New features

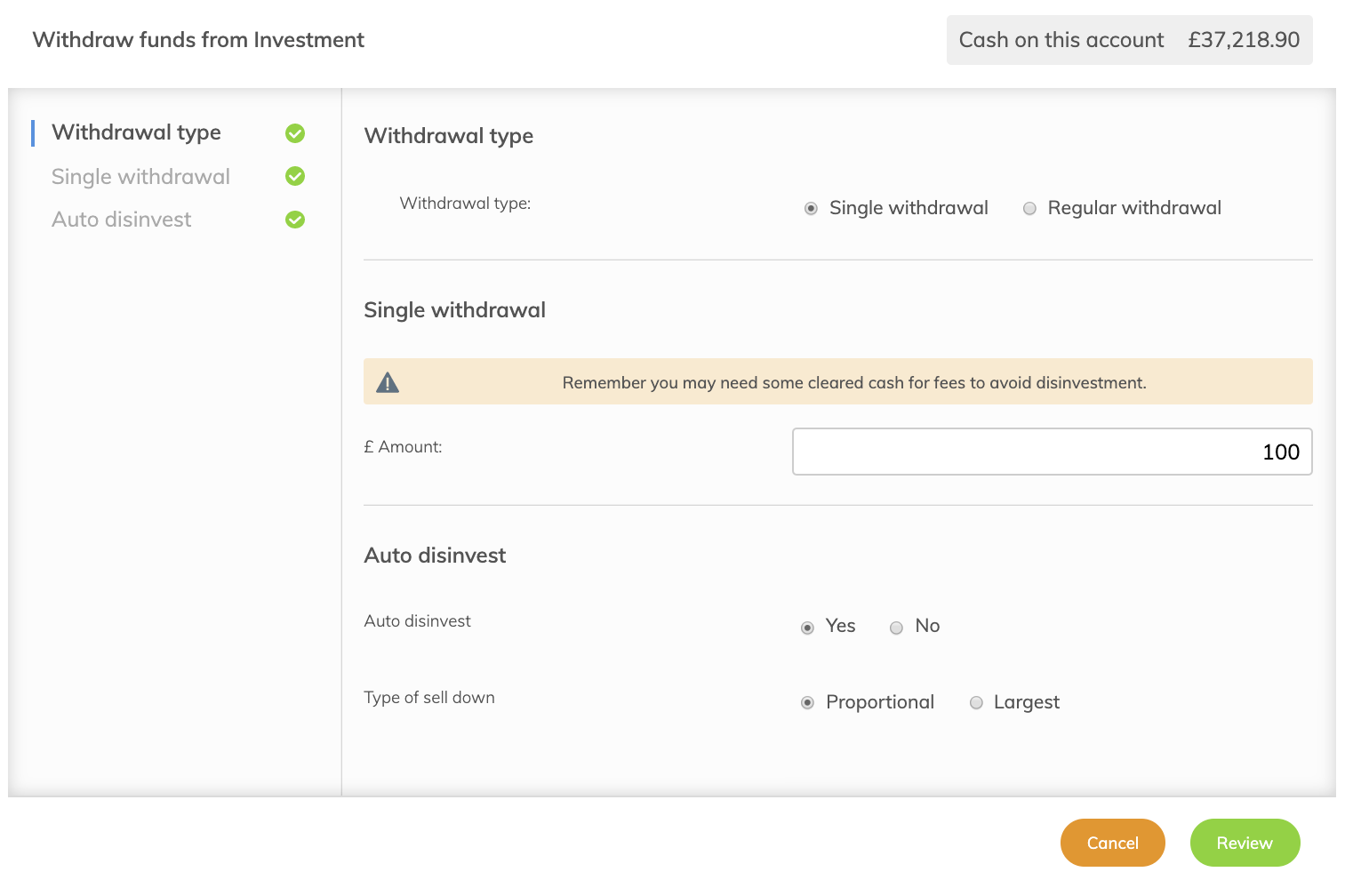

Auto disinvest

Our new auto disinvest feature makes it easy for advisers or their admin staff to make sure their clients receive any withdrawals when they expect them, while keeping them in the market for as long as possible.

When instructing a withdrawal, you’ll now be asked if you’d like to auto disinvest. If you select yes, we’ll automatically sell down as much of your client’s investments as is necessary to fund their withdrawal (if there isn’t enough cleared cash already on their account).

The feature can be used for both one-off and regular withdrawals – and advisers can choose whether to sell down from the largest holding, or proportionally across all. No more calendar reminders and manual sells to fund withdrawals!

