The challenge:

Pairing resilience with agility

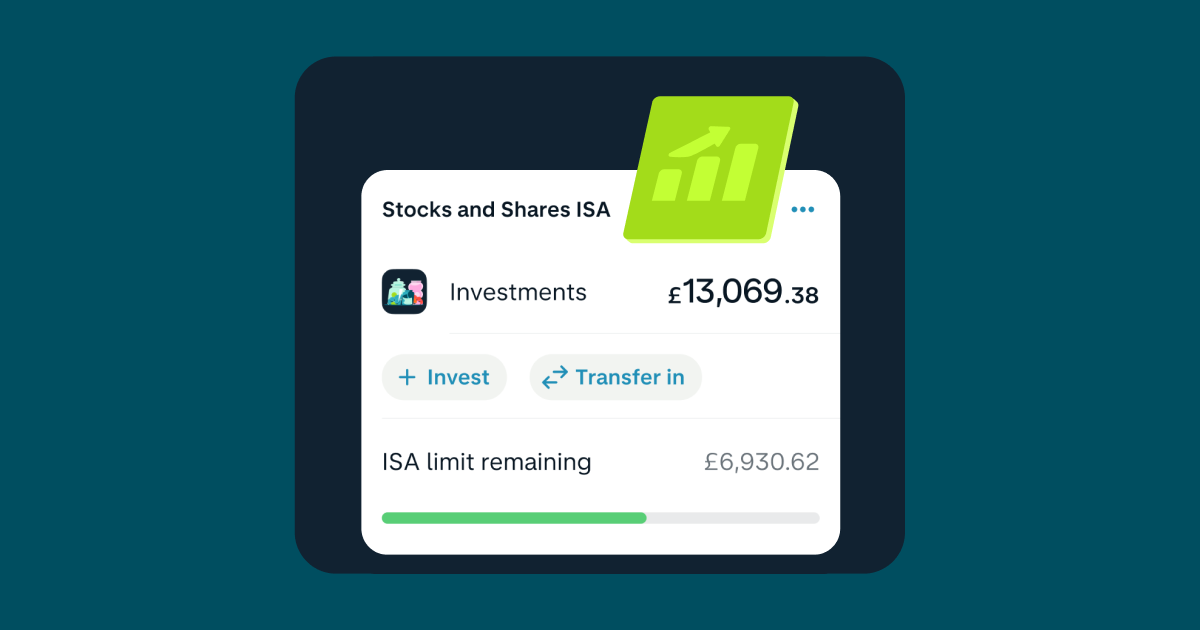

Monzo launched its investment proposition in September 2023, giving its millions of customers the option to open investment accounts and access a range of multi-asset funds directly within their app. As well as a stocks and shares ISA and general investment account (GIA), Monzo also launched a pension tracing and consolidation service in July 2024.

To support its long-term ambitions, Monzo needed a modern and highly resilient investment infrastructure – one capable of scaling safely to meet rising demand while giving its teams the freedom to keep iterating at pace.

The team sought a partner that could:

- migrate several hundred thousand accounts without disruption

- support a fast-moving product roadmap

- underpin the experience with safe, stable, operationally robust technology

Above all, Monzo wanted to ensure customers continued to enjoy a fast and effortless investing experience, even as volumes grew dramatically.

investor and pension accounts migrated seamlessly

created and settled in under 15 minutes

auto-matched in three minutes

record handled without disruption

from first planning meeting to full migration

The solution:

A high-profile migration, executed seamlessly at speed and scale

Monzo selected Seccl as its new technology partner in January 2025. Following a smooth and successful technology integration, the first assets were placed on its new, Seccl-powered proposition in May.

By the beginning of July, all new Monzo investment accounts were powered by Seccl – with the full migration of existing client portfolios completed in September.

We now power its investment proposition end-to-end – acting as custodian, providing and administering its ISA and SIPP products, and managing its ever-growing pool of inbound transfers from other investment platforms. All while allowing them to retain full control of the customer experience, with a digital journey that’s fully native and lightning fast.

We completed the migration of more than 300,000 existing investment accounts with extraordinary speed and stability. Despite being the largest and most high-profile bulk migration we’ve undertaken, the project was completed in just five months. Our first joint planning session took place in April, with the full migration carried out in September.

During the migration:

- We processed around 20x our normal daily payments volume

- We auto-matched around 130,000 transactions in just three minutes

- Around 600,000 new transactions were created in Seccl’s system – all settling in under 15 minutes, with no breaks and a 99.98% automatch rate

To support the partnership and prepare for the migration, we shipped a huge number of product improvements – closing out any outstanding feature gaps and giving both parties confidence in our platform’s ability to handle the incoming transaction volume.

In total, we planned and delivered nearly 20 big-ticket roadmap items in the first half of 2025, testament to the speed and agility of our product and engineering teams.

In line with our mission to make money work for everyone, we’ve helped to demystify investing for thousands of customers, making it simple, transparent and affordable. Working with Seccl means we can go even further and introduce more exciting features and tools that help our customers grow their money, all within the Monzo app.

The impact:

Faster transfers, faster feature development. Potential, unlocked.

For Monzo’s customers, the transition was seamless. Its product and engineering team, meanwhile, have been empowered to launch a range of new features – starting with a fully digital accumulation SIPP (to which customers can make new contributions, not just consolidate existing pensions) and the ability to trade ETFs.

Seccl’s pace of delivery – deploying code more than 10 times a day – means Monzo can continue evolving its investment proposition quickly and safely, with no trade-off between agility and resilience.

Our partnership has also unlocked the enormous potential of Monzo’s transfers pipeline – allowing customers to transfer assets from other providers with unrivalled speed and ease. In total, we completed around 40,000 transfers from the point of migration through to the end of 2025, with an average completion time of just 7.5 days. One customer transferred their assets in just 9 business hours, all with zero human intervention.

This is investment infrastructure built for speed, tested at scale and proven under pressure.

Get in touch

Ready to get started?

If you want to find out more or kick off a conversation, then get in touch – we’d love to chat

By submitting this form, you agree to our Privacy Policy and Terms.