Well, no. The research showed that those same clients were still highly satisfied with their adviser. As Boring Money’s research manager Jessica Galletley put it, ‘a significant minority of advised investors seem to want the comfort of knowing their core portfolio is overseen by a qualified financial professional, while also running a pot of money themselves as an investing side-hustle.’

But, all the same, it’ll no doubt be a source of concern and frustration for advisers – whose job, after all, is to make rounded recommendations based on a total picture of their clients’ finances…or so they think. The more that falls outside of their view, the harder that job becomes.

And no matter how satisfied they are today, there will always be the background fear that clients might be lured in to go it alone by the DIY platform they’re dabbling through. As Altus’s Ben Hammond says, ‘for an adviser there’s a risk that you’re educating your clients to a certain degree and they go off and do it themselves, and you lose that business.’

So, what’s the upshot? Clients are always going to have side hustles alongside their main portfolio, so fighting it is pointless. Instead, wouldn’t it be great if technology allowed clients to do it flexibly alongside their advised portfolio – and for advisers to retain a single view of their clients’ assets? What if it was possible for advisers to allow their clients to run their own side hustles and still keep sight of it?

Well, with Seccl-powered platforms, it is!

Breaking down the divide between advised and D2C

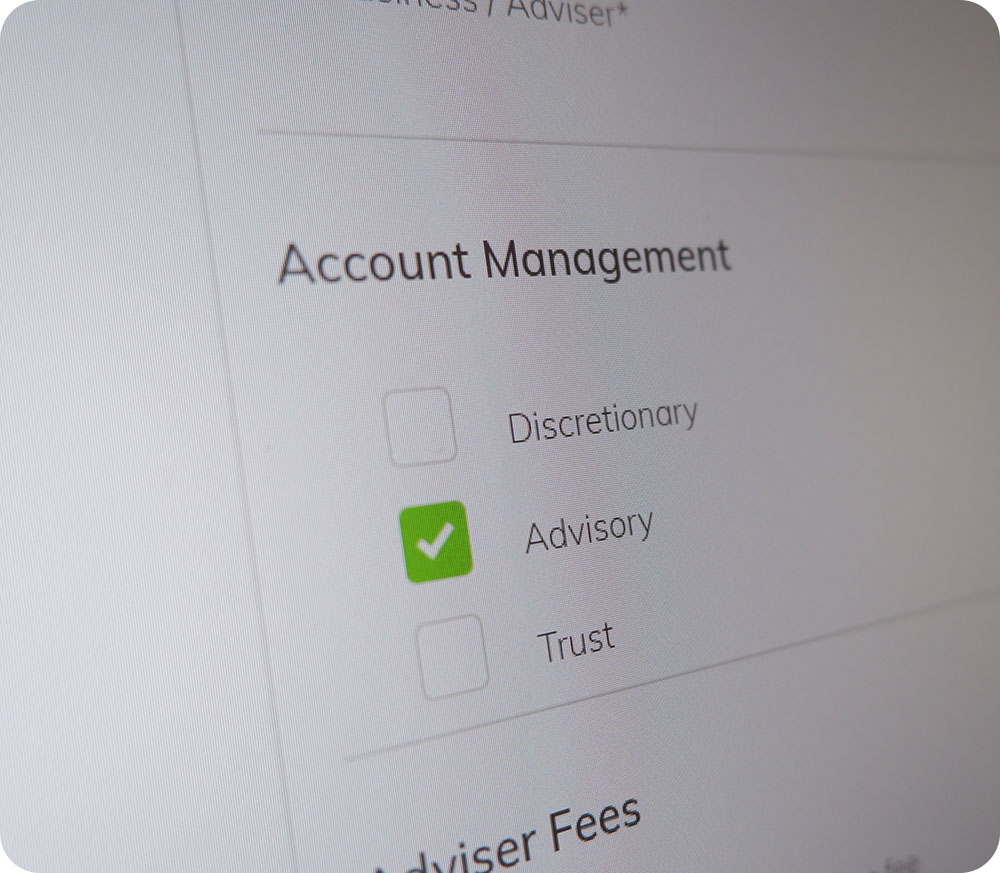

As far as we know, we’re the only platform technology provider that allows advised clients to maintain their own non-advised, execution-only ‘pots’ or sub-accounts within their main portfolio.

And even within individual wrappers, too. For example, a client could keep a little section of their ISA as a ‘DIY’ side-hustle, on which adviser fees aren’t paid, and in which they can choose to buy and sell investments at will.

For the client, it means one less investment platform to have to deal with (and one less password to remember), as well as a cheaper way of investing than that offered by most DIY platforms.

For the adviser, it means they can retain a total picture of their clients’ whole financial affairs, while still giving them the freedom to have a go themselves. What’s more – and most importantly – if the client decides they need a hand, then they can flick a button to bring it into the main advised portfolio.

A golden opportunity – using tech to embrace flexibility

It would be easy to view the recent findings as somehow indicative of a growing threat to financial advice – as seemingly more investors take an active interest in their own affairs.

But, spun the other way, advisers who have the right tech at their fingertips can turn it to their advantage. In fact, I see it as a chance for advisers and their clients to work more closely together, and for technology to make that relationship even more streamlined than ever.

I strongly believe that as time goes on, we’ll see the apparent dividing wall between advised and D2C markets break down. Increasingly, I think the faultline in the market won’t be between D2C and advised or robo and face-to-face, but between firms who embrace tech and those who don’t.

With the abundance of DIY investment apps today, it’s inevitable that clients are going to want to cut their own slice of the pie. As an adviser, you can either turn away from this reality or lean into the opportunity…

I’d love to hear your thoughts on this. If you’re interested in having a chat or finding out more about Seccl, drop me a line.