Enhancements

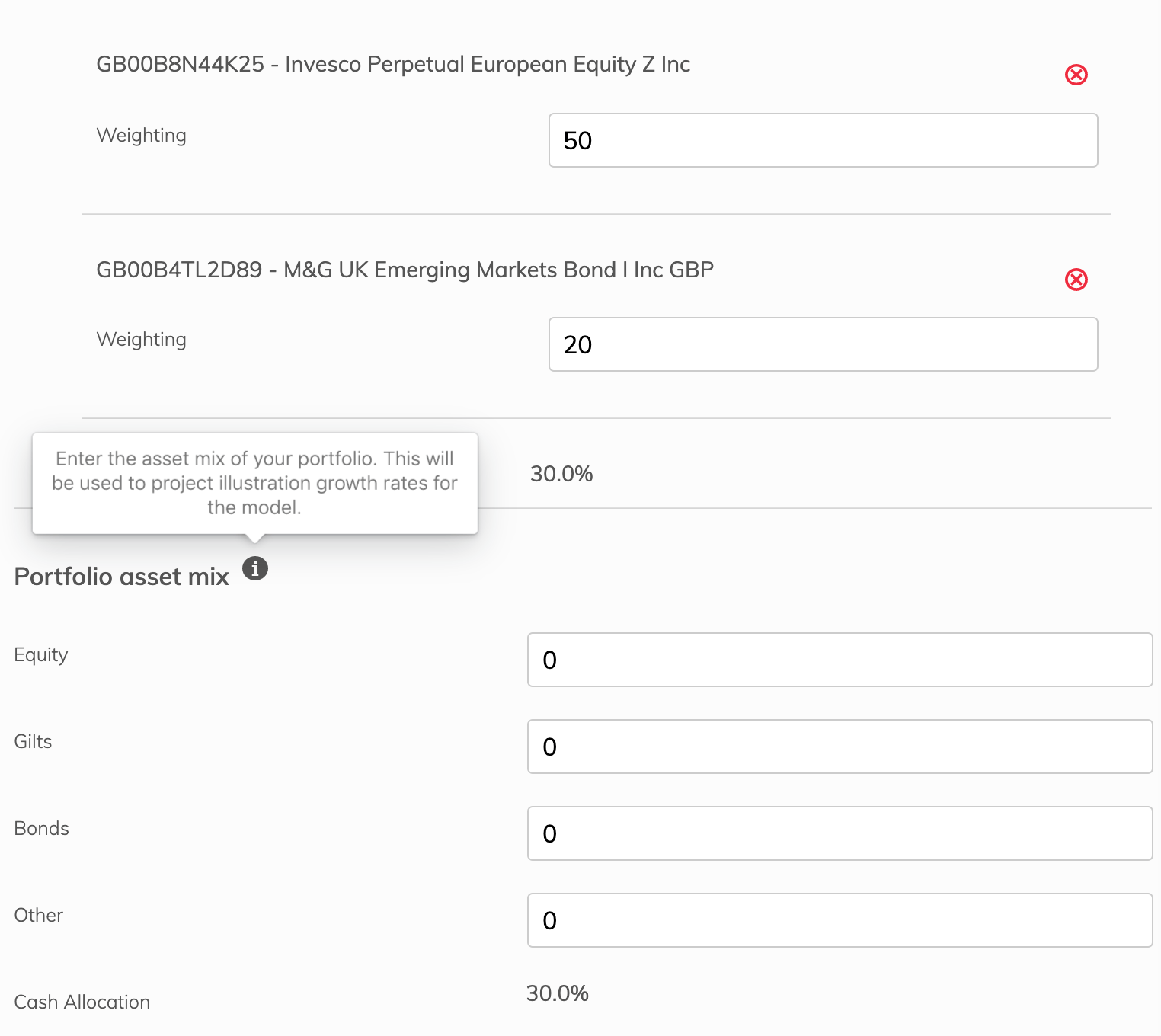

Including asset mix on models

If you’re a DFM, you can now enter the asset mix across all the funds and instruments in your models – so that we can provide tailored growth rates in illustrations, based on the risk profile of the assets you enter.

Individual account rebalances

You can now rebalance at an individual account level, as well as at a model level. This extra flexibility is useful if a specific client has made a new investment or transfer, and you’d rather not wait until the model as a whole is next rebalanced.

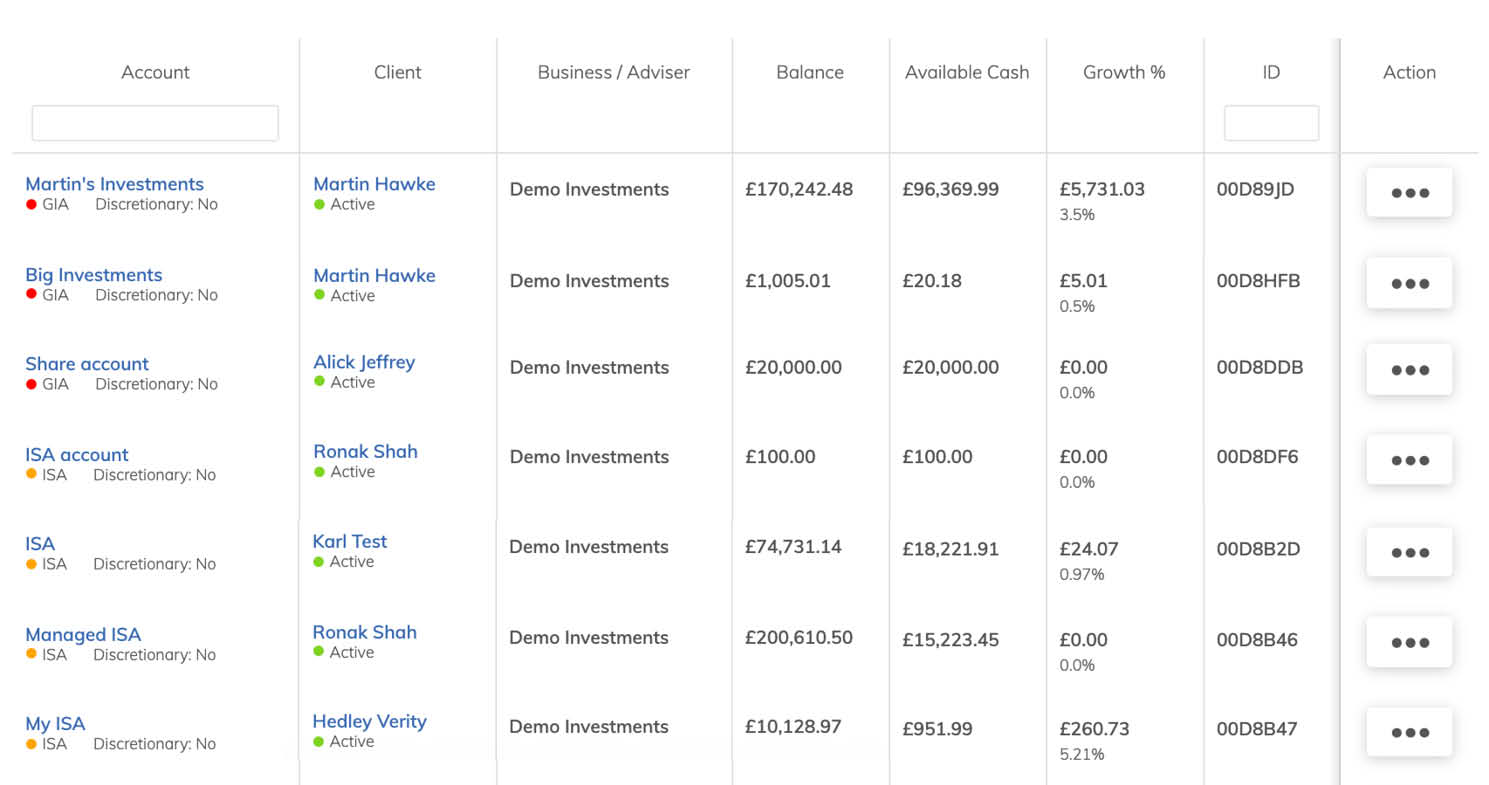

Clearer tables

We’re always looking for ways to simplify the user experience – and so you might notice that things look a little different here and there.

Probably the most conspicuous design changes we’ve made are to our client and account tables. We’ve tried to make them clearer and more digestible, by reducing the number of data columns and focusing in on the most important details. The rest of the information is still there, but reduced in size and grouped around other elements.

We’ve also introduced some colour coding for account types, to make it easier for you to find exactly what you’re looking for. We think it makes for a much tidier, cleaner and more accessible presentation of information, and will look to roll it out across our other tables in due course.

Integrations

Day Cooper Day SSAS

This month we also went live with another third-party pension product integration, to complement the existing SIPP solution we offer through Gaudi.

Now, advisers can support any existing or new SSAS holdings that their clients have with SSAS specialist Day Cooper Day.